Insights March 2024

Insights March 2024

Commodity Overview

- Australian cattle prices recorded a marginal decrease during February. Prices are expected to continue to soften on the back of a dry weather forecast in key production regions and strong supply on local markets.

- Export volume continued to climb over the past month due to strong demand from key markets and elevated numbers of cattle on local markets. It is expected that export volume will continue to lift with the US in a herd rebuild limiting global supply.

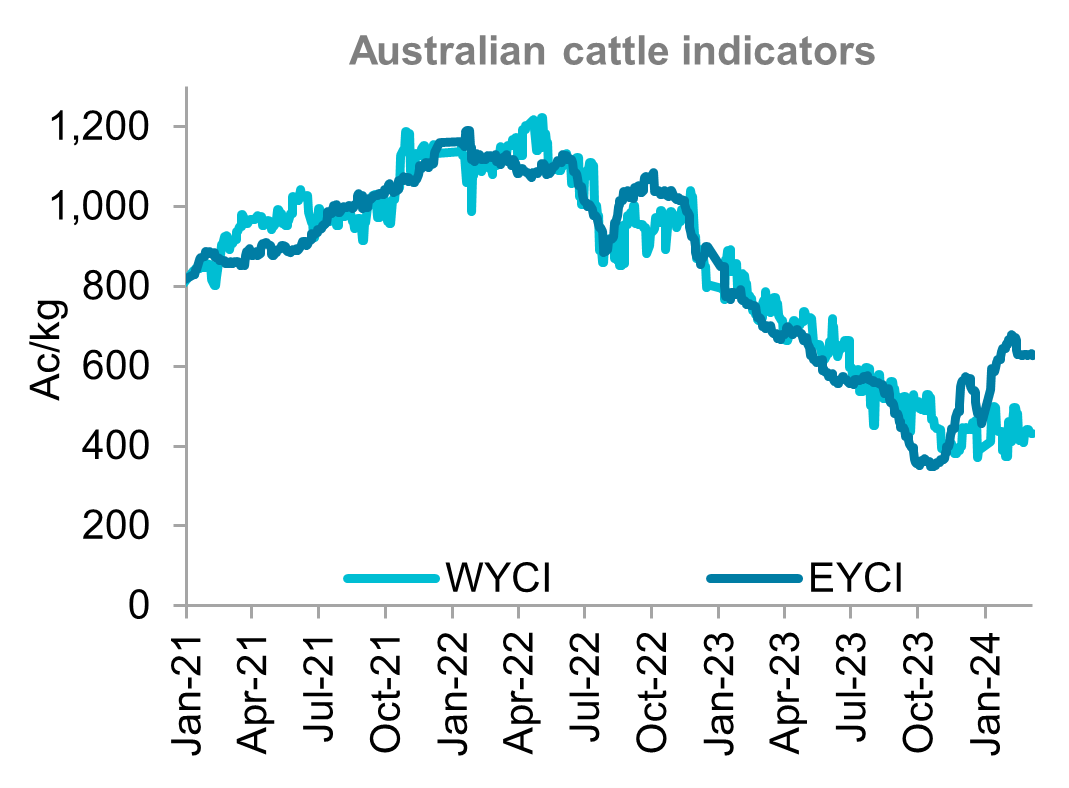

Australian cattle prices were softer throughout the past month. They are expected to marginally soften again in March. The Eastern Young Cattle Indicator (EYCI) fell 6.5 per cent month-on-month to 626c/kg. The recent downwards shift has now placed the EYCI 10.5 per cent lower year-on-year. This is also 20.8 per cent below the five-year average. A recent strong increase in the number of cattle on local markets has applied downwards pressure on pricing. Cattle regions also recorded average to below average rainfall during February. This has likely softened restocker demand at the present time. However, strong export demand to key markets will provide some support for local prices. The Western Young Cattle Indicator also recorded a 6.8 per cent decline month-on-month to 431c/kg. This is 43.6 per cent softer than a year ago.

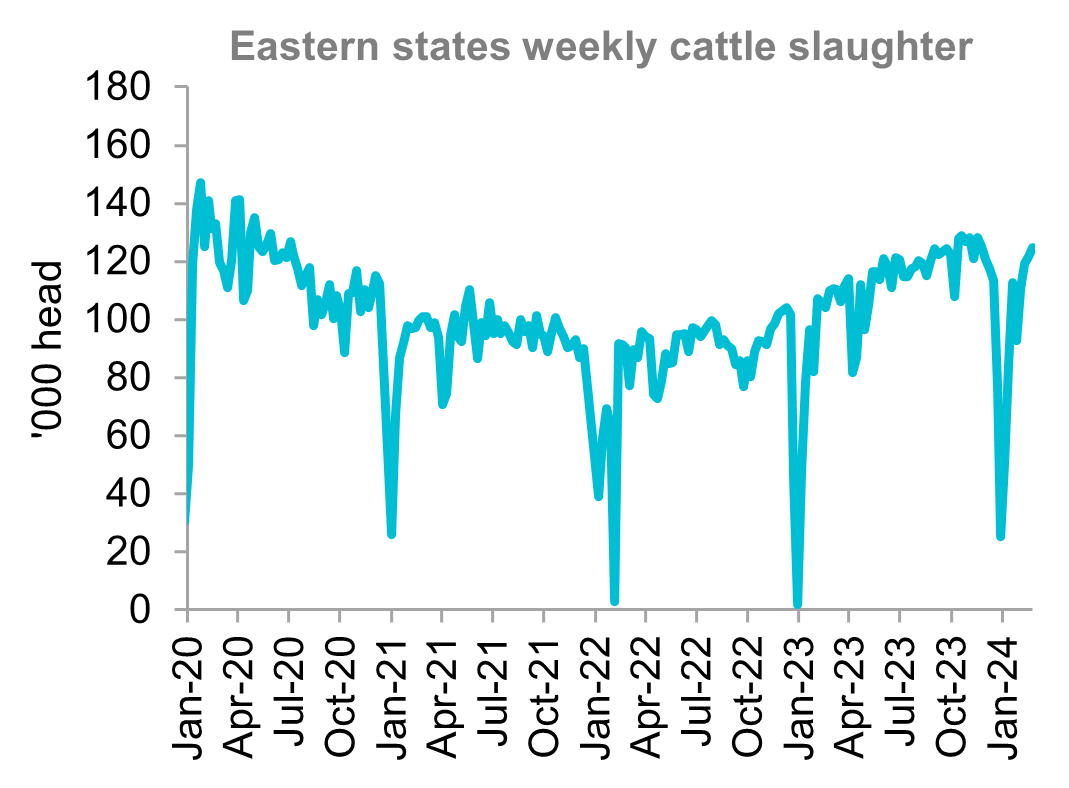

National average weekly slaughter rates increased in February and remain significantly higher when compared to a year ago. Average weekly slaughter in February was 12.1 per cent greater year-on-year. Processing centres recorded strong growth as a reduction in supply chain issues across the east coast boosted production capacity. The recent disruptions in January, particularly in Queensland and New South Wales, have subsided as a result this allowed additional shifts in processing centres to be undertaken and boosted slaughter rates. This was particularly evident near the end of February which saw over 128,000 head processed. This was the largest weekly slaughter since mid-November. The latest Bureau of Meteorology forecasts are indicating a dry March. This is expected to decrease supply chain disruptions and support a lift in slaughter rates. Female slaughter rates accounted for 46.8 per cent of total processing volume during February. This is marginally below the 47 per cent average seen when the Australian herd commences a rebuild or contraction.

Australia’s beef exports recorded the strongest February volume since 2019. The total volume of 93,834 tonnes was 33.3 per cent greater than a year ago. Export volume to the US continued to record strong growth, rising 5.1 per cent month-on-month. With over 21,300 tonnes exported to the US, this has pushed year-on-year growth to 82.5 per cent. This is also 37 per cent above the five-year average export volume in February. The herd rebuild underway in the US has provided Australian exporters with additional opportunities. This is likely to continue to for the remainder of 2024. Exports to Japan lifted significantly over the past month, shifting 45.7 per cent upwards month-on-month due to a rise in domestic demand for beef. Japan’s strong start to 2024 continued, with 23,794 tonnes of beef exported, which was 42.8 per cent higher than this time last year. Export volume to Japan currently sits 14.3 per cent above the five-year average for February and 40.2 per cent greater year-to-date. It is expected that with the decline in US supply, Australian export volume to Japan will continue to grow. Exports to China also recorded a modest increase in February, with a lift of 11.8 per cent. A rise in demand for beef to celebrate the Chinese New Year was the key contributor to the increased export volumes. Indonesia’s beef imports from Australia resumed last month, with import permits officially cleared. This led to 2,797 tonnes of Australian beef exported, however it is 55.6 per cent lower than a year ago. Australian exports to South Korea also recorded an upwards shift of 18.7 per cent. This is 8.9 per cent higher year-to-date and comes on the back of a rise in domestic beef consumption. The downwards movement in the US export capacity has also provided more opportunity for Australian producers into the South Korean market.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.