Insights March 2024

Insights March 2024

Commodity Overview

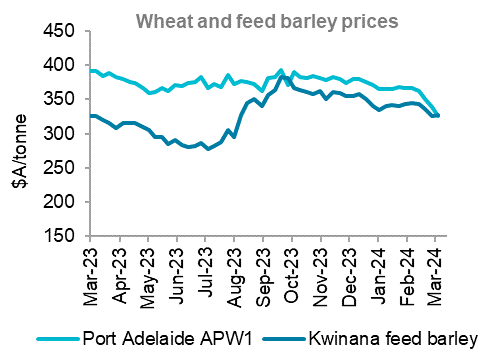

- Strong wheat exports out of Russia along with another projected large crop for the upcoming season has pressured global prices lower. Australian prices have had to follow Russian values lower in order to maintain export demand.

- China have returned to the barley market after Lunar New Year holidays at much lower levels. This drop in demand has seen prices fall across all port zones over the past month.

Global grain markets kept falling in February. Chicago Board of Trade (CBOT) wheat prices dropping to three and half-year lows at the time of writing. Russian wheat exports have remained strong as exporters search for demand to clear out old season stocks ahead of the prospect of another massive crop. This ample supply has caused Russian prices to drop. They have fallen significantly since the start of the year. Wheat values in other key origins, Australia included, have had to follow Russian values down.

From an export perspective, whilst there is still demand for Australian wheat, it has tapered off. Australian wheat being relatively expensive into Asia has meant a more traditional hand to mouth buying program for many exporters. Buyers have plenty of short-term cover and weak demand. So, they have little reason to return to the market to chase grain and push up prices. Shipping data shows that the projected 18 million tonne wheat export program to the end of February is 47 per cent complete. Exporters still have some work to do in the back half of the marketing year to fill this program.

The global barley market remains quiet and is grinding lower in line with weaker wheat and feed grain markets. On the Australian export front China have returned to the market after Lunar New Year holidays at much lower levels. Monthly barley exports to China from October through to January averaged 650 thousand tonnes. In February this dropped to 400 thousand tonnes. The export stem is showing a slight pickup in barley exports for March, but not back to amounts that would provide a significant and sustained lift to prices.

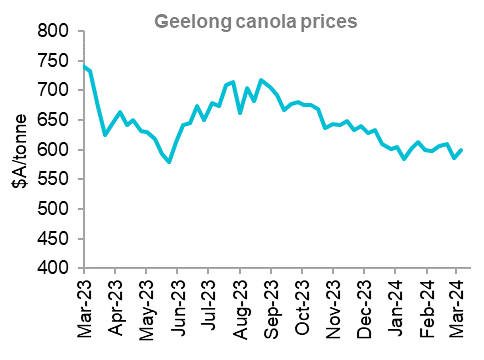

Local canola markets held up better than cereals over February. Prices across most port zones steady to up a few dollars for the month. A cut to European Union (EU) rapeseed production estimates supportive of prices. Current forecasts for this season anticipate total EU output will be eight per cent lower than in 2023. Overall sentiment in the oilseeds complex remains bearish due to ample soybean supplies in South America. Both Brazil and Argentina are poised for a large soybean harvest. If realized this will lead to a surplus in the region and a projected increase in global stocks this season.

Australia’s national forecaster ABARES have released their March Australian Crop Report which has added to the overall supply side. Wheat production was raised two per cent to 26 million tonnes. Canola was raised three per cent to 5.7 million tonnes, while barley was cut three per cent to 10.8 million tonnes. Summer crop prospects saw a significant boost on the back of favourable soil moisture conditions. Sorghum production saw a 38 per cent upwards revision to two million tonnes. This puts production 26 per cent above the ten-year average.

Summer rainfall was better than expected. It boosted east coast crop production. It has also boosted confidence for the 2024/25 winter crop. Despite a very dry February which has seen topsoil dry out, sub-soil moisture levels remain very full. A decent rainfall event prior to seeding will kick the season of positively. For Western Australian cropping regions, the end of a very dry summer was met with heavy rainfall from ex cyclone Lincoln. Whilst still early, these rainfall events have added moisture to the soil profile along with increasing sentiment for the start of the upcoming season.

Source: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.