Insights March 2024

Insights March 2024

Commodity Overview

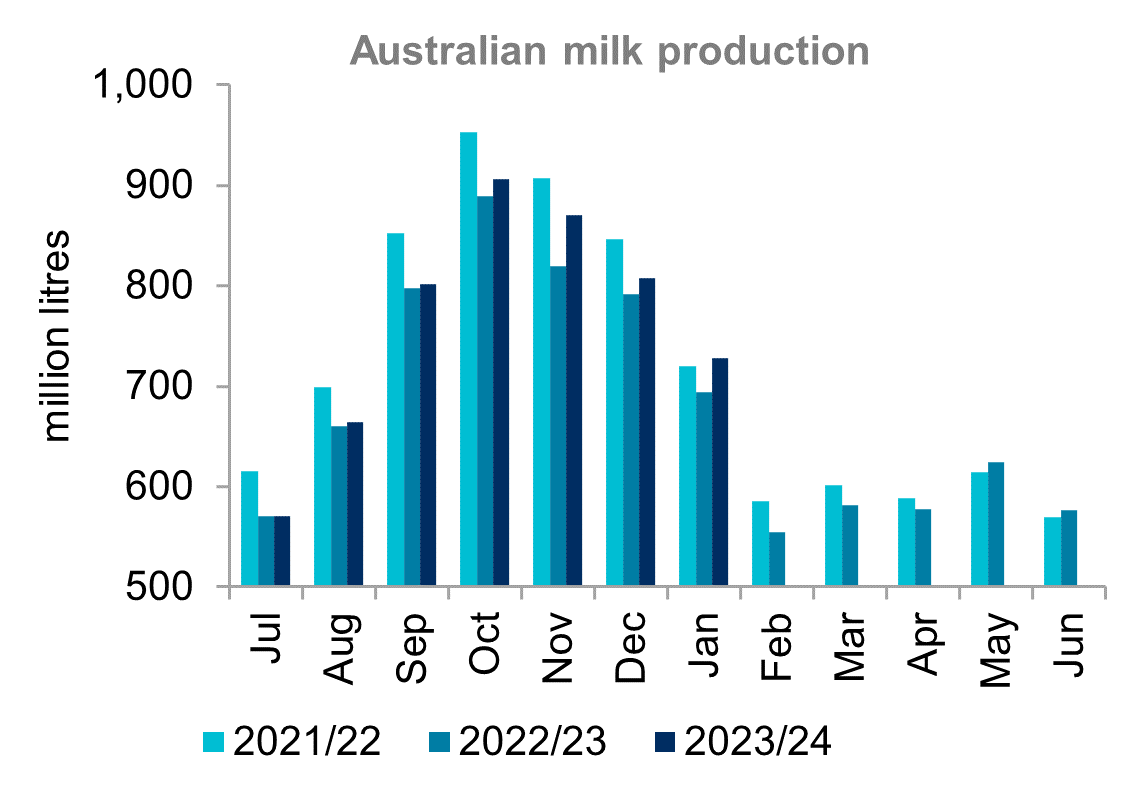

- National milk production continues to exceed last season but will still be well below five-year average production of 8.6 million litres.

- The Global Dairy Trade Index declined for the first time since November last year. The index currently sits below average, but remains 4.5 per cent above this time last year, and 8.4 per cent above June 2023 when opening Farmgate prices were announced.

National milk production in January was a 4.8 per cent increase on last year. This narrowed season-to-date production from 4.5 per cent below average last month to 3.8 per cent this month. New South Wales recorded the largest year-on-year increase in January with 9.4 per cent. Queensland milk production was close to unchanged on 2023, while South Australia produced two per cent less than last year. Season to date production at a state level saw only New South Wales and Tasmania remain around average. Production across all other states, and at a national level remains below average. But gradual growth in output continues with production this time last year sitting at 6.1 per cent below average.

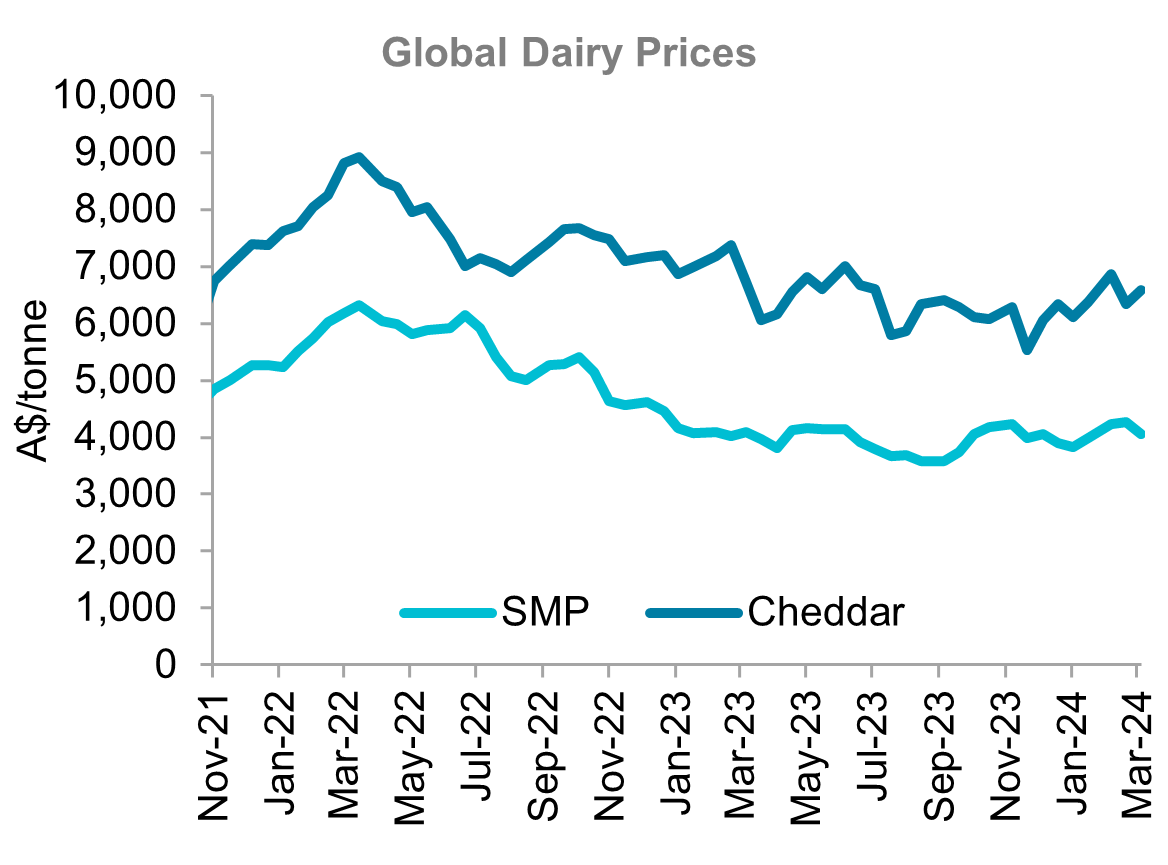

The Global Dairy Trade (GDT) Index has declined for the first time since November last year. This breaks a consecutive run of increases in the last six sessions. This puts the index 1.8 per cent below average, but 4.5 per cent up year-on-year. Weakness in the index was driven by declines in Whole Milk Powder (WMP) and Skim Milk Powder (SMP). China normally provides a baseline of demand for milk powder demand. But subdued Chinese demand has seen more sporadic and opportunistic global purchasing of milk powders. The outlook for Chinese demand isn't overly bullish. China's economic recovery post-COVID has been slower than expected. This has impacted dairy imports in the country. China's dairy imports in 2023 were down 12 per cent year-on-year. Reduced spending in foodservice and increased domestic production has driven lower demand. Decelerating population growth is likely to slow consumption growth seen over the past decade. This indicates Chinese dairy imports are unlikely to see growth in the near term. This is particularly the case for fresh milk and milk powders. There may be some potential for increased Chinese demand for processed dairy products. Chinese demand for cheese has been increasing in recent years, but China has limited processing capacity.

In Australia, high farmgate milk prices and lower global dairy prices are seeing increased imports. Low domestic production means lower processing throughput and less exportable surplus. Despite record farmgate prices, milk production isn't increasing which is seeing a shift in the industry. While milk supply is stabilising this season, the outlook doesn't suggest significant growth in coming years. But industry contraction looks to be easing. Processors 'right sizing' operations will eventually lead to an easing of demand to produce export products. This suggests that the future of the Australian dairy industry will be increasingly domestic focused. For the upcoming season demand is again likely to exceed supply. Competition to secure supply will see high farmgate milk prices maintained, though not at record highs. The GDT Index currently sits 8.4 per cent above June 2023 when opening farmgate prices were announced. This will give processors a little leeway when setting new season prices. But farmgate prices will need to be lower for Australia to recapture export demand.

Sources: Global Dairy Trade, Dairy Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.