Lamb producers are well placed to enjoy a strong second half of 2021. Our mid-year outlook report highlighted favourable seasonal conditions and the COVID-19 recovery as key drivers of an optimistic outlook for the industry. While there are plenty of great signs, a recovery in demand from the Middle East is still missing to complete the positive outlook.

How do lamb exports to the Middle East compare to other major markets?

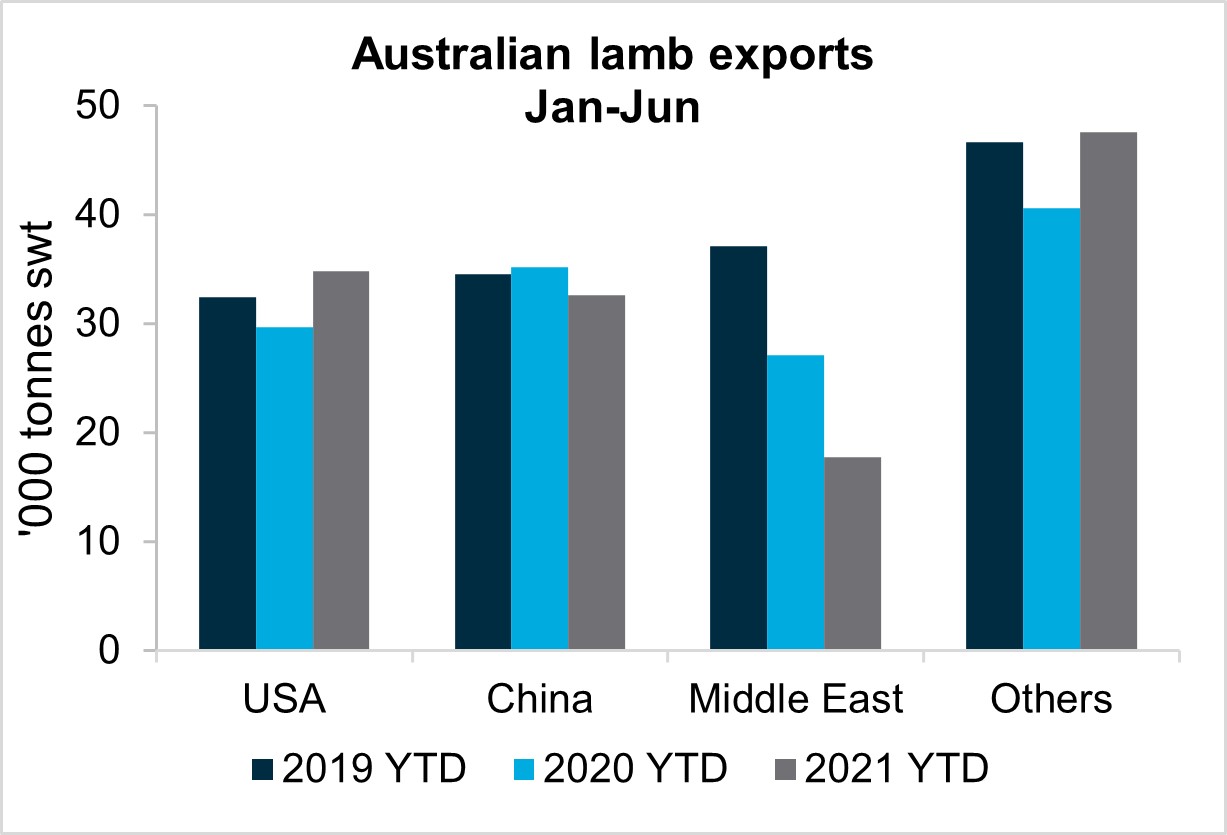

Australian lamb exports in the first six months of 2021 have matched the start of 2020. Despite the overall stability in exports, trends among the “big three” export markets have been mixed. Exports to the United States (US) have grown while exports to China are lower for the year-to-date but have been on an encouraging upward trajectory. Meanwhile, exports to the Middle East have been subdued. Exports to the Middle East in the first half of 2021 were 34.5% lower than 2020 and 52.2% lower than 2019.

The decline in exports to the Middle East in the last two years has seen the percentage of Australian lamb exports to the region fall from 25% in 2019 to 13% in 2021.

Source: Department of Agriculture, Water and the Environment

What’s behind the decline in exports to the Middle East?

The initial cause of decline in exports to the Middle East, aside from reduced Australian production in 2020, was the impacts of COVID-19. These impacts included reduced oil revenue, a lack of tourism and reduced air freight capacity. Exports have remained subdued into 2021 as an ongoing lack of international travel has kept demand weakened.

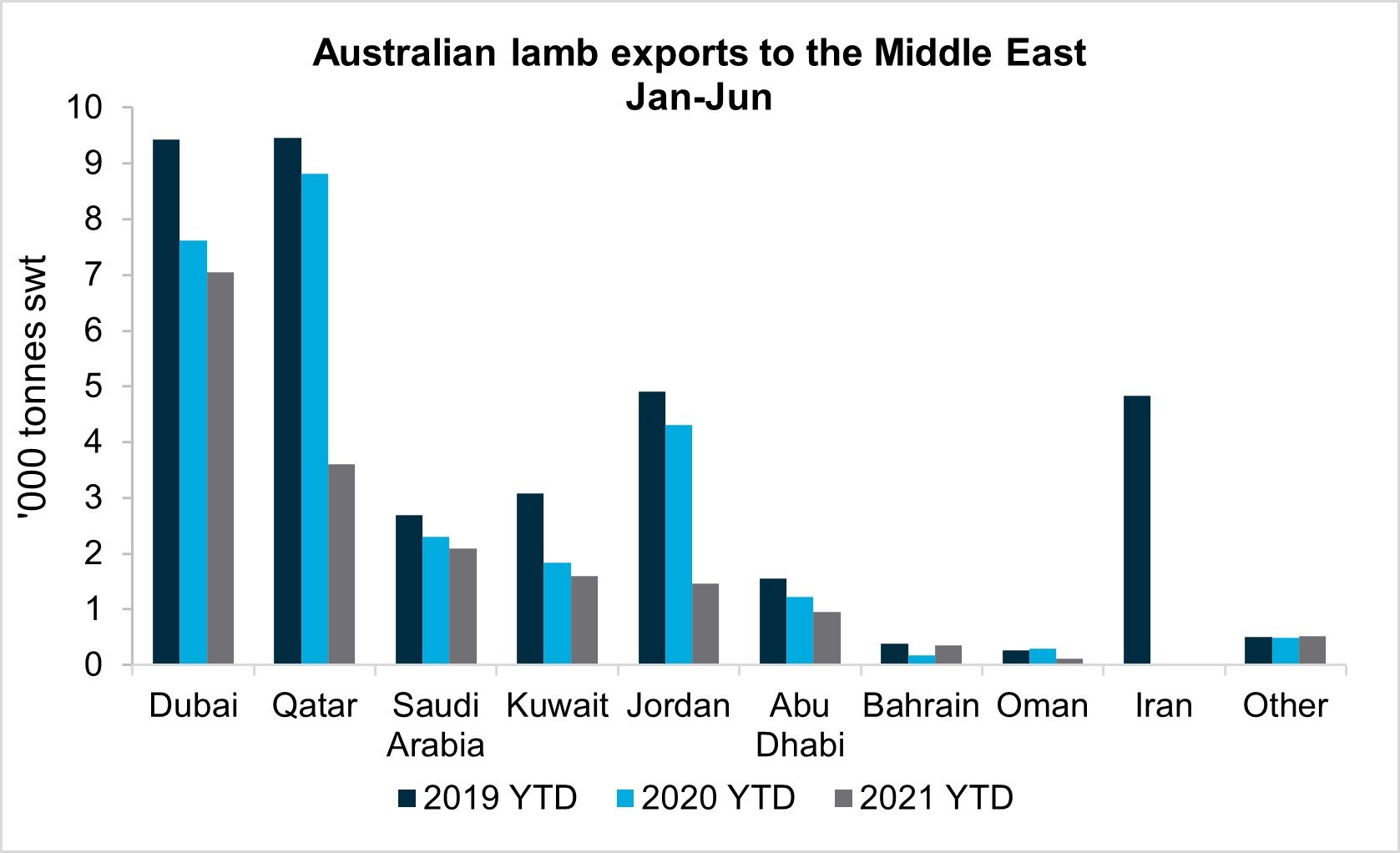

A further cause of reduced exports to the Middle East was the surprise cancellation of the Qatari lamb import subsidy at the end of 2020. Australian lamb exports to Qatar have thrived under this program which made Australian lamb more affordable. The removal of the subsidy contributed to a 59% decline in Australian lamb exports to Qatar in the first half of 2021 compared to 2020. The year-on-year decline to Qatar of over 5,000 tonnes is equivalent to more than half of the total decline across the whole Middle East.

Other notable declines in demand in the last two years include Iran and Jordan. Lamb exports to Iran have been non-existent in the last two years after accounting for 13% of exports to the Middle East in 2019. Exports to Jordan in the first half of 2021 were 66% lower than 2020. The decline in volume to Jordan accounted for 30% of the overall decline to the Middle East so far this year.

Source: Department of Agriculture, Water and the Environment

What does this mean for Australian lamb prices?

Subdued demand from the Middle East is a factor weighing on lamb prices as demand from other key markets is recovering. But while this isn't great news for current prices, there are a couple of positives from the current situation.

Firstly, prices have performed very well in the last 12 months even in the midst of weakened demand from a key export markets. This indicates the strength of demand in other markets, including some emerging markets such as Hong Kong, Taiwan and Papua New Guinea.

Secondly, an eventual recovery in Middle Eastern demand would give a boost to already strong lamb prices. The resumption of international travel is the key factor required to improve demand. However, demand may not fully recover to 2019 levels, particularly with Qatari demand set to remain weak.

A recovery in Middle Eastern demand will be a key factor adding to an already favourable outlook for Australian lamb producers.

For more information download Rural Bank’s half yearly outlook report here.