Australian agriculture outlook 2024: Horticulture

Australian agriculture outlook 2024: Horticulture

Summary

Supply

Low irrigation costs, falling input costs and increased plantings will see output lift the second half of 2024.

Demand

Improved quality and market access will drive a rise in exports. Domestic demand to be steady to slightly higher.

Price

Fruit and vegetable prices are expected to ease on the back of higher supply after rising over the first half of the year.

Outlook

Strong production and growing export demand are driving a positive outlook for growers.

From the field

"Improving seasonal conditions and low irrigation costs will drive strong output over the next six months. Export demand is also expected to lift, though domestic demand remains subdued on the back of cost-of-living pressures. The increased fruit and vegetable volumes should see prices ease slightly; however, they will remain above average. Cost challenges continue to pressure grower margins driving ongoing industry exits."

Wayne Saunders, Regional Manager Agribusiness – North West Victoria

Overview

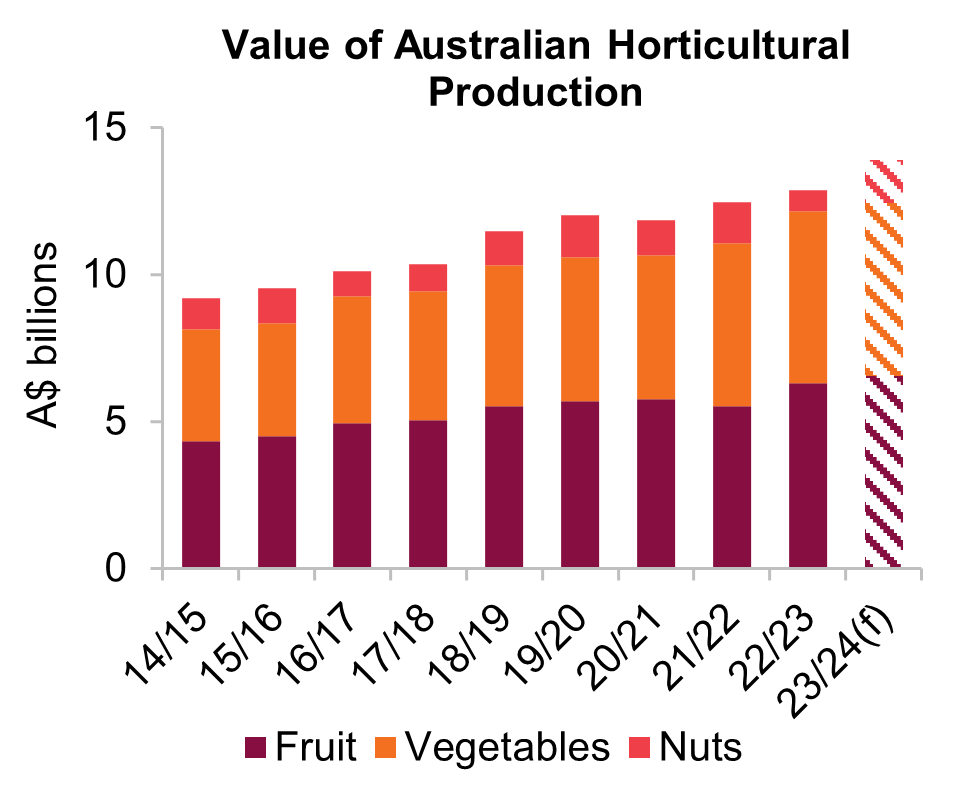

Output across the sector is expected to continue to lift over the next six months. This follows a positive first half of the year where volumes across key fruit, vegetable and nut varieties were notably stronger. Looking ahead, lower input costs and ongoing cheap irrigation will continue to drive strong yields. An increase in planted acreage across key vegetable crops is also forecast as a result. Labour availability is expected to improve further. This will be driven by increased unemployment and changes to the Pacific Australia Labour Mobility scheme. These changes will allow greater flexibility of hours worked per week. This will see greater efficiency of labour use during harvest, which often ebbs and flows based on weather. Export demand more broadly will continue to lift alongside this increased production. Growing export pathways into India are benefiting horticultural producers. The continued rebound of exports to China is also expected to continue. Domestic demand for premium produce remained subdued due to cost-of-living pressures. Having said this, we expect to see some improvement in domestic demand over the next six months. Prices across fruit and vegetable sectors are forecast to dip slightly amidst the rising production, though it will remain elevated compared to long term averages. The nut sector is expected to see a strong back half of the year. Both almond and macadamia producers will see prices lift from historic lows. Having said this, prices will still remain well below longer term averages. High production and supply chain costs remain key issues for all horticultural producers. Public pressure continues to build following the Senate inquiry into supermarket prices and market power. The final report recommended 11 changes. These included making the Food and Grocery Code of Conduct mandatory and greater divestive powers for the ACCC. All of these 11 recommendations will be implemented by the government. It’s hoped the changes will ensure growers receive fair and sustainable prices for their produce going forward.

Fruit sector to see strong production matched by rising demand

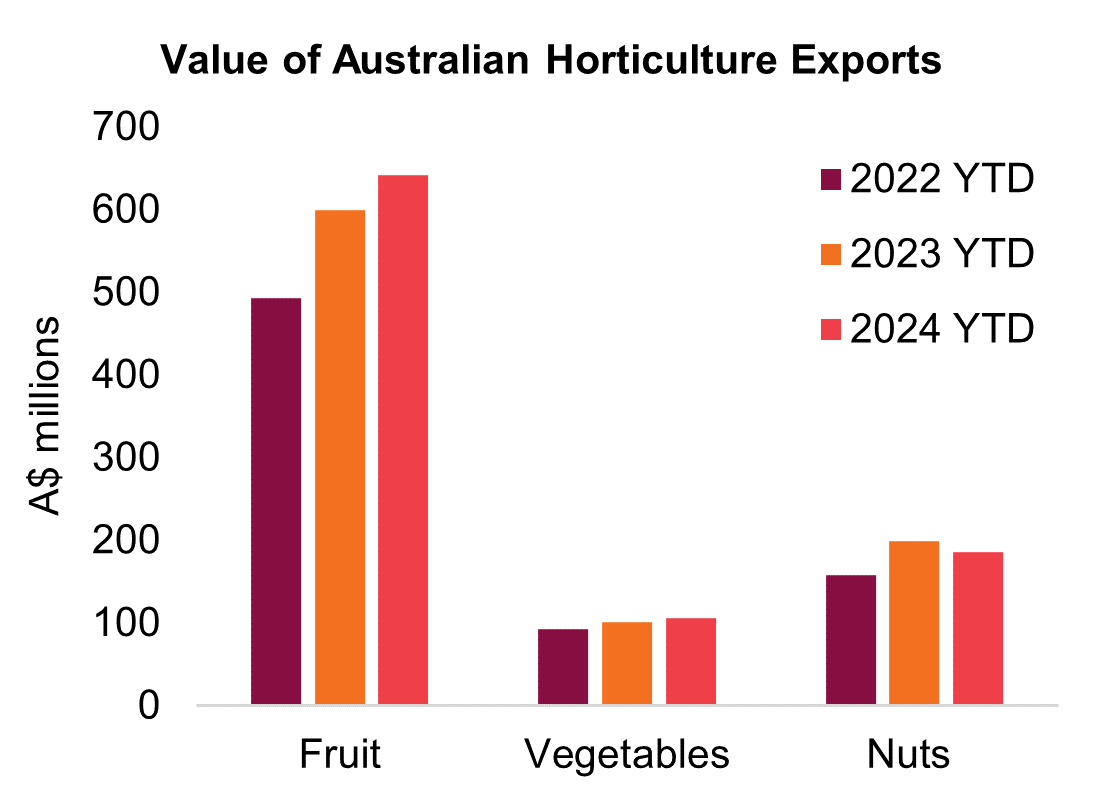

Production volumes across key fruit varieties are expected to remain elevated over the next six months. This is on the back of increased yield estimates for most varieties. These higher yield expectations are aided by the dry autumn seen across most key regions in the east coast. Low irrigation costs, and more affordable fertiliser costs compared to 2023 are also supporting production forecasts. Still, there are regions that may see a drop in volumes. Output in key production regions across northwest Tasmania and Western Australia is likely to come under some pressure. This is a result of the significantly drier conditions seen across these regions. Rising fruit output highlights the growing importance of export markets to the sector. Our smaller domestic market is generally unable to absorb the increasing production volumes. This had been very apparent in the avocado industry over the last five years. Exports across the fruit sector are currently tracking almost seven per cent higher year-to-date in 2024 compared to last year. This trend is expected to continue over the back half of the year. India’s appetite for Australian produce is continuing to grow. While the value of exports to key southeast Asian markets including Thailand and Vietnam will also lift. Domestic demand remains a greater challenge at present. Cost of living pressures are continuing to drive consumers towards higher volume, lower cost fruit. Higher priced premium produce is expected to struggle to attract consumer demand. However; a trend towards healthier living may provide some support from a domestic demand perspective. Prices across the fruit sector have broadly continued to lift over the last six months. A slight easing of prices is expected across the sector over the next six months.

Australian citrus output is expected to lift this season despite some variance across regions. The Queensland mandarin crop is in for a biennial down year which will see volumes across the region drop by up to 40 per cent according to the USDA. This loss is more than offset by a strong citrus season in Victoria. Increased mandarin plantings over the last decade are also providing additional supply. Cheap irrigations costs have added plenty of confidence to the industry across the Sunraysia and Riverland. This increased output will see a lift in export volumes. Global demand for Australian citrus remains high which will absorb this additional supply. Exports are continuing to track above recent seasons with year-to-date exports up 13 per cent on last season. This trend is expected to continue over the remainder of the season. From a market perspective Japan is a key focus for the industry. Japan has imported significantly greater quantities of Australian citrus so far this year as a result. Navel orange wholesale prices are hovering around $2.50/kg with imperial mandarin prices sitting at $2.30/kg. These prices are likely to remain around this level over the course of the season. Unfortunately, elevated production costs are continuing to eat into grower margins. Increasing reports of a lack of viability within the industry is seeing a rising number of growers opt to exit the industry. This is an ongoing trend that may reduce domestic production over the coming years.

National Hass avocado production continues to lift. Significant supplies from Queensland and New South Wales are already coming to market. Greater export market access into India and Thailand is also starting to pay dividends. This is particularly the case for producers in the west following the oversupply seen on the domestic market since 2021. Year-to-date avocado exports are up 143 per cent so far this year. This substantial increase in export volumes will reduce slightly over the back half of the year. This is due to production from the export focused Western Australia crop slowing down. While the increasing viability of exports markets is a positive, domestic sales remain a key source of revenue for most growers. From a domestic perspective food service demand has come under some pressure in 2024 due to high cost of living. This trend will continue over the next 12 months. The drop in food service consumption is expected to be more than offset by an increase in demand at a retail level. Consumer purchases have increased by a substantial 19 per cent year-on-year. Retail pricing is expected to remain near similar levels to 2023 in the range of $1.20-$2 per avocado. Unfortunately, as seen across the horticultural industry, costs remain high. Freights costs in particular are continuing to eat into grower profits.

Berry prices are expected to decline over the coming months. Wholesale prices of blueberries are currently sitting 30 per cent higher year-on-year. While strawberry prices are almost double. This is a result of an early end to the domestic Victorian and Tasmanian season. While a poor New Zealand season has impacted imports, further exacerbating prices. Prices will ease back towards long term averages from July as seasonal output from Queensland and New South Wales picks up. The Queensland season has come in a little later as a result of cooler than usual conditions. We expect wholesale blueberry prices to sit around $6/kg with strawberries to also drop back to average prices.

Vegetable plantings to lift, though foodservice demand remains a concern

Australian vegetable production is forecast to remain steady to slightly higher over the back half of the year. Planting intentions across most key winter vegetable varieties were strong. This was thanks to lower input costs, strong seasonal conditions, and favourable water allocations. This lift in planted acreage is also expected for spring planted crops. Unfortunately, cost of living pressures are weighing on the vegetable sector from a demand perspective. Food service demand has continued to decline. Though retail demand is slightly higher year on year. Lower prices over the next six months may see further uptick in domestic buying, though this increase won’t be substantial. Frozen vegetables are a bright spot for the sector with the segment continuing to see market growth. Consumers are increasingly drawn to the cheaper prices and reduced perishability. Preprepared vegetable products have also seen increased buying on the back of the time saving benefits. From an export perspective demand remains high, although exports are a far less important part of the demand equation for the vegetable sector. Vegetable prices lifted over the first half of the year. A slight easing of pricing due to an influx of winter and staple vegetables is expected over the next six months. Having said this, weather remains a key risk for the sector. Extreme events have the potential to significantly disrupt supply and impact pricing.

Production volumes of staple vegetables remain above average for this time of year. The winter months will see smaller volumes come to market. Output will pick up coming into spring and summer. Decent water allocations for the 2024/25 season across the key Murrumbidgee and Murray irrigation areas are expected. This is despite lower water storage levels on last year. The even chance of a La Niña developing is also positive from an irrigation perspective. Although this could have a negative impact should soils become saturated. Strong plantings of both potato and onion crops are currently expected. However, Tasmanian output has some questions around it. Well below average soil moisture levels combined with a high chance of below average rainfall has the potential to impact yields. This is particularly evident across northwest Tasmania. Irrigation costs there are already trending higher which may impact output. Domestic demand is expected to remain steady for staple vegetables. Though export demand, particularly for onions remains elevated due to varied global output. Onion prices remain in line with three-year averages with pricing expected to ease slightly in in spring. Carrot prices are sitting below average. These should lift in line with seasonal trends.

Output of macadamias to grow, with a lift in prices also expected

Australian almond producers have had a fantastic season with harvest wrapping up earlier this year. Production topped 160,000 tonnes (kernel weight equivalent). This follows a poor 2023 harvest of just over 100,000 tonnes which saw stocks reduced over the season. National output is still on track to hit over 200,000 tonnes in the next 3-5 years according to the industry body. A dry harvest helped to drive large volumes of high quality in shell almonds according to the Australian Almond Board. As a result, key in-shell export markets such as India and China are seeing strong demand. This demand has been further boosted by a lack of good quality almond availability from California, the world’s largest producer. Exports into China are up 110 per cent on last season as a result. While exports to India are up 97 per cent as the recent trade agreement continues to pay dividends. A sustained lift in almond prices is expected over the 2024/25 season. This is a result of the high-quality season and strong export demand combined with a relatively low Australian dollar.

Australian macadamia output for the 2024 season is estimated at almost 51,000 tonnes in shell by the industry body. Relatively affordable irrigation costs combined with good conditions during flowering have lifted sentiment. This is in sharp contrast to last year’s challenging season where a crop of just 48,400 tonnes in-shell was produced. Unfortunately prolong hot conditions followed more recently by rainfall have impacted yields ahead of harvest. While low pricing also drove reduced fertiliser application and orchard management practices earlier in the season. This has limited yields and weighed on total output. Harvest across Bundaberg is now almost complete, though other areas are just getting started. Year-to-date average export prices have declined by almost 30 per cent on 2023. Things are looking more positive for the back half of the year. Significant import demand from China and increased domestic buying are supportive. When combined with the smaller 2023 crop, local inventories have also reduced sharply. The reduced stocks combined with the sustained lift in domestic and export demand will see prices lift over the back half of 2024. An increase in global pricing of between 10 and 20 per cent is expected to occur by the end of 2024. Though supply and demand dynamics remain in a precarious position. Another season of record global production is forecast. While cost of living challenges have the potential to impact consumer demand. This will restrict any significant price growth above current expectations.