Insights June 2024

Insights June 2024

Commodity overview

- Navel orange prices are now on the decline as additional volumes from southern states begin to hit supermarket shelves.

- Potato volumes remain above average. Good early autumn rainfall has driven strong yields while a very dry May has allowed harvest to progress quickly.

Fruit

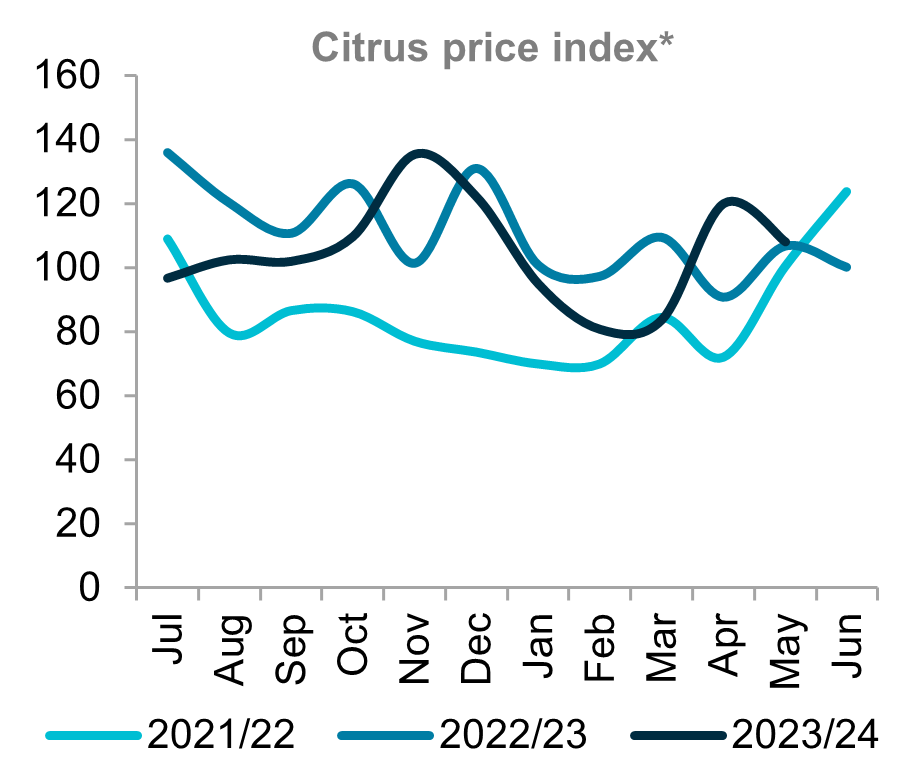

Citrus season continues to ramp up in Victoria and South Australia. Navel orange prices are now on the decline as additional volumes begin to hit supermarket shelves. Queensland produce has been available since early-May, though additional supply from southern states is placing downwards pressure on the market. Wholesale navel oranges averaged $2.02/kg in April before declining to $1.86/kg in May. This trend is expected to continue across the winter months. Imperial mandarins are seeing a similar trend with prices also easing during May.

The Queensland University of Technology has successfully developed a banana genetically engineered for resistance to Panama Disease. The new variety has been approved by Food Standards Australia New Zealand. While the University has no plans to commercialise the banana, the new variety will be utilised as a safety net should Panama Disease spread throughout Australia. Cavendish banana prices are currently elevated with the cooler weather impacting volumes in the winter months.

Vegetables

Strong potato volumes have come to market over the first half of the year. A great season in Victoria developed thanks to good early autumn rainfall. This drove above average yields before a very dry May allowed harvest to progress quickly. South Australia has also seen strong output with volumes now starting to slow coming into winter. Good prices have also continued into 2024. These prices, combined with strong production, should see another year of above $1 billion in farmgate production value. However, challenges remain for the industry with increased costs of production continuing to be felt. There are no signs of costs easing in the near term. These costs are partially offsetting the strong prices seen at a farmgate level.

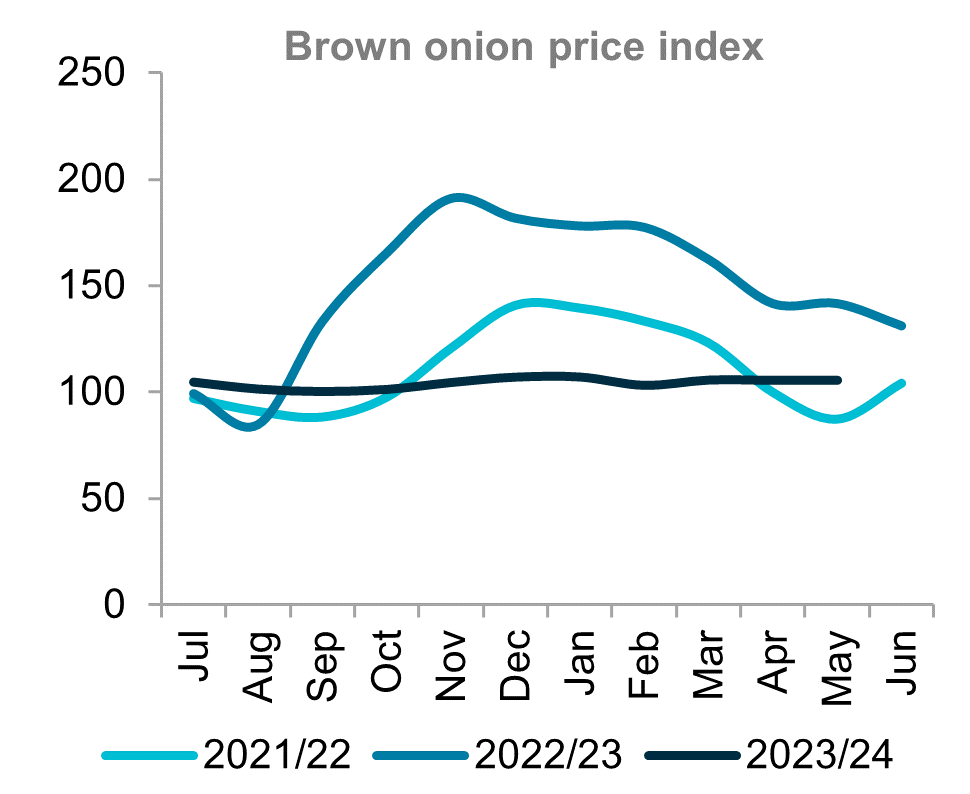

Tasmania onion harvest finished in April. A dry season impacted yields but is also driving higher quality which has provided positive sentiment from an export perspective. Current year-to-date onion exports are tracking almost 50 per cent ahead of the same time last year. This growth is primarily on the back of rising export demand from south-east Asia and Europe. Meanwhile, the domestic market remains stable with little fluctuation in demand. This can be seen in average wholesale brown onion prices remaining in line with long-term averages well down on last year’s elevated prices following disrupted supply.

Nuts

Almond harvest is now complete, though the processing of a near record crop is keeping the industry busy. Almonds Australia have released their latest position report with export figures for March (the first month of the new season) now available. Favourable weather during harvest has resulted in improved quality compared to last season. As a result, there was a resurgence in export demand from China, while demand from India continues to boom following the 50 per cent reduction in tariffs on kernel and in-shell Australian almonds. This demand bodes well for the season ahead. Unfortunately, the same cannot be said from a price perspective. Weakness in almond prices over the last couple of months can be attributed to a significant lift in output from the 2024 Californian crop compared to the season prior. This improved output will lift global volumes substantially.

* Citrus price index includes oranges, limes, lemons, and mandarins

Sources: Ausmarket Consultants, Rural Bank

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.