Insights April 2024

Insights April 2024

Commodity Overview

- Australian cattle prices continued to trend downwards during March on the back of dry weather conditions and a softening of restocker demand. Prices could remain under some pressure with warmer and drier conditions forecast for the next few months.

- Supply remains high with weekly slaughter sitting above a year ago and is likely to remain strong in the next month.

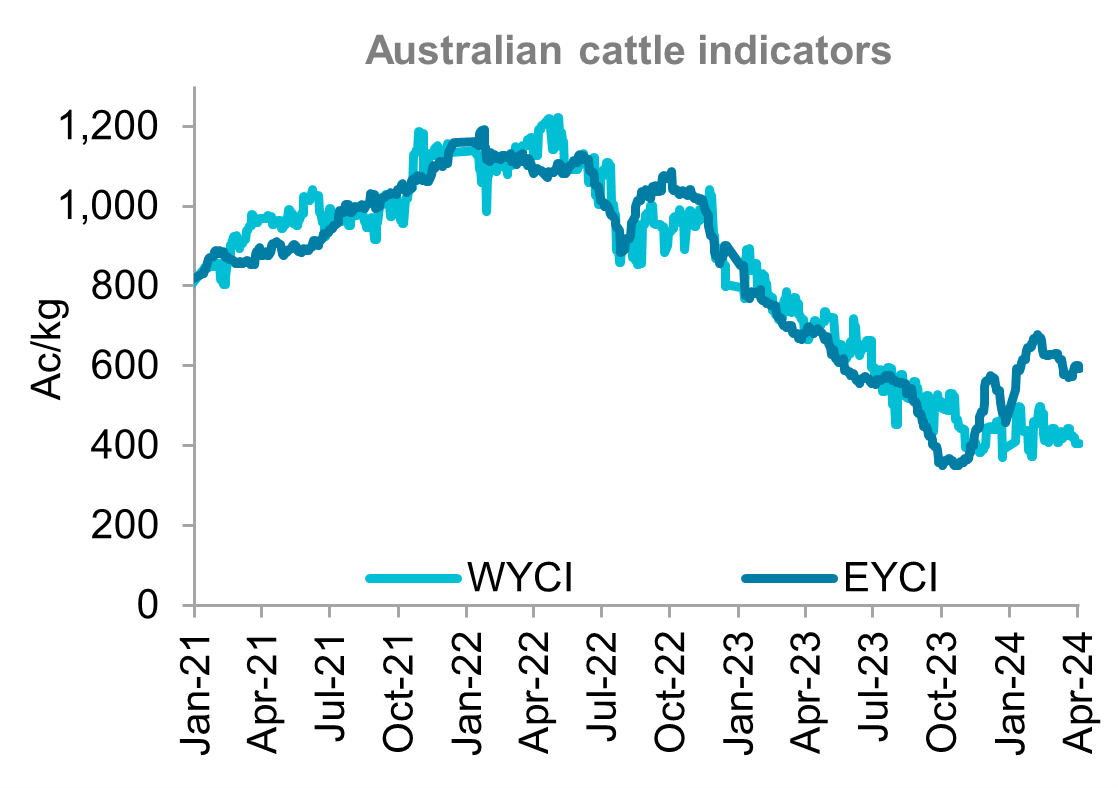

Australian cattle prices were softer over the last month. The Eastern Young Cattle Indicator (EYCI) fell 5.7 per cent month-on-month to 594c/kg. Cattle prices recorded a volatile month during March. The EYCI shifted lower during the first half of the month, falling to 569c/kg. However, once rainfall was recorded in northern regions, prices began to recover, finishing at just under 600c/kg. The majority of cattle areas recorded between 10-100mm of precipitation over the last week of March. However, dry conditions earlier in the month along with strong supply applied downwards pressure on prices. The outlook for the next few months is for warmer and drier conditions with an average chance of exceeding median rainfall in Queensland. New South Wales and Victoria are forecast to see below average to average rainfall for April. This may lead to further downwards pressure on local pricing. However, strong export demand will provide support for local prices and limit any significant falls in the market. The Western Young Cattle Indicator (WYCI) also trended downwards during March. The WYCI was 6.3 per cent lower month-on-month and 39 per cent softer than a year ago. Without rainfall throughout the past week, the WYCI did not follow the trend of the EYCI and just declined steadily over the month. The chance of exceeding median rainfall in April for Western Australia’s cattle regions is below average. This is likely to continue applying downwards pressure on local market prices.

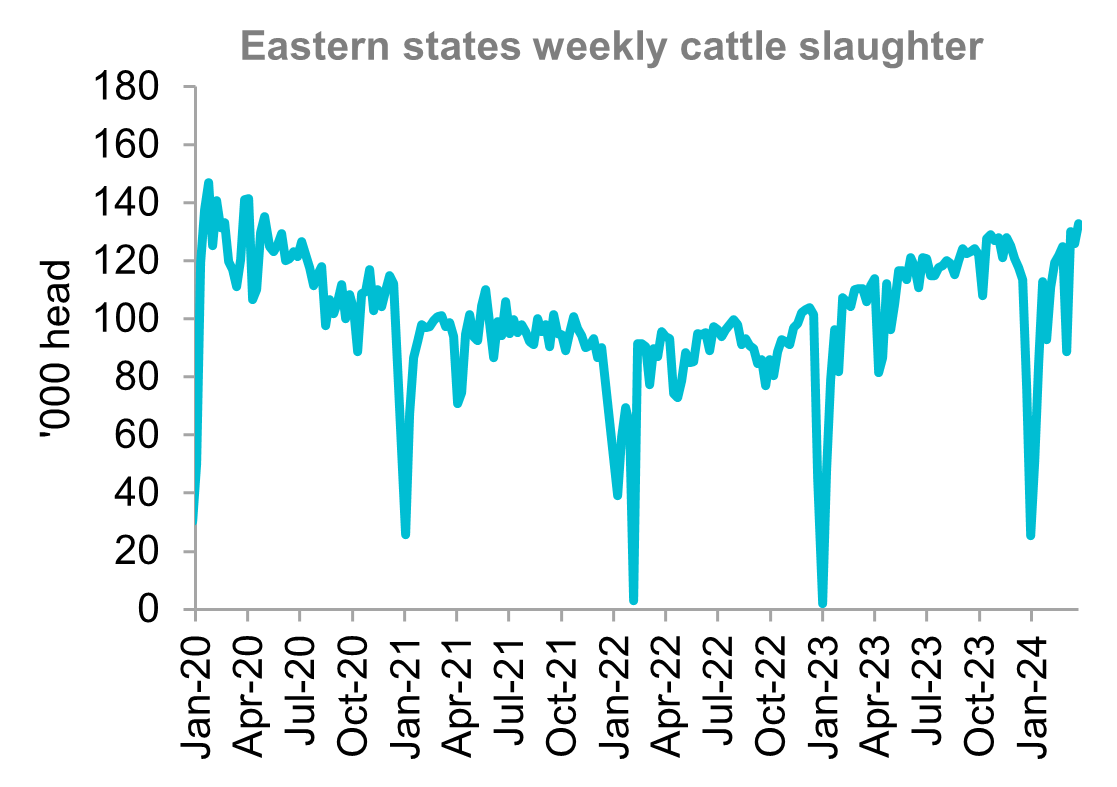

National weekly slaughter rates lifted in March and continued to be significantly higher when compared to a year ago. However, the recent rainfall throughout Queensland and New South Wales have caused supply chain issues. Beef processing centres are reporting alterations to expected delivery times due to road closures and blockages. Should the weather forecast of warm conditions in the state eventuate these supply chain issues should subside. Despite the challenges, the average weekly slaughter in March was just under 123,000 head, up 8.7 per cent from the previous year. Year-to-date average weekly slaughter is also 11.1 per cent higher when compared to 2023. The final week of March recorded over 136,500 head processed nationally, which is the highest point since March 2020. Female slaughter has also surpassed the 47 per cent average. This is typically when the Australian herd commences a rebuild or contraction. It is now sitting at 48 per cent.

The US beef industry continues to operate with a reduced herd at the present time. US production in February was 3.6 per cent higher than a year ago, but 4.9 per cent softer than in January. However, export volume remains below average and in strong competition with Australian producers. US beef imports recorded the largest month on record in January at just over 504 million pounds. This was 38 per cent greater year-on-year. The US also recorded an upwards shift in domestic cattle prices throughout the past month. This was due to a recent rise in domestic demand. Australian producers are expected to continue having strong export opportunities to key markets as the US continues battle with a reduced herd in 2024.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.