Insights May 2024

Insights May 2024

Commodity Overview

- Global grain and oilseed markets have seen a strong rally since mid-April. This was driven by weather concerns in the Northern Hemisphere.

- Australia’s winter crop planting faces a mixed start. Rain is urgently needed in southern regions to germinate existing crops and allow planting to continue. Dry conditions threaten canola area.

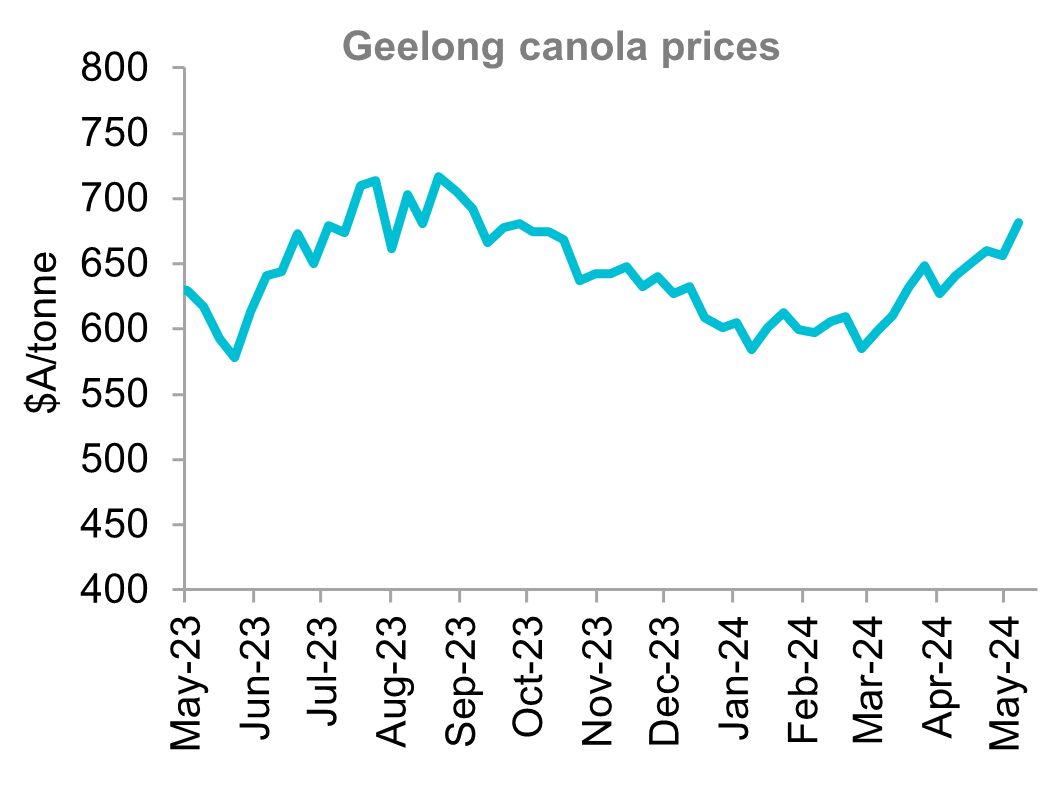

- Australian canola export activity has shown a positive shift with bulk shipments up 51 per cent in April. This trend is set to continue with shipping stem data showing a potential season high of 675 thousand tonnes to be shipped in May.

Global grain and oilseeds markets have rallied strongly since mid-April. This shift reflects growing concerns about weather impacting crops in the Northern Hemisphere. In the oilseeds market, flooding in Brazil has provided support for prices. However, it is wheat that takes the lead as dry weather concerns intensify across key export regions. Southern Russia's main wheat-growing regions are under the most scrutiny due to recent rain deficits. Time remains for Russian wheat conditions to improve and alleviate market anxieties. So we can expect markets to stay volatile in the short-term. This will last until global production estimates for the 2024/25 crop are more certain.

Seeding for Australia's 2024/25 winter crop is off to a patchy start as conditions vary across regions. Soil moisture remains favourable through Queensland and most of New South Wales. Southern New South Wales along with Victoria have both missed out on recent rain. This is starting to become concerning as yield potential reduces every day after mid-May germination. Conditions remain very dry across South Australia and Western Australia as both states are yet to receive an Autumn break. Much of the crop has gone in dry to this point. Both states need widespread rain in the next couple of weeks in order to get what is planted out of the ground and to encourage planting the rest.

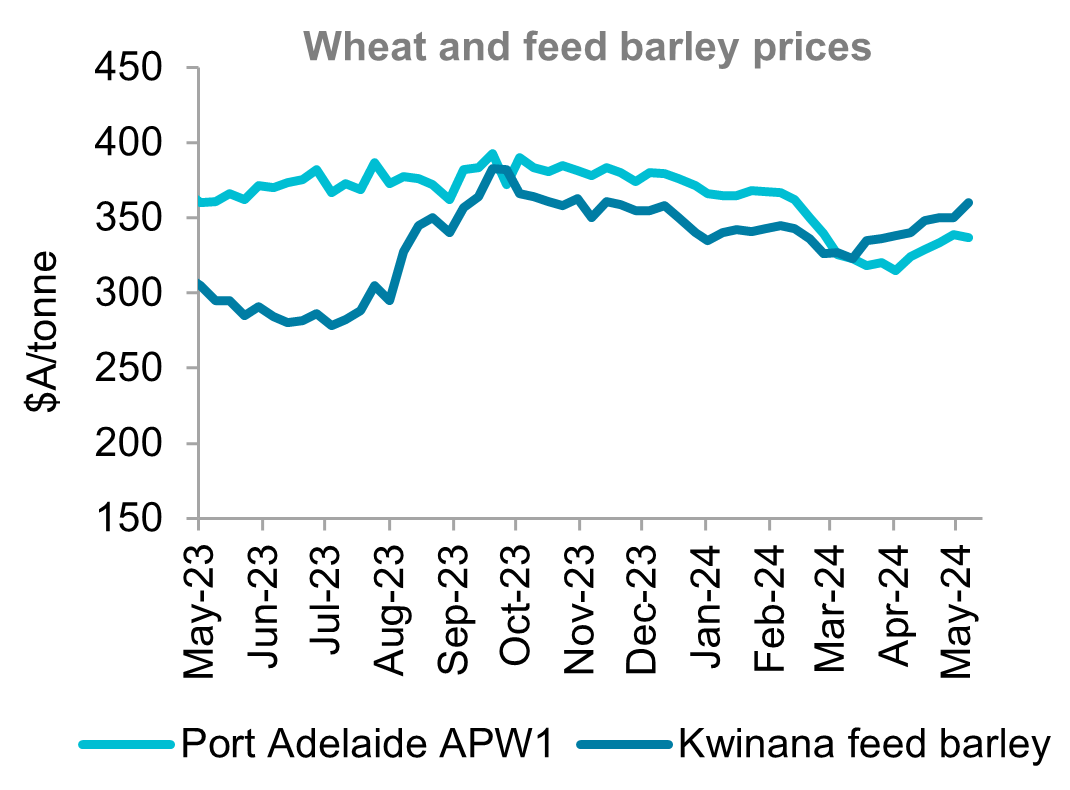

Australian wheat prices have gained good support from offshore moves. All port zones have risen by 7-10 per cent in the past month to reach three-month highs. Barley prices followed wheat over the past month with similar gains. Grain stocks are low in Queensland and northern New South Wales. Also, demand from northern feedlots is firm. This is pushing price support further south. Exports of wheat and barley also continue to tick along, providing additional support. They will likely be helped further by current worries about offshore production.

Canola prices were up by around 10 per cent across all port zones over the past month. Recent adverse weather in Brazilian soybean crops was a key driver. However domestic supply and demand factors have also lent support to local prices. Concerns have emerged about potential reductions in Australian new crop canola area. Dry conditions in key regions are likely to see growers pull up on planting canola as the optimal window passes. Export activity has also shown a positive shift. Recent additions have significantly increased forward shipping schedules. Additionally, the potential for further offshore demand exists. Estimates suggest an additional 250-400 thousand tonnes. With stocks running low on the east coast this would have to be sourced from Western Australia. Continued strong demand, would result in national canola ending stocks reaching their lowest level in several years.

Current market sentiment is heavily influenced by weather conditions, both domestically and abroad. The absence of rainfall in key dry growing regions could continue to bolster local prices. However, a significant rainfall event could quickly dampen this upward trend or even trigger a reversal. This would attract renewed selling pressure.

Source: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.