Insights February 2024

Insights February 2024

Commodity Overview

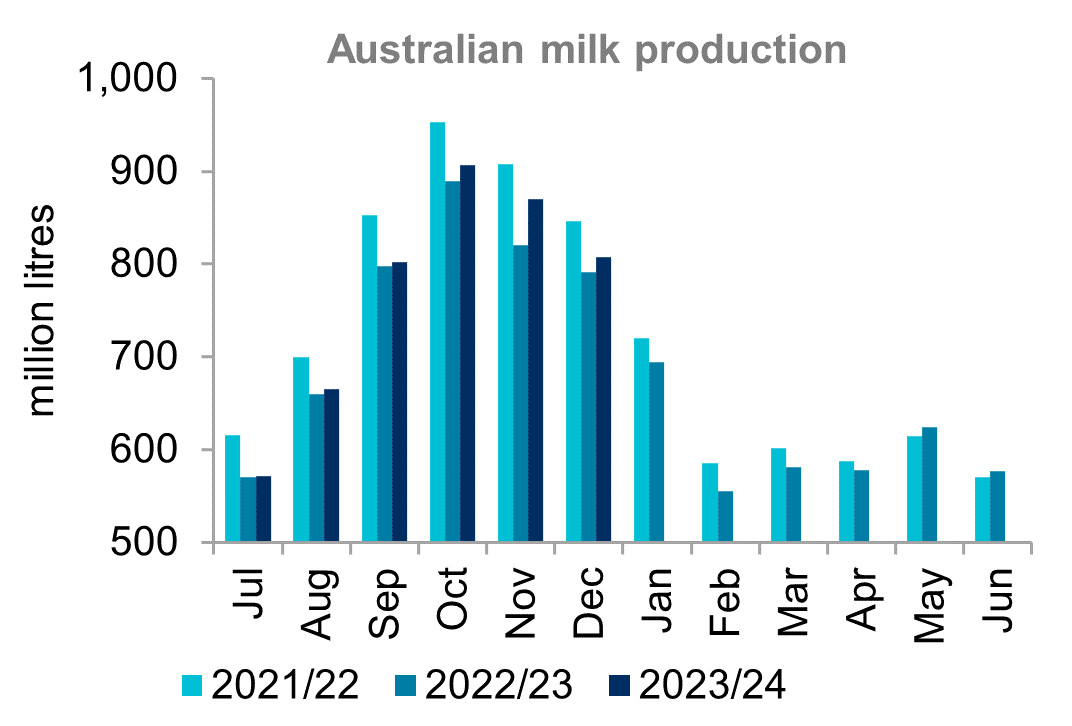

- Season to date national milk production is two per cent up year-on-year with full season production forecast at 8.2 to 8.3 billion litres.

- Global prices have trended upwards over the past two months which, if maintained, will be positive for opening farmgate price bids.

Australia has produced 4.6 billion litres of milk at the halfway point of the season (July to December). While this is a two per cent increase on the 2022/23 season, it is still 4.5 per cent below average. Milk production in all states is up season-on-season, ranging from +0.9 per cent in Victoria to +7.1 per cent in New South Wales. Production remains below the five-year average in all states bar Tasmania which is on par. Seasonal production remains on track to exceed last season’s 30 year low of 8.1 billion litres. But with the peak production period over, 2023/24 production is likely to be well below average at around 8.2-8.3 billion litres.

Coles' purchase of two milk processing plants has been approved by the Australian Competition and Consumer Commission (ACCC). Dairy industry representatives remain concerned over Coles' market power. The ACCC concluded that the acquisition is unlikely to substantially lessen market competition. From an industry perspective, this is another step in the contraction of the Australian dairy industry. Australia's declining milk production has led to an excess of processing capacity. Processors of export products are more exposed to global dairy price movements. This is seeing some buyers 'right sizing' their processing capacity. Low domestic production has been a driver of record prices as processors compete to secure supply. As processing capacity eases, so will competition to secure milk supply. While this is a gradual process, it will likely play a part in anticipated lower prices in 2024/25.

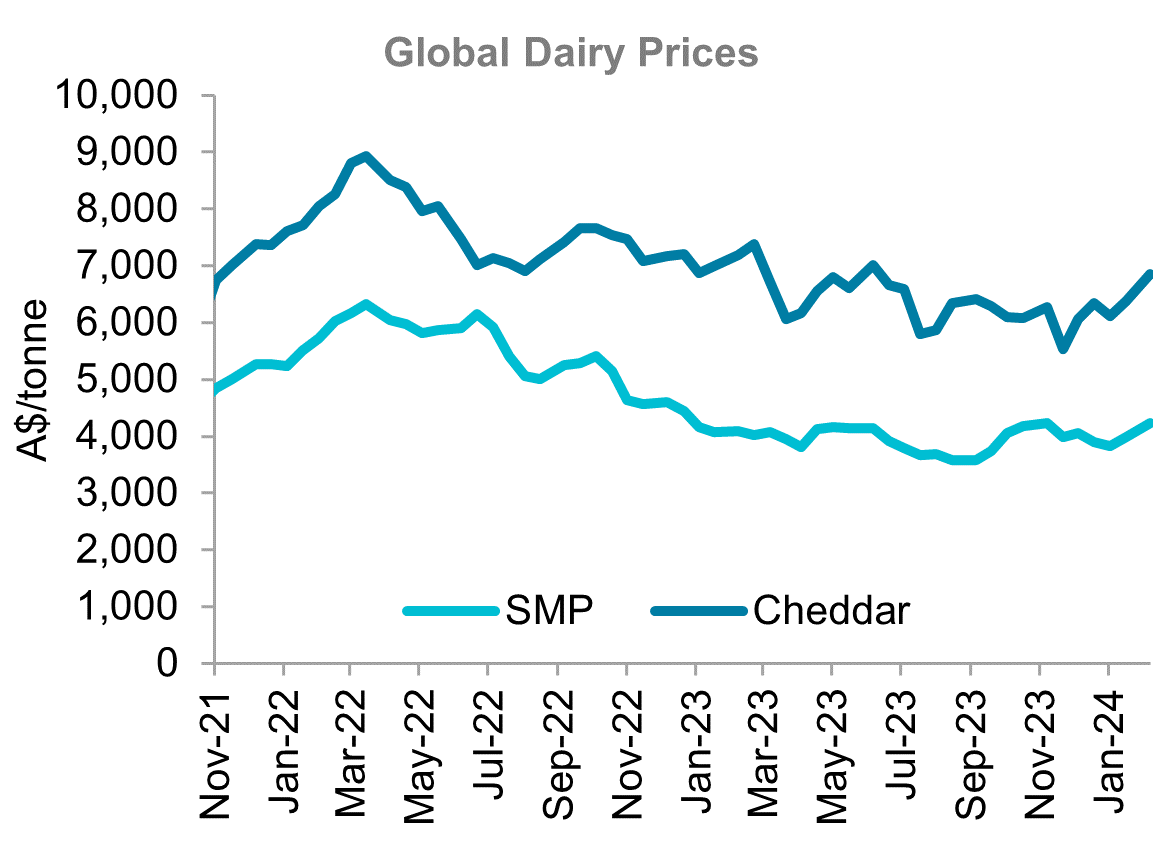

The Global Dairy Trade (GDT) Index has lifted 7.6 per cent since November 2023. While it is still 3.9 per cent below the five-year average, this is 3.0 per cent up year-on-year. Converted to Australian dollars, global butter, cheddar and Whole Milk Powder (WMP) prices are above year-ago levels. Skim Milk Powder (SMP) remains below average predominantly due to the slow recovery of Chinese demand. Stronger global prices will provide support for opening farmgate prices.

The quantity of dairy products exported in 2023 was the lowest in ten years and 18 per cent below average. Meanwhile, import quantity of all dairy products was a record high in 2023, up nine per cent year-on-year and 14 per cent above average. Imports have been a growing factor in the Australian dairy market over the past 20 years. A record high $1.8 billion worth of dairy was imported in 2023, the equivalent of 62 per cent of export value of $2.9 billion. This ratio (exports minus imports) has more than doubled from around 30 per cent 10 years ago. Increased imports are a direct result of reduced local milk production and high prices. The imbalance between local and global prices will continue to see increased imports. Growth in global dairy prices will ease some margin pressure on processors in the upcoming season. However, reduced milk production and excess processing capacity will continue to drive competition to secure supply. This is likely to see farmgate prices lower than current levels up to and over $10/Kg MS. Prices are likely to open in the $8.00 to $8.50/Kg MS range but are anticipated to step up to around the $9.00/Kg MS range later in the season.

Sources: Global Dairy Trade, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.