Australian agriculture mid-year outlook 2024: Cropping

Australian agriculture mid-year outlook 2024: Cropping

Summary

Supply

Australian winter crop production to increase nine per cent to 51.3 million tonnes in 2024/25.

Demand

Low carryout across all commodities will see strong demand from both domestic users and exporters for the 2024/25 winter crop.

Price

Upcoming Northern Hemisphere harvest to pressure prices in the short term. Tightening global stocks positive long term.

Outlook

Winter planting concludes under varied conditions. Continued in crop rainfall essential, with long range forecasts mostly neutral.

From the field

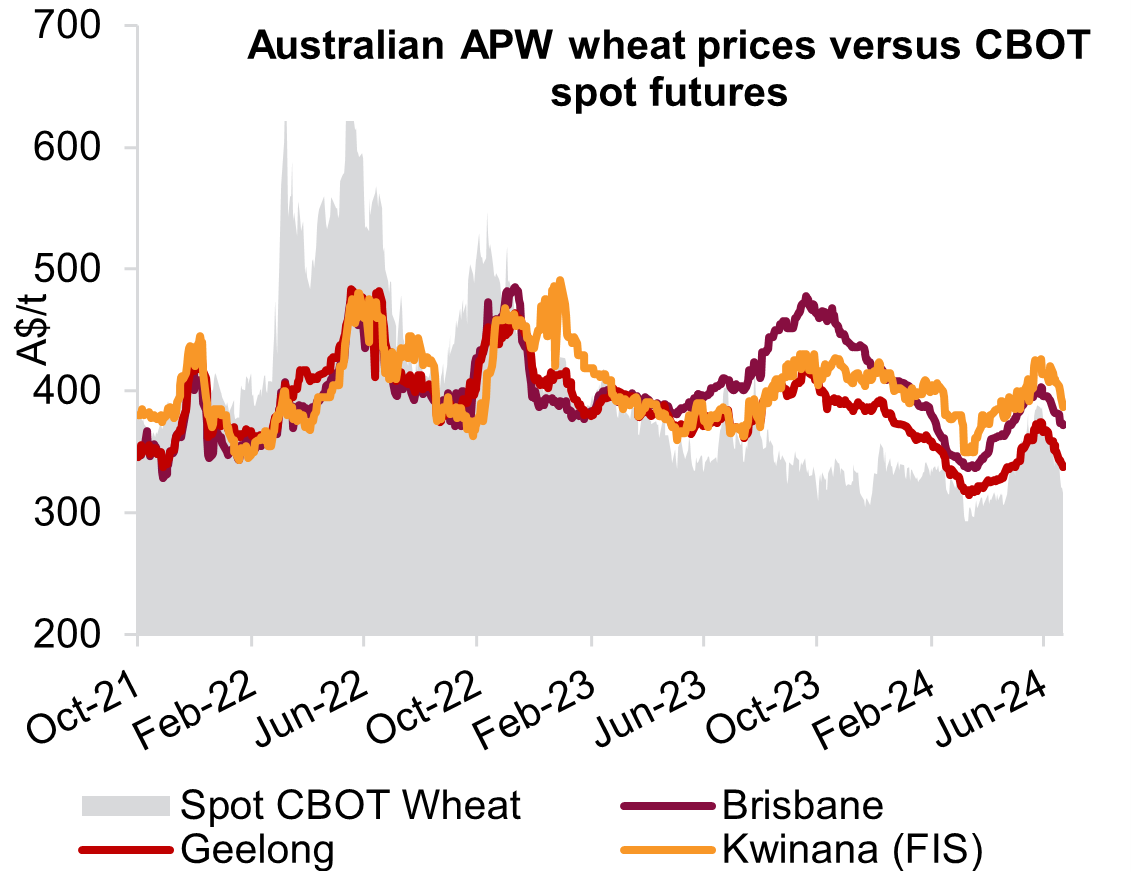

"Recent price rallies due to Russian production concerns allowed growers to make solid sales, nearing completion of old-crop marketing. Prices have since eased due to stabilised production estimates for Russia and selling pressure from the northern hemisphere harvest. But Black Sea/European shortfalls of 20-25 million tonnes suggest a smaller harvest pressure window. Low domestic ending stocks add another layer of support. We maintain a neutral near-term outlook on wheat prices due to northern hemisphere harvest pressure but hold a positive longer-term view due to tightening global stocks."

Wayne Saunders, Regional Manager Agribusiness – Western Victoria

Cereals

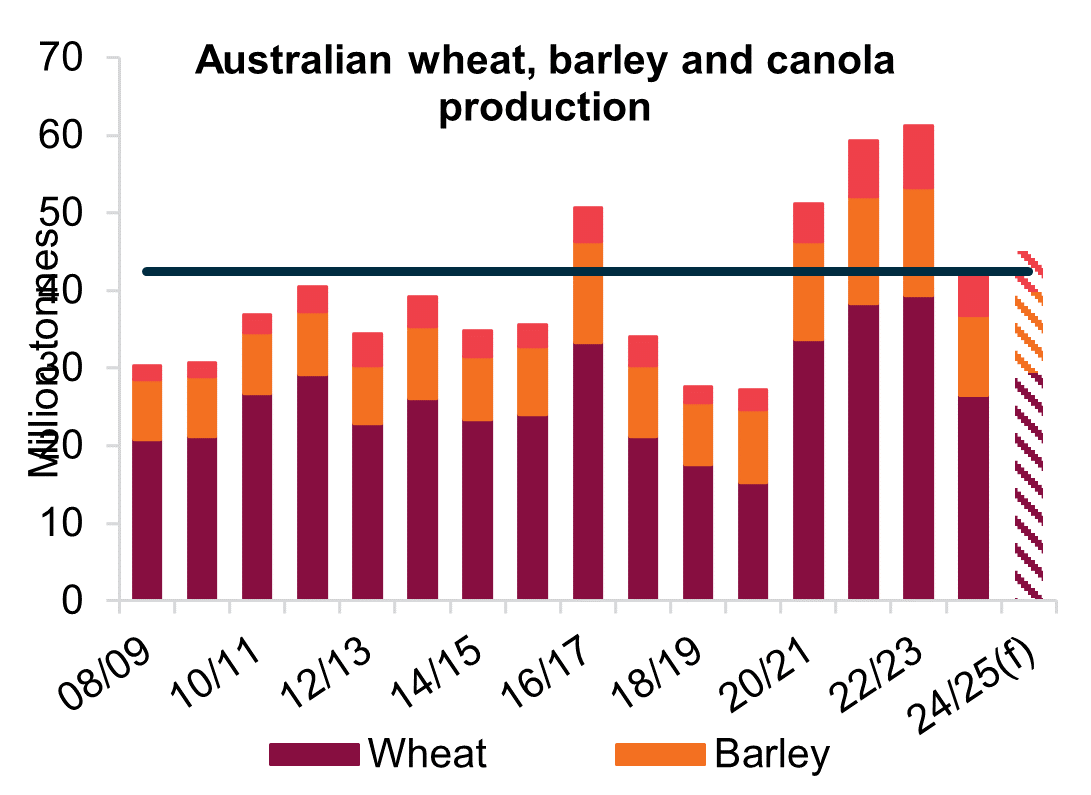

Winter crop planting in Australia is all but wrapped up. The challenging autumn across many regions has led to crops emerging under varied conditions. The focus now shifts to the growing season. Timely rain and a kind spring finish are crucial for meeting current production estimates. Some regions are well-positioned to achieve above-average yields. While others face challenges due to uneven rainfall distribution. Southern Queensland and New South Wales stand out with consistent autumn rains, fostering excellent crop emergence and establishing a positive outlook. However, conditions are less promising in other areas. Recent rains in Western Australia, South Australia, and Victoria were welcome. But they have not been enough to fill soil moisture profiles. South Australia and Victoria have a big moisture deficit. Western Australia needs more rain to reach its full potential. Despite these differences, winter crop production in Australia will increase by nine per cent to 51.3 million tonnes in 2024/25. Wheat production is on track be strong this year. It's forecast to increase by 12 per cent to 29.1 million tonnes in 2024/25. This exceeds the 10-year average by a big 10 per cent. Barley production is also set to rise. It will increase by a promising seven per cent to 11.5 million tonnes. This will surpass the 10-year average by two per cent.

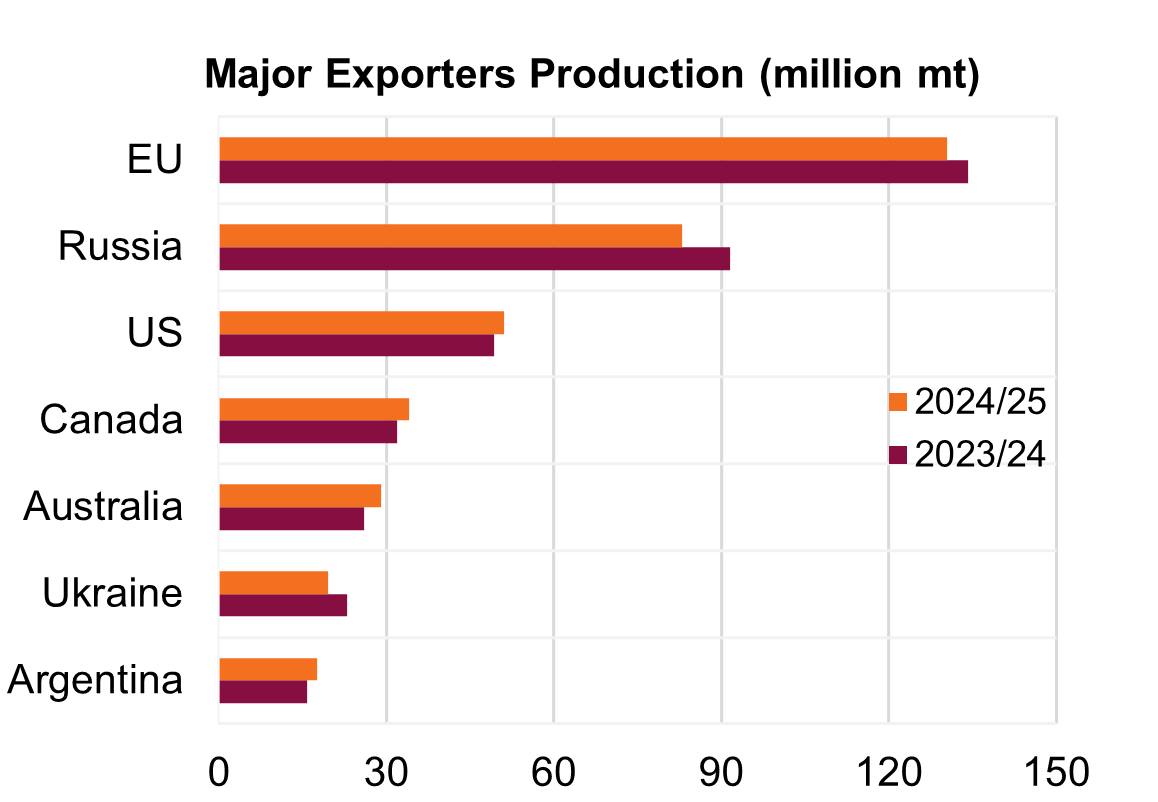

The United States Department of Agriculture (USDA) says the global wheat outlook for 2024/25 is 790.7 million tonnes. This is 7.4 million tonnes lower than the May estimates. The drop is due to less output in Russia, Ukraine, and the European Union. But the estimates are still 3.2 million tonnes above 2023/24 levels. Global ending stocks are estimated to finish at 252.3 million tonnes, a decline of 2.8 per cent from last season and the lowest level since 2015/16. Global barley production is forecast to rise four per cent year-on-year to 148 million tonnes. Cuts to Russia and the Ukraine more than offset by increases to the EU, Canada, and Australia.

Demand

High numbers of cattle on feed, reaching a record 1.35 million head in the March quarter, signals strong domestic demand for grains. This is due in part to the significant investment in expanding existing feedlot sites. The good outlook for world beef markets fuels optimism among feedlot operators. It suggests that grain fed cattle numbers will likely stay high in the second half of 2024. This translates to continued robust demand for grain from the feedlot industry.

Australia's wheat exports for the 2023/24 season are on pace to reach 20 million tonnes. Shipping data suggests that over 80 per cent of this volume had been shipped by the end of June. However, dwindling stockpiles will limit any further upside potential. Carryout – the amount of wheat remaining at the end of the season – is expected to be the lowest since 2019/20. This tight supply leaves little buffer for unforeseen events in the latter half of 2024. Any supply side shocks or harvest-related disruptions could trigger price hikes as the market strives to balance export commitments with domestic needs.

Australia is forecast to export 7.6 million tonnes of barley in 2023/24, making it the world’s leading barley exporter. A spike in Chinese demand drove this after import duties were removed in August 2023. This combined with a decline in production in 2023/24 from adverse El Niño weather impacts will see very low carry in stocks for 2024/25. With domestic demand to remain strong, 2024/25 exports are forecast at a five-year low of six million tonnes. China's barley imports for 2024/25 are forecast to drop from 2023/24. But the USDA predicts imports will be the third highest on record at 10.2 million tonnes. Australian barley exports for malt and feed will be in strong demand from China and will see prices remain well supported. However, EU production is forecast to be at a four year high of 53.8 million tonnes. Exports are to grow by 12 per cent to 7.3 million tonnes. The EU is well positioned to become the top exporter in 2024/25. They will help meet the market's needs and keep a lid on prices.

Outlook

The global wheat market continues to be dominated by developments in Russia. However, the influence of Russian weather conditions is waning. Recent rains have made conditions stable. Analysts now forecast a crop of 80-83 million tonnes. This translates to comfortable export levels of 46-48 million tonnes, a figure that should ease global anxieties. However, a drop below 43 million tonnes for Russian wheat exports could reignite concerns and trigger price surges. Less production and exports also raise the chance of Russian government intervention. On a broader scale, global wheat fundamentals are undergoing a shift towards tighter supplies. Major exporters are experiencing their lowest stock levels in years, a trend demanding close attention. Global market dynamics, particularly from major exporting regions, will significantly influence local wheat prices throughout the July to September harvest season in the Northern Hemisphere. As the harvest progresses and global production forecasts are revised, we expect this influence to remain strong. Given the imminent harvest pressure, we maintain a neutral view on wheat prices in the near term. However, the long-term outlook is more positive due to the tightening global stock situation.

Oilseeds

Canola production in Australia is forecast to decline by five per cent to 5.4 million tonnes in 2024/25. However, this remains an impressive figure, exceeding the 10-year average by a significant 21 per cent. This decrease is primarily attributed to a projected nine per cent reduction in planted canola area, reaching 3.2 million hectares. Several factors contributed to this decline. Unfavourable conditions at the start of planting season in key regions. Plus, lower returns led some growers to choose alternative crops. Crops like wheat, barley, and pulses were rotated. Worldwide, production is forecast to drop slightly in the 2024/25 season. It will fall from 88.74 to 87.07 million tonnes. Bad weather during the northern hemisphere spring is the main cause. It led to a large 6.25 per cent year-on-year drop in EU canola production, down to 18.75 million tonnes.

Australia is on track to achieve strong canola exports of 5.8 to 6.0 million tonnes for the current 2023/24 marketing season. However, similar to wheat and barley, ending stocks are expected to be tighter compared to recent seasons. This lower carryout will combine with a drop in domestic production. This will lead to an estimated export volume of 4.5 million tonnes for the 2024/25 season. The rising EU export demand (up 14.5 per cent to 6.3 million tonnes) due to lower domestic production presents a significant opportunity for Australian canola. Australia is well positioned to capture around half of this increased demand. However, improved Canadian production is expected to ease demand for Australian canola in South America and the Middle East. Australia recently gained traction in these regions, firstly to drought across Canada in 2021/22 which reduced canola output. While increasing Canadian crush capacity further limited Canadian canola exports which further drove demand towards Australia. Despite this, demand for exports will remain high in North Asia and the Indian subcontinent. This will help absorb Australia’s exportable surplus.

We would expect to see more limited upside for local canola markets coming into winter. There are a few key factors behind this. Firstly, this time of year typically sees an increase in the availability of palm oil, while a near record Brazilian soybean harvest will also be keeping the oilseed market well supplied. Secondly, export demand will begin to wane as canola harvest across the EU and Ukraine picks up in July, with Canada not far behind. Local seasonal conditions are harder to predict. But a large part of key east coast regions has good soil moisture. So, sentiment there remains good and that may also limit gains. Though dry weather on the west coast could prove supportive to prices. The long-term outlook is better. The US has strong biofuel demand. Also, Ukraine and the EU will likely have a slightly smaller canola crop. This will see strong export demand return from the EU later in the year as their own supplies start to run out. While the prospect of near $1000 per tonne canola prices are well behind us, these positive factors may very well see canola prices on the East Coast push back above the $700 per tonne mark in late 2024. For Western Australia everything will need to go to plan during the growing season along with a very kind finish required to achieve an average crop. Depending upon how seasonal conditions develop, prices in that state could come under pressure as grower selling picks up towards the end of 2024.

Pulses

Australian winter pulse plantings are forecast to jump 17 per cent in 2024/25, driven by significant increases in chickpea and lentil plantings. High chickpea prices are fuelling this surge, as a result of the Indian tariff suspension and strong global demand, pushing prices above $1000 per tonne. These strong pricing signals are expected to see growers increase planted area by 80 per cent to 730 thousand hectares, 24 per cent above the 10-year average. Ideal sowing conditions, bolstered by favourable early season rains in Queensland and New South Wales, have further supported the increased chickpea plantings. Additionally, the favourable lentil market, with sustained high prices, has driven a projected record planting area of 885 thousand hectares.

Pulse exports in general have been strong with lentils the standout. Shipping data is showing that 1.1 million tonnes have been shipped by the end of June. However, the recent rise in container freight rates has the potential to have an impact on local prices for the rest of the season and into new crop. The Drewry World Container Index (WCI) has risen 77 per cent since late April. Container freight rates continue to look quite unstable beyond June/July, the major factor is the geopolitical instability in the Middle East, especially in the Red Sea region. Increasing container freights rates into the subcontinent will make it difficult to compete into these markets at current values. The removal of the chickpea tariff could also see further increases on container freight.

New crop chickpea prices have remained above $1000 per tonne since the Indian government announced it would suspend tariffs. Despite these elevated prices along with ideal seasonal conditions in the key growing regions of QLD and northern NSW, grower selling has been limited. Depending on the size and quality of the crop these prices are bound to face some selling pressure at some stage. Analysts are forecasting a deficit of two million metric tonnes in India for the 2024/25 season which is unlikely to be satisfied by chickpea imports, with peas needed as substitutes. As a result, the Australian market is expected to remain well supported around current levels.

Lentils are also the beneficiary of reduced Indian import tariffs which are set to continue through to March 2025. This has seen Victoria and New South Wales lentil prices holding relatively steady around $900 per tonne for most of this year, lifting to around $1,000 per tonne on the back of positive news on Indian chickpeas. Canada is experiencing very good crop conditions, so we expect new crop traders to become more aggressive closer to their harvest. This will likely pressure prices lower in the short term. However, the Turkish harvest has been poor and Indian crops were also poor, so global demand will remain good. Lentils should remain steady with good demand from India with prices to remain in the $880-$900 per tonne range.