Insights February 2024

Insights February 2024

Commodity Overview

- Australian wool prices have softened across weekly auctions to start 2024, losing much of the gains seen in December.

- Lower volumes of wool offered to markets coupled with a softening Australian dollar point to demand being the limiting factor driving prices lower.

- Export trends from 2023 show Australia’s strong reliance on Chinese demand for Australian wool with a lack of growth to smaller processing markets.

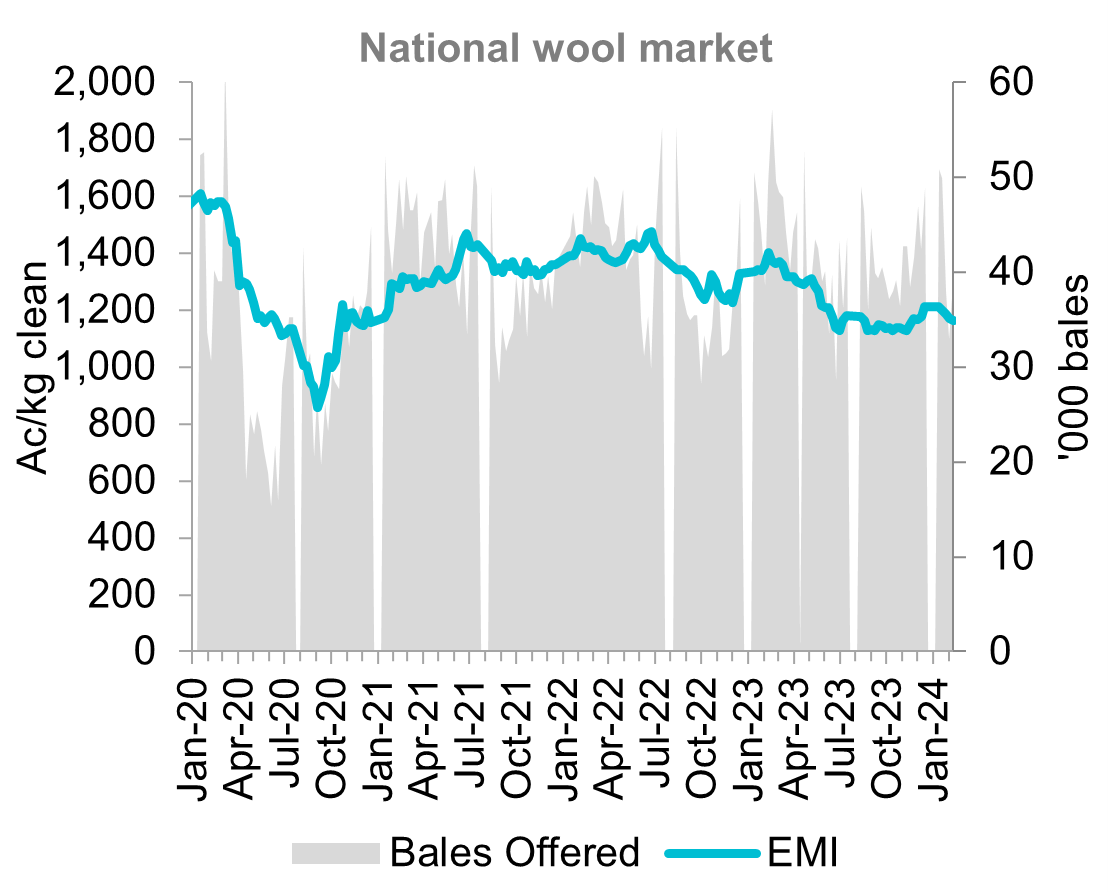

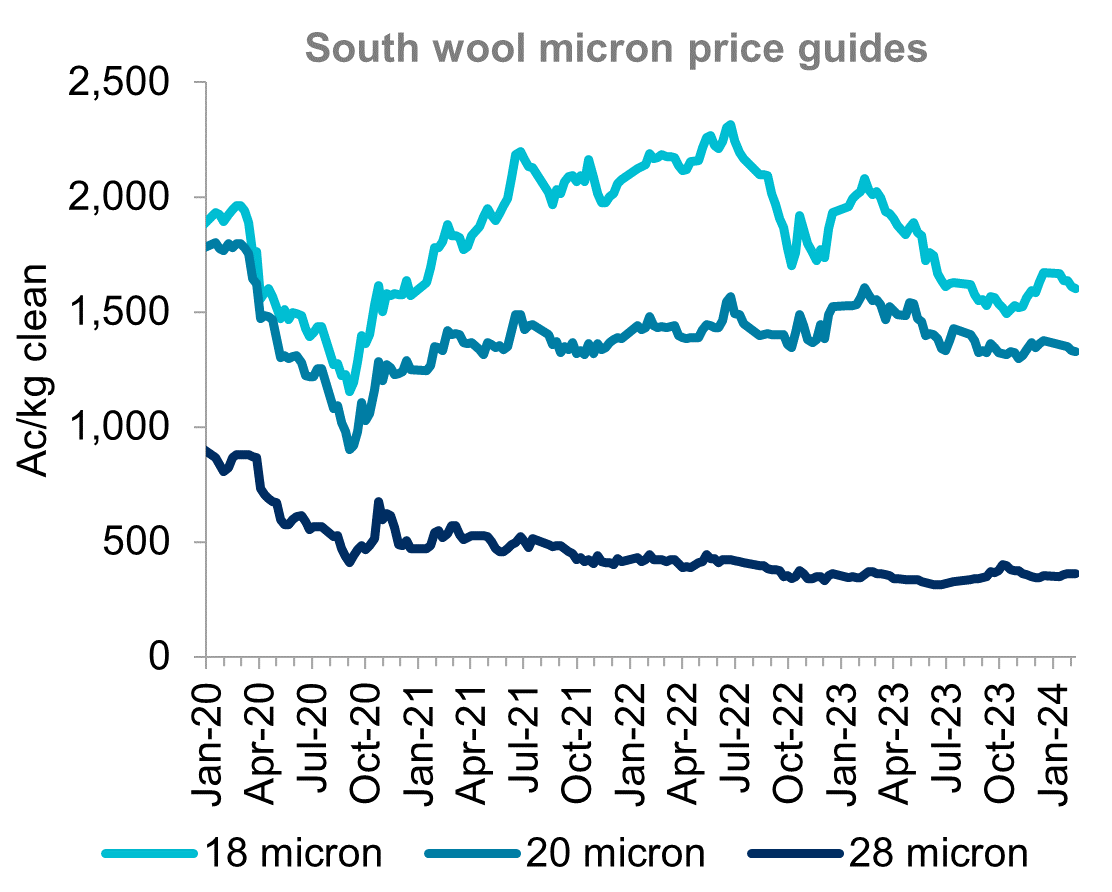

After an encouraging end to 2023, Australian wool prices have trended lower to start 2024. The new year’s first week of auctions saw the Eastern Market Indicator (EMI) hold near its 2023 closing level at 1,213c/kg. However, the following four weeks saw the EMI lose 50 cents, or 4.1 per cent. This brings the EMI back to 1,163c/kg, on par with late-November. Loses have been greater for fine microns. The Micron Price Guide (MPG) for 18-micron wool in Melbourne has fallen 66 cents (-4.0 per cent) from it’s opening value. Meanwhile, 20-micron wool has only lost 33 cents (-2.4 per cent). In contrast, crossbred wool has staged a steady recovery with 28-micron wool up 13 cents (+3.7 per cent) from the opening week. However, 28-micron wool is still languishing below its five-year average by 36.7 per cent. By comparison, 18-micron wool is 15.6 per cent below average and 20-micron wool is down 9.9 per cent from average.

These declining prices have come despite a shrinking volume of bales offered since the first week of auctions this year. After a strong start of 50,884 bales offered, this volume has progressively declined to sit 24 per cent lower for the week ending 9th February. This likely represents sellers holding back bales in response to weaker prices. In that time the Australian dollar has seen a modest decline from 67.2 USc to 65.3 USc. The combination of lower supply and a more favourable exchange rate points to softening demand as the cause of price declines.

Looking back on wool production in 2023, wool test volumes showed a 5.7 per cent rise to just over 354 thousand tonnes. This was the largest production volume since 2017. Production growth was greatest in fine wools with nearly 19 thousand tonnes (+11.2 per cent) more wool finer than 20-micron. Broad wools also saw production growth, up six thousand tonnes (+10 per cent). Meanwhile, medium wools between 20-23 micron saw a six thousand tonne (-5.6 per cent) decline in volume.

The value of Australian wool exports declined by 8.5 per cent in 2023 to $2.76 billion. This was the lowest export value since 2020 and 5.1 per cent below the five-year average. The decline in value was driven by a 12 per cent decline in average export price which offset a 4.1 per cent rise in export volume. Export volume of just over 317 thousand tonnes was the highest since 2017. Growth in export volume was almost exclusively seen in broader wools. Exports of wool broader than 23-micron saw a 24 per cent increase in 2023 while 23-micron and finer saw only a 0.9 per cent increase. Unfortunately, export prices lost most of the ground gained in the prior two years to fall 16.6 per cent below the five-year average. Declines in export price were seen across all micron groupings, reflecting weaker auction prices. Australia exported a record volume of wool to China in 2023. Exports of just over 277 thousand tonnes was 6.7 per cent higher year-on-year and just eclipsed the previous record from 2007. This saw China account for 87.5 per cent of Australian wool exports in 2023, up from 85.3 per cent in 2022. Despite record volumes, lower prices meant export value to China of $2.34 billion was down 6.7 per cent year-on-year and 3.3 per cent below the five-year average. India was Australia’s second largest export market but only accounted for six per cent of exports at $166 million. The removal of a tariff on wool in December 2022 under the Australia-India Economic Cooperation and Trade Agreement was unable to deliver growth in exports to India. Export value fell 9.7 per cent thanks to a 3.5 per cent decline in volume and 7.8 per cent fall in average price. Declines in exports to Italy, Australia’s third largest market, were greater with value falling 24 per cent to $148 million. Australian wool remains deeply reliant on Chinese wool processors for demand. Unfortunately, the economic outlook for China remains unfavourable for any improvements in demand for wool processing or woollen products. This makes price improvements unlikely for the time being. The likelihood of reduced Australian wool supply to support a price improvement has also reduced under improved seasonal conditions which have slowed sheep turnoff and improved feed availability.

Sources: Australian Wool Exchange

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.