Sheep exports 2022/23

Sheep exports 2022/23

Sheep commodity overview

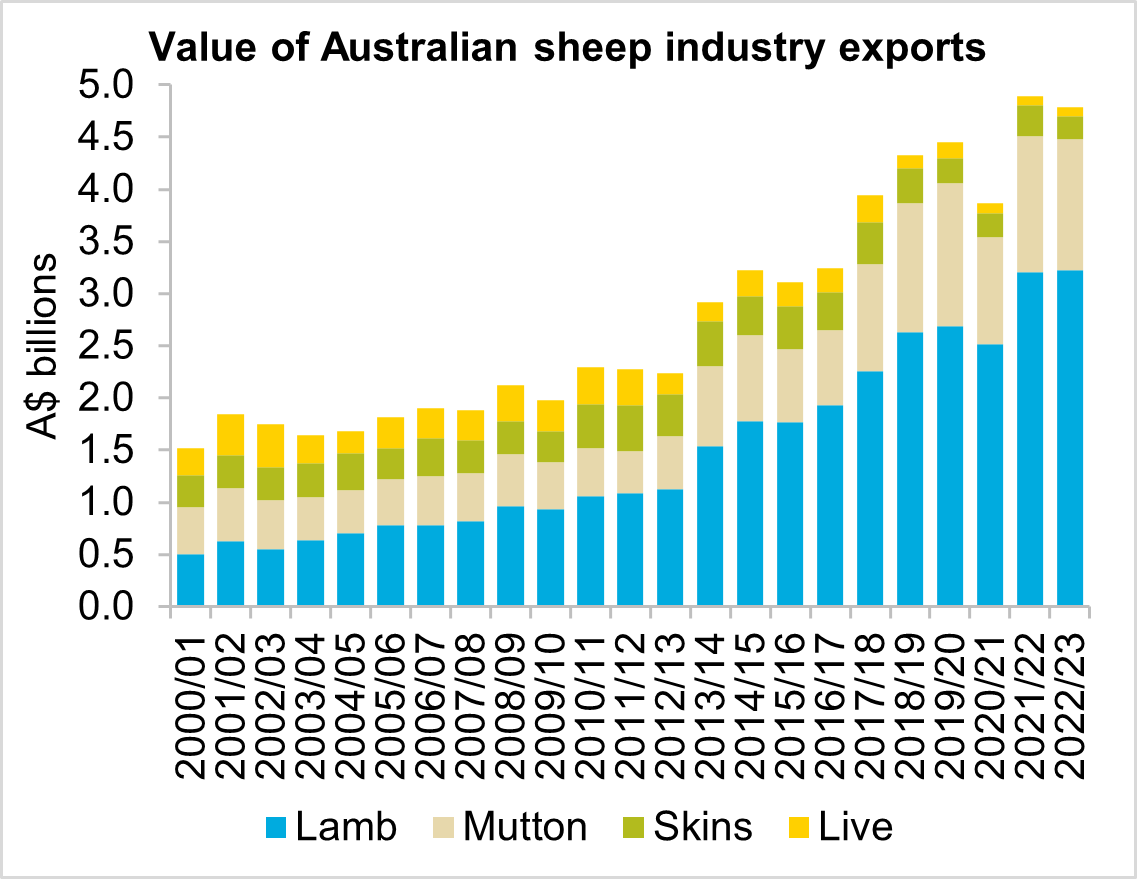

- The value of Australian sheep industry exports fell $104.9 million (-2.1 per cent) in 2022/23 to a total of $4.79 billion.

- Export value was driven lower by weakened prices due to increased supply and softer consumer demand.

- Australian sheep industry exports are expected to see a slight decline in value again in 2023/24, as increases in production will be offset by lower prices.

Trade performance in 2022/23

The value of Australian sheep industry exports decreased in 2022/23 as increased production was not able to account for the reduction in prices. Australian sheep industry exports totalled $4.79 billion in 2022/23, down $104.9 million (-2.1 per cent) on the record set the previous year, but still the second highest value on record. The volume of sheepmeat exports were the largest on record, with lamb and mutton exports rising 7.5 per cent and 21.9 per cent respectively. The increased export volume was driven by production growth stemming from the national flock rebuild reaching maturity, with the flock now 23 per cent higher than in 2020.

The value of lamb exports in 2022/23 was relatively in line with the previous year, only up by 0.4 per cent. This was driven by a 7.5 per cent rise in export volume coupled with a 6.6 per cent reduction in average export price. Lamb production has grown on the back of the flock rebuild and average carcass weight steadily increasing over the past 20 years. The domestic price of lamb has seen a sharp decline since the start of the year, with this trend being seen in export prices which fell from record levels in 2021/22. Despite the fall in lamb export prices, they remained 5.8 per cent above the five-year average in 2022/23.

Australian mutton exports fell by $41 million (-3.2 per cent) in 2022/23. The volume of mutton exports rose by 21.9 per cent, as farmers turned off older breeding stock following the flock rebuild. The increased supply forced prices lower, with prices falling to the lowest levels seen since 2018/19. The unit price of mutton was down 20.6 per cent to $6,554 per tonne in 2022/23. This was 7.9 percent below the five-year average. The majority of the increase in mutton exports was absorbed by China and the Middle East.

The value of Australian sheep skin exports fell sharply in 2022/23. Skin exports fell by almost $76 million (-25.9 per cent) due to reduced demand for skins around the world. Demand for sheep skin products has fallen due to rising cost of living pressures reducing discretionary spending. Average price per skin fell 46.1 per cent in 2022/23, and is well below the long term average. Export volumes of Australian sheep skins were 31.6 per cent higher than the previous year, partially offsetting the impact of the drastic reduction in price.

Live sheep exports saw a steep rise in quantity matched with a reduction in price. This resulted in Australian live sheep export value being mostly unchanged at $85 million in 2022/23. The volume of live exports were up 41.5 per cent, which was in stark contrast to the long-term downwards trend. Despite the increase in 2022/23, live export volumes were still down 8.9 per cent on the five-year average. The export price for Australian live sheep fell $51 per head (-29.5 per cent) to $123 per head. Western Australia accounted for 95 per cent of the Australia’s total live sheep export value, down from 98 per cent in the previous year.

Major export markets

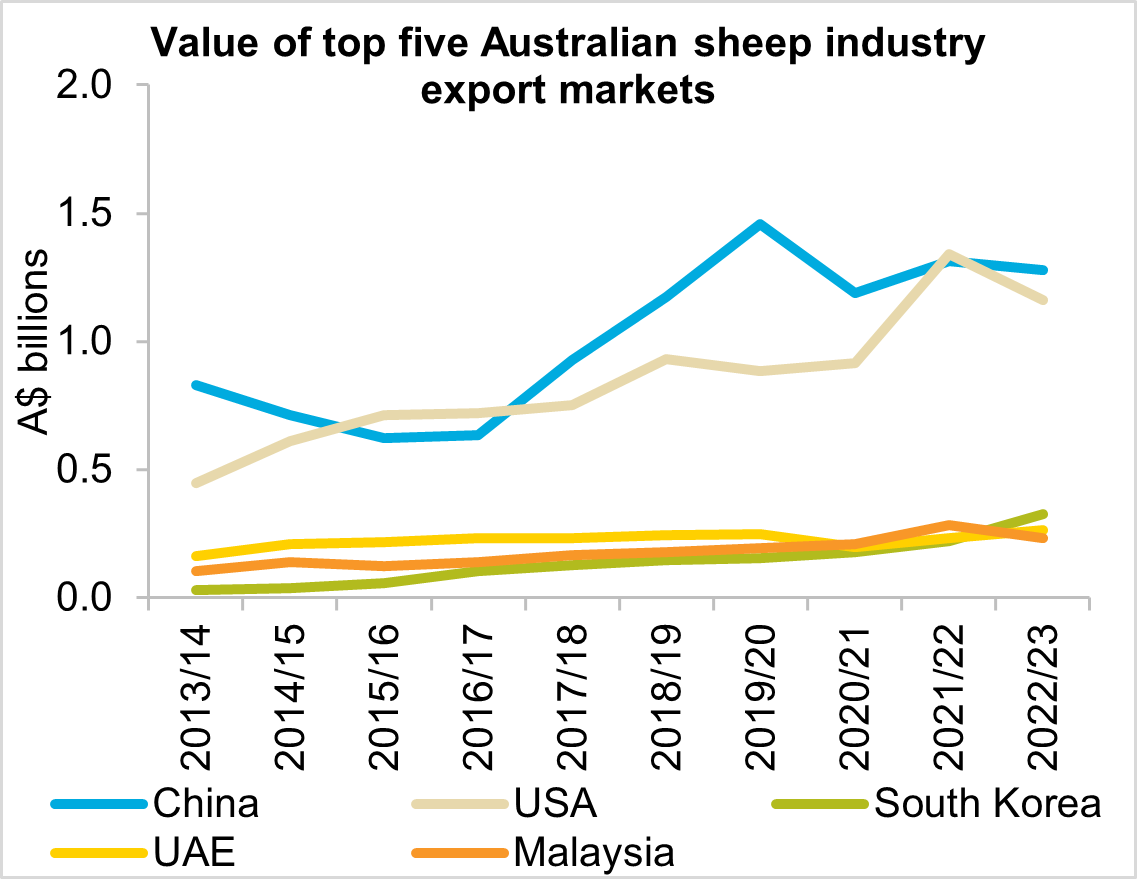

China regained its position as the largest export market for the Australian sheep industry in 2022/23. This followed a brief drop to second place in the previous year. Sheep industry exports to China fell by $36.5 million (-2.8 per cent) to $1.3 billion, and accounted for almost 27 per cent of Australian sheep industry exports. The decline in export value to China was led by skins and lamb in 2022/23. The value of skins fell by $79 million while lamb saw only a $22 million decline. These losses were mostly offset by an increase in the value of mutton exports which was up $64 million (+13 per cent). China is the major export destination for Australian mutton, accounting for 44 per cent of the total value of mutton exports in 2022/23.

The value of Australian sheep industry exports to the US fell $177 million (-13.2 per cent) in 2022/23 to $1.2 billion. Exports remained strong in comparison to historical value, being 11 per cent above the five-year average. Sheep industry exports to the US are predominantly focused on lamb, which has made up 88 per cent of their export value over the past three years. The US is the main export market for premium cuts of lamb. The value of lamb exports to the US fell 10 per cent in 2022/23. Cost of living pressures reduced demand for premium meats and across the food service industry.

South Korea was the largest growth market for Australian sheep industry exports in 2022/23. Growth in value for 10 consecutive years means South Korea has now overtaken the UAE to become the third largest export market. Sheep industry exports rose $107.5 million (+49 per cent), and were 59 per cent above the five-year average. Lamb exports make up over 90 per cent of the total value of sheep industry exports to South Korea and have more than doubled in value over the past three years. The rise in lamb exports to South Korea has been driven by increased demand for premium cuts in restaurant meals and home meal kits.

Outlook for 2023/24

Australian sheep industry exports are expected to follow a similar trend in 2023/24, with increased export volumes being paired with weakened demand and lower prices. Both lamb and mutton production are forecast to increase in 2023/24. The dry seasonal outlook may further add to export volumes as farmers look to destock to manage feed availability. Lamb and mutton prices are currently tracking well below five-year averages which will likely see export prices soften in 2023/24. We may see lamb prices rally as new season lambs enter the market, although any uplift will be limited by the high volume of lambs available. Economic conditions are likely to continue to limit consumer demand for premium cuts of lamb as well as the leather products derived from sheep skins. The future of Australia’s live sheep exports is being challenged by the current Federal government policy to phase out live sheep exports by sea. The time frame and strategy for the phase out is yet to be determined. A panel was appointed to consult with stakeholders and advise the government on how and when the phase out should take place. The panel is due to provide a report to the Minister for Agriculture outlining their recommendations by 30th September 2023. The uncertainty surrounding live exports is dampening the confidence of the sheep industry in Western Australia.

Source: Global Trade Atlas

Explore our other trade performance deep dives

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.