Australian agriculture mid-year outlook 2024: Wool

Australian agriculture mid-year outlook 2024: Wool

Summary

Supply

Australian wool production to contract over the 2024/2025 season due to a decline in the number of sheep being shorn.

Demand

Demand should increase slightly as interest rates and inflation lowers.

Price

Wool prices to remain steady and possible increase, depending on economic conditions.

Outlook

Wool markets to hold steady towards the end of 2024 until there is a lift in global demand.

From the field

"Challenging economic conditions will continue to suppress demand for Australian merino wool over the coming season. From a quality perspective, the dry start to winter will see improved cut quality and allow for price premiums where possible. This, alongside a tighter supply picture will add some underlying support to wool prices in 2024-25. However, challenges for producers remain with the high costs of shearing and low prices on offer continuing to impact profitability."

Neil Verringer, Regional Manager AgriBusiness SA – Adelaide

Supply

Coming to the close of season 2023/24 an increase in numbers of sheep shorn in New South Wales, South Australia, and Tasmania has been observed. However, all other states have seen an overall reduction for the 2023/2024 season. A decrease in average cut per head for the season has also been recorded, down 2.2 per cent from 2022/23. The Australian Wool Production Forecasting Committee’s (AWPFC) revised forecast from April 2024 predicts the 2023/24 season will finish at 324 million kilograms (Mkg) greasy, down 4Mkg from the December forecast. Looking ahead, Australian wool supply is expected to be flat to slightly down for the coming season. The first forecast for 2024/25 has predicted national wool production of 306Mkg greasy, down 5.8 per cent on 2023/24. A six per cent reduction in total number of sheep shorn over the new season is also estimated. This will bring the number of sheep shorn down to 67.3 million head. The average cut per head is expected to sit at 4.55kg/head greasy, similar to the 2023/24 season.

Between January and May the supply of wool started to decline, with volumes offered down 11 per cent on the previous season. It is expected these lower offerings will continue into the start of the new season and beyond. Despite this decline in volumes, there is still a willingness to sell, with pass in rates remaining under 10 per cent for much of the season. The dry start to 2024 across many states is also likely to influence the average cuts per head. Although there has been a small benefit in terms of reduced fly activity and worm impacts. Looking ahead to the new season, there will be higher flock numbers. This is due to an increased holdover of lambs and older breeding ewes. This trend has been observed across New South Wales (+3.8 per cent) and South Australia (+2.5 per cent). Surging grain markets and lower wool prices have resulted in a shift to cropping for many producers across the country. Combined with still elevated costs, particularly in shearing, sentiment for the upcoming season isn’t particularly positive. There is discussion among some producers of leaving the industry and moving to cattle. There is also an expected increase in shedding flocks and a move away from Merino. However, covering costs with crossbred wool will prove a challenge which will encourage producers to persist with finer microns. There has also been a noted shift towards annual shearing in place of six monthly due to the increased costs. The recent weather has seen vegetable matter levels remain steady, which will continue into the new season.

Greater traceability is becoming a key industry focus. Electronically identified wool packs (ePack) have been in use since March 2023 and there are hopes that by January 2025 100 per cent of wool packs going into market will be ePacks. This will enable greater traceability along the wool supply chain. The traceability hub is anticipating that by July 2025, 90 per cent of Australian wool bales will be able to be traced to property of origin. Currently this figure sits at 50 per cent leaving some work to be done in the coming start to the season. This hub will also allow a faster response to any possible emergency biosecurity outbreak, limiting its impact on the industry.

The live export ban, proposed to be introduced in 2028 remains a key issue. The number of live sheep exported has reduced by approximately 90 per cent in the past 20 years. There is real concern among sheep farmers about the future of the industry and its associated commodities. A ban would see volumes bound for export enter the domestic market, impacting sheep prices. Producers would likely leave the industry and there would be a fall in the flock size, reducing volumes available for both sheep and wool over the longer term. This may eventually lead to price gains; however, before this point is reached the lower prices would challenge the sustainability of communities supporting the industry. Western Australia provides 75 per cent of Australia’s sheep exports and sells into the South Australian marketplace. A ban would predominantly impact Western Australia but have flow on effects across both states.

Demand

Supressed demand for wool on the international market will continue to weigh on prices moving into the 2024/25 season. As a premium product, demand for woollen products is lower than in recent years. The current cost of living challenges within Australia and across much of the world are a main driver of this poor demand outlook. Australia provides 45 per cent of global wool export volumes. This leaves us particularly exposed to global economic conditions. Wool products are often viewed as luxury goods, an area that currently has limited spending. There is hope that improved economic conditions in Europe will allow for more discretionary spending in these markets. If this occurs there will be a lift in demand, and possibly prices. China continues to dominate the demand for Australian wool, taking 87 per cent of wool exported from the country. Higher competition and interest from multiple buyers are required to see a substantial improvement in price over the coming season. While there has been some increased demand from India, the demand from Europe has been flat. Europe tends to have greater interest in the finer micron wool that can demand a greater price premium.

Trade between China and Australia is improving from a broad perspective. Though current Chinese economic conditions are not promising for increased wool buying in the near term. As with many countries, inflation continues to remain stubbornly high. Until there is an improvement in broader economic conditions it is difficult to see a substantial increase in demand. China's consistent buying during periods of low prices means a lower average buying price. This allows them to continue to buy more even as prices rise. It also allows China a competitive advantage against small buyers trying to re-enter the market.

Price

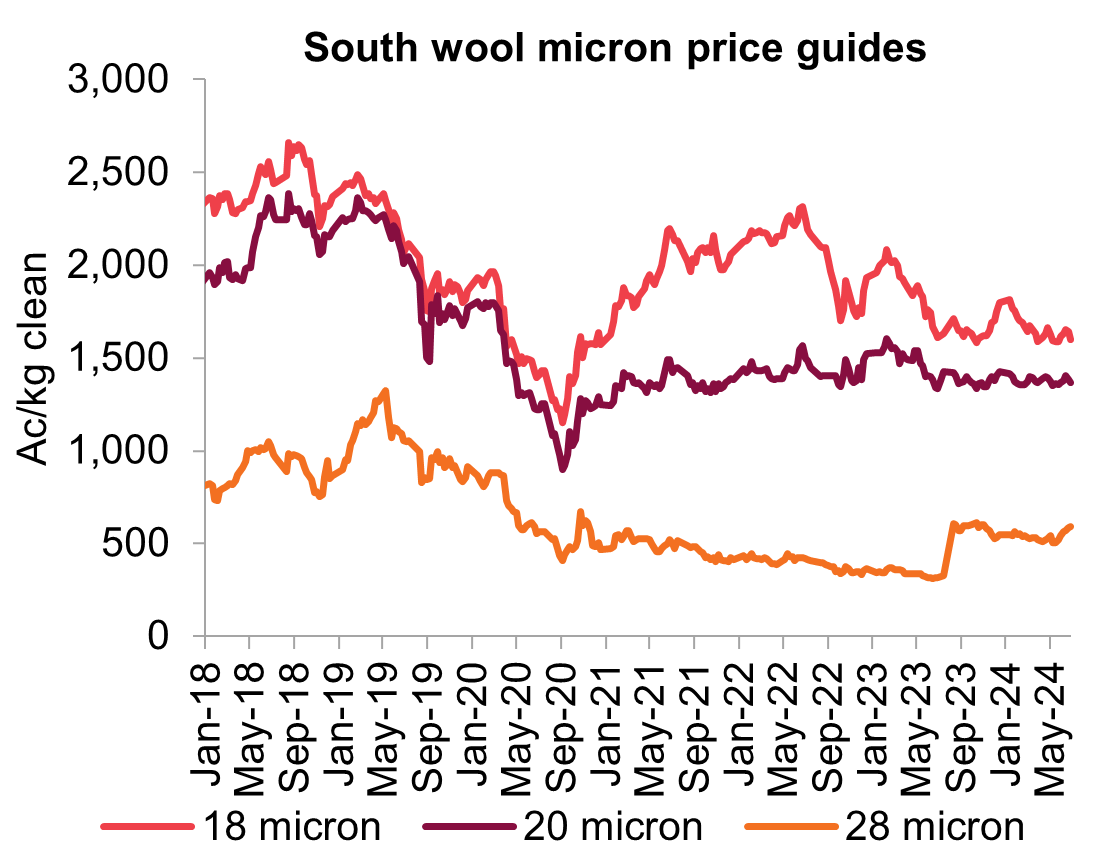

There has been some negligible improvement in the Eastern Market Indicator (EMI) over the 2023/24 season. The EMI lifted by 16 cents higher over the course of the season. Much of the growth for the EMI has come from 21-micron wool and higher. Many of these microns are now sitting above their prices from the same time last year. However, the finer microns' prices are struggling compared to historical averages. This is one of the reasons producers are looking to move away from Merinos and looking more to crossbreeds. While volumes on offer remain low, it is likely that a minimum level of support will remain and keep prices steady into the new season. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has forecast a three per cent price rise in the EMI to 1,194 cents per kilogram. This is on the back of slightly improved economic conditions and reduced supply. Any significant increase in supply would test the competitiveness of the market. Should this happen, it may lead to prices falling again, although at this stage expectations are that it will remain flat.

Despite the small year-on year increase, the EMI is still 10.9 per cent down on the five-year average and even further off the pace of the 10-year average. Coarser microns have had price gains year-on-year, but they remain further from the five-year average than the finer microns. A change towards coarser microns on offer means the lower volumes of finer microns may allow for some price support to be found. A heavy influence on the price across all microns will be the quality, with the best cuts being able to obtain premium prices. The dry winter should prove positive from this quality perspective. There are still significant cost challenges across many parts of the industry. This will influence what product is brought to market going forward, particularly depending on prices offered. Ongoing high costs of shearing is an issue in all states. Fodder and transport availability are also challenging in some states. High costs are key to producers’ decision making and the actions they are choosing to take with their flock management. Movement of the Australian Dollar will also continue to influence prices. Many week-to-week shifts in prices have been a result of overall exchange rate changes rather than an indication of quality, supply, or demand changes.