Australian agriculture mid-year outlook 2024: Cattle

Australian agriculture mid-year outlook 2024: Cattle

Summary

Supply

Australian cattle supply is forecast to stabilise in the second half of 2024 at levels higher than last year.

Demand

Stronger export demand is expected due to reduced US beef production and exports.

Price

Australian cattle prices are expected to marginally increase due to strong export demand.

Outlook

Stability in beef production and opportunities for continued export growth supports a favourable outlook for Australian cattle.

From the field

"Australian cattle prices are likely to trend slightly higher throughout the next six months thanks to a lift in export demand. With the US continuing to battle a reduced herd, Australian producers are expected to see further export opportunities to key markets for the rest of 2024."

Michael Gorogo, Senior Agribusiness Relationship Manager – Queensland

Australian and global beef production forecast

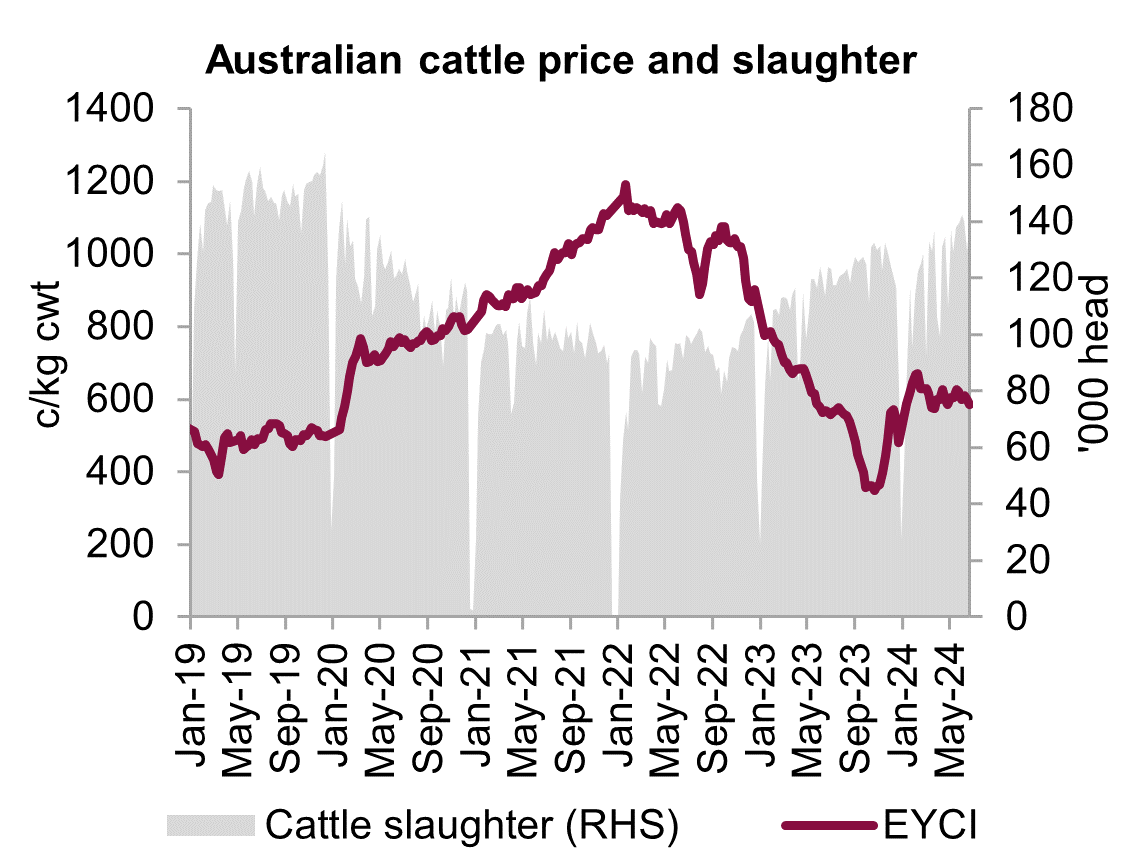

Australian beef production is forecast to remain stable throughout the second half of 2024. National cattle slaughter has trended higher across the first half of 2024. Average weekly slaughter was 13 per cent higher than the first half of 2023 but only 1.6 per cent above the strong second half of 2023. The end of May saw weekly slaughter above 140,000 head for the first time since April 2020. It is expected that slaughter will stabilise around this mark in the second half of 2024. This comes on the back of northern processing centres reporting that capacity is nearing maximum levels. To manage the large amount of cattle on the market, extra shifts have been added on weekends. It is expected that with most centres booked out months in advance, significant production growth will be limited. This level of slaughter is around 30 per cent above the five-year average.

Global beef production is forecast to rise by 0.6 per cent in 2024 by the USDA. Reduced US production is weighing on global production. The US entered 2024 with the lowest herd since 1951. US beef production is forecast to decline 1.9 per cent, adding to a 4.7 per cent fall in 2023. Production is set to tighten across the second half of 2024 with only a 0.3 per cent decline seen for the year-to-date. The reduction in production from the US will be offset by growth in China, India, Australia and Brazil. Production in Brazil is forecast to lift by 2.4 per cent due to softer local prices and strong export demand. China is expected to increase their beef production throughout the remainder of 2024. However, recent weather conditions throughout production regions have caused supply chain issues, which may limit growth.

Domestic and export demand forecast

Domestic demand for Australian beef is likely to marginally lift throughout the second half of 2024. Retail prices in the March quarter were 4.5 per cent lower year-on-year. This is expected to translate into a lift in volume consumed during the remainder of the year. However, ongoing cost of living pressures are likely to keep demand limited for higher end beef products.

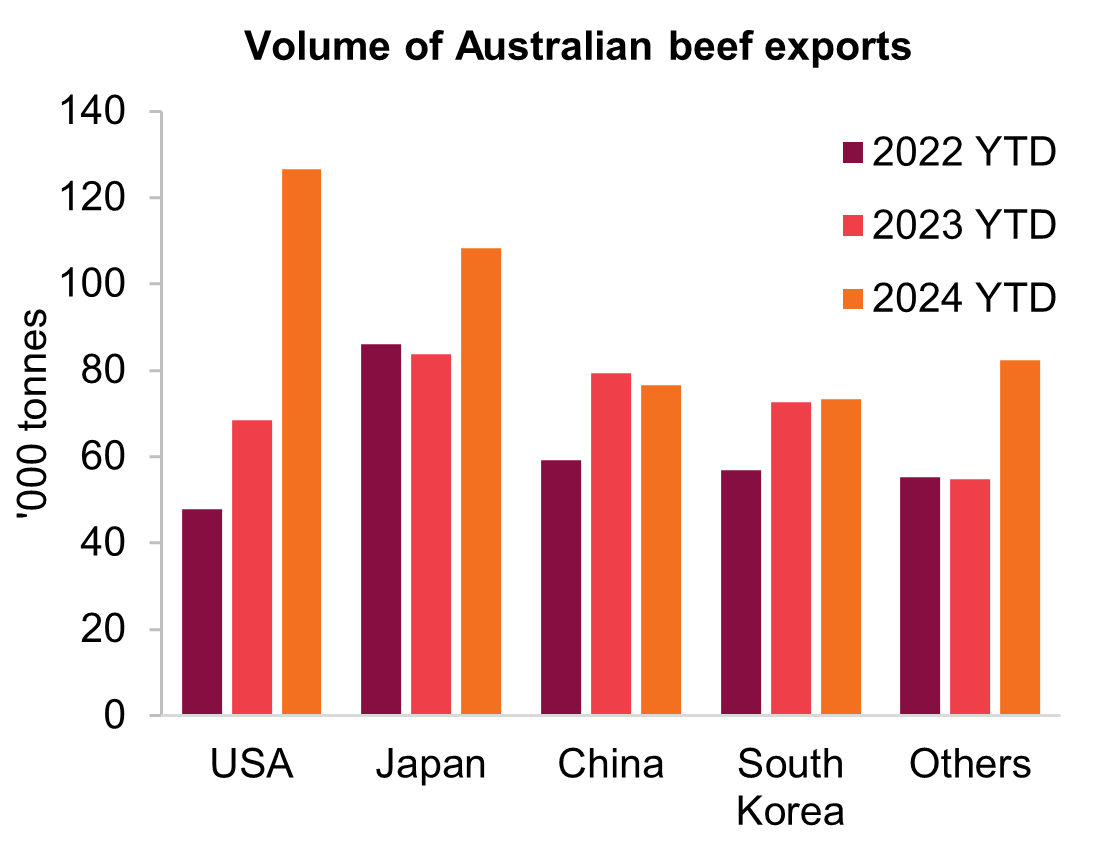

Export demand is likely to continue strengthening throughout the second half of the year. This is largely due to reduced US production driving strong import demand from the US and reduced competition from the US in other markets. US beef imports are forecast to rise by 12 per cent in 2024 by the USDA. This follows a 9.9 per cent increase in 2023. Australian beef has been a large beneficiary of this stronger import demand so far in 2024. Australian beef exports to the US for the year-to-date (January-May) were up 85 per cent on last year. It is expected that with the continued softening in US production that imports of Australian beef will increase over the next six months. US beef exports are forecast by the USDA to fall 7.7 per cent in 2024, adding to a 14.3 per cent fall in 2023. US exports to Japan and South Korea have declined already in 2024. This has helped support a 29.4 per cent rise in Australian beef exports to Japan already in 2024. Further tightening of US supply is likely to see Japanese demand for Australian beef lift further. Exports to South Korea were up only one per cent for the year-to-date, but should likewise benefit from reduced US supply on global markets. However, demand growth from South Korea may be limited due to their renewed focus on domestic production. Chinese demand is likely to increase. This is thanks to the recent removal of export suspensions on several Australian processing centres. Export volume to China has been 3.5 per cent lower year-to-date. This comes as Australia continues to face strong competition for this market with South American countries. China is also forecast to see a 2.3 per cent increase in domestic production, which could limit growth in imports of Australian beef.

Australian cattle prices expected to improve

Australian cattle prices held relatively steady in the first half of 2024. Prices recovered from the significant drop in November 2023. The Eastern Young Cattle Indicator recovered 95 per cent from its the lowest point in mid-October to a high in February. For most of the first half of 2024, the EYCI has ranged 30c/kg either side of an average of 612c/kg. This price stability amidst increased supply has been supported by favourable rainfall in northern cattle regions boosting competition among buyers, coupled with firm export demand. Despite these improvements, the year-to-date average for the EYCI remains 19 per cent below the five-year average of 757c/kg. In contrast, US feeder steer prices are at record highs and 50 per cent above their five-year average. The EYCI is expected to improve during the second half of 2024. This is a result of further strengthening of export demand and stability in supply. However, it is likely that prices will still remain below the five-year average.