Insights May 2024

Insights May 2024

Commodity Overview

- Australian cattle prices were volatile throughout April with rainfall across cattle regions providing a boost to prices which had fallen during the middle of the month.

- Australia’s beef exports continue to be strong with ongoing growth in three of the four key markets and was the highest April volume since 2015.

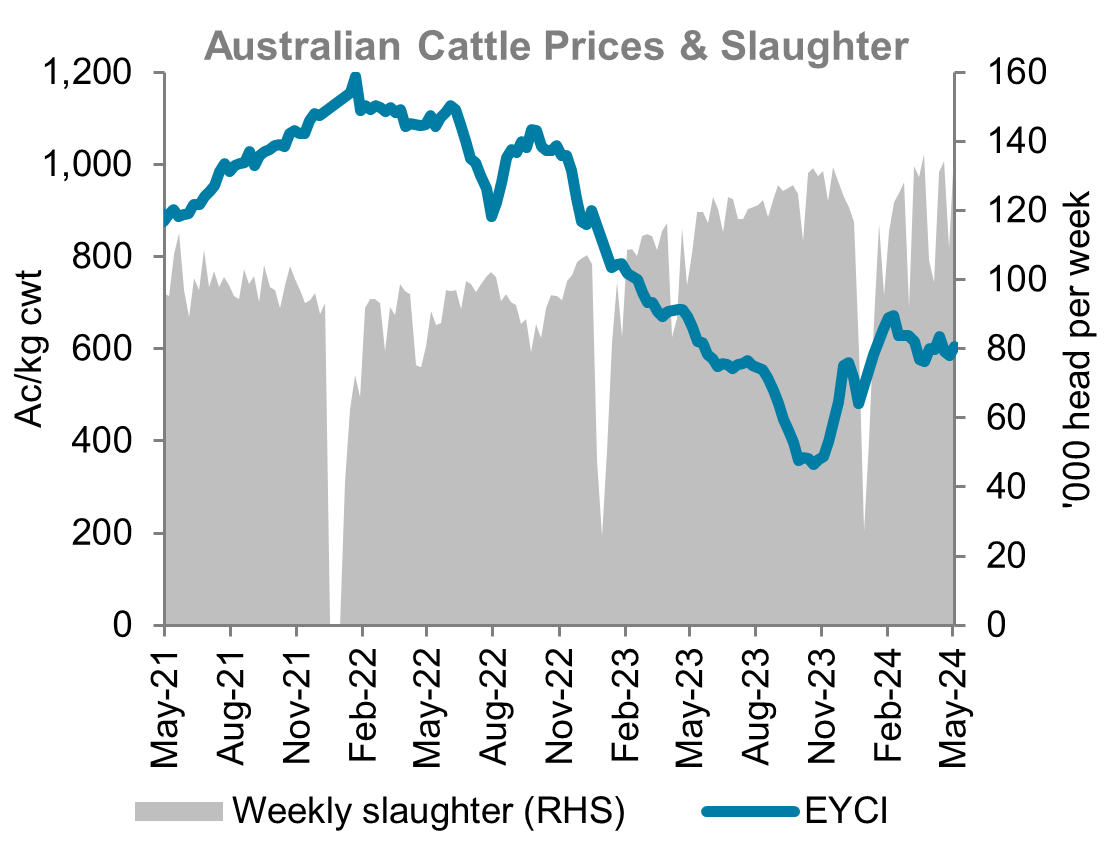

Australian cattle prices were volatile over the past month. The Eastern Young Cattle Indicator (EYCI) increased 1.2 per cent month-on-month to 604c/kg. Cattle prices recorded a strong uplift at the beginning of the month, peaking at 627c/kg, before softening in the middle of the month to a low of 582c/kg. The last week of April and early May saw prices recover 4 per cent to conclude at 604c/kg. This places the EYCI 5.5 per cent lower year-on-year. Strong export demand will continue to provide support for prices. The Western Young Cattle Indicator (WYCI) remained relatively stable, dropping 1.9 per cent to 456c/kg. This is 36.1 per cent lower than a year ago. The recent dry conditions across Western Australia have contributed to a wider gap between the EYCI and WYCI.

National weekly slaughter lifted in April to average just over 122,000 head a week. This continued in the first week of May which was up 27 per cent year-on-year. Year-to-date slaughter is 18.7 per cent greater than 2023. Northern processing plants are continuing to manage the backlog of cattle which were purchased the previous month but struggled to be transported due to wet weather conditions. With dry weather now forecast it is expected that the supply chain issues will be resolved this month and processing capacity will improve. Slaughter rates are forecast to lift throughout May with most northern processing centres adding additional shifts to manage the high levels of stock currently in the backlog.

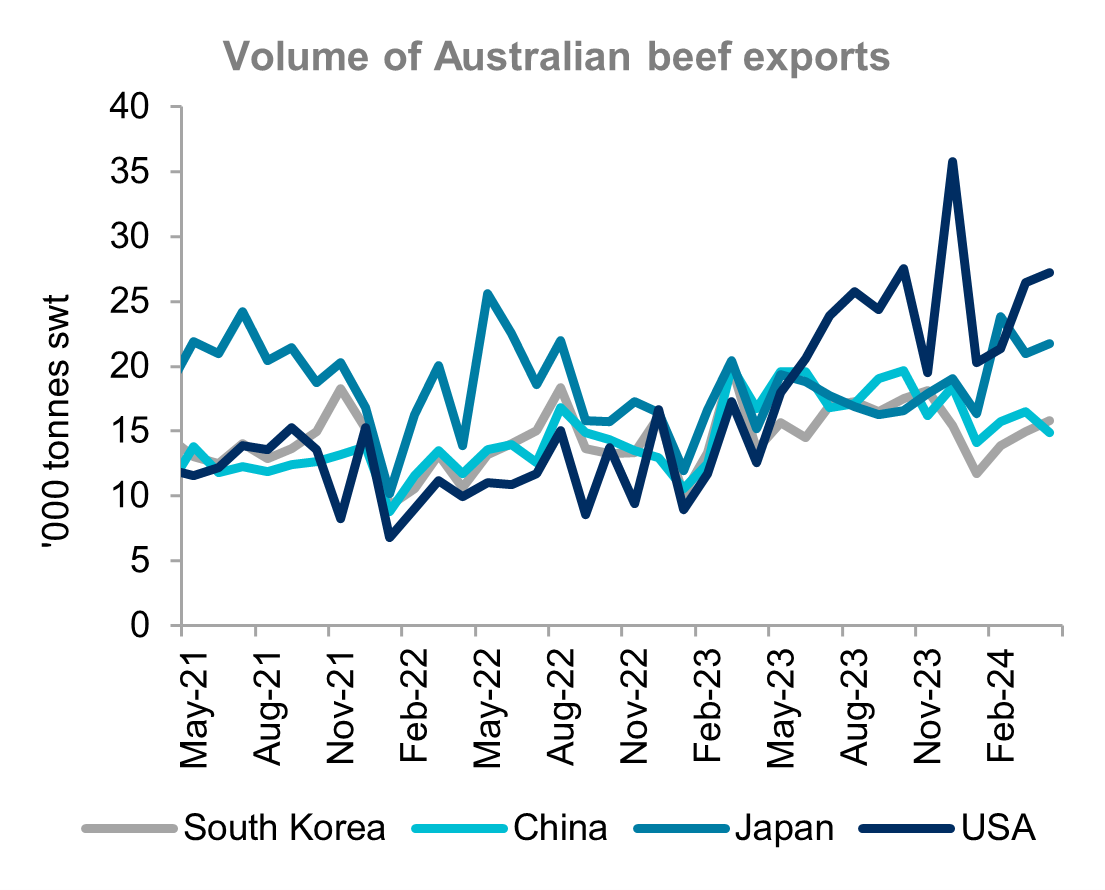

Australian beef exports recorded the strongest April volume since 2015. The total volume of 105,367 tonnes was 46.2 per cent greater year-on-year. Export volume to the US continued to record growth, lifting 3 per cent month-month and was 117 per cent above a year ago. With the US continuing to battle with a reduced herd, exports have been strong. This has resulted in the first four months of 2024 being 81 per cent higher than this time in 2023. It is expected with no public holidays in May for Australia and less infrastructure issues in the east and west coast ports in the US that volume will continue to rise. Export volume to Japan also lifted throughout April, increasing 3.4 per cent month-on-month. This is also 42.7 per cent higher year-on-year. This comes on the back of firm domestic demand for Australian premium cuts and no backlog issues at Japanese ports which were prevalent this time a year ago. The backlog issues at Japanese ports which transported Australian beef pushed export volume lower at the beginning of 2023. China was the only major market to record a downwards shift in export volume in April, falling 9.7 per cent. This was also 11.1 per cent lower than a year ago and comes on the back of economic difficulties. Exports to South Korea increased 6 per cent month-on-month. However, exports for the first quarter of 2024 remain on par with 2023. This is due to a renewed focus on domestic production to counter inflation issues. Indonesia recorded a decline of 22.7 per cent month-on-month. However, exports to Indonesia are forecast to be stable moving forward as the import licence issues with Australian producers appear to be resolved. Australia’s beef exports are forecast to lift in May with no public holidays and strong demand pushing volume upwards.

Source: Meat & Livestock Australia, DAFF

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.