Horticulture exports 2022/23

Horticulture exports 2022/23

Horticulture commodity overview

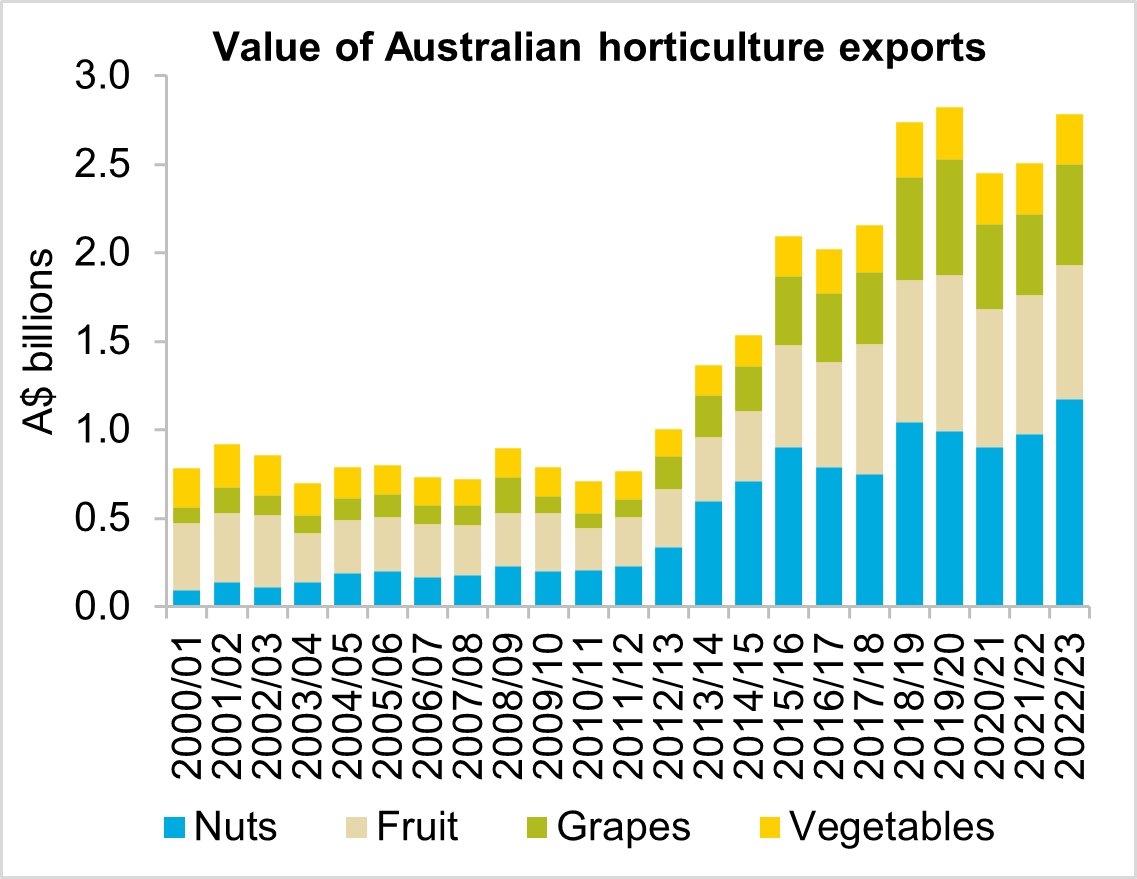

- The value of Australian horticultural exports rose by $277.9 million (+11.1 per cent) to $2.78 billion in 2022/23.

- The jump in the value of exports was primarily driven by increased grape and nut exports amidst rising production volumes.

- The value of Australian horticultural exports is forecast to rise further in 2023/24. This is driven by strong production forecasts across key export varieties and improving quality.

Trade performance in 2022/23

The value of Australian horticultural exports rose to their second highest level in 2022/23. This was primarily a result of increased grape and nut exports which more than offset a slight decline in the value of other fruit and vegetable exports. Horticultural exports totalled $2.78 billion in 2022/23, up $277.9 million (+11.1 per cent). The volume of horticultural exports also increased marginally for the third consecutive year, up 2.5 per cent. This was driven by record production across the horticultural sector resulting from low irrigation costs, above average rainfall and improved labour availability.

The value of Australian fruit exports jumped by $82 million (+6.6 per cent) to reach $1.3 billion in 2022/23. The volume of fruit exports was unchanged on last season at just over 424 thousand tonnes (+0.3 per cent). As a result, the growth in the overall value of fruit exports in 2022/23 was driven by an increase in the average price of exports rather than increased volumes. The average price of fruit exports increased by 6.2 per cent. At a commodity level, table grapes were the best performing sector following a couple of challenging seasons. Exports surged by $114.1 million (+24.9 per cent) to total $571.9 million. A recovery in demand from the Chinese market was key to this rebound. China accounted for 40 per cent of table grape exports in 2022/23, up from just 28 per cent in 2021/22. The value of orange exports declined by $11.3 million (-4.4 per cent) to $248.5 million. This was the lowest value of Australian orange exports since 2016/17. Poorer quality citrus impacted export volumes which declined 8.4 per cent on the previous season. Stone fruit also recorded a significant drop off in exports during 2022/23. Exports declined by $19.9 million (-12.9 per cent) to $134.1 million. The decline in exports was spread relatively evenly across stone fruit varieties led primarily by a drop in cherry, plum and nectarine exports. Volumes also dropped by 18.5 per cent as the wet summer period impacted the amount of export quality produce available.

The value of Australian nut exports grew by $199.3 million (+20.4 per cent) in 2022/23 to a record $1.17 billion. This was the first time nut exports exceeded $1 billion. The ongoing maturation of plantations saw a record volume of nuts exported in 2022/23, totalling almost 173 thousand tonnes, (+32.6 per cent). Growth was almost exclusively due to a surge in almond exports. The value of almond exports grew by $201.5 million (+32.3 per cent) in 2022/23 to $824.7 million. This was matched by a similar increase in export volume of 34.8 per cent, while the average export price dipped by just 1.8 per cent. China’s continued tariffs on almond imports from the US, the world’s top producer accounting for almost 80 per cent of global output, ensured demand for Australian almonds remained high. As a result, almonds continue to be the dominant export variety, accounting for over 70 per cent of exports by value and 77 per cent of exports by volume. This was contrasted by a sharp decline in the value of macadamia exports which dropped $14.9 million (-4.7 per cent) to $301.5 million, the lowest total in six years. This comes despite ongoing production growth across key production regions. Export volumes jumped 27.6 per cent to a record 133 thousand tonnes in 2022/23. Unfortunately, production growth was matched by similar growth in competing markets. As a result, an oversupply of macadamias has hit the global market. This negatively impacted global demand for Australian macadamias. The average export price fell by 25.3 per cent to its lowest level in a decade as a result.

The value of Australian vegetable exports was relatively unchanged in 2022/23 at $282.3 million, down only $3.3 million (-1.2 per cent). Total export volumes declined sharply by 11.5 per cent to just over 190 thousand tonnes, the lowest level of export volumes since 2014/15. This was driven by a sharp decline in carrot exports out of Western Australia. Reduced volumes drove a comparative increase in the average price of vegetable exports of 11.7 per cent which mostly offset this decline in volumes. Western Australia remains the largest vegetable export state by some margin. The state accounted for over 38 per cent of all vegetable exports, though this was down from 42 per cent the season prior. Carrot exports slipped by $9.5 million (-10.3 per cent) to $82.7 million amidst lower production. The volume of carrot exports declined by 11.3 per cent to just over 88 thousand tonnes. Conversely, the value of potato exports grew by $1.7 million (+3.9 per cent) to $45.5 million amidst strong demand across eastern Asia, our major export region. This strong demand pushed the average export price of potatoes over $1,000 per tonne for the first time. This increased average price helped to offset the below average national production. Potato export volumes declined by 12.3 per cent to just over 45 thousand tonnes. Onions, our third major vegetable export crop recorded the largest year-on-year increase in value. The value of onion exports jumped to a record $39.6 million, an increase of $5.7 million (+16.9 per cent). The theme of lower volumes and higher average export prices held true here as well. The volume of onion exports decreased by 13.3 per cent to 36 thousand tonnes amidst challenging growing conditions. Dry weather across key European production nations drove significant global demand for Australian onions. This pushed the average export price to just over $1,000 per tonne for the first time.

Major export markets

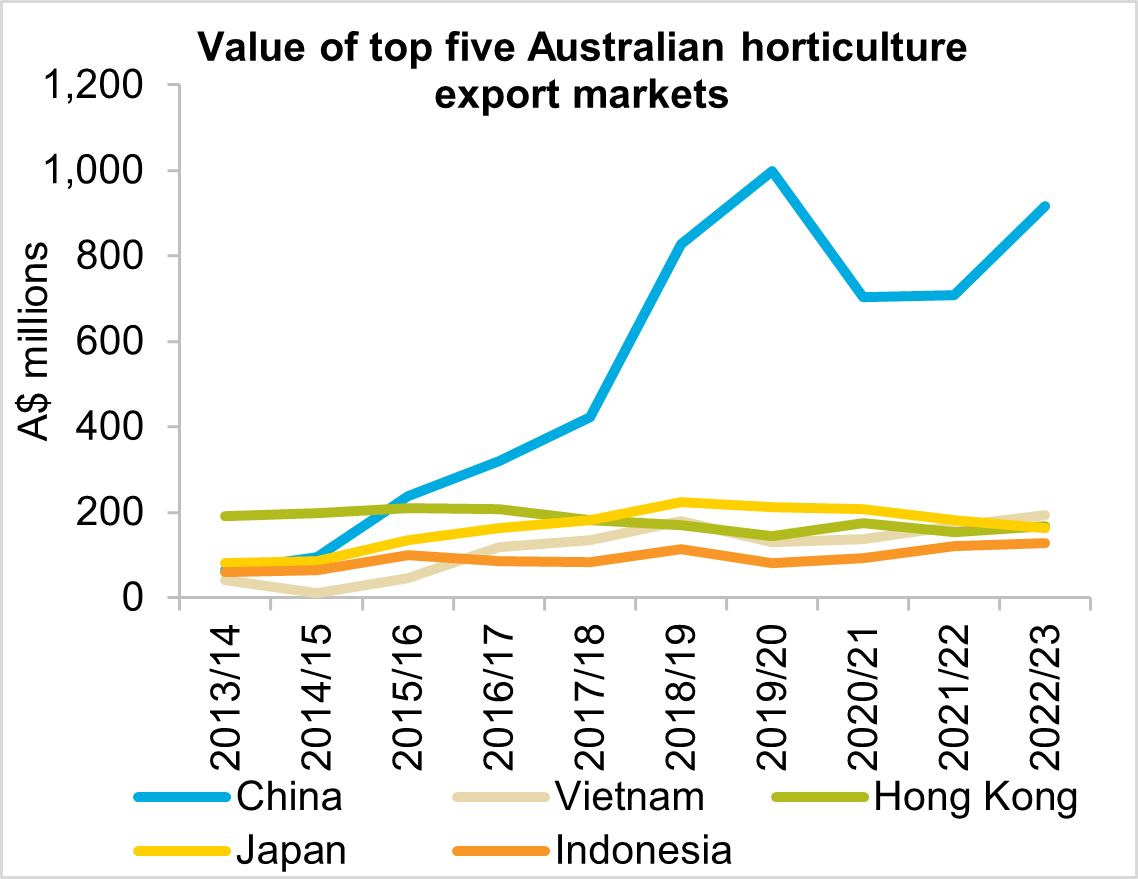

China remained Australia’s most valuable export destination by some margin in 2022/23, accounting for 33 per cent of horticultural export value. The value of exports to China rose $208.1 million (+29.4 per cent) to $916.9 million, returning to pre-pandemic levels following two years of decline. Exports to China predominantly comprised of almonds, grapes and macadamias. China was the number one export destination for each of these commodities. Australian almond exports to China totalled $409.6 million in 2022/23 while macadamias totalled $149.8 million. China was also our largest market for fruit exports by some margin in 2022/23, accounting for 25.4 per cent of all fruit exports. These exports were primarily comprised of table grapes, citrus and stone fruit. These varieties totalled $194.5 million, $94.4 million, and $45.5 million respectively. Increased almond (+32.3 per cent) and table grape (+86.3 per cent) exports to China more than offset smaller declines to citrus (-10.4 per cent) and stone fruit (-18.8 per cent) exports. China is not a major market for Australian vegetable exports, accounting for only 0.2 per cent of total value.

The value of Australian horticultural exports to Vietnam grew by $26.5 million (+15.8 per cent) to $193.9 million in 2022/23. This growth pushed Vietnam from our third to second largest export market. Vietnam accounted for seven per cent of all Australian horticultural exports. The fruit and nut sectors again comprised the majority of horticultural exports to Vietnam. Table grape exports totalled $71.7 million (-5.5 per cent) while citrus and stone fruit exports accounting for $33.7 million (+103.7 per cent) and $12.4 (+30.6 per cent) million respectively. Almond exports to Vietnam grew by 35.3 per cent to total $43.8 million while macadamia exports also jumped 24 per cent to $23.8 million.

Hong Kong saw a slight rebound in the value of Australian horticultural exports during 2022/23. The value of exports increased by $13.8 million (+9.0 per cent) to $167.3 million. This accounted for six per cent of all Australian horticultural exports. Citrus remains the primary fruit export to Hong Kong, accounting for $42.4 million in 2022/23, though this was a decline of $7.1 million year-on-year (-14.4 per cent). Table grape exports picked up the slack, more than doubling to $34.9 million while stone fruit also grew by $6.2 million to $29.2 million (+26.6 per cent). Australian vegetable exports have continued to trend lower falling $3.7 million to sit at just $16 million (-18.7 per cent). Major vegetable exports to Hong Kong include carrots, potatoes and cabbages.

Exports to Japan declined by $8.7 million (-6.9 per cent) to $117.2 million in 2022/23. This saw Japan drop from our second to fourth most valuable market for horticultural exports. The was driven by a $7.8 million (-24.2 per cent) decline in table grape exports amidst increasing global competition.

Outlook for 2023/24

The overall value of Australian horticultural exports is expected to continue trending higher in 2023/24. The value of nut exports, the largest growth segment for the industry over the last decade, is anticipated to continue rising. Almond and macadamia plantings are continuing to reach full maturity. This is driving higher domestic production and export volumes. Unfortunately, growing international output remains a challenge to prices. This is particularly the case for the macadamia industry where prices are near all time lows. Fruit exports are also forecast to increase. Improved labour availability combined with low irrigation costs will drive increased volumes of higher quality fruit. Our key export varieties including table grapes and citrus in particular are expected to reflect this improved quality. The prospect of a dry spring and summer remains a threat with the potential to negatively impact export volumes. Demand from China is expected to remain strong following the rebound observed during 2022/23. Improved access to an increasingly diverse range of export markets will also prove supportive. Trade agreement with the UK and Indian are now in force which will drive higher volumes of Australian horticultural produce to these markets in 2023/24. These agreements will prove particularly beneficial for almond producers, while volumes of citrus and avocado exports are also anticipated to rise. Vegetable exports should rebound with higher planting and production volumes anticipated. This follows the disruptive weather events the negatively impacted production in 2022/23.

Source: Global Trade Atlas

Explore our other trade performance deep dives

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.