Insights February 2024

Insights February 2024

Commodity Overview

- Table grape quality is looking much improved compared to last season. This is thanks to favourable conditions across the summer months. Reduced US production will provide strong export demand from key Asian buyers.

- Almond harvest is now underway. Industry estimates are pegging the crop at just over 164,000 tonnes. This is a 60 per cent increase on last season.

Fruit

Table grape quality has been excellent from what has been seen so far this season. This is thanks to improved weather conditions, especially compared to least season’s rainfall impacted crop. Most table grape varieties are ripening as per normal this year. Maturity was delayed by around a month last season. This means that the production window will be larger from January to May. This will also assist retailers as supply is more consistent over a longer period rather than a glut of supply hitting the market at once. This allows for much better market and freight scheduling and prices will remain more consistent as a result. Markets are currently buoyant at both a domestic and export level, partially due to a lower-than-average US table grape crop. California only produced 60 million cartons this season when they would normally produce 100 million. This is weather related with very unusual July-August rainfall recorded in the primary US production region of California. Below average US output has seen key Chile and Peru producers focus their exports on the US rather than Asia which should see Asian demand move towards Australian produce and be prove supportive of prices. The recent end of industrial action across key Australian ports has also come as a big relief to table grape growers. The dispute had been causing significant delays in shipping times. This would have been particularly impactful for table grapes from a quality perspective with high quality produce being key for our export markets. There were reports that exports to Japan would have been pushed from 15 to 25 days.

There are reports of damage to mandarin trees across Far Northern Queensland resulting from ex-Tropical Cyclone Jasper. Citrus Australia have also asked for further Government assistance with growers grappling with significantly higher freight costs resulting from damage to road infrastructure across the region. The USDA’s January forecast for Australian mandarin/tangerine production totalled 180,000 tonnes. This would be the third highest on record as recent plantings continue to mature. This will likely be reduced slightly as a result of the cyclone damage. Meanwhile, Australian orange production is currently estimated at 530,000 tonnes by the USDA. This is a five per cent increase on last season thanks to dry weather during fruit set followed by good rainfall in the subsequent months. Orange production is limited in Far North Queensland with minimal impact from the recent cyclone anticipated.

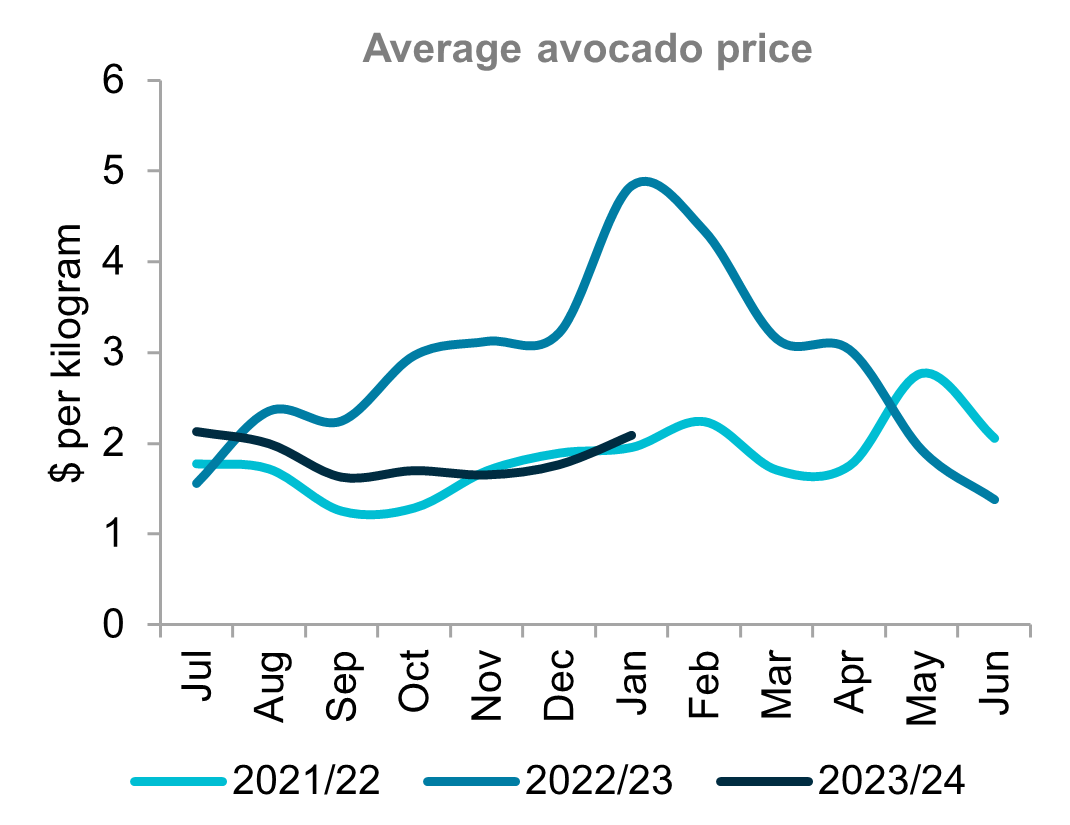

Shepard avocado season is about to begin with the Hass season now coming to an end. Australia’s avocado industry body are expecting total 2024 production will lift by 20 per cent compared to the 2023 crop. Increased output is expected to be seen across all states. Greater market access and these larger production volumes are also expected to drive an increase in export totals.

Vegetables

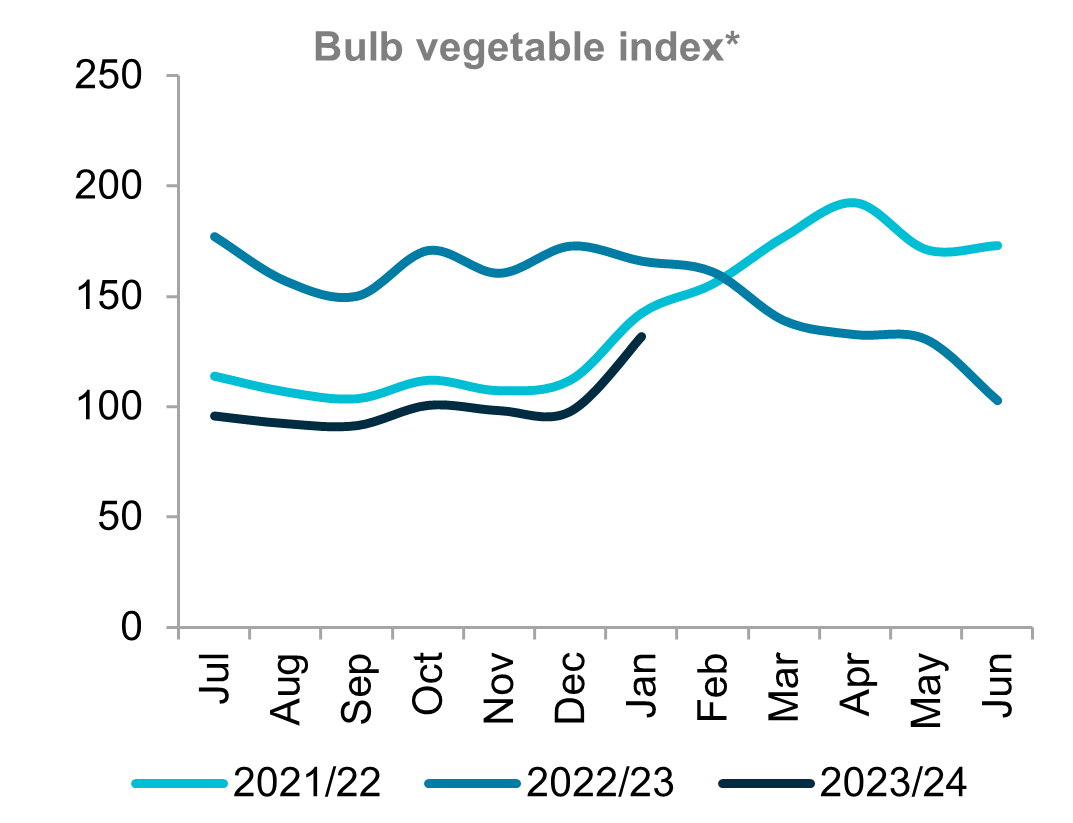

Vegetable prices were generally trending marginally higher over the last month, though compared to the same time last year prices are broadly lower. Looking at staple vegetables, wholesale brown onion prices are now back in line with longer term averages, having declined by 40 per cent year-on-year. This follows last year's flooding events on the east coast that impacted production. Capsicum prices have fallen by an average of almost 25 per cent year-on-year and remain well below the three-year average.

Nuts

Almond harvest is now slowly getting underway. Almonds Australia are estimating a national crop of 164,700 tonnes which is well above prior estimates. This updated forecast is a 60 per cent increase from the 2023 crop which was impacted by challenging weather conditions. Export demand remains strong and are currently eight per cent ahead of the same time last season. Despite this, pricing remains low as a result of strong global supply and high cost of living impacting demand at higher price ranges.

* The Bulb Vegetable Index includes onions, garlic, fennel, leeks and shallots.

Sources: Ausmarket Consultants, Rural Bank

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.