Insights February 2024

Insights February 2024

Commodity Overview

- Production upgrades to the national winter crop were largely driven by Victoria. A soft finish to the season saw final yield for Victoria at or above record. Ongoing rain during harvest eventually led to some downgrading.

- Barley exports in the first four months of the marketing season are running at record pace. Between October and January, four million tonnes were shipped. China accounted for 3.2 million tonnes, or 80 per cent of the market share.

Despite an ongoing El Niño weather pattern, much of Australia's east coast cropping regions experienced above average rainfall over the harvest period. This led to a boost in yields and production estimates for the 2023/24 season. Final estimates are close to average. It wasn't all positive as the rain did cause harvest delays and eventually led to some quality downgrades. The soft finish to the season has also seen a larger proportion of ASW low protein wheat produced through southern NSW and Victoria. A dry finish to the season saw Western Australia growers finish up before Christmas. It marked one of the earliest finishes in a long time. Although wheat yields were well down on last season, quality surprised to the upside. Around 75 per cent of the crop made premium grades, with a large proportion being high protein.

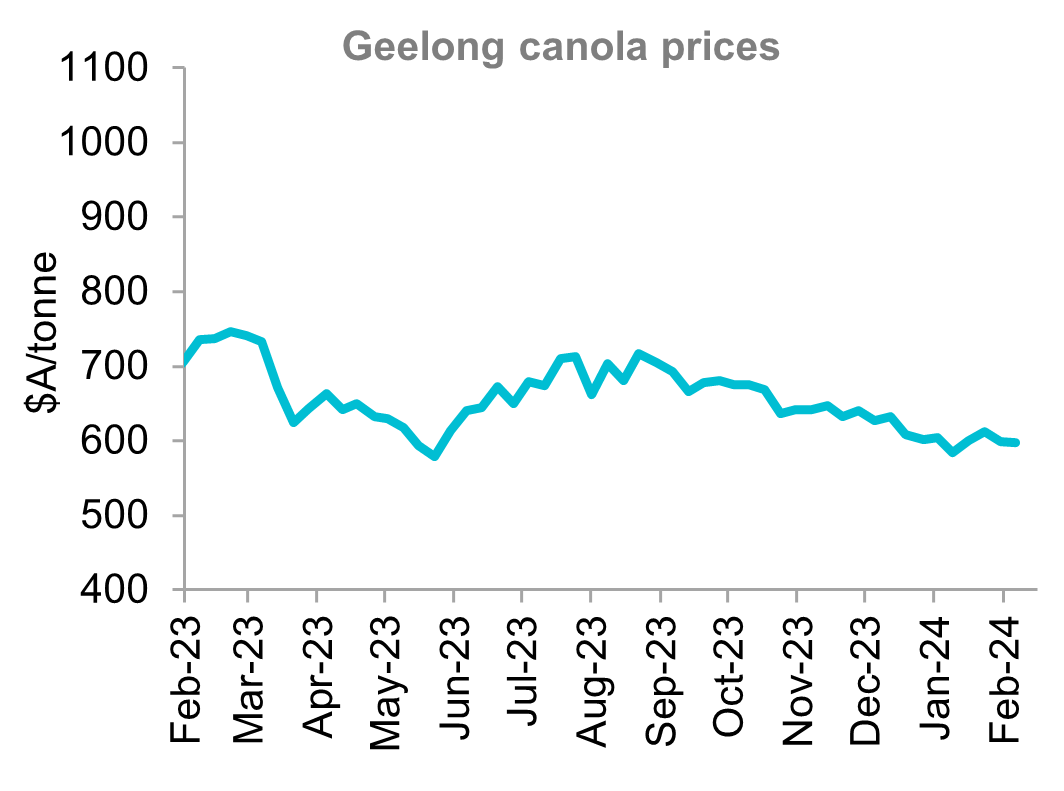

In their January report, Australian Crop Forecasters (ACF) shifted national wheat production higher, adding one per cent to forecasts to sit at 26.4 million tonnes. Barley production also lifted one per cent to 10.4 million tonnes. Canola saw a two per cent increase to 5.6 million tonnes. An increase in Victorian yields was the main driver.

Combined wheat, barley, and canola exports have been above average in the first four months of the marketing year. This has been helped by record barley exports to China. China's appetite for Australian barley has been insatiable since lifting tariffs in August last year. Between October and January, four million tonnes were shipped. China accounted for a staggering 3.2 million tonnes, or 78 per cent of the market share. The barley export estimate of 6.9 million tonnes is now with reach. This will tighten things dramatically in Australia in terms of ending stocks. This, combined with global barley ending stocks to use ratio at the second tightest since pre-2000, will be supportive of prices as we head into the new season.

Wheat has had to work harder into export markets due to stiff competition from Russia keeping a lid on global values. Most of our exports have gone to our traditional markets in Asia. There has been enough demand to keep exports above the five-year average with 6.82 million tonnes shipped to the end of January. If maintained, ACF's export estimate of 18 million tonnes will be reached. This will see ending stocks fall below three million tonnes for the first time in four years.

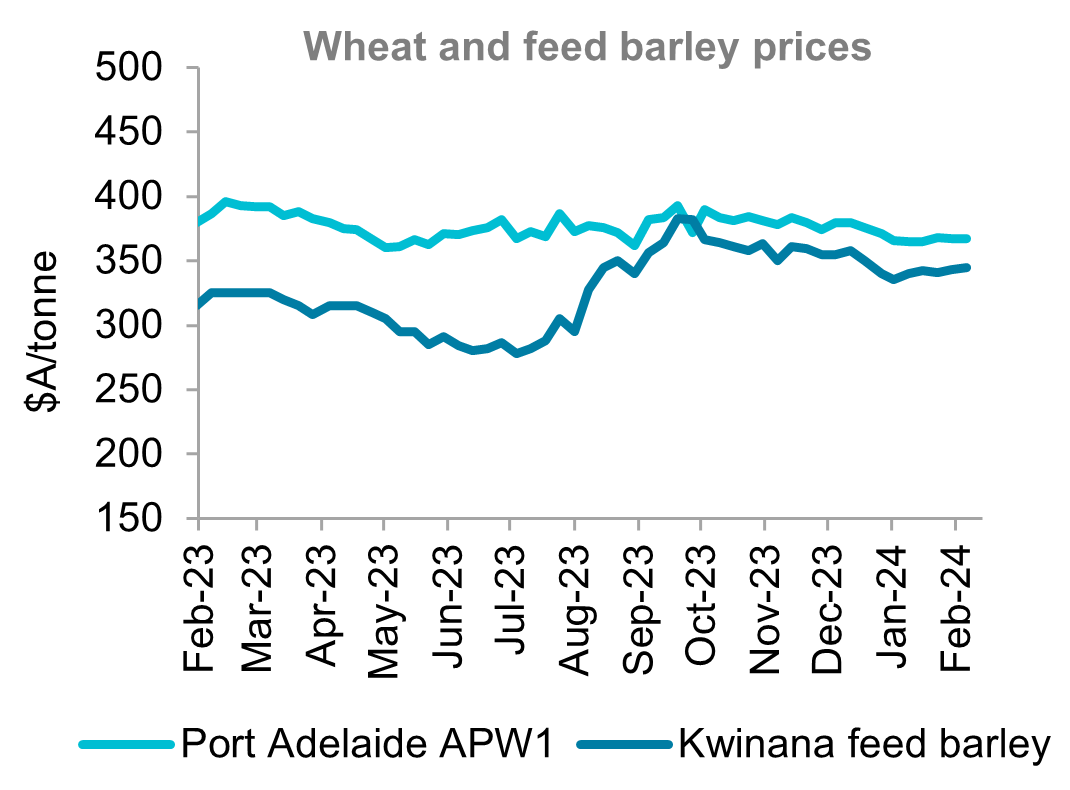

Domestic demand for cattle on feed remains stable or decreasing. This is because cattle numbers in feedlots continue to decline. The continued rainfall on the east coast has regenerated grassland for graziers along with boosting sorghum crop production outlooks. This has seen northern feed grain markets decline by up to 11 per cent over the past month. In export-oriented states, grain prices have mostly followed international values over the past month, moving in a sideways pattern and a fairly narrow range. It does feel like we are getting close to a seasonal low. Cattle on feed numbers are expected to increase as we move into March and April. Ongoing export programs will cause stocks to continue dwindling as we head into the second half of the marketing year. Also look to any weather-induced short term price spikes as the northern hemisphere winter crops come out of dormancy to push local prices higher.

Sources: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.