Insights April 2024

Insights April 2024

Commodity Overview

- Harvest of Tasmanian apple orchards continued in March. Favourable growing conditions over spring and summer are driving fantastic quality.

- Strong supply and high global demand saw Australian onion export volumes triple year on year during the month of January.

Dry conditions continued through March which has aided quality and harvest of table grape and almond crops. Key horticultural regions across most of Victoria, the South Australian Riverland and southern New South Wales saw soil moisture levels decline as a result. Though a decent rainfall event in early April across the east coast offered some respite. Western Australia recorded decent rainfall totals during March, except for coastal regions in the Southwest. Meanwhile, the Australian government has announced the approval of an agricultural visa. The visa is targeting workers from various agriculture sectors across Southeast Asia. We’re yet to see how significant the uptake of this new visa will be.

Fruit

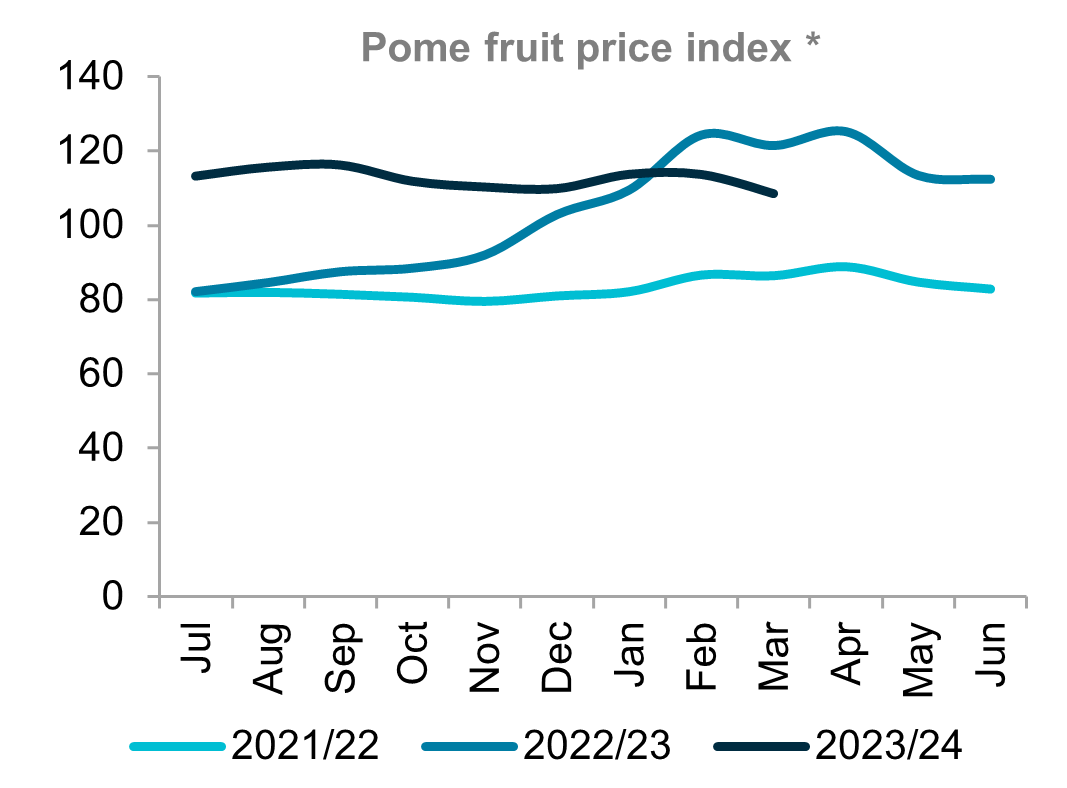

Harvest of Tasmanian apple orchards continued throughout March and into April. Favourable growing conditions were seen across the state over spring and summer. This has driven fantastic quality with large sizing and good colour reported. Wholesale Tasmanian apple prices at a broad level are around eight per cent higher than this time last year. Though prices did show some signs of softening in March. Wholesale domestic table grape prices are currently between 10 and 20 per cent lower compared to last season. Export demand and pricing remains comparatively strong. This is resulting from the changing global supply dynamics driven by a smaller US crop. Unfortunately, some quality issues with Crimson seedless red grapes have negatively impacted Chinese demand for this particular variety. Commercial red wine grape producers are also anticipating an upwards lift in prices for next vintage. This follows news that the Chinese Government would be lifting punitive tariffs on Australian wine.

Vegetables

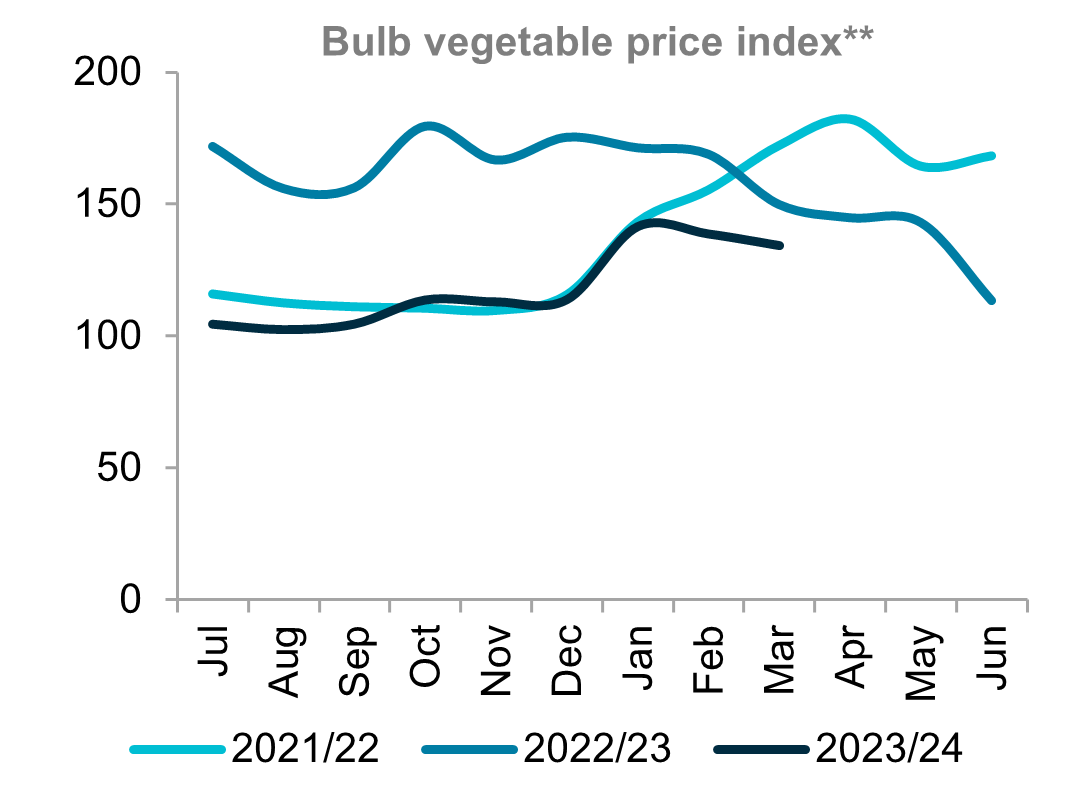

India and Egypt, two of the world's largest onion exporters, restricted the exports of onions over the first quarter of 2024. This has seen European importers turn to China to meet their demand for onions. As a result, traditional southeast Asian markets are sourcing onions from alternative regions. This has benefited Australian onion exporters as it comes at a time when seasonal Australian onion supply is at a high level. Given the increased demand and high supply, Australian onion export volumes tripled year on year in January. Over one thousand tonnes of onions were exported, this is up from 357 tonnes in January 2023 and the 131 tonnes exported in January 2022. Taiwan and Southeast Asian destinations saw the largest increase in export volumes.

Nuts

Global Macadamia prices are beginning to rebound following multiple years of near record lows. This is due to substantial buying from China over the last six months which has reduced global stocks. As a result, an increase in global pricing of between 10 and 30 per cent is expected to occur over the coming season. Though supply and demand dynamics remain in a precarious position. Strong production out of key global competitors and a large Australian crop, currently estimated at 56,000 tonnes in-shell, will keep supply high. Meanwhile, Almond producers across Sunraysia and the Riverland have benefited from the dry start to 2024. This has helped to drive large volumes of high quality in shell almonds according to the Australian Almond Board. As a result, key in shell exports markets such as India and China are expected to see strong demand. This will likely drive record almond exports for the opening months of the 2023/24 season.

* The pome fruit index includes apples and pears.

** The bulb vegetable index includes onions, garlic, fennel, leeks, shallots, and spring onions. Sources: Ausmarket Consultants, Rural Bank

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.