Insights February 2024

Insights February 2024

Commodity Overview

- Australian cattle prices are expected to continue to lift throughout the next month on the back of strong export demand and favourable seasonal conditions forecast in key cattle regions boosting restocker demand.

- Beef export volume is likely to continue from a strong January due to increased demand from key markets.

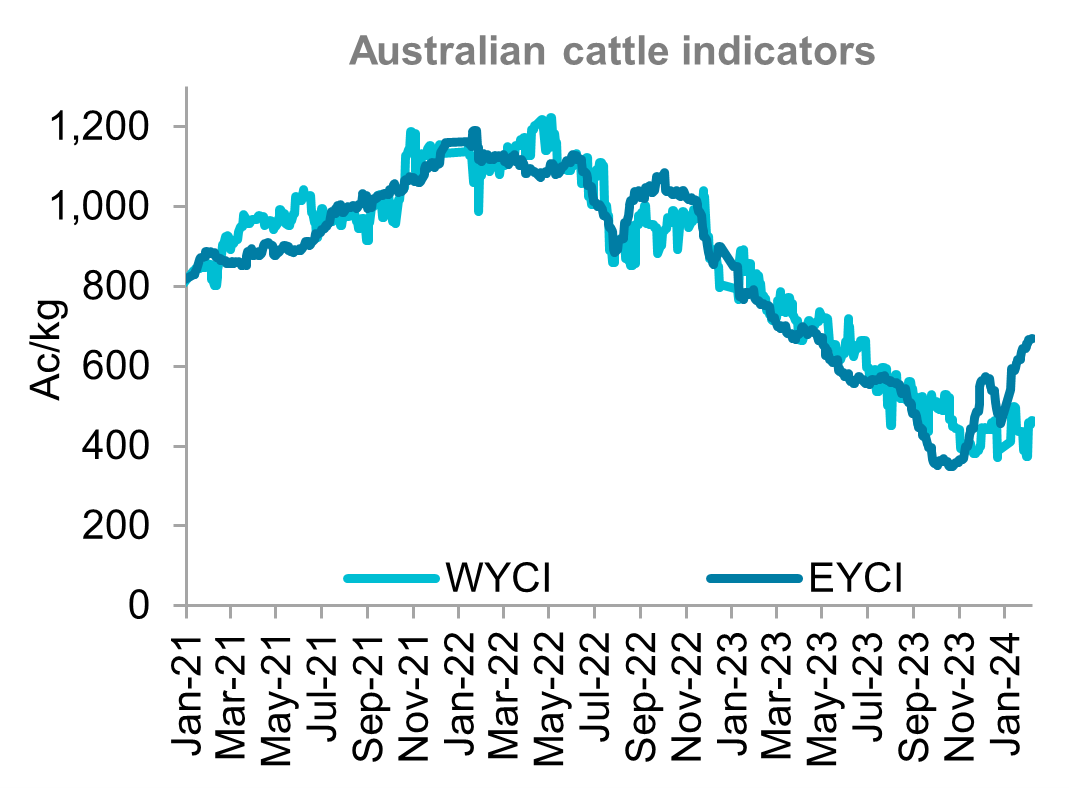

Australian cattle prices are expected to increase during the next month. This will be a continuation of the firm growth recorded since mid-November last year. The Eastern Young Cattle Indicator (EYCI) returned above 670c/kg in early February. This was a 92.8 per cent increase from the lowest point of 2023 in mid-October. Despite the market recording strong growth over the past month, the EYCI still remains 11.6 per cent below this time last year. It is also 11.5 per cent lower than the five-year average. The recent rainfall recorded in key cattle regions in eastern states has provided support for prices. Additionally, stronger export and restocker demand has also boosted local prices. The Western Young Cattle Indicator (WYCI) also recorded a modest increase of 12.7 per cent, sitting at 463c/kg. However, the WYCI is still 42.7 per cent lower than a year ago and 41.8 per cent softer than the five-year average.

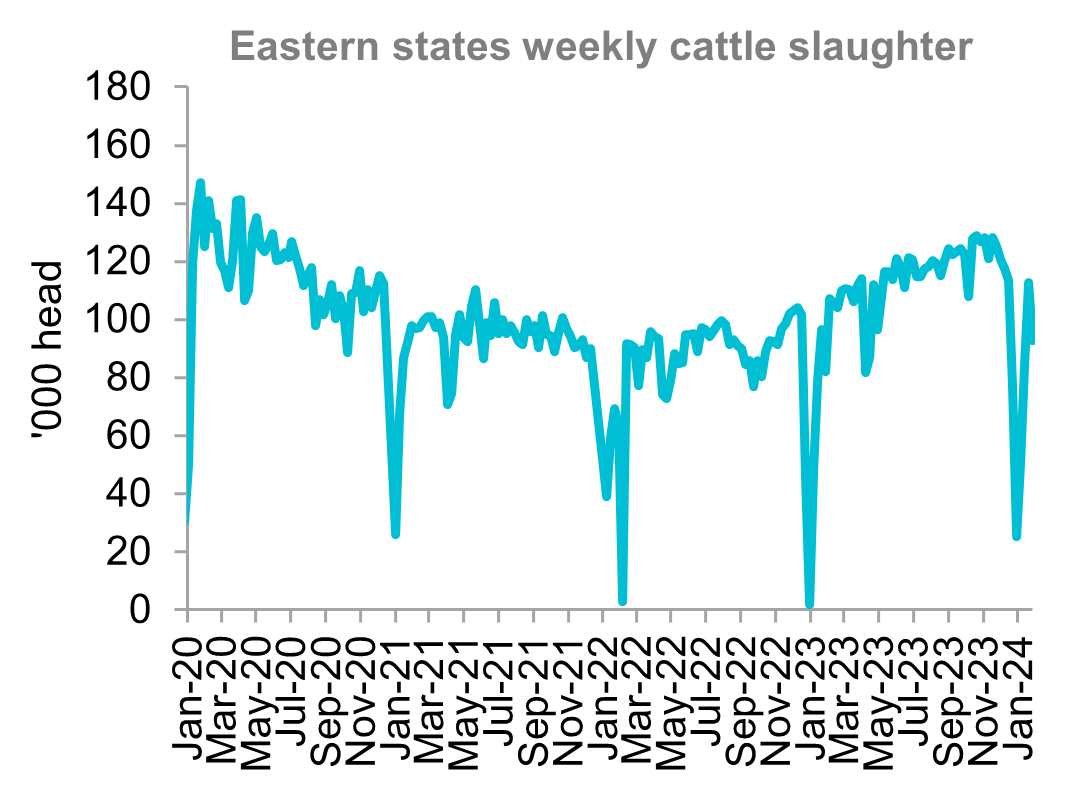

National slaughter rates in January were significantly stronger than the start of 2023. Average weekly slaughter in January was 12.1 per cent greater than a year earlier. Supply of cattle to processing centres has been disrupted by extreme weather events in Queensland and New South Wales. This has caused a variety of supply chain issues involving transportation to and from processing centres. Heavy rainfall is still forecast over the next month throughout cattle regions. It is expected that these weather impacts will continue to affect slaughter rates. With ongoing road closures and paddocks too wet for some producers to move cattle at the present time, strong growth in slaughter rates may be limited in February.

Australia’s beef export market recorded the strongest start to the year since 2020, with total export volume of 75,585 tonnes for January. Australian beef exports were 46.9 per cent greater when compared to the beginning of 2023, with the US importing over double this time last year. Ongoing drought conditions and a significantly reduced herd in the US is expected to translate into further opportunities for Australian producers throughout 2024. Additionally, the “Other Country Beef quota” which allowed 65,000 tonnes of tariff free exports of beef from Brazil to the US is set to expire in February. This is due to Brazil fulfilling just over 71 per cent of the total volume in January. The tariff of 26.4 per cent for Brazilian exports to the US is likely to lead to a softening in export volume. This will provide further opportunities for Australian producers for the remainder of 2024. Exports to Japan commenced 2024 strongly, 36 per cent higher than a year ago. This is as the Golden Week festivities led to an increase in demand. Australia’s live export trade with Indonesia dropped 82.1 per cent when compared to the beginning of 2023. This was due to delays in the issuance of 2024 import permits. It is likely that once the issuance of permits have been completed, exports will increase. Demand from China for Australian beef continued to be solid, with export volume sitting 34 per cent higher than a year ago. The recent removal of bans on several Australian processing centres has likely contributed to the recent lift in exports. The geopolitical issues in the Red Sea had minimal impact on Australian exports to the Middle East. Exports recorded strong growth of 23 per cent year-to-date when compared to 2023.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.