Insights April 2024

Insights April 2024

Commodity Overview

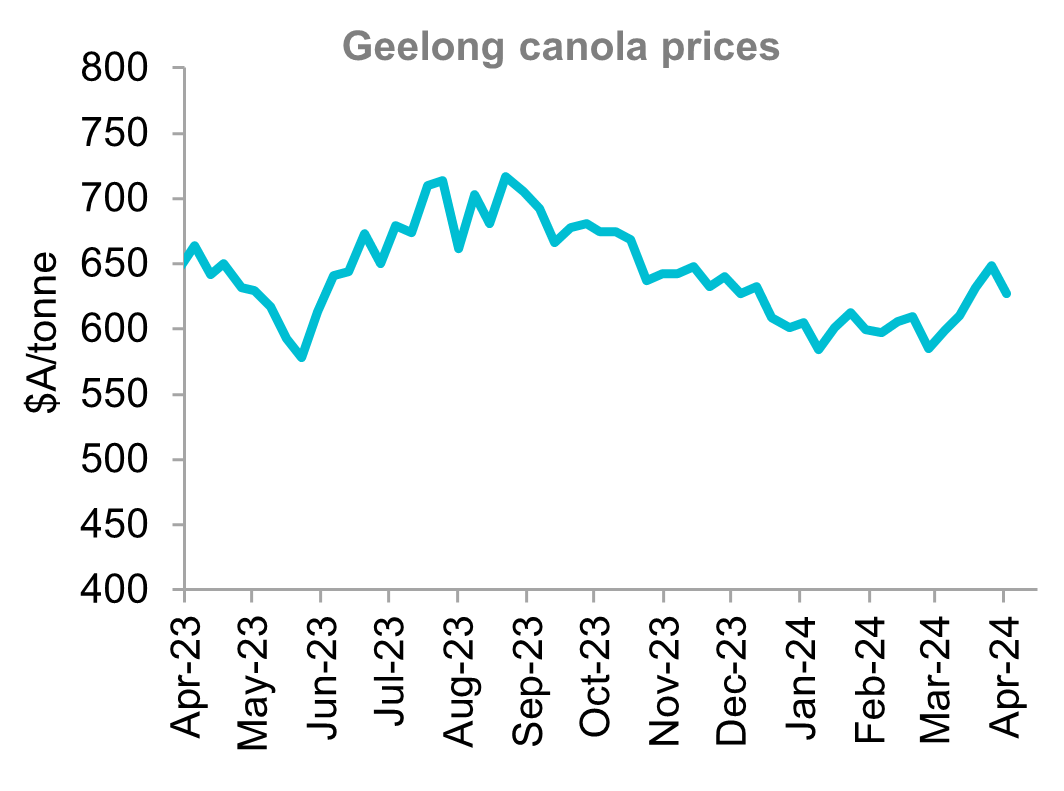

- Local canola values managed some strong gains over the month with prices recovering to levels not seen since mid-November. Growers made some heavy selling engagement on this rally.

- Planting of the 2024/25 winter crop is in the very early stages in areas with sufficient soil moisture. Planting will get underway in earnest on the more traditional ANZAC day start unless weather conditions change.

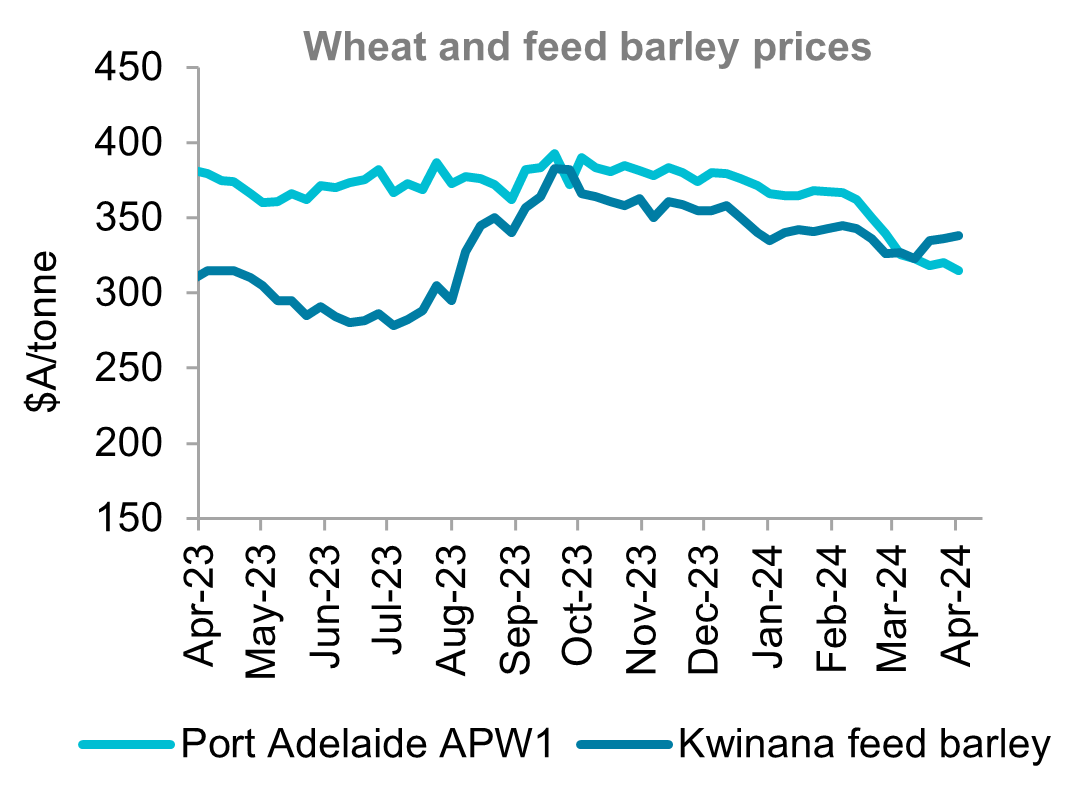

Black Sea escalations and some late weather concerns for the US winter crop saw wheat futures rally 6 per cent from the three and a half year lows they touched in early March. Prices have eased at the time of writing as ample global supplies continue to weigh on markets. Current production forecasts for Russia’s wheat crop sit at a near record 91.5 million tonnes. This would give them an all-time high exportable surplus of 51 million tonnes. Some supportive global fundamentals have developed for barley. Government forecasters are projecting area planted to barley in Canada and France to be down by 2.5 per cent and 7 per cent respectively in 2024. Both are major export competitors into the Chinese market. If these two countries cut exports, local new crop prices could be supported.

Local wheat prices failed to follow international wheat markets higher over the month. Values across the country were flat to slightly lower. News that China had cancelled or postponed Australian wheat shipments weighed heavily on prices early in the month. Wheat prices in the export-oriented state Western Australian dropped to over two-year lows early in March. The drop in prices sparked some new demand. Cancelled shipping slots were taken up with new sales. This saw prices rally from the lows and finish mostly unchanged for the month.

Domestic feed barley prices increased across most port zones over March. The Australian feed barley (index) price gained $6 per tonne to finish at $313 per tonne. Domestic usage amongst processors has dropped given the tight spread between wheat and barley. But this has picked up over March with good demand into grazing areas where conditions have dried off in recent months. Recent Chinese buying is also lending support to prices. Interest in malt barley has also continued to remain strong with prices up by $8 to $13 per tonne across most port zones.

Local canola values managed some strong gains over the month. Prices recovered to levels not seen since mid-November. Prices rallied by $33 to $70 per tonne across port zones. But they pulled back in the last week of March to finish around 5 per cent up for the month. Grower selling has slowed on the pull back; however, some heavy selling engagement was made on this rally.

Planting of the 2024/25 winter crop is in the very early stages in areas with sufficient soil moisture. Grazing crops have been planted in New South Wales and Victoria along with some canola and long season wheat. Western Australia's south and southeast have received good rainfall since early March. They have now begun seeding. Planting will get underway in earnest across other regions on the more traditional ANZAC day start unless weather conditions change.

Source: Profarmer Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.