Insights November 2023

Insights November 2023

Commodity Overview

- Australian wool prices continue to trend well below average, but prices have seen some stability over the past month.

- Wool producers are prepared to meet the market and sell at the below average prices as supply is expected to be deplete over the coming months.

- Demand for Australian wool is unlikely to pick up over the coming months due to challenging economic conditions.

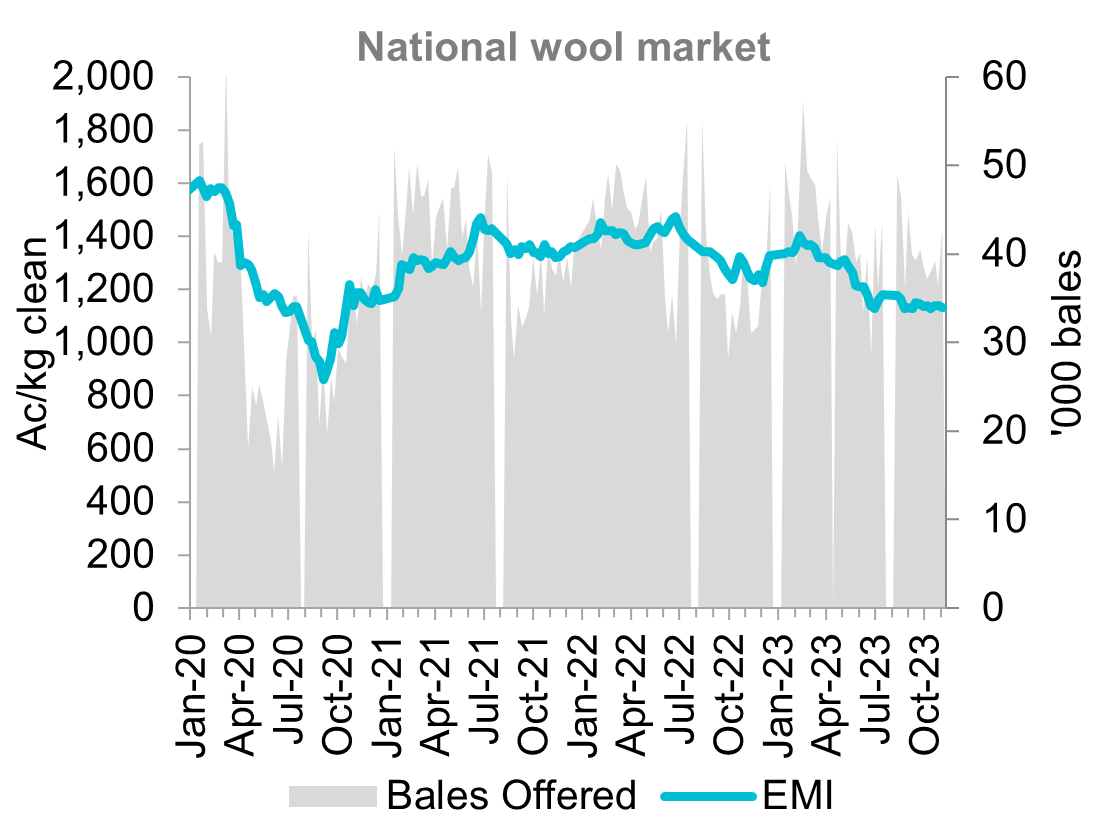

The Australian wool market saw varied movement over the past month. The Eastern Market Indicator (EMI) softened nine cents to sit at 1,129 c/kg. Notable increases were made early, though gains were given up as the month progressed. The EMI was relatively steady during the first week of October, sitting at 1,138 c/kg, before losing 10 cents the following week. The next fortnight again saw stability enter the market. The EMI is now resting at 1,139 c/kg for two consecutive weeks before losing 10 cents during the first week of November. Month-on-month this reflects a 0.8 per cent decline. Whilst there was stability for the EMI over the month, producers are still hoping for some underlying strength to return to the market. The EMI remains 10.5 per cent lower than this time last year. Wool prices have struggled this year as consumer demand wanes due to challenging economic conditions. The high supply of wool has also placed downwards pressure on the market. Prices have found some support from the weakening AUD, which has fallen 8.4 per cent since the start of the year.

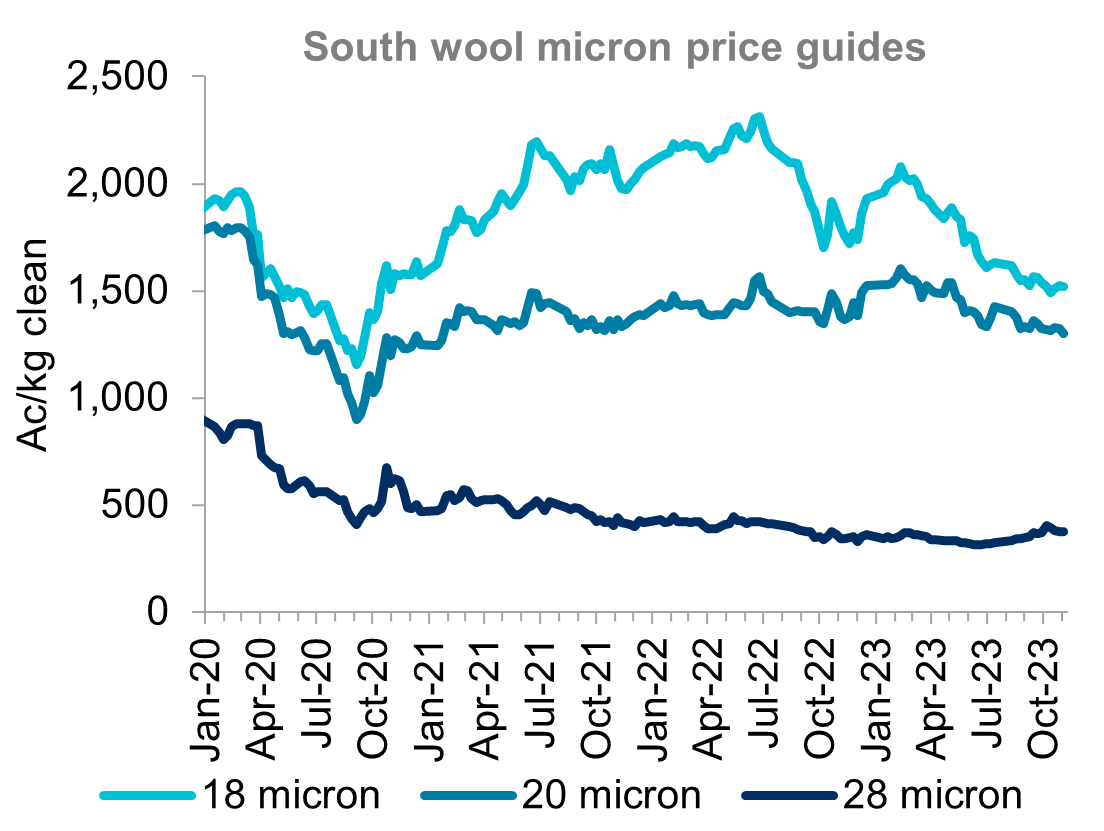

In the South, micron price guides for fine wool have seen stability, with slight increases recorded. The 17 and 18-micron wools had price rise of four and three cents respectively for the month. 17-micron wools finished the month at 1,702c/kg with the 18-micron closing at 1,520c/kg. Comparing to the same period last year 17-micron wools are now sitting 20 per cent lower year on year, whilst 18-microns have dropped 19 per cent from the same period last year. The best price increase for the month was for 18.5-microns which finished 13 cents higher, to finish at 1,442 c/kg, a 0.9 per cent rise for the month. Broad wool in the South did not follow this trend will all microns finishing the month softer. 20-micron wools dropped 1.6 per cent, finishing at 1,298c/kg while the 28-micron declined 7.2 per cent, to 373c/kg. The Southern Regional Indicator lost twelve cents over the month, finishing 1.1 per cent lower month-on-month and 8.2 percent below where it was at the same time last year.

October saw 193,514 bales offered nationally, with an average pass in rate of seven per cent across the month. The average pass in rate reduced three per cent month-on-month, indicating buyers are prepared to meet the market and sell. The highest pass in rate for the week ending November 6th was recorded in the South where 10 per cent of offered wool was not sold. North and West selling centres had a lower pass in rate for the same period of eight per cent across both locations. Fine wool supply is soon expected to be exhausted for another season. Producers would obviously prefer higher prices but are now opting to meet the market and sell, rather than hold onto stock. This is likely because of producers cash flow requirements stemming from lower commodity prices and seasonal conditions.

Sources: Australian Wool Exchange

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.