Insights November 2023

Insights November 2023

Commodity Overview

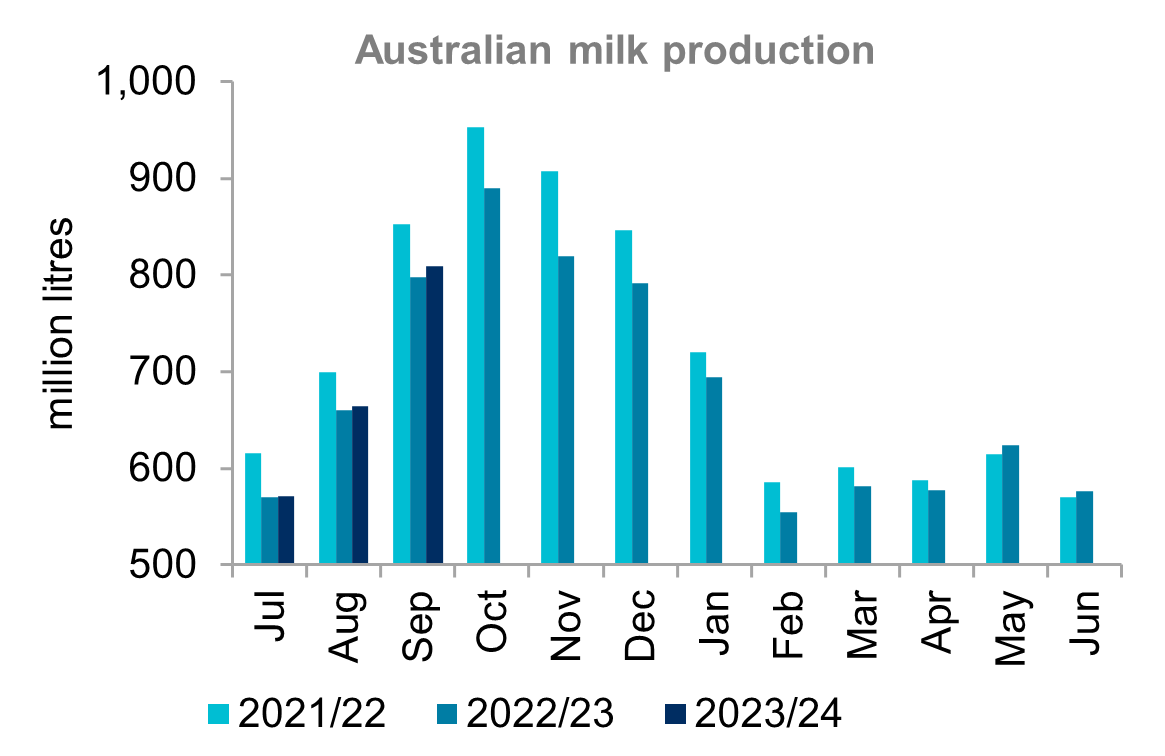

- Season to date national milk production is one per cent up year-on-year, with Victoria the only state below last season’s production.

- Global prices remain below average as growth in demand is stymied by sufficient supply and cost of living pressures.

- A large disconnect between local and global prices will continue to price Australian dairy out of export competitiveness.

Australia produced 809 million litres of milk in September, a 1.4 per cent increase on last year. This puts season to date production up 0.8 per cent year-on-year, but 5.3 per cent below the five-year average. Victoria was the only state not to register higher year-on-year production in September. Season to date production is up year-on-year for all states except Victoria, which is a marginal 0.24 per cent down on this time last year. September through to December is peak milk production period. It will be important to maximise supply in coming months. The dry outlook is likely to take its toll as the season progresses.

In local news, Victorian dairy factory workers and milk tanker drivers went on strike in mid-October. Disputes with processors over wages and conditions saw up to 1,400 United Worker Union members across 12 processing sites walk off the job. It was reported some producers having to dump milk that was unable to be picked up. Further strike action was averted after the United Workers Union reached an agreement with a number of producers. The agreement will seen an increase in wages for more than 1,000 dairy factory workers.

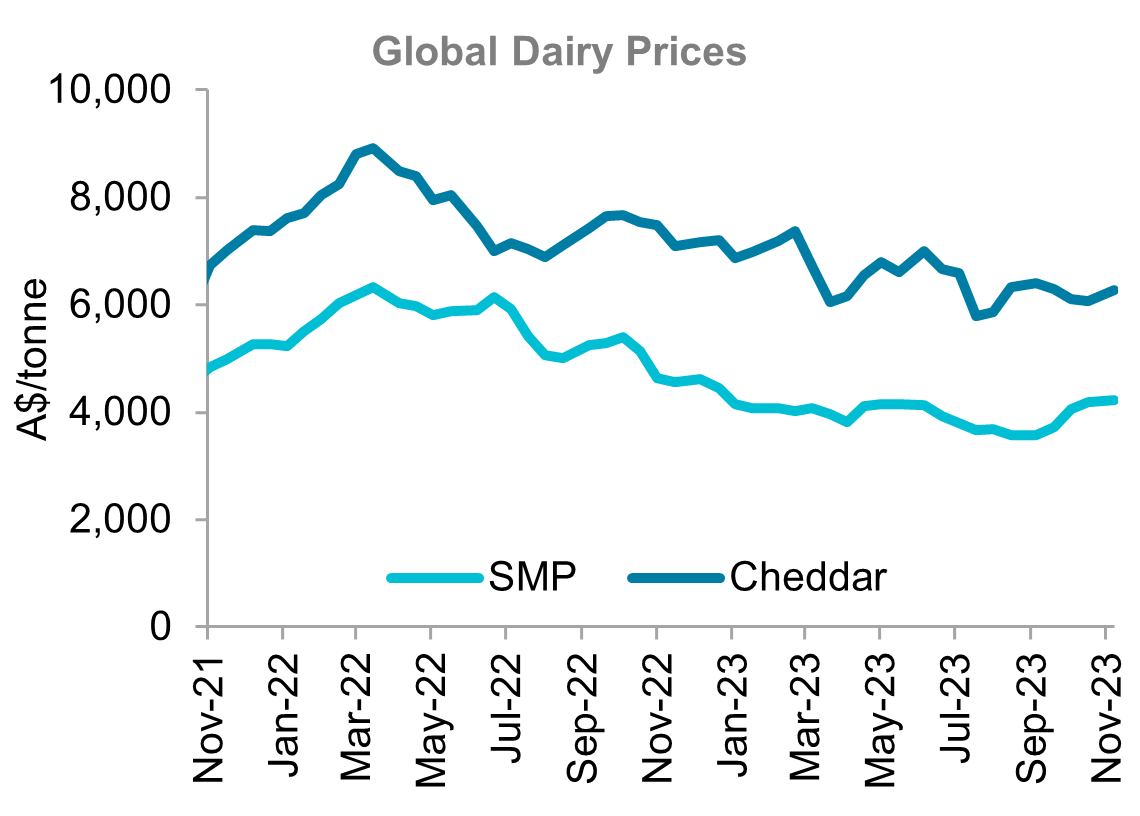

The Global Dairy Trade Price Index ended a two-month run of price increases in the most recent sales. The index fell one per cent and now sits ten per cent below average. But a floor seems to have been reached with the current index 16 per cent higher than August. Weakness in Whole Milk Powder (WMP) and butter dragged the index down. Cheddar and Skim Milk Powder (SMP) recorded gains from the last sales event in October. Overall, global dairy buying remains sporadic. Any lift in a particular dairy class is mostly a result of opportunistic buying rather than sustained demand. Global supply remains sufficient for current demand. Though Chinese demand remains slow which continues to limit upside.

Australian dairy exports remain well below average pace. September data showed volume down 5.7 per cent from last year. This puts year-to-date dairy export volume 16 per cent below last year, with value down almost 18 per cent. Given the disparity between high farmgate prices and soft global prices, Australian dairy isn't competitive into export markets. A dry weather outlook suggests production is more likely to trend lower in the new year. Low domestic production will continue to place pressure on producers to secure supply. But low domestic production and reduced profitability will continue to see industry contraction. Record farmgate prices over the past two seasons haven't encouraged production increases. Unless global prices lift significantly, Australian dairy will remain priced out of exports. This will see cost pressures remain on processors. This will likely result in processors offering lower farmgate prices next season in an attempt to remain competitive.

Sources: Global Dairy Trade, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.