Insights March 2024

Insights March 2024

Commodity Overview

- Shepard avocado harvest is now underway in Far North and Central Queensland with above average volumes expected.

- This year’s macadamia crop is estimated to reach 56,000 tonnes in-shell (3.5 per cent moisture). This compares to last year’s crop of just 48,400 tonnes.

Supply and quality across most key horticultural varieties remains high following a relatively dry February. This is especially true across the east coast of Australia, with strong production forecasts coming into autumn. A dry three-month outlook across eastern states could see some water stress begin to impact irrigated crop output coming into winter. This is especially the case across Queensland where water levels are currently much lower in comparison to southern states.

Fruit

Dry weather has seen table grape harvest progress well across northwest Victoria and the Riverland region. As mentioned last month, markets remain supported at both a domestic and export level. This is partially due to a lower-than-average US table grape crop. Our key export competitors in Chile and Peru are continuing to focus their exports on the US as a result, leaving Asian demand focused on Australia. We will likely see export prices begin to ease in late-March and early-April. This is when Chile will turn their focus away from the US to Asian markets as seasonal US prices decrease in this period.

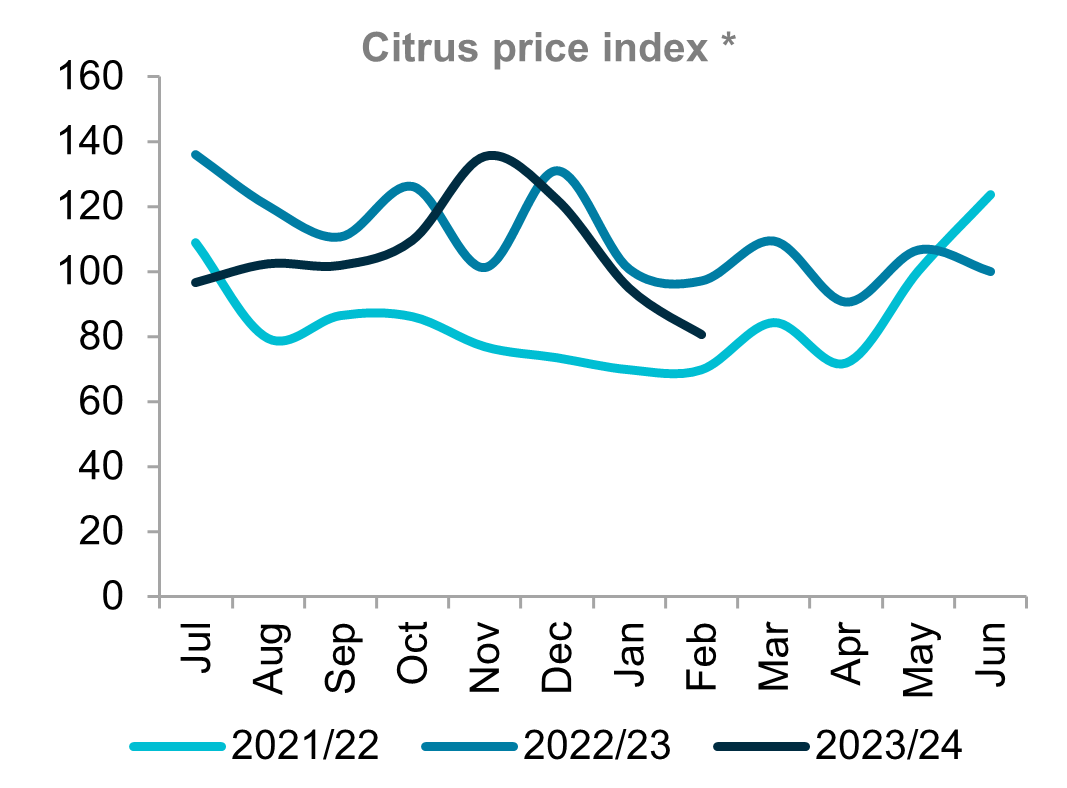

Australian citrus growers are gearing up for a big season. Production growth is expected to continue to expand in 2024. Output growth over coming seasons is expected to exceed increases in domestic consumption. Further investment is being made to expand export markets as a result.

Shepard avocado harvest is now underway in Far North and Central Queensland. The season appears to be a little later than last year. Despite the late start, another year of above average volumes are expected. Avocadoes Australia are launching a more aggressive marketing campaign alongside the season in an attempt to capture more domestic demand. Initial wholesale pricing currently sits around 20-30 per cent below the same time last year. Extended availability of Hass avocadoes may also be impacting Shepard prices.

Vegetables

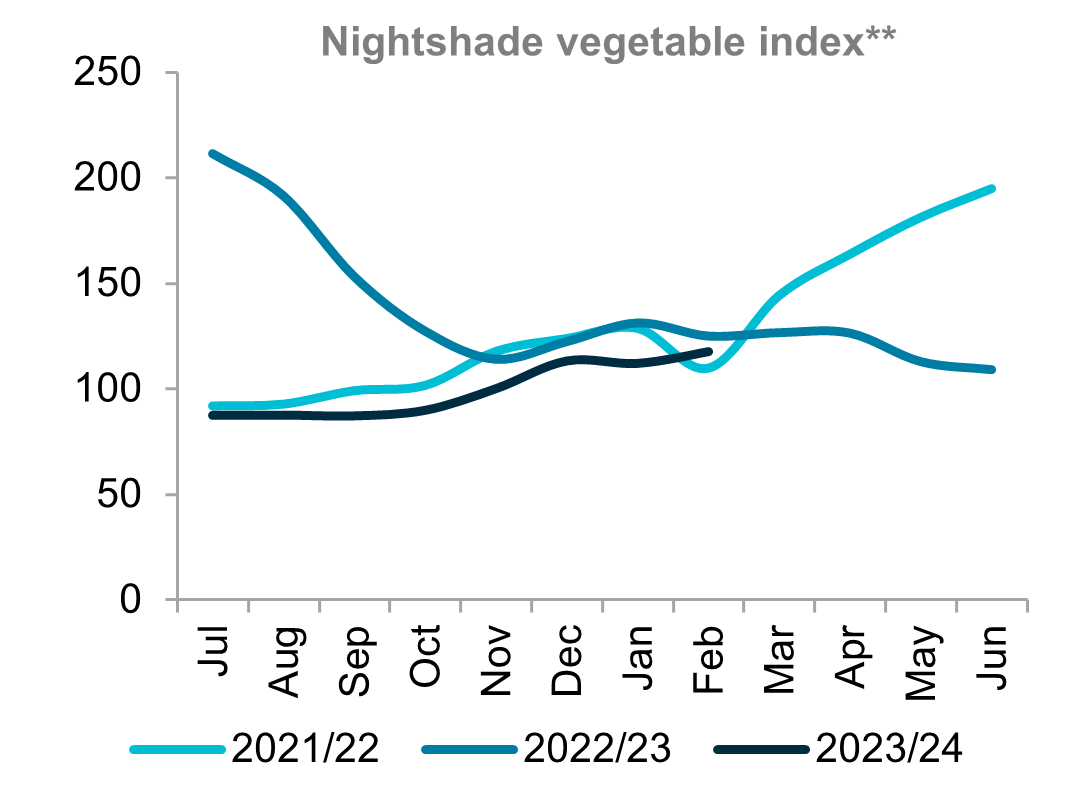

Capsicum prices out of Queensland lifted throughout February. Wholesale prices for red capsicums are currently around six per cent higher than average. Tomato field gourmet prices were higher year-on-year, though remain below longer-term averages. Prices should ease further coming into April and May when available volumes will lift.

Nuts

The Australian Macadamia Society are estimating this year’s macadamia crop will reach 56,000 tonnes in-shell (3.5 per cent moisture). This compares to last year’s crop of just over 48,000 tonnes. Last year’s crop yields were impacted by reduced fertiliser application resulting from the historically low prices seen that season. A rebound in production will be driven by favourable conditions and a return to more typical fertiliser management. Should growers again opt for reduced application then crop estimates will likely reduce.

As mentioned last month, this year’s almond crop is expected to reach over 160,000 tonnes by the Almond Board of Australia. Almond producers are expecting near record sales volumes this marketing year (Jan ’23 – Feb ’24). This is despite a well below average crop of just 103,000 tonnes last season. Almond exporters are continuing to focus on South-East Asian markets given their proximity and favourable trade agreements. India is also expected to see further lift in export volumes over the coming season.

* The citrus index includes oranges, mandarins, limes and lemons

** The nightshade vegetable index includes capsicums, chillies, tomatoes and eggplants. Sources: Ausmarket Consultants, Rural Bank