Insights November 2023

Insights November 2023

Commodity Overview

- The dry finish to the season has led to an early and rapid harvest. On a national level 6.3 million tonnes of grain has been delivered into the main bulk handlers, compared to 1.4 million tonnes for the same time last year.

- Prices for wheat, barley and canola all coming under downwards pressure from increased harvest selling.

The dry finish to the season is seeing harvest of the 2023/24 winter crop progressing at a rapid pace. The harvest in Queensland is almost done, but some areas in the south still have activity. Progress in Western Australia is advancing with over three million tonnes of grain delivered by growers. In South Australia growers started harvesting two to four weeks earlier than normal. Viterra, the main grain handler in South Australia have received a record-breaking 925 thousand tonnes of grain for October. October brought cooler and wetter weather to Victoria and southern NSW. As a result, harvest activity is just starting to increase. On a national level 6.3 million tonnes of grain had been delivered into the main bulk handlers for the week ending 9th of November. For the corresponding time last year just 1.4 million tonnes had been delivered.

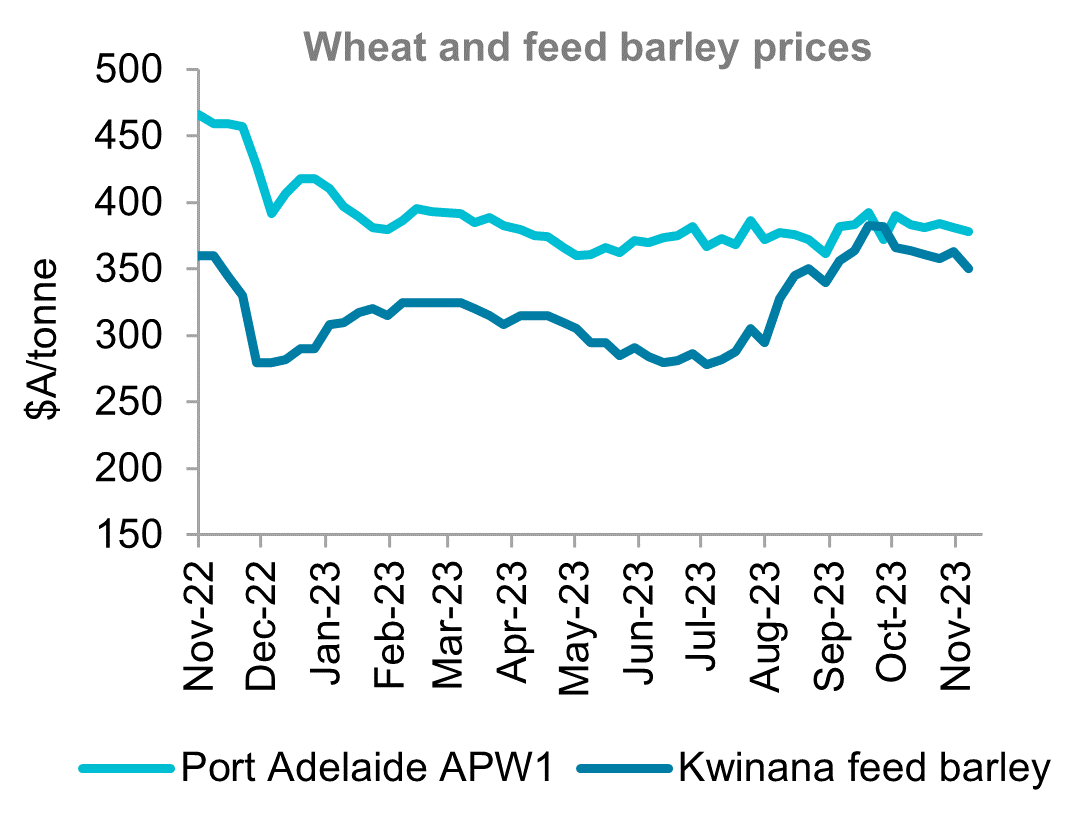

Wheat prices eased over October due to the impact of harvest pressure, with the Australian APW Wheat (index) falling $11 per tonne. Prices in Queensland and northern New South Wales fell the most, dropping $25 per tonne. Demand is decreasing because feed users in these areas are already covered until January. As the harvest in central and southern New South Wales increases, more supplies are available, causing further price pressure.

The Australian Feed Barley (index) price fell $14 per tonne over October for similar reasons to wheat. This is due to domestic feed and malt end users being largely covered for the short term. Buyers are now sitting on their hands as they wait to get a better picture of quality and yields as the harvest moves south. We will have an exportable surplus of wheat and barley this year, and prices have eased which will help push our grain into export markets.

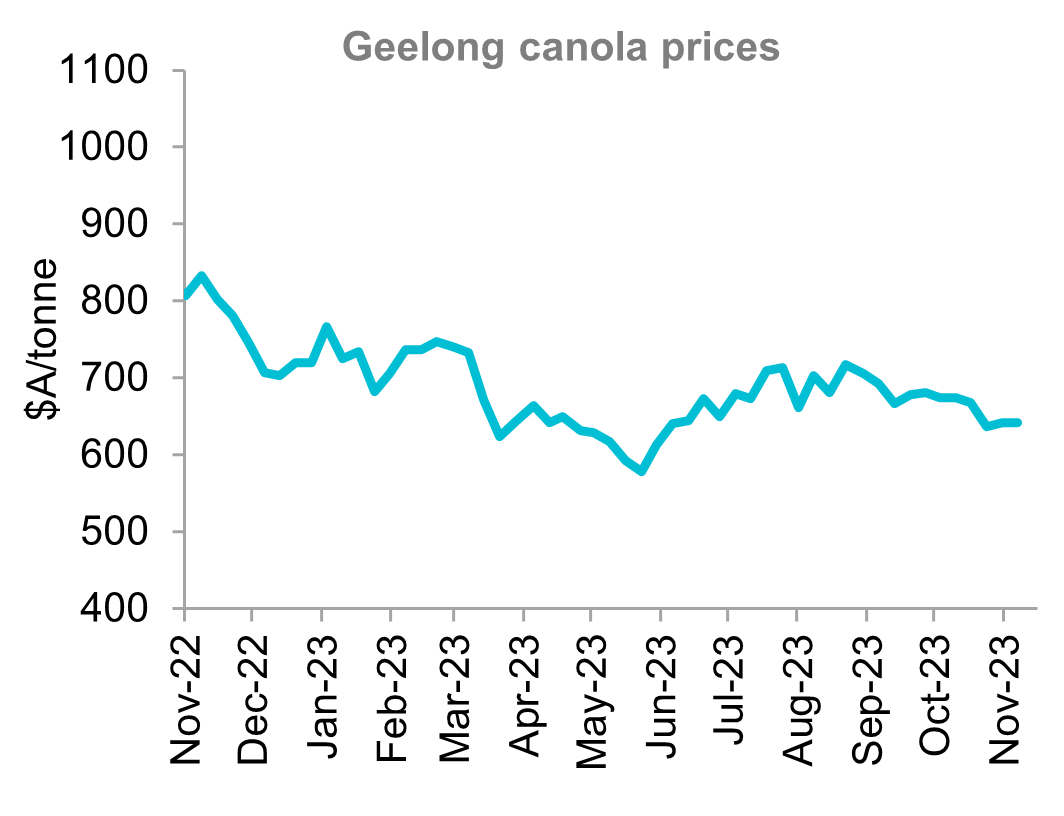

Despite international oilseed markets improving, local canola prices have continued to decline. Local values falling by $26 to $40 per tonne depending on which state. Exporters remain concerned about levels of demand in the short-term. They have flagged small to no export margins currently, so their buying behaviour is mimicking this sentiment. Australian growers now facing the lowest canola harvest prices in several years.

With harvest well advanced and a smaller crop than last season’s, this short-term surge of supply that is pressuring prices should ease by Christmas time. This will see a return to the demand side for pricing. Fundamentals still show that global supplies held by major exporters are at multi-year lows. Any change in international values will be a catalyst for Australian prices as they are still governed by export.

Sources: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.