Insights June 2024

Insights June 2024

Commodity overview

- Australian slaughter rates recorded strong growth throughout May, on the back of a lift in supply availability on local markets.

- Australian cattle prices remained relatively stable month-on-month, however strong export demand is likely to apply upwards pressure on local market prices throughout June.

Australian cattle prices were volatile throughout the past month. The Eastern Young Cattle Indicator (EYCI) reached a peak of 626c/kg in the middle of May before falling to a low point of 597c/kg in the final week of the month. The beginning of June has seen prices recover to 607c/kg. This places the EYCI on par with a month ago and 4.7 per cent higher year-on-year. The Western Young Cattle Indicator (WYCI) recorded a moderate increase of 9.2 per cent, concluding at 495c/kg. This is 25.2 per cent lower than a year ago. Strong international demand for Australian beef will continue to provide support for prices. Additionally, with the Bureau of Meteorology forecasts showing 25-100 mm of rainfall in the next week in cattle areas. This is likely to encourage restocker demand and provide further support for prices.

National weekly slaughter saw an uplift in May to average just over 137,000 head a week. The strong growth was exemplified by the final week of May which was up 14.6 per cent year-on-year. Year-to-date slaughter is 18.6 per cent greater than in 2023. Northern plants have managed to continue the strong growth in volume processed with extra shifts on weekends. Additionally, processing centres have been purchasing more stock at lower prices in the north. This is due to most southern buyers buying more local. The onset of winter conditions in southern regions has seen a greater amount of cattle onto local markets. This has been pushing the price marginally lower throughout the final two weeks of the month. With a greater amount of southern processing centres purchasing local, this has decreased competition for northern plants. This has allowed them to buy more cattle. It is expected that the growth in processing capacity will continue throughout June. However, with rainfall forecast in cattle regions restocker demand may lift. Should this eventuate, it will be creating a more competitive environment and lifting prices.

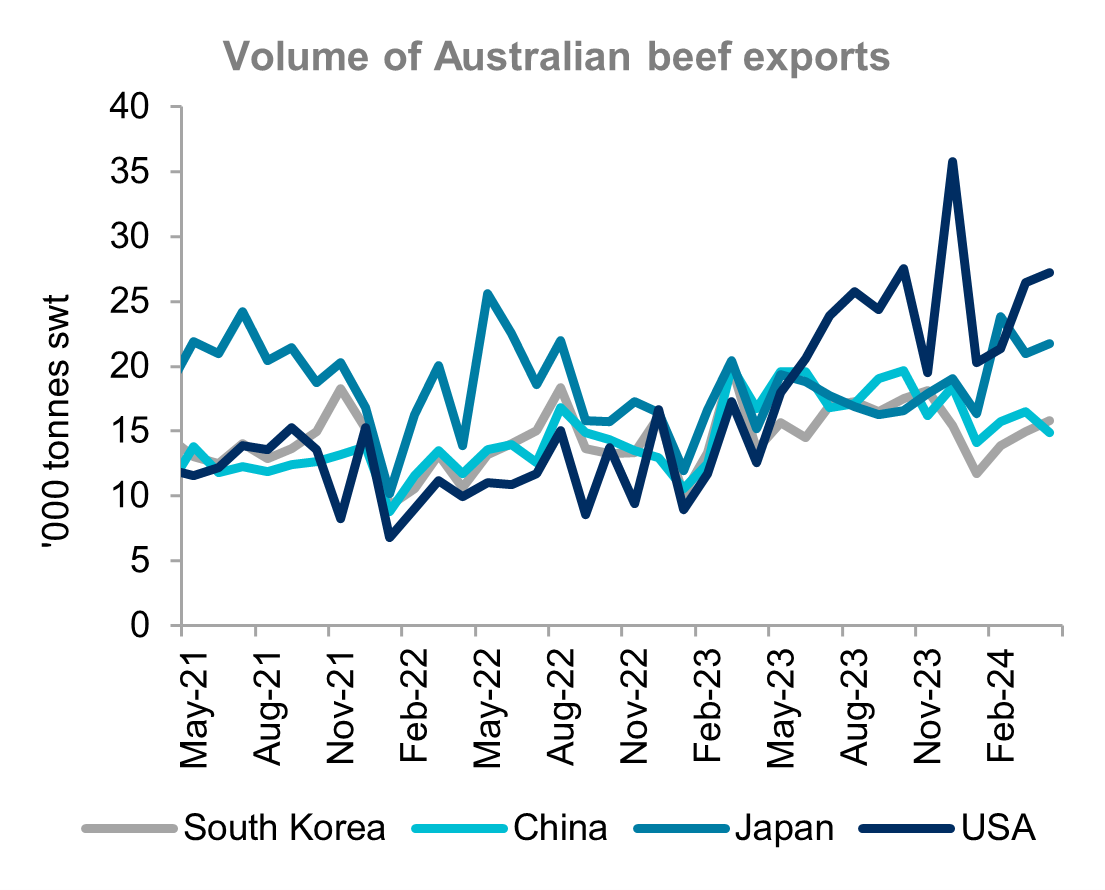

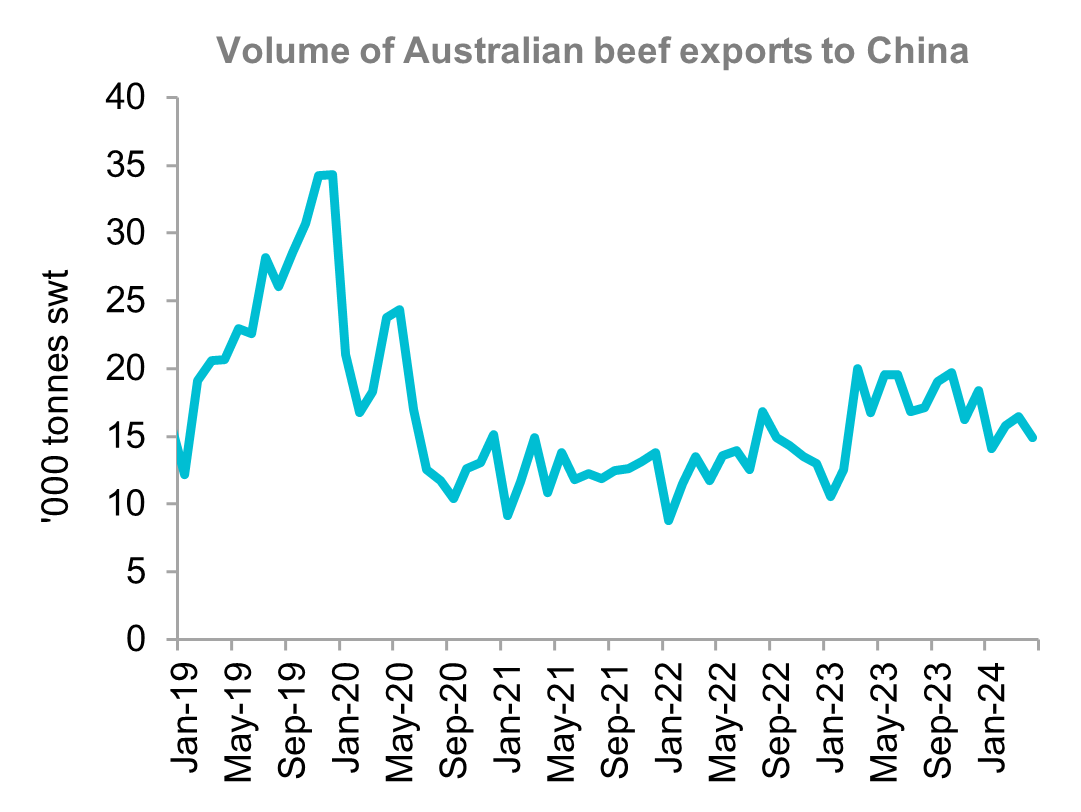

China has recently announced the removal of suspensions on five Australian processing centres. These are primarily located in Queensland and New South Wales. These restrictions were implemented over four years ago. Now suspensions on eight out of the original ten processing centres have been removed. Australian beef exports to China were worth over $1.6 billion in 2023 and are now expected to lift higher. Throughout the first quarter of 2024, exports to China have been three per cent higher year-to-date. This is now expected to lift heading into the second half of the year. However, strong growth may be limited with domestic consumption levels in China remaining stable. Additionally domestic production is forecast to be lifting two per cent this year.

The US continues to battle with a reduced herd. A recent USDA report forecast US production at 12.1 million tonnes. This is two per cent lower than the previous forecast last month and comes on the back of lower inventories. The US inventory level from the beginning of 2024 was at the lowest point since 1951. It is forecast to continue softening throughout the remainder of this year. US exports are also forecast to decline on the back of lower production levels and competitive prices internationally reducing demand for US beef. The decline in production is likely to continue providing Australian producers with strong export opportunities.

Source: Meat & Livestock Australia, DAFF

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.