Insights April 2024

Insights April 2024

Commodity Overview

- Easing input costs, stronger global pricing and positive seasonal conditions provide a broadly optimistic outlook for dairy producers heading into the 2024/25 season.

- The Global Dairy Trade Index has lifted in April reversing declines in March to currently sit 12.4 per cent above this time last year.

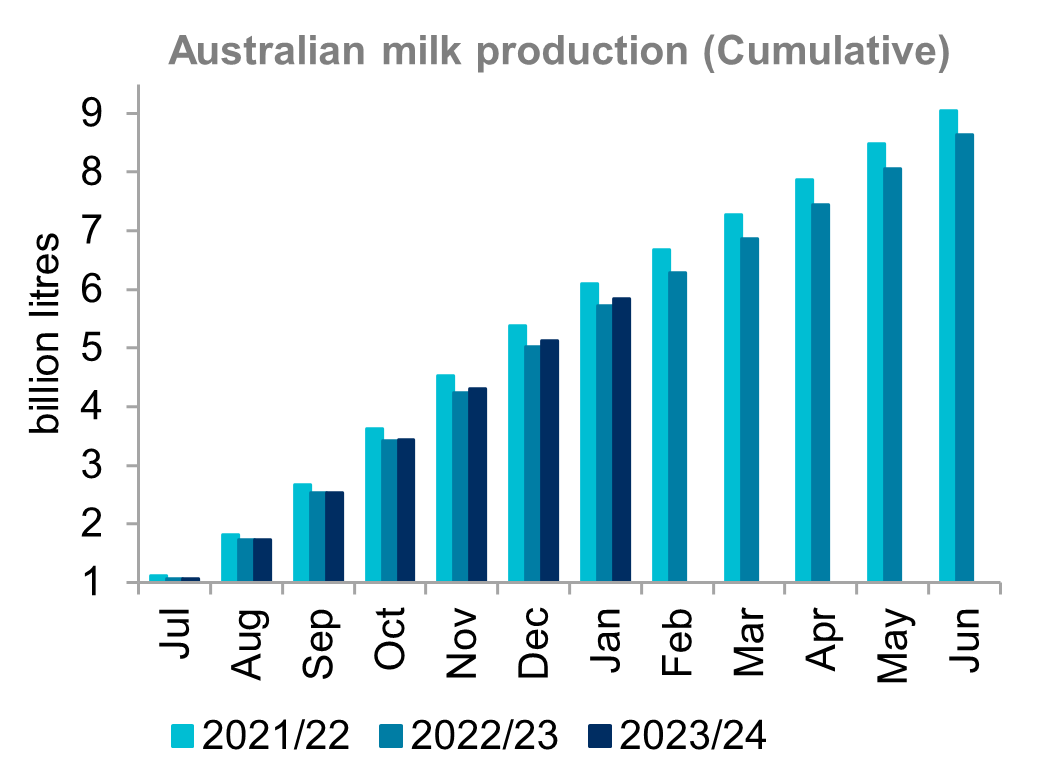

Season to date (July ’23 to January ’24) national milk production of 5.35 billion litres is up 2.4 per cent year-on-year. Monthly milk production has consistently improved on last season. Timely rainfall in eastern states through summer has improved prospects. Water for irrigation is cheap and rainfall has built soil moisture and been beneficial for pasture growth. A positive outlook for the remainder of this season has seen our forecast for 2023/24 season lifted from around 8.2 billion litres to 8.35 billion litres. This would be a 2.6 per cent increase on 2022/23 production of 8.14, but still 2.7 per cent below the five-year average.

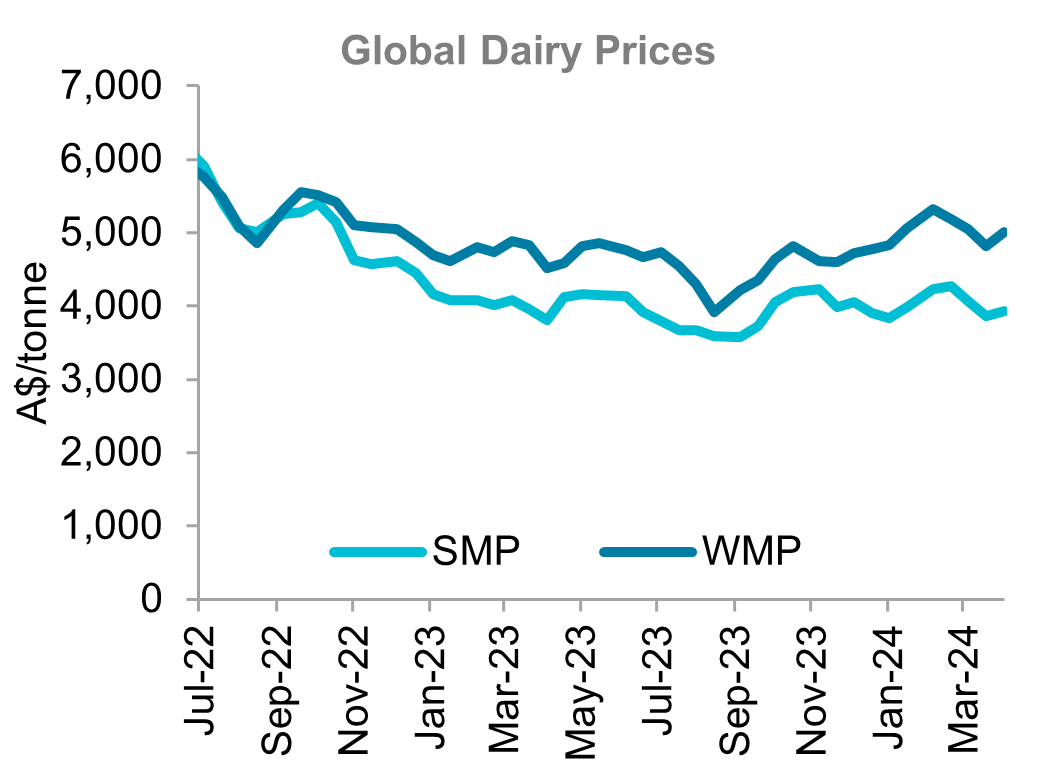

Following six consecutive gains, the Global Dairy Trade (GDT) Index fell across both trading events in March. The GDT Index lifted 11.0 per cent over the six events but lost 5.1 per cent in the two March events. The most recent trading event on 2 April saw a reversal of the downward momentum with the Index lifting 2.7 per cent. There are some caveats though. A total of 18,737mt of product was sold, the lowest figure in over four years and down 21.4 per cent year-on-year. This demonstrates the lacklustre demand in the global dairy trade at the moment. The low quantity purchased could indicate opportunistic buying following a price slump. Despite flat global demand, global dairy prices have continued to strengthen. The GDT Index currently sits 12.4 per cent above this time last year, which will be important when local processors set new season opening farmgate prices.

The U.S. Department of Agriculture (USDA) has confirmed the detection of Highly Pathogenic Avian Influenza (HPAI) in dairy herds in Michigan, Texas and Kansas. Positive test results are also understood to have been received in New Mexico and Idaho. While HPAI presents no concerns about the safety of milk because products are pasteurised, it can affect milk production in cows. Symptoms include decreased lactation, low appetite and other symptoms among primarily older cows. The USDA claims milk loss resulting from symptomatic cattle is too limited to have a major impact on supply. US milk production is expected to rise slightly in 2024. A smaller herd than last year has year-to-date production just 0.6 per cent above 2023. But HPAI is highly contagious, so the situation is being monitored closely.

The short-term outlook for Australian dairy is broadly optimistic. Farmgate prices are at record levels, input costs have settled (though remain elevated). Climatic conditions are mostly favourable, global production remains flat and international prices are recovering. Some headwinds remain in ongoing labour challenges, a stagnant global economy and flat demand. But 2023/24 was a profitable season for many producers. Stabilising local milk supply, improved global prices and a positive weather outlook have boosted confidence as we approach the new season.

Sources: Global Dairy Trade, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.