Cattle exports 2022/23

Cattle exports 2022/23

Cattle commodity overview

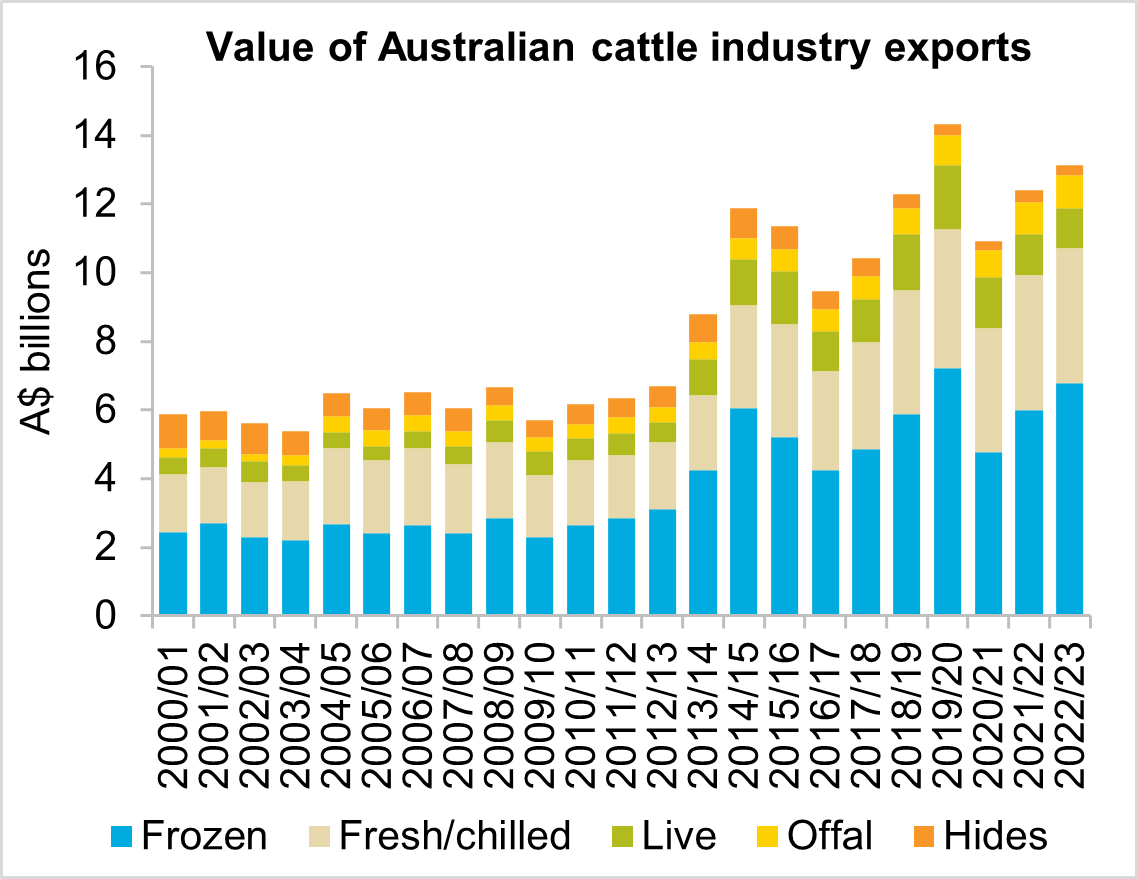

- The value of Australian cattle industry exports increased $725.9 million (+5.9 per cent) in 2022/23 to a total of $13.12 billion.

- Export value was driven by increased domestic production and stronger demand from China and the US.

- Australian beef exports are expected to record a lift in value for 2023/24 due to further production growth and strong international demand, in particular from the US who will be continuing their herd rebuild.

Trade performance in 2022/23

The value of Australian cattle industry exports increased in 2022/23 due to rising domestic production and improved demand from key export markets. Australian cattle industry exports totalled $13.12 billion in 2022/23, lifting $725.9 million (+5.9 per cent) from the previous year. Beef exports alone increased by $799.4 million (+8.1 per cent) to $10.7 billion. The rise in export value was primarily driven by a greater volume of beef exports while the average export price of beef remained stable. In terms of beef products, frozen beef accounted for most of the sector’s rise in value, up $777.6 million (+13 per cent) while chilled beef saw a rise of only $21.7 million (0.6 per cent).

The volume of beef exports rose 7.9 per cent in 2022/23 and returned above one million tonnes for the first time since 2019/20. This was the first sign of a recovery in export volume following a 27 per cent decline across the previous two years. Despite the rise, export volume was still 8.7 per cent below the five-year average. Growth in export volume reflected the 7.3 per cent increase in Australian beef production in 2022/23, the result of recent years of herd rebuilding beginning to translate into increased production.

The average export price of Australian beef remained relatively stable in 2022/23, rising only 0.1 per cent to $10,567 per tonne. This stands in contrast to the performance of Australian cattle prices. The Eastern Young Cattle Indicator recorded an average price of 815c/kg in 2022/23, down 23 per cent from the average price during 2021/22. Local cattle markets saw stronger declines as cattle supply increased and restocker demand weakened.

The value of Australian live cattle exports declined for the third year in a row. A a decline of 2.9 per cent during 2022/23 took export value to $1.15 billion. Live export value contributed 8.8 per cent to the total cattle industry export value during 2022/23. The decrease in export value was driven by a 4.6 per cent drop in the number of cattle exported. Meanwhile the average price of cattle rose by just 1.7 per cent from the previous year.

Major export markets

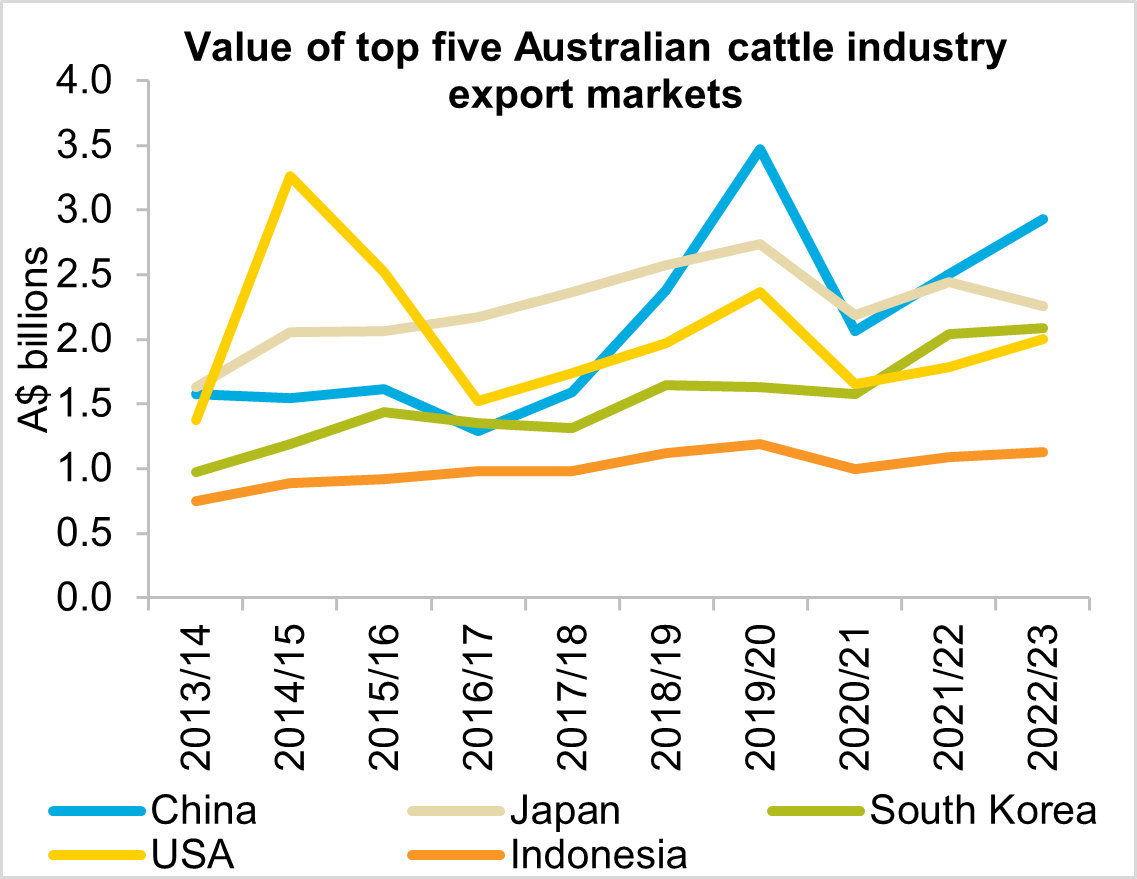

China continued to be the most valuable market for Australian cattle industry exports, accounting for 22 per cent of total export value in 2022/23. The value of exports to China lifted $424.3 million (+17 per cent) to $2.9 billion. This followed a year of strong growth in export value during 2021/22. This rise was driven by a 21.1 per cent increase in the value of beef exports, up to $2.3 billion. China accounted for 72 per cent of the value of cattle hide export value in 2022/23. However, there was a 10.6 per cent reduction in the value hide exports to China.

The second largest growth market for Australia cattle industry exports was the US which saw a $219 million (+12.3 per cent) rise in 2022/23 to $2 billion. The strong growth to the US pushed export value reach $2 billion for the first time since 2019/20. Growth to the US was predominantly led by frozen beef, which grew by 15.7 per cent in value in 2022/23. Beef export volume to the US recorded a 14 per cent increase during 2022/23, finishing at just over 160 thousand tonnes. Improved demand from the US comes on the back of reduced US production, the result of a drought-induced herd reduction.

Japan remained the second largest export market but saw the largest decline in the value in 2022/23. Export value fell $185.2 million (-7.6 per cent) to $2.3 billion. A 10.6 per cent fall in the value of chilled beef exports was the main contributor to the overall downwards shift for 2022/23. Frozen value also fell by five per cent. Beef export volume to Japan recorded a downwards shift of 9.3 per cent during 2022/23, finishing at just under 209 thousand tonnes. The rise in Japanese domestic production, softer consumer demand and strong competition with the US late in 2022 contributed to the decline in export value and volume to Japan in 2022/23.

South Korea recorded moderate growth in export value during 2022/23. A rise of $47.5 million (+2.3 per cent) lifted export value to $2.1 billion, placing South Korea as Australia’s third largest market, just ahead of the US. A lift in frozen beef exports of 11.7 per cent helped drive the overall export value upwards while chilled export value fell 13.8 per cent. Beef Export volume to South Korea recorded a 5.7 per cent rise during 2022/23, finishing at just under 180 thousand tonnes.

Outlook for 2023/24

Cattle industry exports are expected to see another increase in value in 2023/24 due to strong growth in beef export volume. Beef export volume is expected to lift 10 per cent during 2023/24. This is driven by rising Australian production resulting from recent years of herd rebuilding. However, elevated supply will continue to place downward pressure on prices. As a result, the average price of beef is forecast to decline from 2022/23. A reduction in global supply, led by the reduced herd in the US, is expected to provide greater export opportunities for Australian beef in 2023/24 and offer some price support. Despite lower prices year-on-year, the lift in supply available to be exported is expected to drive the export value higher in 2023/24 and take it further above $13 billion.

Source: Global Trade Atlas

Explore our other trade performance deep dives

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.