Insights November 2023

Insights November 2023

Commodity Overview

- The supply of mangoes out of the Northern Territory will slowly begin to decline throughout November. The Queensland season is now underway with volumes out of the Bowen region to peak in late November/early December.

- Poor European onion production is expected to ensure export demand for Tasmanian onions will remain elevated for the second season in a row.

Fruit

Wholesale Hass avocado prices edged a touch higher across October. Prices will continue to rise through November and December as supplies ease following another season of significant production. The large volumes have seen exports remain at record levels. Over 14,800 tonnes of avocadoes have been exported for the year to September. This compares to five-year average of just over 7,500 tonnes. Imports are also near record lows at just over 12,700 tonnes.

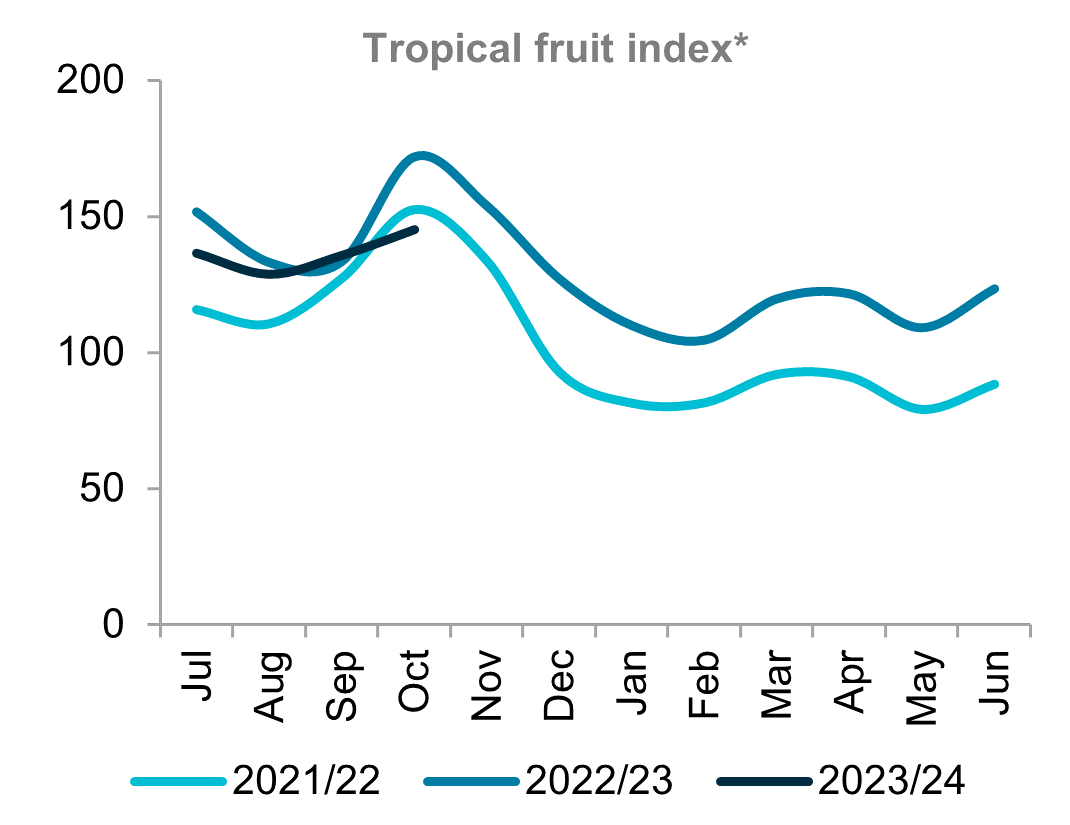

After peaking during early October, the supply of mangoes out of the Northern Territory will begin to decline through November. The early start to the season was driven by an unusually warm winter which has also negatively impacted overall volumes. Prices are currently sitting lower than last season due to the earlier start. Despite this, mango prices won’t hit the same lows recorded in December and January last season. The Queensland season is now underway with volumes out of the Bowen region to peak in late November/early December. There are currently almost 4,700 trays of mangoes expected to hit the market this season by the Australian Mango Industry Association. This compares to last season when over 8,900 trays were sent to market.

Vegetables

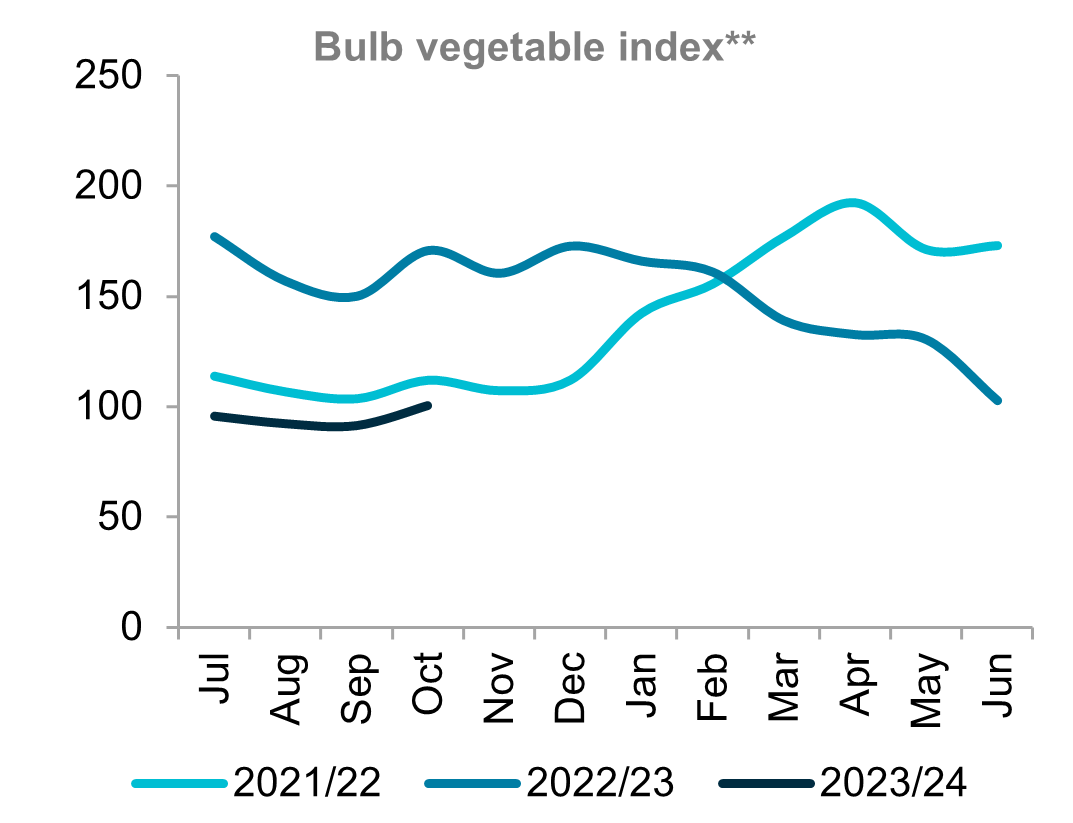

Poor European onion production is expected to ensure export demand for Tasmanian onions will remain elevated for the second season in a row. Relatively good yields and quality have been seen across Tasmania’s key growing regions following dry weather. Harvest should be into full swing by early January. European shortages will peak around March which is well timed with the Tasmania harvest. Output from New Zealand will also be key to filling supply gaps with the country recently securing a Free Trade Agreement with the EU. The agreement saw the 9.6 per cent tariff on NZ onions removed immediately. Tariffs remain in place on Australian onions following a breakdown in Free Trade Agreement negotiations at the end of October.

Asparagus season has started early with volumes to ramp up as warmer weather begins to hit. Prices are currently sitting a touch below the same time last season. Prices will begin to increase in summer as supply begins to wane.

Nuts

The USDA are forecasting global almond production for the 2023/24 season will increase three per cent to 1.5 million tonnes (shelled). In good news for prices, global consumption is also expected to increase by six percent to 1.6 million tonnes. Global exports are estimated to rise five percent to 1.1 million tonnes amidst strong demand from China and India. Australian almond output is forecast to rebound 28 per cent from last year’s poor crop to total 140,000 tonnes. A large local carryout has now been depleted amidst strong export demand during the 2022/23 season, though the increase in production will keep exports elevated above average.

* The Tropical Fruit Index includes bananas, mangoes, papaws, passionfruit, and pineapples

** The Bulb Vegetable Index includes onions, garlic, fennel, leeks, and shallots.

Sources: Ausmarket Consultants, Rural Bank

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.