Australian agriculture mid-year outlook 2024: Sheep

Australian agriculture mid-year outlook 2024: Sheep

Summary

Supply

Australian lamb supply to ease compared to the first half of 2024 but still well above average.

Demand

Firm demand from domestic and export markets to be maintained across the second half of 2024.

Price

Firm demand and easing supply is set to support lamb prices rising back above five-year average levels.

Outlook

Lamb producers should enjoy an improved second half of 2024 with higher prices and favourable seasonal conditions.

From the field

"The sheep industry is set to enjoy a much better period ahead than it endured a year ago. Further price rises are expected for lamb, adding to gains in the first half of the year. Strong demand from both domestic and export consumers is expected to provide support for increased prices amidst a high supply environment. However, with the sheep flock likely at its peak, demand from buyers looking to expand breeding flocks will remain weak."

Ryley Verley, Agribusiness Relationship Manager – South Australia

Lamb supply to ease from a record first half of 2024

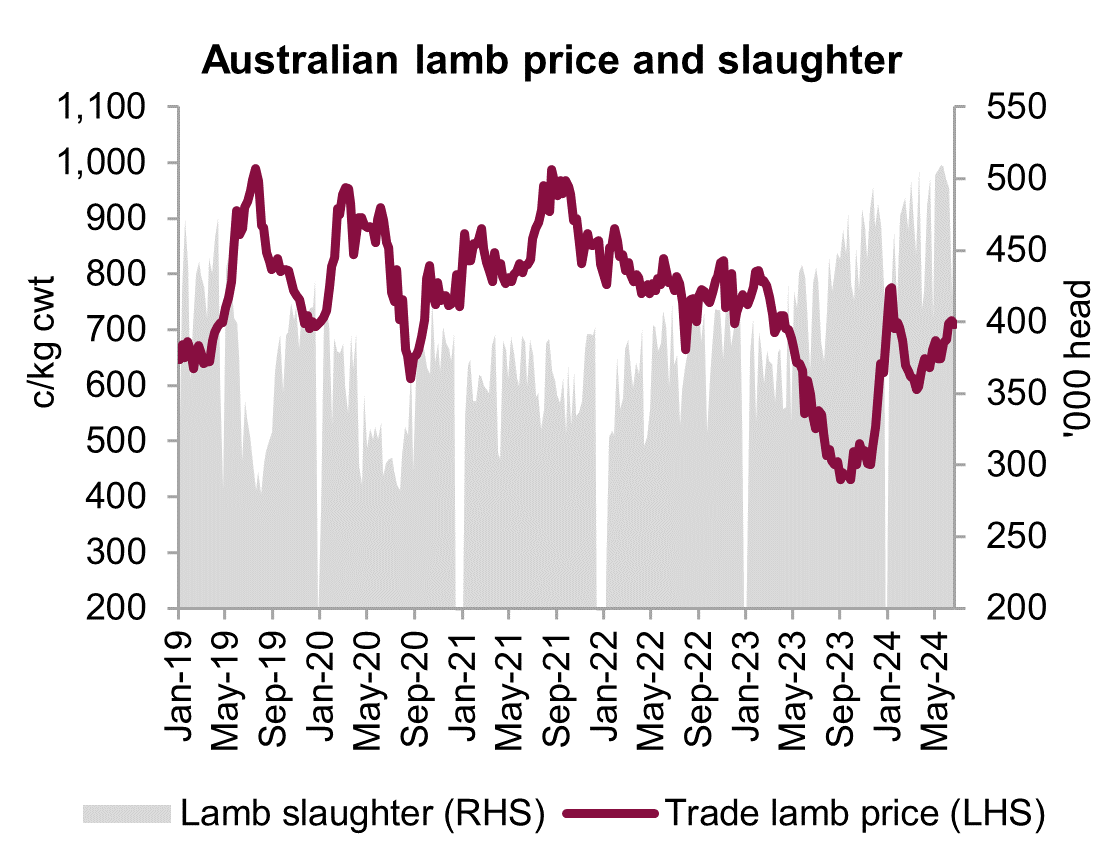

Supply of lambs is expected to decline in the second half of 2024 following a record-setting first half of the year. Weekly lamb slaughter rates across the first half of 2024 have tracked 21.8 per cent higher compared to a year earlier and 8.2 per cent above the second half of 2023. The acceleration in slaughter has come from flock growth resulting in a greater lamb cohort in 2023. More of these lambs than expected were carried over into 2024 for sale. Supply across the second half of 2024 is expected to ease from this elevated level. Fewer ewes are likely to have been joined in 2024 following a 54 per cent increase in sheep slaughter in 2023. Although many of these were older, less productive ewes held over during flock rebuilding. In addition, dry conditions during joining across key lamb regions and a relatively dry winter is expected to drive lower lambing percentages compared to last year. These factors will drive a reduced lamb cohort in 2024 compared to last year. Lamb slaughter in the second half of 2024 could be 10-15 per cent lower than first half of the year. Supply is expected to particularly tight in late-winter and early-spring. Dry conditions in South Australia and western Victoria have likely prompted earlier turn-off of old season lambs and will delay weight gain in new season lambs. This will likely create a longer gap in supply than recent years. Despite supply easing, the strong start to the year should ensure 2024 is another record year for lamb production.

Lower prices driving stronger domestic demand

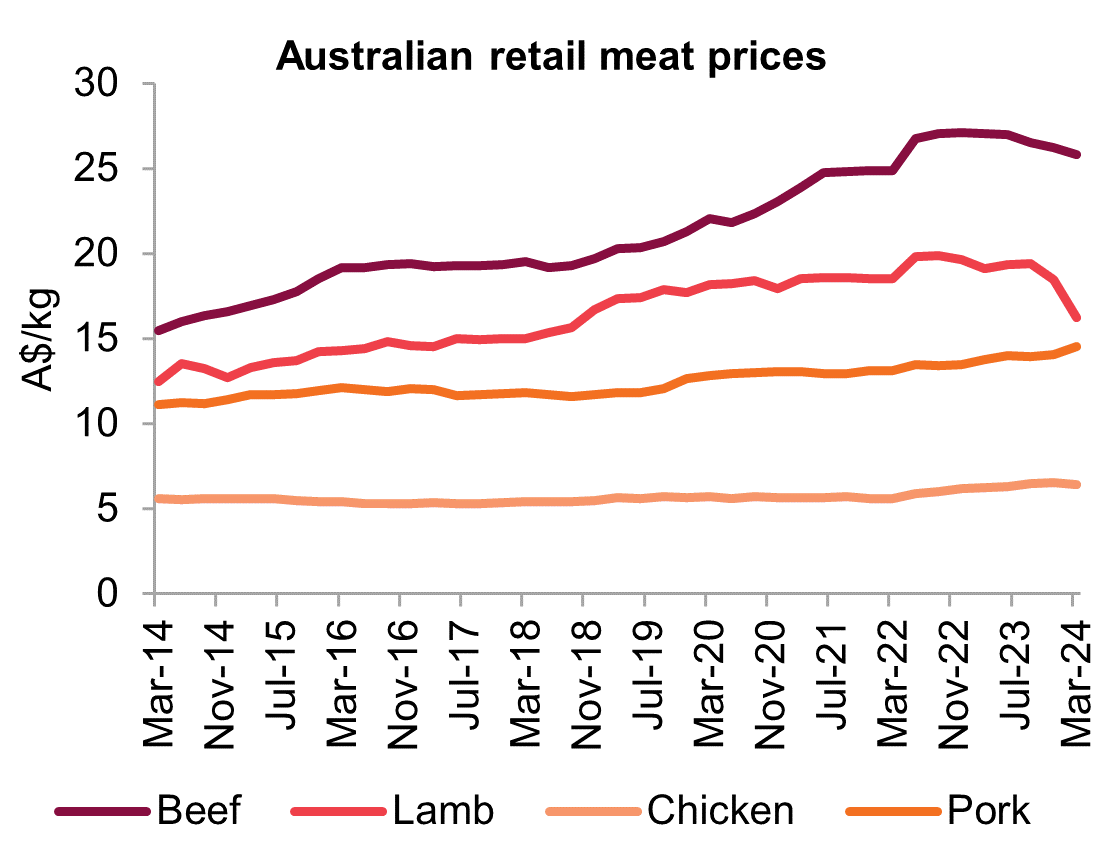

Demand from Australian consumers should improve following recent declines in lamb retail prices. The average quarterly retail price of lamb fell 16.2 per cent from September 2023 to March 2024. This took lamb prices to their lowest point since September 2018. That alone was welcome relief to consumers already navigating high living costs. Coupling this with the movements in other major meats paints an even more positive picture for the relative affordability of lamb. Over the same period beef prices saw only a 2.7 per cent decline, chicken fell 0.3 per cent and pork rose by 4.2 per cent. For consumers deciding between red meat options, lamb held a 37 per cent discount to beef in March compared to only 27 per cent six months earlier. Substituting away from red meat is also less compelling than it was six months ago. Lamb’s premium over pork closed to 12 per cent in March from 39 per cent six months ago. Lamb was 152 per cent more expensive than chicken, down from 200 per cent. Approximately 40 per cent of Australian lamb is consumed domestically. Improved demand from Australian consumers would offer strong support to lamb markets across the next six months.

The Middle East and US to continue leading firm export demand

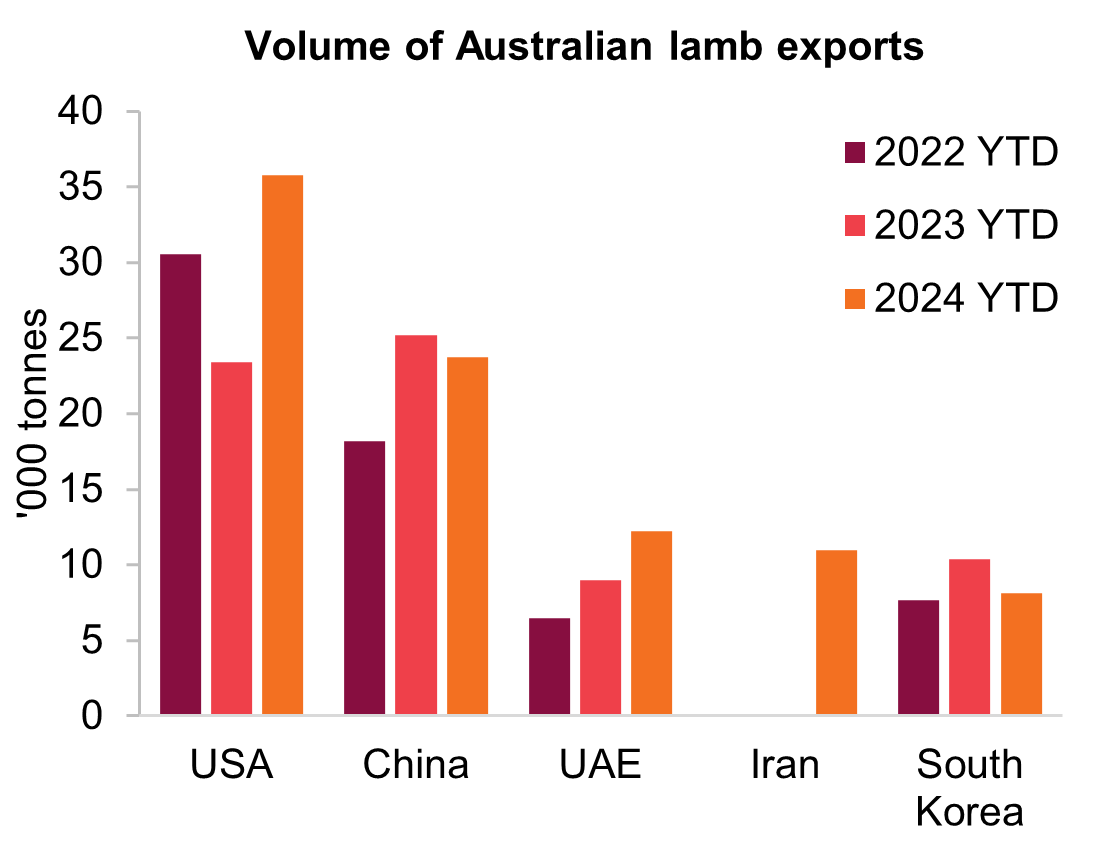

Firm export demand is expected to continue absorbing high supplies of Australian lamb. This has been a pivotal factor supporting lamb prices under the weight of record supply in the first half of 2024. Australia has exported almost 155,000 tonnes of lamb for the year-to-date (January-May). This is a record pace and 32.6 per cent higher than last year. Growth has been led by resurgent demand from the Middle East and the US. Exports to the Middle East for the year-to-date have more than doubled, up 113 per cent. This adds to the strong recovery in demand seen across 2023. The UAE continues to exhibit strong demand and remains the largest market within the region, showing growth of 36.7 per cent. However, it is the re-emergence of demand from Iran since September that has accelerated the region's growth. Exports to Iran have totalled nearly 11,000 tonnes in 2024, up from only 160 tonnes for the same time in 2023. This has propelled Iran to be Australia's fourth largest lamb market in 2024. Although it is uncertain whether this demand will continue across the rest of 2024. The US is expected to remain Australia's largest lamb market with demand stabilising in the second half of the year following a strong start. Year-to-date lamb exports to the US were 53 per cent higher than last year when export volumes declined. Tight US production coupled with lower exports from New Zealand in the second half of the year bodes well for continued firm US demand for Australian lamb. China remains the outlier of Australia's major lamb markets with a 5.7 per cent decline in year-to-date exports. A challenging economic environment for Chinese consumers is likely to continue keeping spending on dining out subdued. This will translate into weakness for lamb demand. Demand from the UK has improved but it remains a small market. The first 12 months of the Australia-United Kingdom Free Trade Agreement have seen nearly 12,000 tonnes of lamb exported. While this was an 80 per cent increase on the preceding 12-month period, it only accounted for 3.3 per cent of Australian lamb exports. This volume was well short of the 25,000-tonne quota available under the agreement.

Lamb prices to continue rising through winter and early-spring

With ongoing firm demand providing underlying support, lamb prices will hinge on lamb supply across winter and spring. Easing supply as winter progresses is set to see prices add to the 28 per cent rise seen since mid-March. Prices could soften as the spring flush of new season lambs hit markets. However, they will remain well above the lows of spring 2023. An element of weakness in prices could come from feeders given the relatively higher feed prices expected later in the year. This should see lamb prices return to levels above five-year averages.

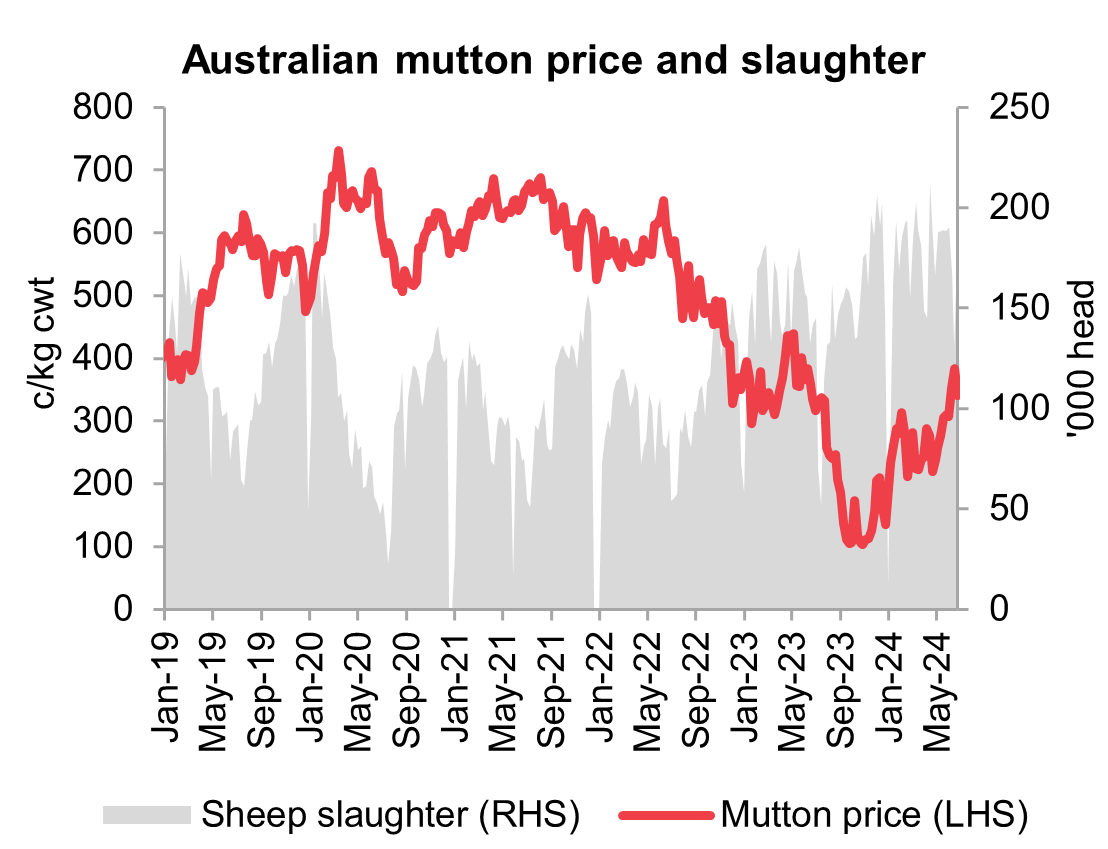

Mutton prices to continue languishing below-average

Drivers of mutton markets are suggesting a less optimistic outlook compared to lamb. Sheep slaughter is set to remain near recent high levels as older breeding stock continue to be turned-off. Average weekly lamb slaughter in the first half of 2024 was 20.4 per cent higher than the second half of 2023 and 40.3 per cent above the 10-year average. Growth in mutton production has been absorbed by exports markets, albeit at subdued prices. Export volume for the year-to-date is up 15.2 per cent year-on-year. The Middle East has absorbed most of the additional volume with exports to the region more than doubling, led by Saudi Arabia and Qatar. Concerningly, export volumes to China are down 22.2 per cent on last year. The average export price of mutton in 2024 is 524c/kg, down 11.9 per cent year-on-year and the lowest since 2016. Ongoing high supply coupled with weak Chinese demand is likely to limit any significant upside to mutton prices in the second half of the year. In addition, with the sheep flock likely at its peak, demand from buyers looking to expand breeding flocks will also remain weak.