Insights May 2024

Insights May 2024

Commodity Overview

- Opening farmgate prices for the 2024/25 season are expected to be around 5 per cent lower than last year’s opening bids.

- Full season farmgate prices are forecast to finish at or above $9/kg MS, but processors will be reluctant to step up too quickly.

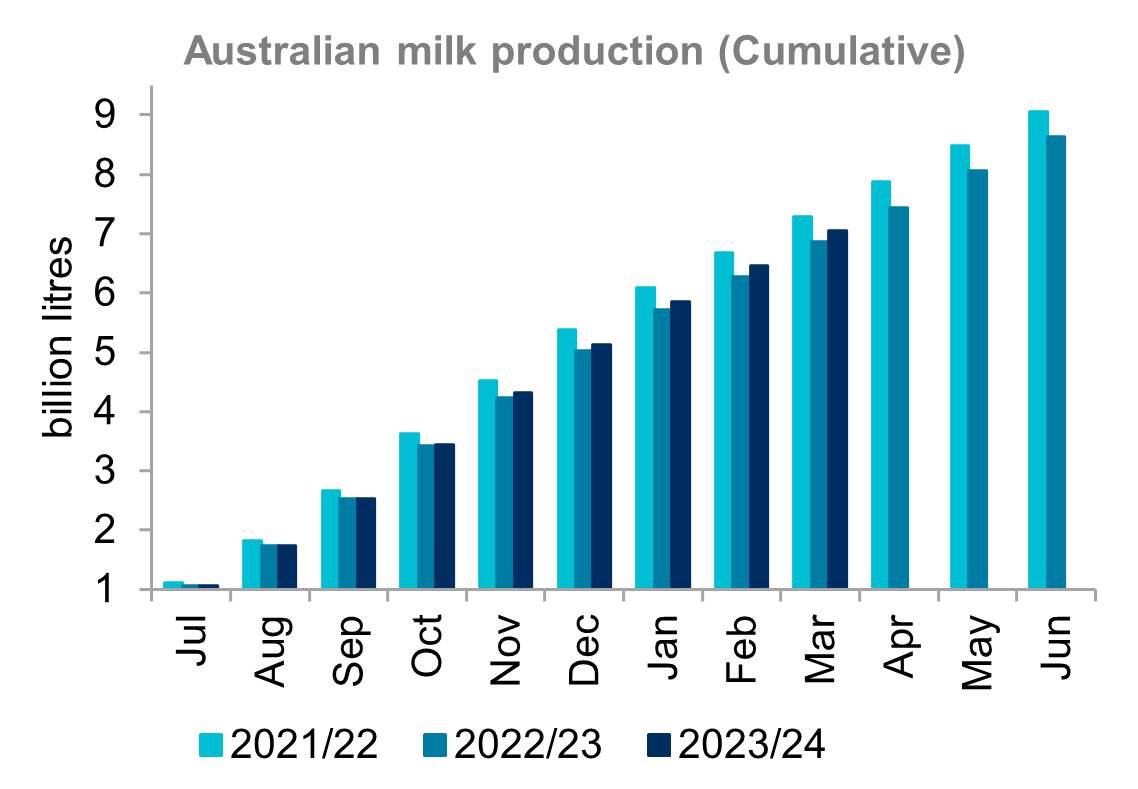

Australian milk production in March was up 2.6 per cent year-on-year. This puts season-to-date production at 6.55 billion litres, up 2.9 per cent from last season but 3.1 per cent below average. We expect production in the final three months of the season to stay in these bounds. This would see 2023/24 production finish around 8.35 billion litres. Despite this year-on-year improvement, local supply remains at historically low levels. Significant production growth isn't expected in 2024/25, but supply is expected to stabilise. The dairy industry has been in a state of contraction for a number of years now. There is an assumption - yet to be confirmed - that industry exits are easing. Dairy Australia's Dairy Farm Monitor Reports show that average profitability in 2022/23 was at record or near record highs in most states, predominantly due to record high farmgate prices. There was an assumption prices would decline in 2023/24 but this wasn't the case as current season farmgate prices were at new record highs. High profitability in recent seasons is expected to see a slowdown in industry exits. Seasonal conditions will play a big part in determining future production. But assuming average conditions, we would anticipate production to be slightly below the average of 8.5 billion litres in 2024/25.

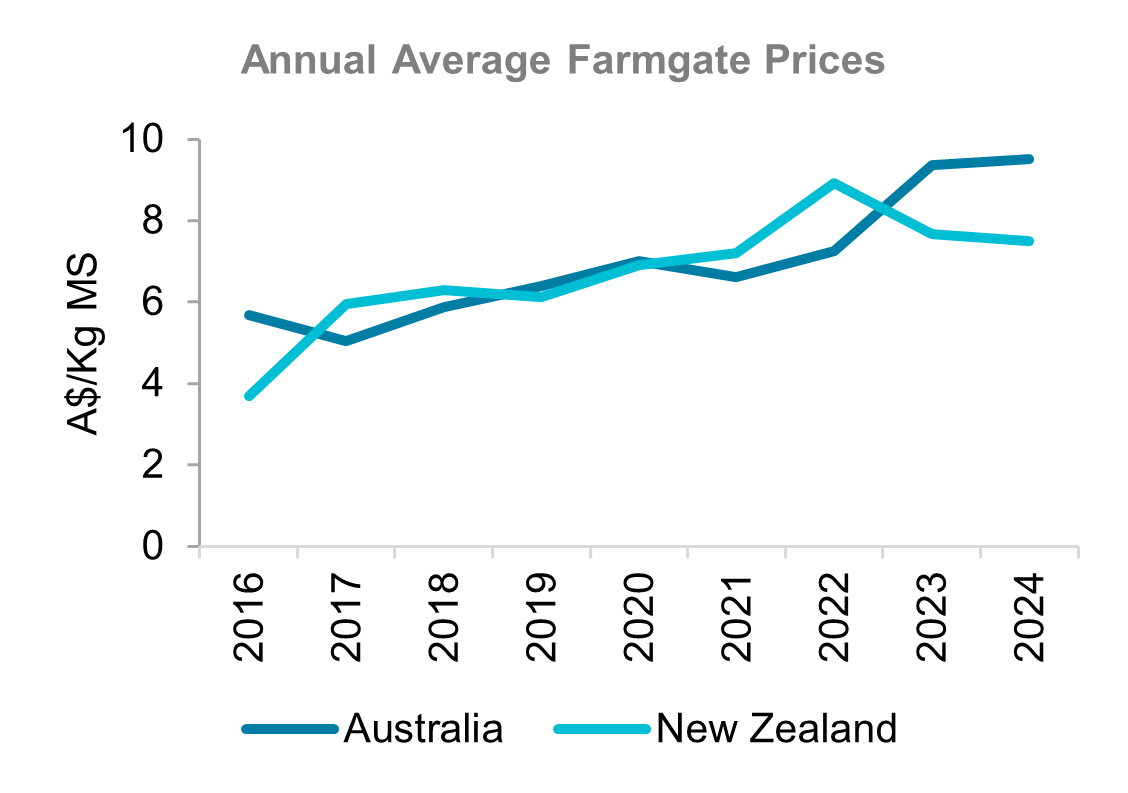

As we head into June, all eyes will be on the processors. Processors must publish their standard form milk supply agreements on their website by 2:00pm on 1 June each year. This includes revealing their minimum opening farmgate milk price bid. Farmgate milk prices vary between processors who will consider a number of factors like product mix, quality requirements and seasonality in collections. Whether a processor supplies domestic or export markets is another big influence, but recently one of the main drivers of record high prices has been competition to secure supply. This has also led to a significant premium for Australian milk over global prices and our closest competing exporters. The Global Dairy Trade Index is 8.4 per cent higher than this time last year, but a large gap remains. When converted to Australia dollars, Australian farmgate milk prices this season are 25 to 30 per cent higher than New Zealand's.

For these reasons it is assumed new season farmgate prices will be lower year-on-year. This is supported by some early guidance provided by Saputo to suppliers about expectations for opening bids. Stressing that these are not an opening price, Saputo indicate a range of between $7.80 - $8.00/Kg MS as early guidance for what to expect. Saputo provide reasoning for lower opening farmgate prices. Slow global demand and improved year-on-year local supply are mentioned. As is the disconnect between global dairy prices and Australian farmgate milk prices. Opening farmgate prices for major processors in 2023/24 ranged from $8.50 - $8.90/Kg MS. Producer dissatisfaction and competition to secure supply saw those prices stepped up over $9.00/Kg MS within a few weeks. Ultimately, average farmgate milk prices exceeded last season's record high. In line with Saputo's indications, we expect opening bids in 2024/25 to be lower than last year. The question is will we see step ups, and to what extent? We do anticipate more hesitance from processors to lift opening bids in the coming season. While local production is improved on last year, supply this season and next is forecast to remain below average. This will mean processors will still face competition to secure supply. Farmer lobby groups are highlighting cost of production pressures and are urging processors to maintain current high prices. Input costs remain elevated and labour accessibility remains an issue. The risk of a downturn in seasonal conditions is also used as a point of consideration.

In the past three seasons, final farmgate prices have been on average 9 per cent higher than opening farmgate bids. Based on Saputo's indications, this would have 2024/25 farmgate prices finishing in the $8.50 - $8.70/Kg MS range. This would put new season farmgate prices as the third highest on record behind the last two seasons. There is little doubt opening bids will be lower that last season. But we feel that competition to secure supply and pressure from producers will see final farmgate milk prices around or above $9/Kg MS on average.

Sources: Milk Value Portal, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.