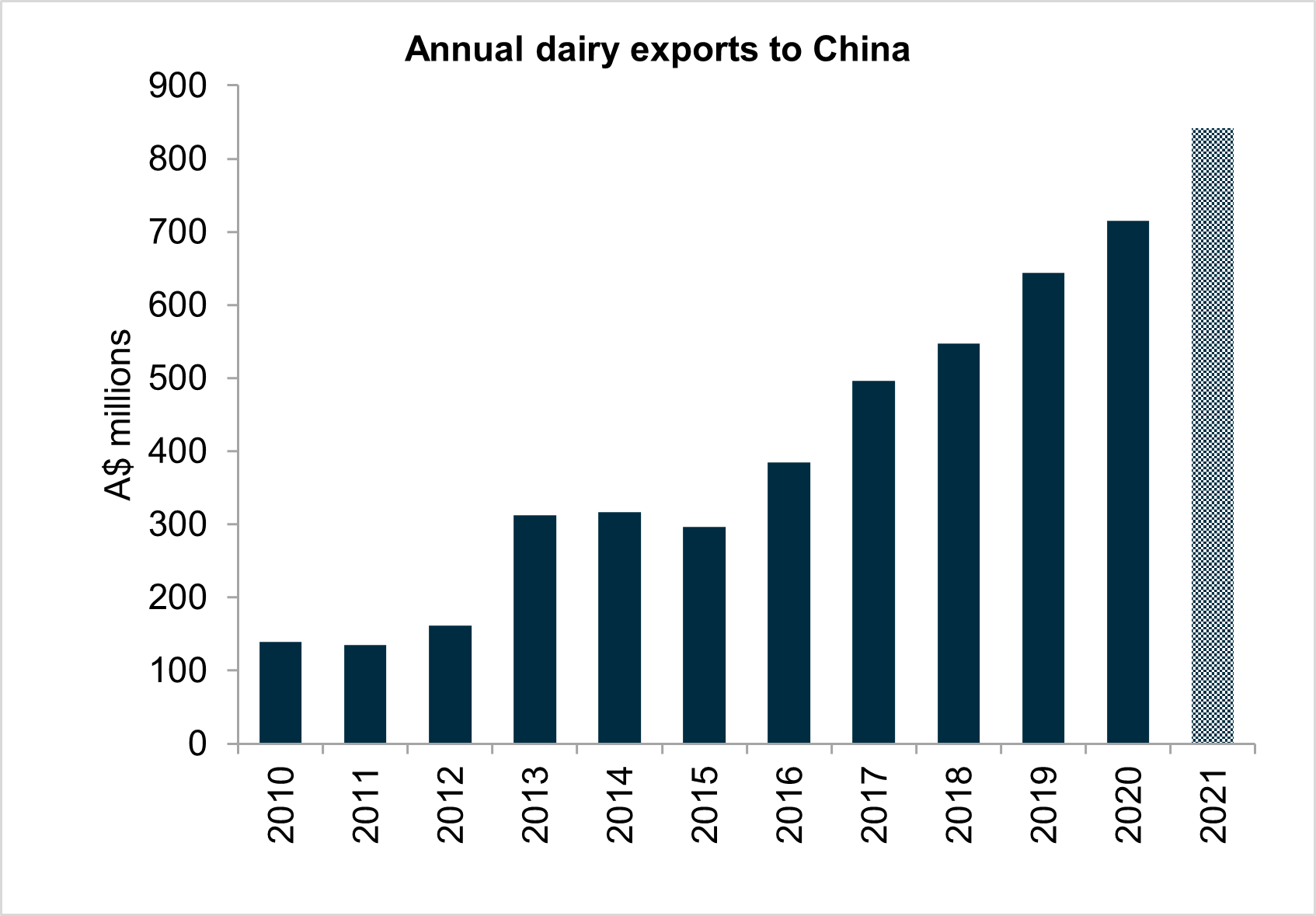

While many Australian agricultural commodities have experienced downturn in trade with China recently, there is one commodity in particular that enjoyed a phenomenal year. Amidst the disruptions of 2020, Australian dairy set a new record high in export value to China. However, that record has already been beaten by exceptional strength in Chinese demand in 2021.

China is an import market for Australian dairy. In 2020, Australia exported $716 million of dairy products to China which accounted for 28 per cent of Australia dairy exports. This was a record high at the time and the fifth consecutive year of growth.

Exports to China have grown again in 2021 and had exceeded the 2020 record by September. For the year-to-October, Australia has exported $842 million of dairy products to China. This was a 45 per cent increase compared to the same period in 2020 and 84 per cent above the five-year average.

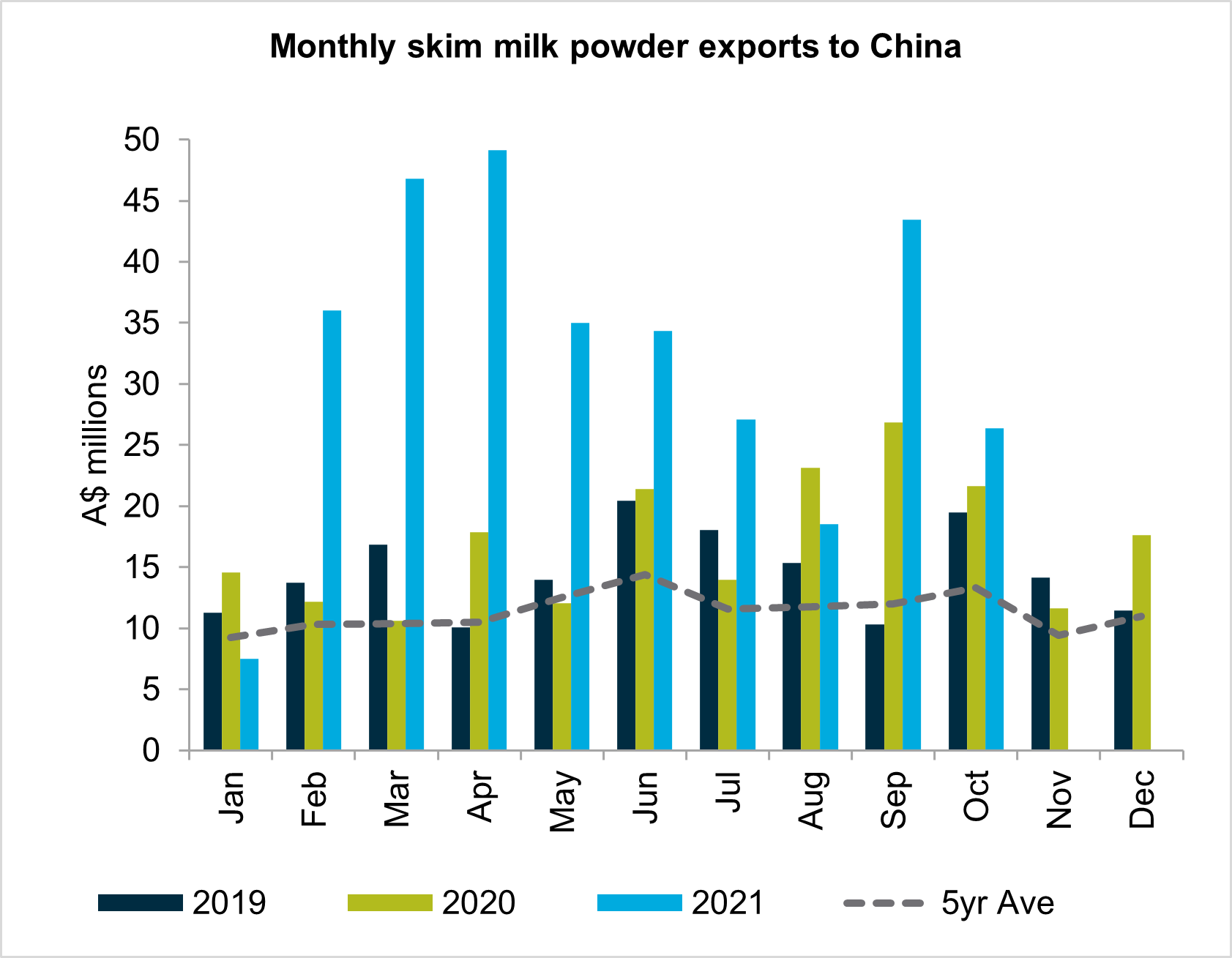

Skim milk powder is the major dairy commodity Australia exports to China, accounting for 38 per cent of total dairy exports. In addition to this, skim milk powder has been the primary driver of growth for dairy exports to China in 2021. In 2021, Australia has exported $324 million of skim milk powder to China, a massive increase of 86 per cent from 2020.

Chinese skim milk powder imports have grown as consumption of foods processed with skim milk powder has increased. This is partially due to the increased consumption in foodservice and schools supported by the COVID-19 recovery.

Demand is expected to remain firm in the new year with Chinese skim milk powder imports forecast to rise eight per cent by the United States Department of Agriculture. Stronger Chinese demand coupled with stable global supply should offer support to global prices. This is great news for Australian dairy farmers and adds confidence to already strong opening farmgate milk prices for the new season.

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.