Insights June 2024

Insights June 2024

Commodity overview

- Opening 2024/25 farmgate prices from major processors average around $8.10/Kg MS, 9 per cent below last season’s opening.

- Step ups are expected to be more considered in the coming season, but a low domestic pool and improved global dairy prices provide some room for step ups.

Opening farmgate bids for the 2024/25 season have been announced. Fonterra were first out of the blocks on Thursday 30 May with an average price of $8.00 per kilogram milk solids (Kg MS). Saputo followed the next day with a weighted average milk price of $8.00 to $8.15/Kg MS. Other processors waited until June 3 to announce opening bids. Smaller processors with greater flexibility or lower supply requirements offered more. Norco is Australia's largest dairy farmer co-operative, based in Lismore, New South Wales. Norco produce predominantly fresh milk and were able to offer $12.35/Kg MS (around 89.5 cents per litre).

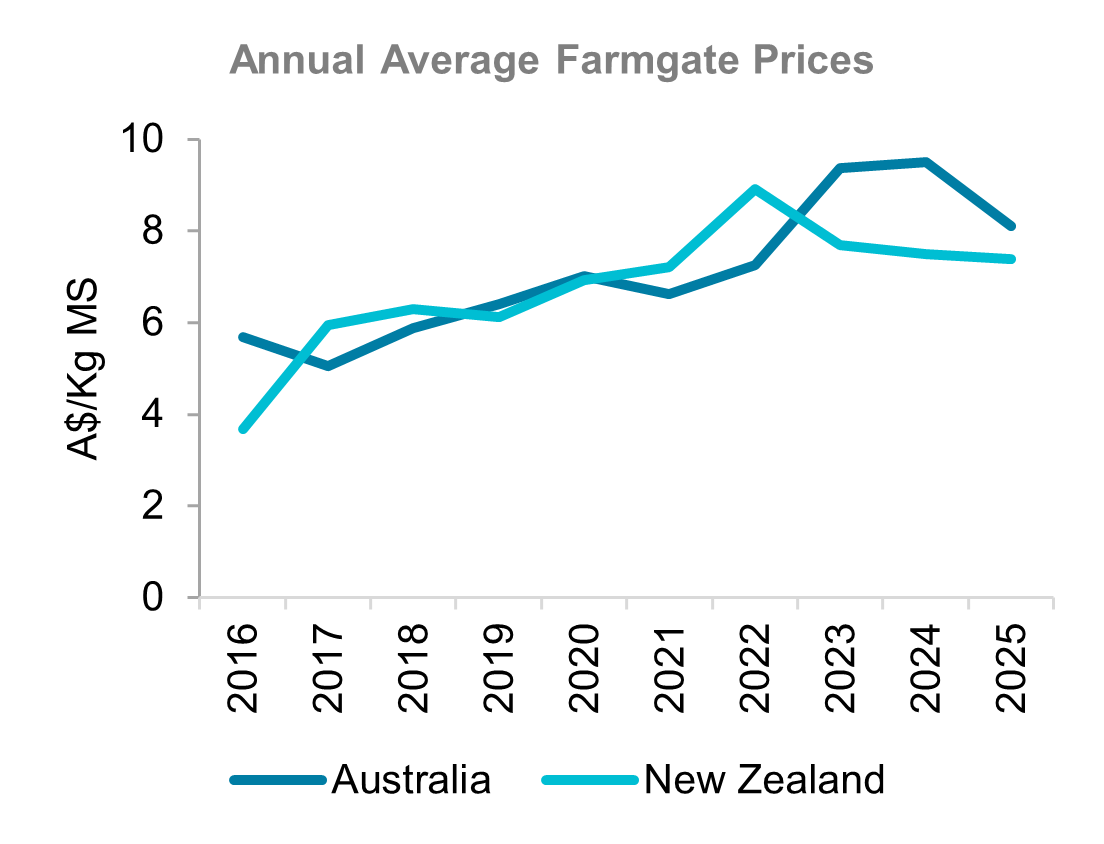

Prices from major buyers ranged from lows of $7.80/Kg MS to highs of $8.65/Kg MS, with an average of around $8.10/Kg MS. This is 9 per cent below last season's opening bids, and 15 per cent below current record high farmgate prices of around $9.51/Kg MS. However, this season's price of $8.10/Kg MS is the third highest opening on record behind the last two seasons. Importantly, lower prices in 2024/25 narrows the gap between Australian and New Zealand farmgate prices. Australian milk prices this season are around 30 per cent higher than New Zealand prices. Australian new season prices around $8.10/Kg MS are closer to 10 per cent higher than New Zealand's 2024/25 price indications. This means Australian dairy products will be more competitive into both domestic and export markets.

Last season processors announced step ups within a week or two of opening bids. Competition to secure supply and vocal supplier dissatisfaction resulted in quick price lifts. The response this season has been more muted. Processors have been outspoken about the pressures record high farmgate prices and lower global dairy prices have had on their businesses. With this signalling, suppliers were expecting a price drop in the coming season. Dairy farmers are still facing cost of production pressures. Input costs remain elevated and labour access is still an issue. The broad response from suppliers to opening farmgate prices seems to be 'not angry, just disappointed'. But farmers are still expectant of seeing step ups throughout the year.

In support of this, global dairy prices continue to lift. The Global Dairy Trade (GDT) Index has lifted 10 per cent in the past five events. It now sits 16 per cent higher year-on-year, and five per cent over the five-year average. Global dairy prices are expected to remain reasonably steady through 2024. Global supply remains tight, but demand is relatively slow and not anticipated to lift significantly. This tension is expected to provide a limit to significant upwards or downwards movements.

Farmers are aware that prices announced in June aren't necessarily what is on offer in July. Farmers can negotiate or shop around suppliers for a better price. Improved supply and margin pressures will see processors more reluctant to immediately step up farmgate prices. So we're unlikely to see the frequency and size of step ups that featured last season. But improved global dairy prices and competition to secure supply should provide some room for lifts throughout the coming season.

Sources: Milk Value Portal, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.