Wool exports 2023-24

Wool exports 2023-24

Wool commodity overview

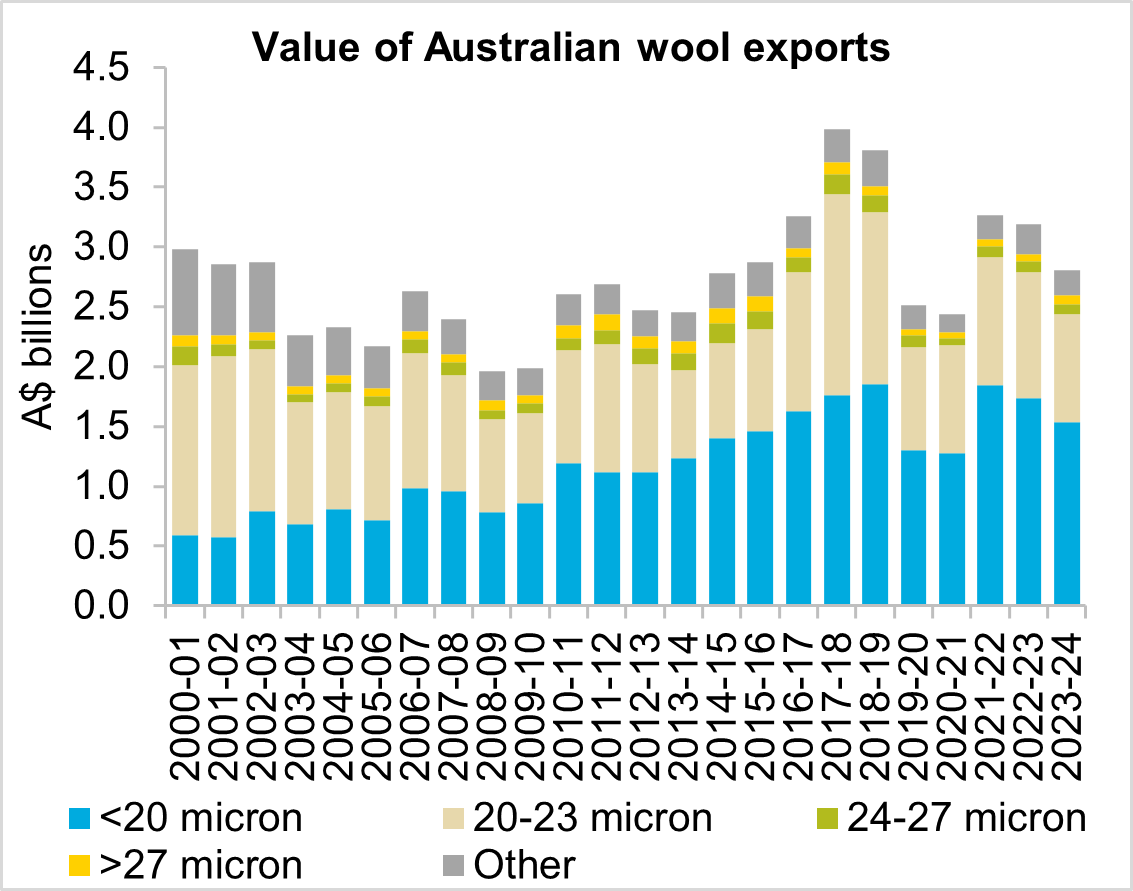

- The value of Australian wool exports fell $382.8 million (-12.0 per cent) in 2023-24 to a total of $2.8 billion.

- Weak demand drove wool prices lower across the year which more than offset a small rise in export volume to see export value decline for a second consecutive year.

- Wool exports are set to see another decline in value in 2024-25 with lower production set to combine with a further easing in prices.

Trade performance in 2023-24

It was another disappointing year for Australian wool exports in 2023-24 with a decline in value for a second consecutive year. The fall of 12 per cent in 2023-24 followed a decline of 2.3 per cent in 2022-23. This took the value of exports to 7.7 per cent below the five-year average.

This decline was driven by a 13.9 per cent fall in the average export price of wool. Average export price fell to $8,307/tonne, the lowest since 2014-15 and 19.7 per cent below the five-year average. Declines in prices were largest for fine wools with wool below 20-micron declining by 14.4 per cent. Medium wools saw slightly lower declines of 11.8 per cent for 20-23 micron and 9.9 per cent for 24-27 micron. Broad wool saw a small rise in average export price, with wool broader than 27-micron seeing a rise of 1.9 per cent. However, this was still the second lowest price in the last 29 years and 28.8 per cent below the five-year average.

The decline in price was more than enough to offset a 2.2 per cent rise in export volume. This was the fourth consecutive year of growth in export volume as an expanding sheep flock has driven a 38.1 per cent rise in export volume since 2019-20. This has taken export volume to 14.7 per cent above the five-year average. Increased export volume in 2023-24 was led by wools finer than 20-micron and coarser than 27-micron. Meanwhile there was a 2.6 per cent decline in wool between 20-23 micron.

Major export markets

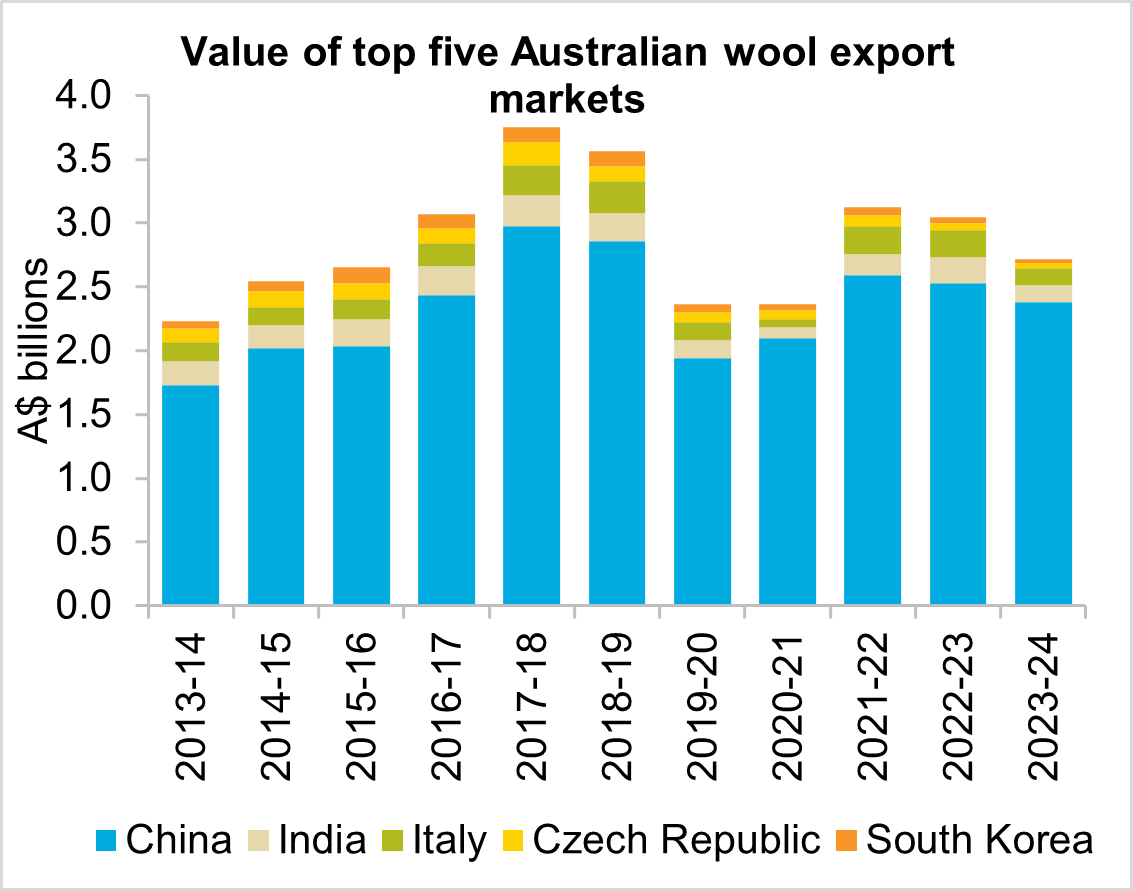

China took an increased share of Australian wool exports in 2023-24. Although the value of exports to China dropped $154 million (-6.1 per cent) to $2.4 billion, this accounted for 84.6 per cent of the total value of wool exports, up from 79.3 per cent in 2022-23. China was the only major market to which export volume rose in 2023-24. Export volume to China increased by 7.0 per cent and rose to its highest level since 2006-07. Meanwhile, export volumes fell by over 20 per cent to both India and Italy. This combined with declines in average export prices saw the value of exports to India fall 31.2 per cent and to Italy by 39.1 per cent. Export value to India and Italy were particularly weighed down by fine wool with both markets seeing a fall in the value of wool finer than 20-micron of 40 per cent.

Outlook for 2024-25

It is expected to be another challenging year for wool exports in 2024-25 with declines in both export price and volume set to drive export value lower for a third year in a row. Export prices are expected to continue drifting lower with little indication of demand improving. Consumers in China, Europe and the US are likely to continue to face challenging economic conditions and keep spending on discretionary items to a minimum. A slowing of inflation and the beginning of interest rate cuts in some economies indicates a recovery in consumer sentiment could be getting closer, however it will likely take some time after conditions improve to see uplift in spending on woollen products. China’s economic situation is less optimistic which will continue to weigh on demand for some time. Unlike the previous four years, the volume of exports is expected to decline in 2024-25. Dry conditions across most sheep regions in the past 12 months has brought flock expansion to an end. High turnoff of sheep will likely cause the flock to have declined and leave fewer sheep to be shorn in 2024-25. The Australian Wool Production Forecasting Committee expect there to be a 10.3 per cent decline in the number of sheep shorn in 2024-25. Dry conditions in the first half of 2024 will also contribute to lighter wool cuts. Expected declines in both average export price and volume could see export value fall by around 10 per cent to $2.5 billion.

Explore our other trade performance deep dives

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.