Insights June 2024

Insights June 2024

Commodity overview

- Stabilized production forecasts for the Russian crop, alongside improved crop ratings for both US winter and spring wheat sees the recent wheat price rally falter.

- ABARES latest crop report is forecasting a sharp increase for winter crop production, estimating a 10 per cent year-on-year increase to 51.3 million tonnes.

- Australia’s winter crop seeding is in its final stages, estimated at over 90 per cent complete. Recent rainfall across Western Australia and South Australia has been enough to germinate crops. However, follow up rain will be required in many regions to get good establishment.

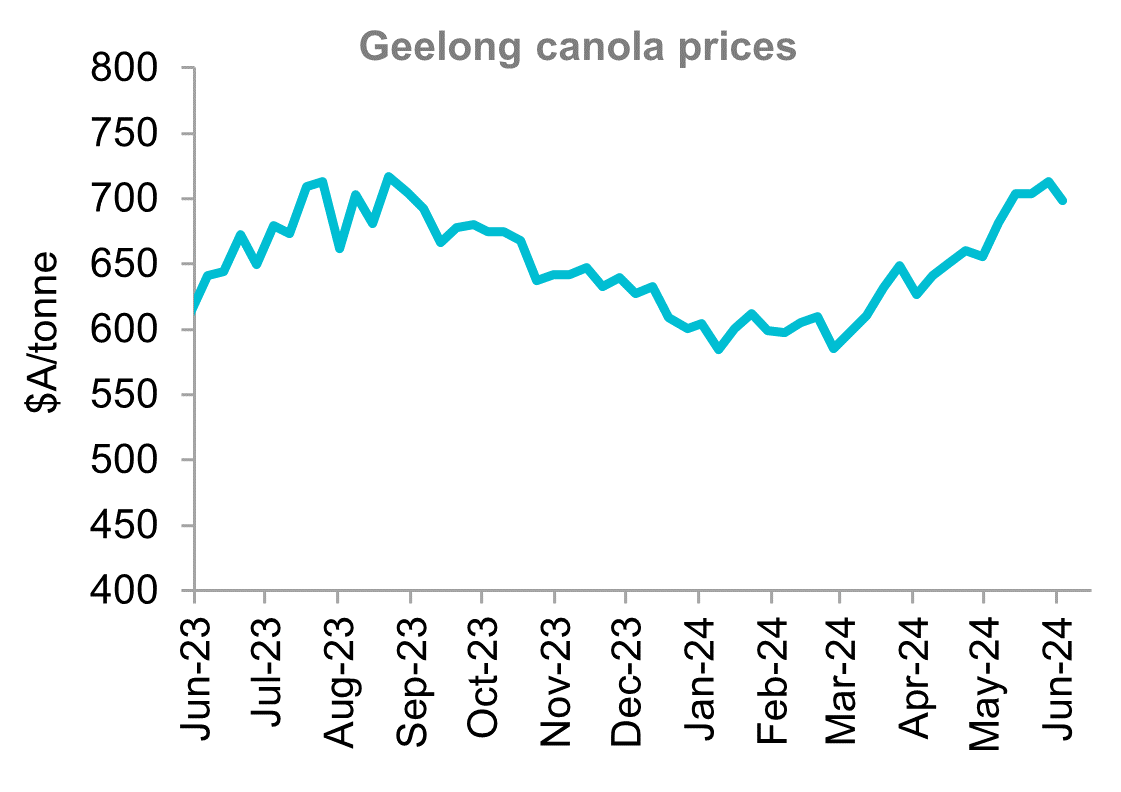

A six-week surge in global wheat prices has been countered by recent developments. Stabilized production forecasts for the Russian crop, alongside improved crop ratings for both US winter and spring wheat compared to last year, have driven wheat futures prices down by 7 per cent since late May. Crop progress data is also showing that the US corn crop is off to its best start since 2018, which has pressured both US corn and global feed values lower. Oilseed markets haven’t been spared from the pressure. As with wheat and feed grains above, improved US weather and planting pace has weighed on soybean values. Other factors weighing on oilseed markets included forecast rain for the Canadian Prairies improving recently planted canola crop there.

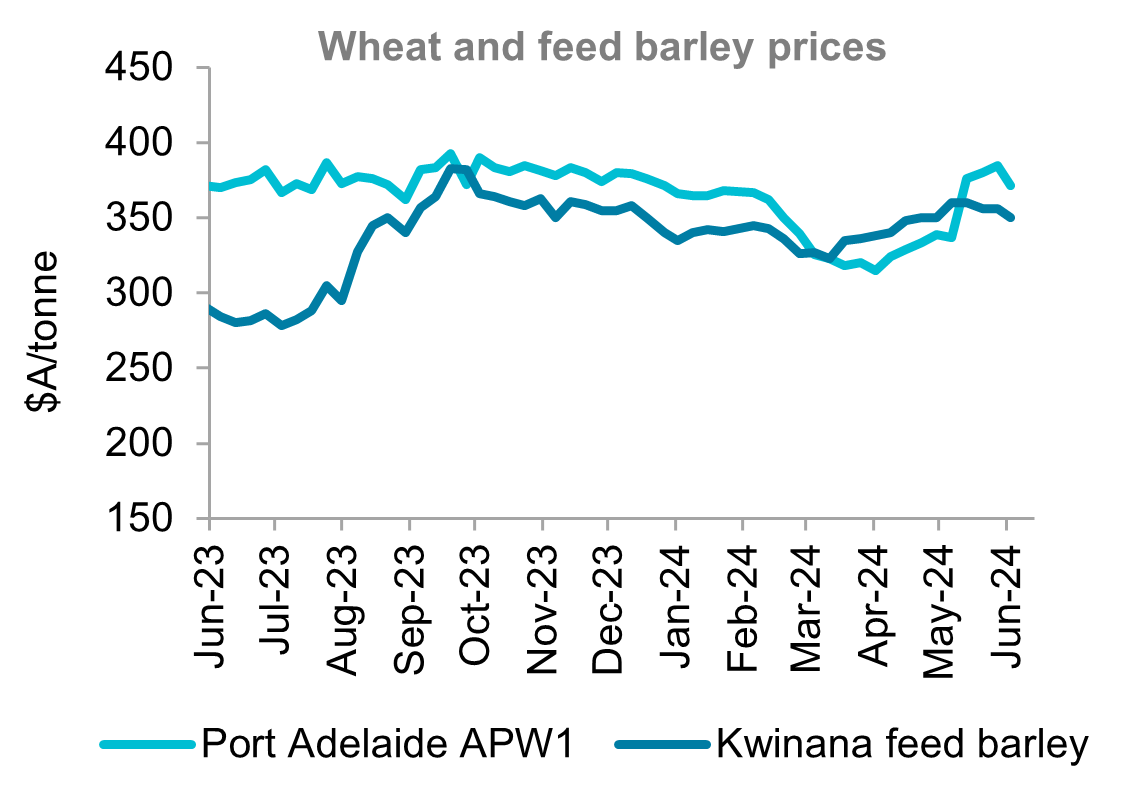

Domestic wheat and barley prices mirrored the global decline, though to a lesser extent. The recent rally had brought local prices back to pre-harvest levels, prompting some grower selling. However, thin selling persists due to uneven rainfall distribution across the country. This combined with aggressive buying from both export and domestic markets, has helped support domestic values. Canola wasn’t immune from the downward pressure, with both old and new crop prices dropping roughly 2 per cent since late-May. While overall canola values remain firm, trading activity is sluggish. Low old crop stock levels and grower uncertainty regarding the new crop is contributing to the lack of selling.

Seeding of Australia’s 2024/25 winter crop is in its final stages at over 90 per cent complete. Queensland and most of New South Wales have had a very positive start after favourable autumn conditions. Key export states Western Australia and South Australia along with many Victorian regions have had a very challenging start to the season. A large proportion of the crop has been dry sown with little subsoil moisture sitting below it, especially in Western Australia. The overwhelming feeling is that recent rainfall totals have been disappointing through these states’ cropping regions. While it has likely been enough to germinate recently planted crops, the next two to three weeks will be critical for development.

The latest ABARES crop report is forecasting a sharp year-on-year increase for winter crop production. ABARES has forecast production to reach 51.3 million tonnes in the crop currently being planted. The figure is almost 10 per cent higher year-on-year, with winter production for 2023/24 put at 46.7 million tonnes in the March 2024 update and reflects substantial increases in production across all parts of mainland Australia. ABARES production estimate of 51.3 million tonnes hinges on successful crop establishment in South Australia and Western Australia, along with favourable spring conditions.

The recent wheat price rally has faltered due to a lack of fresh bullish news. With winter wheat harvests in the Northern Hemisphere, particularly the Black Sea region, poised to begin, a wave of new-crop wheat will soon reach offshore markets, satisfying immediate demand. Similarly, rain in Australian cropping regions with moisture deficits could trigger increased selling. Local buyers should absorb at least some level of forward selling given we remain in line with offshore futures markets. But any larger than expected selling will see basis come under pressure.

Source: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.