Insights March 2024

Insights March 2024

Commodity Overview

- Stability had characterised Australian wool prices from the second half of February. Though the first week of March saw a strong improvement across nearly all microns.

- Wool supply has tightened and could remain lower on the back of a reduced sheep flock, but demand remains the missing piece needed to spur any further significant price improvement.

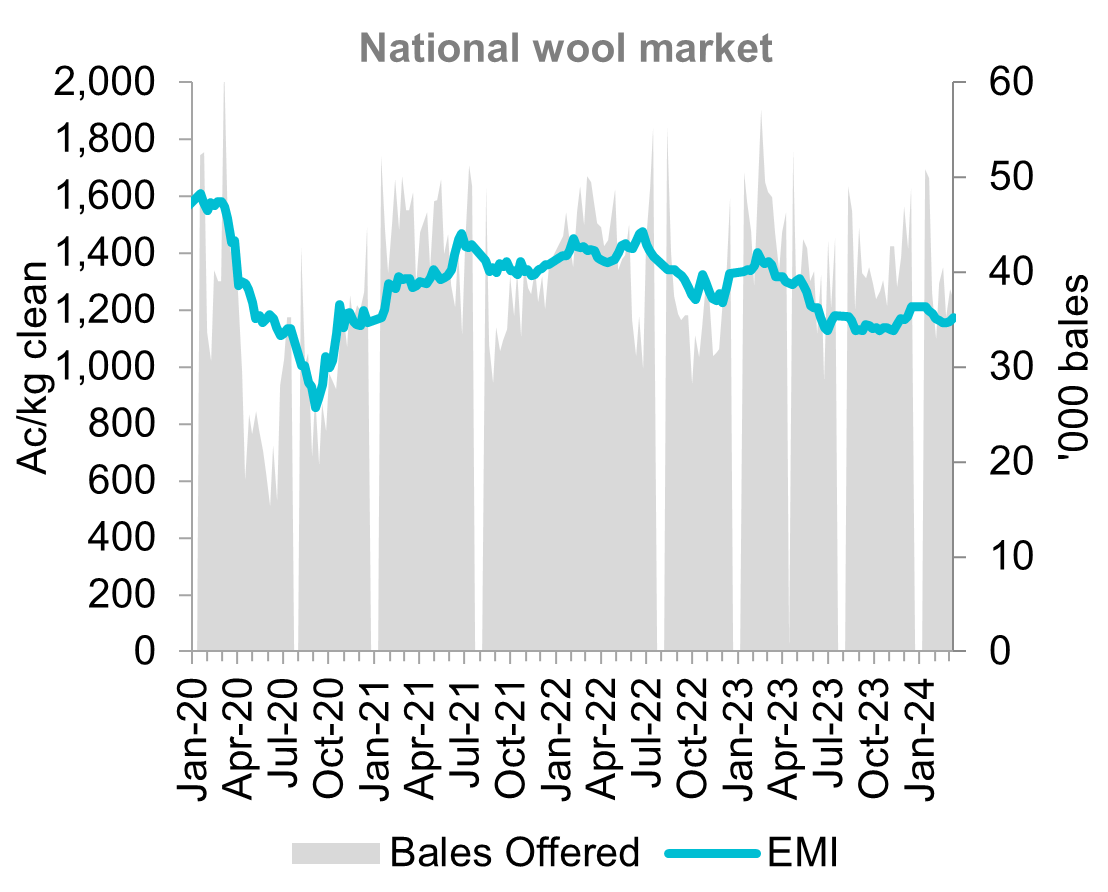

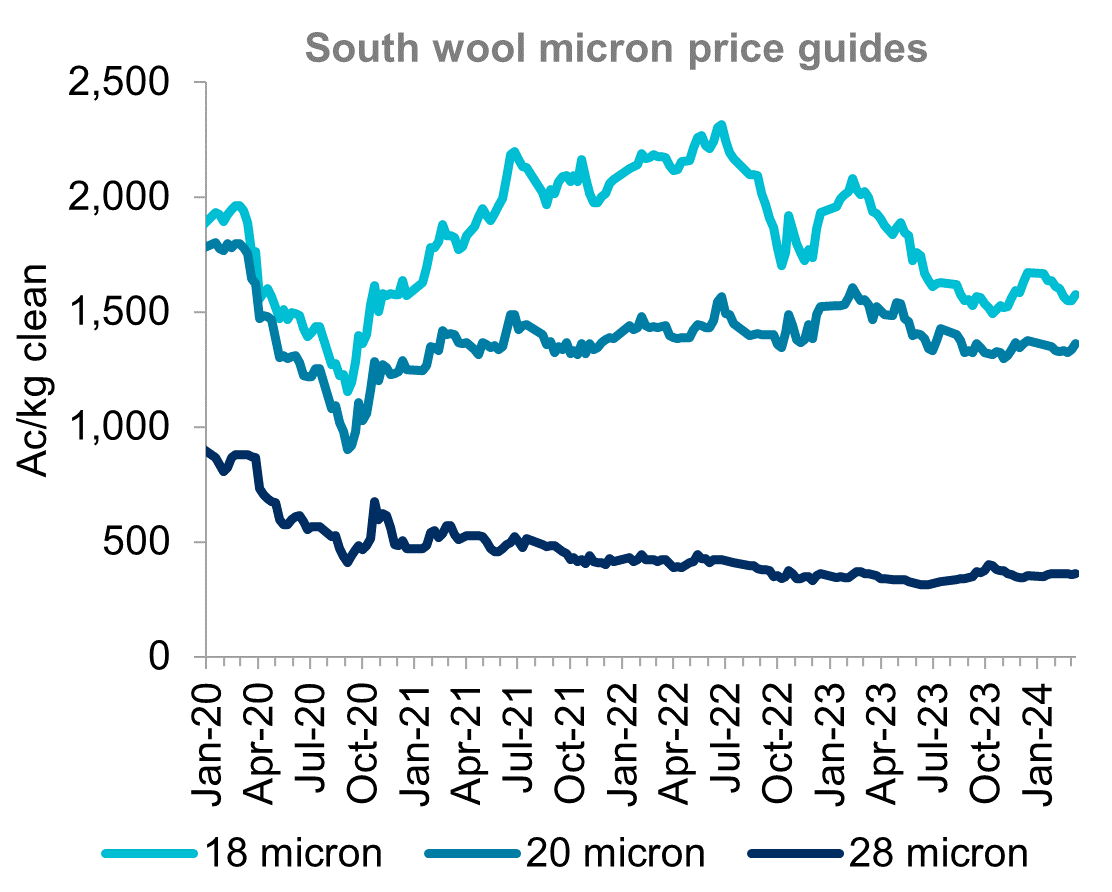

After declining across the first five weeks of 2024, the Australian wool market found some stability in the second half of February. The Eastern Market Indicator (EMI) finished February at 1,158c/kg, down 4.5 per cent on its opening value for the year and trailing a year ago by 15.4 per cent. The market has largely been dragged lower by fine wools since the start of 2024. At the end of February, 18-micron wool was 7.2 per cent lower than its opening value. In contrast, 20-micron wool was only 1.7 per cent lower and 28-micron wool was 3.2 per cent higher. The first week of March saw the first real sign of the market improving for 2024. The EMI lifted 14c/kg, back to 1,172c/kg. Fine wools saw a larger price rise with 18-micron wool up 29c/kg. A similar rise occurred for 20-micron wool, up 25c/kg, while crossbred wool saw only a modest rise of 2c/kg. Despite a much-welcomed improvement, all wool types remain lower compared to five-year averages. The EMI sits 12.9 per cent lower than average, similar to 18-micron wool at 15 per cent lower. Closer to average is 20-micron wool at 7.8 per cent lower. Crossbred wool, while seeing modest recent improvement is still trailing its average by the furthest, down 34.6 per cent.

The average weekly bales offered in February was down 20.2 per cent from January and 24.2 per cent lower year-on-year. Overall, summer saw a decline in wool supply compared to the strong supply seen in spring based on data from the Australian Wool Testing Authority. Volume across summer was down 19 per cent from spring and 7.6 per cent lower than the 2022/23 summer. The lower year-on-year trend marked a quick shift from spring 2023 when wool supply was 12.9 per cent higher year-on-year. Supply has quickly shifted from being elevated in spring to recent months being noticeably tighter. While total wool supply in summer 2023/24 was 7.6 per cent lower than the previous summer, there were contrasting trends across microns. The decline in supply was led by medium wools. Wool between 19-28 micron saw a decline in volume of 8,416 tonnes (-15.7 per cent) from the previous summer. Meanwhile, wool finer than 19-micron saw an increase of 1,025 tonnes (+4.1 per cent). Broad wool above 28-micron had an increase of 810 tonnes (+10.6 per cent). Fine wools remain in decent supply which helps explain why 18-micron wool is currently 23.5 per cent lower year-on-year while 20-micron wool is only 14 per cent lower. Overall, the weakness in prices amidst tightening supply indicates that demand is lacking.

Further tightening of wool supply is looking more likely for 2024 on the back of a decline in the national sheep flock. Meat and Livestock Australia’s (MLA) recent sheep projections report forecast a 2.9 per cent fall in the national sheep flock between June 2023 and June 2024. This decline of 2.3 million sheep is driven by excess turnoff of sheep and lambs in late-2023 in response to dry conditions. This suggests a reduced number of sheep to be shorn in the coming year. Lower production could help support some upside to wool prices, or at least stem the weakening trend.

The missing piece in wool markets continues to be consumer demand. While inflation has been declining and interest rate cuts are becoming a more realistic scenario later this year in key wool consuming markets such as the US and Europe, it will be sometime before this translates into renewed consumer spending. In addition, China’s economy is showing signs of weakness which will likely keep household consumption subdued. Wool markets will continue their anxious wait for economic conditions to reinvigorate consumer spending on woollen products for most of 2024.

Sources: Australian Wool Exchange

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.