Insights May 2024

Insights May 2024

Commodity Overview

Citrus season is now underway across the country. The harvest of Queensland's Imperial mandarins kicked off in early April.

Almond harvest is now essentially complete across most key regions. Large volumes of high quality in-shell almonds have been harvested this season which bodes well for export demand.

Fruit

Shepard avocado season was in full swing during April as harvest continued across central Queensland. Increased supplies have seen wholesale Shepard prices drop by over 15 per cent since the season started in February with prices currently hovering around $3/kg. Hass avocados will return to market towards the end of the month and into June. While substantial production growth over the last five years is keeping prices constrained, growing access to key export markets is boosting industry sentiment. Avocados Australia are hosting a launch event for Australian avocados’ entry to India this week with avocado exports to the subcontinent to continue to rise over coming seasons. India has taken over 320 thousand tonnes of avocadoes so far in 2024. Market access to Thailand is also proving beneficial with for Western Australian producers with exports to the nation totalling 235 thousand tonnes so far this year. Year to date (Jan-Mar) avocado exports at a national level are currently 170 per cent above the same period last year.

Citrus season is now underway across the country. The harvest of Queensland's Imperial mandarins kicked off in early April. The Queensland mandarin crop is in for a biennial down year which will see volumes across the region drop off by between 40-50 per cent. However, quality across Queensland is good with large fruit also a positive. Wholesale imperial mandarin pricing out of Queensland is currently sitting at $2.21/kg. Pricing will ease significantly over the next month as greater volumes comes to market. Further south, lemons and early season navel oranges started harvest across the Riverland and Sunraysia region in early May.

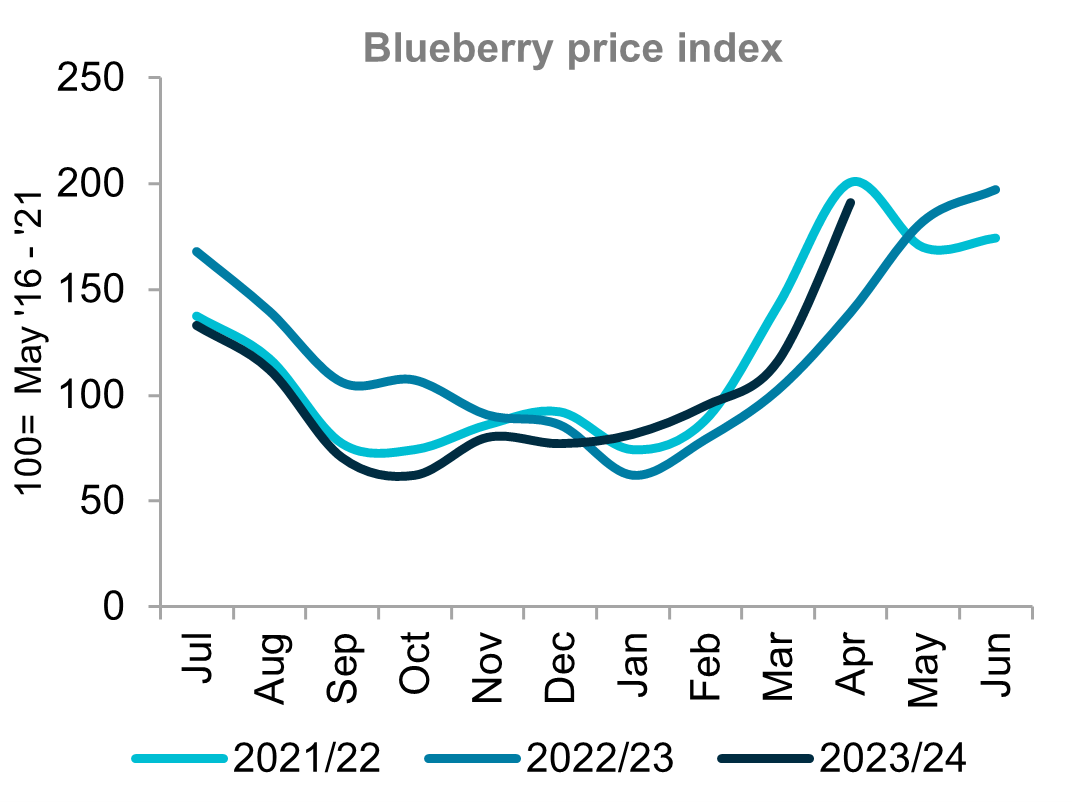

Blueberry prices remained elevated throughout April. The Tasmanian and Victorian blueberry season ended in March while a lack of imports from New Zealand has also exacerbated prices. Blueberry volumes out of New South Wales won’t begin to pick up until mid-June. Current wholesale blueberry prices are around 37 per cent higher compared to the same period in 2023. We expect prices will remain elevated throughout May and into June as a result.

Vegetables

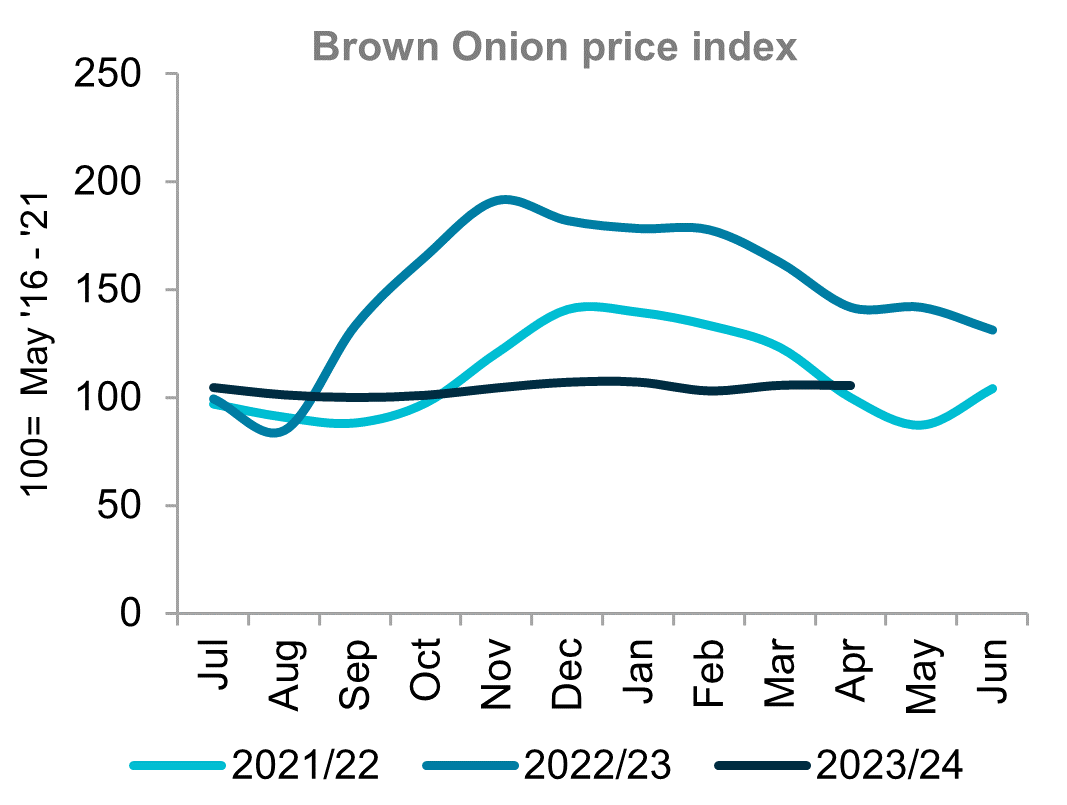

The cooler, though still sunny autumn weather saw key winter vegetable crops develop well across the east coast of Australia during April. But substantial rainfall totals in early May across central New South Wales will have growers monitoring their crops closely. Onion volumes have started to decline marginally out of South Australia and Tasmania over April. Both Tasmania and South Australia’s peak onion period is now in the rear view mirror. Favourable conditions drove strong production. Year to date (Jan-Mar) export volumes out of the two states tracking 85 per cent ahead of the same period in 2023.

Nuts

Almond harvest is now essentially complete across most key regions. Large volumes of high quality in-shell almonds have been harvested this season. Strong export demand from key in-shell exports markets such as India and China remain a positive for the industry. The strong export demand will also prove positive from a pricing perspective with low stocks leading into harvest also proving supportive.

Sources: Ausmarket Consultants, Rural Bank

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.