Horticulture exports 2023-24

Horticulture exports 2023-24

Horticulture commodity overview

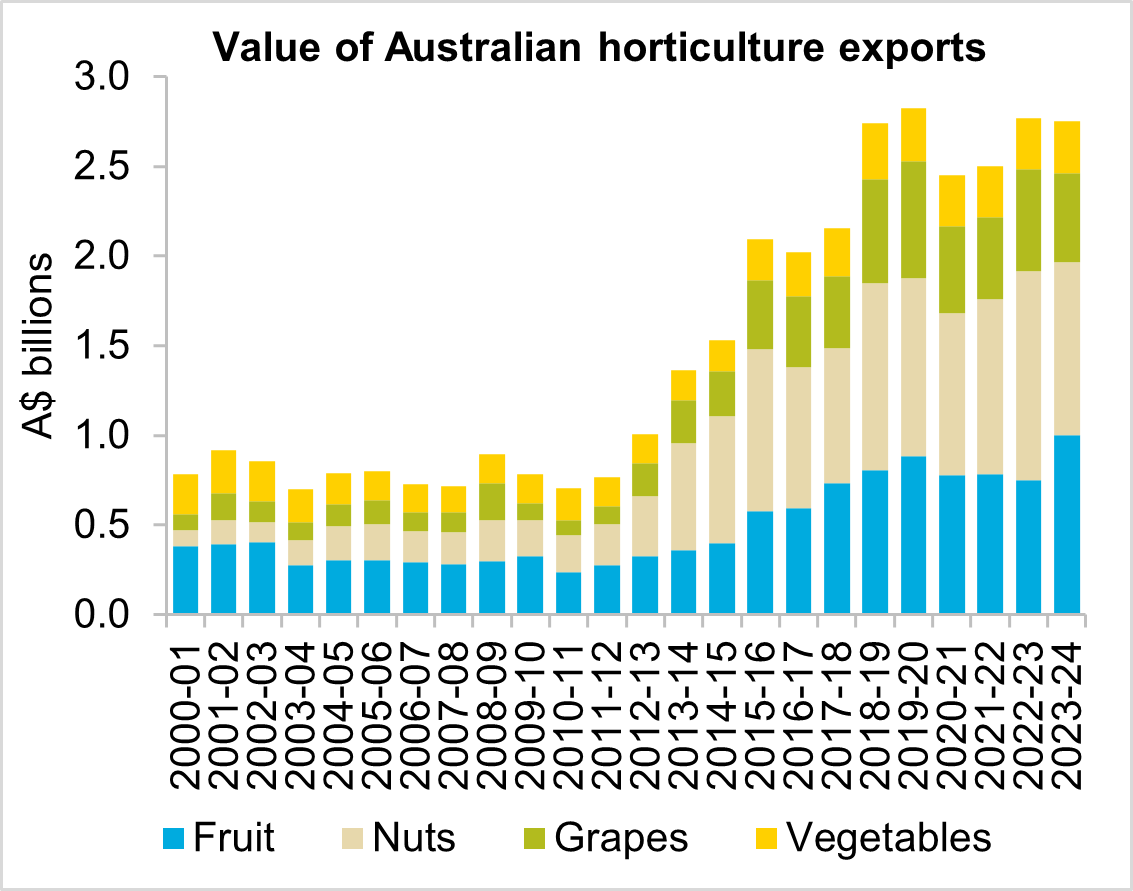

- The value of Australian horticultural exports declined $14.6 million (-0.5 per cent) in 2023-24 to a total of $2.75 billion.

- Export value was supported by growth in citrus and stonefruit volumes. Quality issues caused a sharp decline in the value of table grape exports. This combined with a decline in almond and macadamia output pushed the value of horticultural exports slightly lower.

- The outlook for Australian horticultural exports remains broadly positive for 2024-25. Export value should lift thanks to a rebound in almond and macadamia volumes available for export.

Trade performance in 2023-24

The value of Australian horticultural exports was almost unchanged in 2023-24. While on the surface the lack of growth in export value may appear disappointing, the sector continues to exhibit strong signs of growth. The value of both fruit and vegetable exports continued to lift. Proximity to key Asian markets, a lower Australian dollar and expanded market access continued to support growth. Unfortunately, a sharp decline in the value of nut exports following reduced output in 2023 was the key driver behind the overall decline for horticulture. Despite the decline, export value in 2023-24 was still 3.6 per cent above of the five-year average. The volume of horticultural export increased for the third consecutive season, rising by 4.8 per cent. Again, this was primarily on the back of an increase in fruit and vegetable output. The increased volumes were due to mostly favourable growing conditions and cheap irrigation costs in 2023-24.

The value of Australian fruit exports increased by $176.2 million (+13.3 per cent) to $1.5 billion in 2023-24. This was the second highest value of fruit exports on record, just $40 million shy of the record set in 2019-20. This was driven by export volumes rising by 9.9 per cent to 464,000 tonnes. Adding to the positive result was an accompanying lift in the average price of fruit exports of 3.1 per cent. Australian fruit exports enjoy the benefit of growing on a counter seasonal cycle to northern hemisphere markets. Challenging seasons for key export competitors across the southern hemisphere in Chile, Peru and South Africa further aided export demand for Australian produce. At a commodity level, the value of citrus exports lifted to the highest level on record at $554.6 million (+25.7 per cent). Oranges reached their third highest level on record at $293 million (+19 per cent). However, mandarins were the standout, surging by $58.7 million (+32.3 per cent) to a record $240.3 million. The value of stonefruit exports also lifted by $47.4 million (+35.3 per cent) to a record $181.5 million. Growth was seen across cherries, plums, peaches and apricot varieties resulting from strong production over summer. The improving trade relationship with the Chinese market also proved favourable. An expanded list of orchards, packhouses and treatment facilities allowed to export to China was released in June 2023. This was the first time the list had been updated since 2020. Substantial growth in fruit exports was partially tempered by a decline in Australia’s most significant fruit export: table grapes. The value of table grape exports dropped by $74.8 million (-13.1 per cent) to $496.5 million. This was primarily due to reported quality issues impacting demand.

The export value of Australian nuts was well down in 2023-24. Exports fell $197.8 million (-17 per cent) to $969 million. Almond exports fell by $57 million to $761.7 million (-7 per cent). A weather-impacted almond harvest in 2023 resulted in a large drop in production and therefore export volume. Macadamia producers encountered a similar situation with the smallest production in four years also impacting exports. Challenging weather weighed on production, though this was partially offset by the ongoing maturation of recent plantations. Macadamia exports totalled $189.2 million, a decline of $111 million (-36.9 per cent). The volume of exports across nuts sectors declined by 8.1 per cent with almond and macadamia export volumes dropping by 5.2 per cent and 7.3 per cent respectively. Unfortunately, the drop in volumes was not offset by an increase in price. The average price of macadamia exports declined by a staggering 31.9 per cent in 2023-24 to a record low. Global supply is continuing to grow by around 10 per cent annually which is adding further pressure to prices. This is especially concerning given the export focused nature of the crop. The average price of almond exports recorded a more restrained drop, down 1.9 per cent.

The value of Australian vegetable exports lifted by $7 million (+2.5 per cent) to $287.9 million. The value of Australian vegetable exports has been incredibly consistent over the past four years with exports varying by a maximum of just $7 million over this period. Total export volume increased by 5.3 per cent to over 199,000 tonnes. These increased volumes saw the average export price of vegetables ease by 2.6 per cent from the previous year’s record level. Western Australia continued to account for the majority of Australia’s vegetable exports due to substantial carrot exports of which it accounts for 89 per cent. Carrots remain Australia’s most valuable vegetable export. However, a decline of $10.8 million (-13 per cent) left the value of exports at their lowest level since 2014-15 at $71.7 million. Competition from rising carrot production in China and Egypt impacted demand into Australia’s key Middle Eastern markets. The value of potato exports continued to surge, lifting by 19 per cent to an all-time high $53.7 million. This was the result of a rebound in volumes to near record levels combined with a 5.3 per cent rise in average export price to a record high. The value of onion exports also lifted 18.2 per cent to record levels at $46.3 million. Poor production across India, a key global onion producer supported this lift in exports. Both potatoes and onions saw challenging seasonal conditions in 2022-23 which impacted production. This was not the case in 2023-24, helping to push export values to record levels.

Major export markets

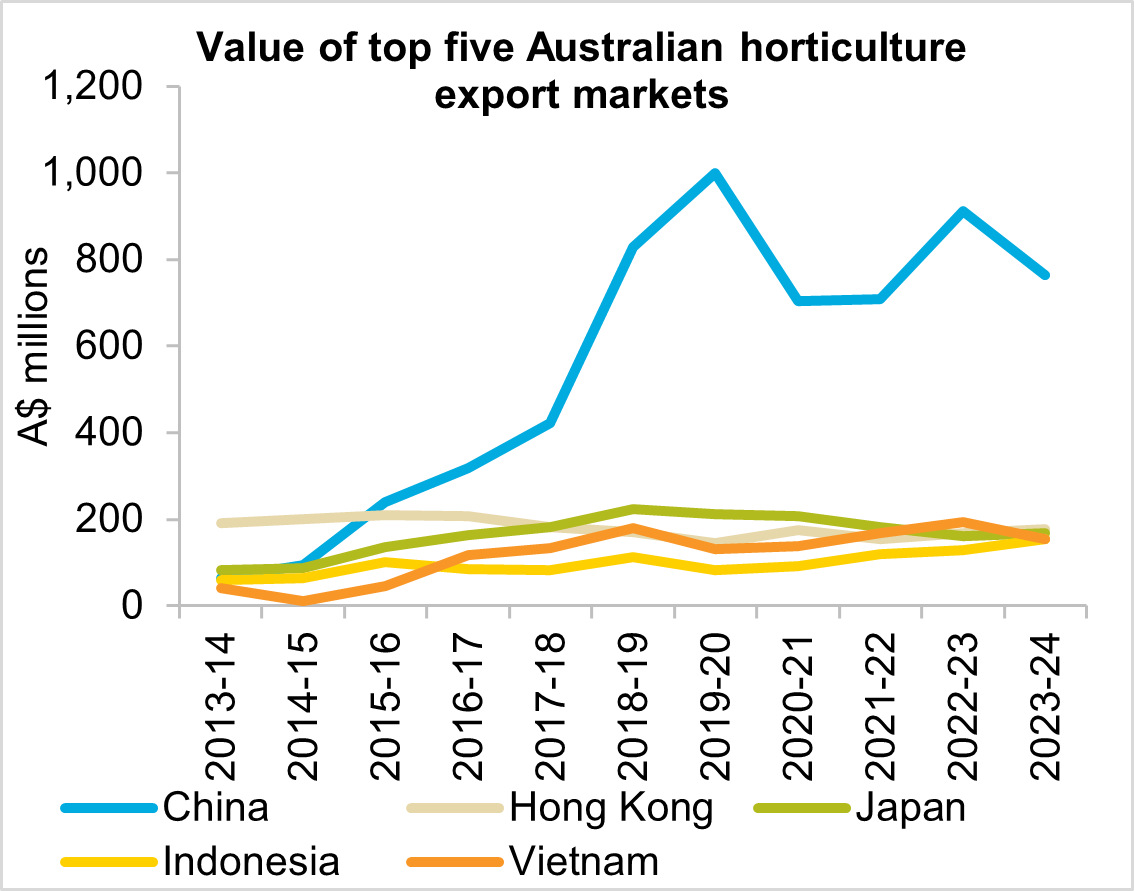

Australia’s key markets for horticultural exports remain concentrated within the Indo-Pacific. Seven of Australia’s top ten horticultural export markets by value recorded growth in 2023-24. China was a key outlier with a decline in export value of $148.1 million (-16.2 per cent). This left the value of exports at $763.5 million, still the most valuable horticulture market. Exports to China in 2023-24 were 8 per cent below the five-year average. The decrease was led by a drop-off in almond, macadamia and table grape exports. The decline in both almond and macadamia exports were driven by reduced Australian production volumes and sluggish consumer demand in China. Australian table grape exports to China work on a counter seasonal cycle. Unfortunately, China also saw extended domestic supply this season which further weighed on demand. Quality issues also had an impact on demand with Crimson Red grapes reporting some undesirable characteristics. Citrus export to China remained essentially unchanged at $92.2 million while stonefruit exports surged $25 million (+55 per cent) to a record $70.4 million in 2023-24. The surge in stonefruit exports were the result of a lift in quality and output across key varieties. The improvement in the trade relationship between the two nations also proved favourable.

Hong Kong remained Australia’s second most valuable market for horticultural exports. Growth of $9.8 million (+5.9 per cent) to $176.4 million was driven by a lift in the value of citrus (+15.1 per cent), avocado (+37 per cent) and stonefruit (+12.3 per cent) exports. Exports to Hong Kong in 2023-24 were 8.8 per cent above the five-year average. Avocados have seen a continued uplift in Australian production following substantial plantings over the last decade. The surge in production has created an oversupply on the market over the last five years. As a result, the ongoing expansion into current and new export markets will continue. Hong Kong was our second most valuable market for fruit exports and our seventh largest market for vegetable exports.

Export value to Japan saw a small rebound of $7.1 million (+4.4 per cent) to $168.8 million in 2023-24. Despite this rebound, export value remained 14.6 per cent behind average. This is a result of the significant declines recorded over the preceding four years. A lift in citrus (+23.9 per cent) and avocado (+207 per cent) export value more than offset a decline in table grape exports (-31.3 per cent). In terms of value, Japan is Australia’s fourth largest market for fruit exports and the sixth largest market for vegetable exports. The importance of the Japanese market to nut producers continued to decline in 2023-24. The value of nut exports declined by $15.8 million (-44.9 per cent) to $19.4 million, making the market just our eighth most valuable market, falling from our fourth most valuable market just three years ago.

India and Indonesia recorded the most significant year-on-year growth in horticultural export value. India saw growth of $49 million (+48.9 per cent) to $149.3 million. Indonesia recorded a lift in export value of $26.3 million (+20.5 per cent) to $154.7 million. Both markets are now sitting 45.1 and 44.4 per cent above the five-year average respectively.

Outlook for 2024-25

The outlook for Australian horticultural exports remains broadly positive heading into 2024-25. A rebound in production across both almond and macadamia crops will lift the export value of the nut sector back above $1 billion. Rising export demand from India will be of particular benefit to almonds. Almond production topped 160,000 tonnes while macadamia output estimates sit at almost 51,000 tonnes in 2024. This means there is a substantial export program to execute in 2024-25. The challenging economic conditions across China will likely continue to weigh on consumer demand. This may place a ceiling on the growth in export value to China for the coming season. Over the medium-term both almond and macadamia exports will continue to trend higher as recent plantings continue to mature and produce greater volumes.

Average rainfall currently forecast by the Bureau of Meteorology across the east coast is driving positive production and quality prospects for fruit growers. This is further assisted by ongoing cheap irrigation costs. Table grape exports are expected to lift, though weather across summer months will be key to ensuring quality remains high. Favourable quality is key to maintaining demand from our key export markets of China, Japan and Vietnam. Table grape producers have also just received greater access to the Japanese market. We can now export more than 130 varieties into Japan. Exporters have previously only had clearance to export three varieties of table grapes. These varieties were Crimson Seedless, Red Globe and Thompson Seedless. This expanded market access is expected to lift the value of the Japanese market from $30 million to $50 million over the next few years. Citrus exports will likely ease back towards average of around $280 million as output across regions typically follows a biennial “tic-toc’ pattern. This decline will be led by mandarin exports. Output of mandarins has eased slightly over the harvest period, particularly in key Queensland production areas. Stonefruit exports are also expected to ease slightly. This follows the strong production season seen in summer 2023. Despite this, stonefruit exports will remain above the average of $160 million. This is assuming the volumes of export quality output remains.

The value of Australian vegetable exports will remain reliant upon how production shapes up across key competing nations such as China and India. Production potential across 2024-25 remains favourable on the back of low irrigation costs with high prices also encouraging strong plantings. Forecast average rainfall across the east coast will also enable full planting programs and limit disease concerns for root vegetable growers.