Insights June 2024

Insights June 2024

Commodity overview

- May saw mixed results for wool with a few microns having month-on-month increases, however most microns are sitting lower than the same time last month as well as year-on-year.

- There was a steady decline in the number of bales offered across May resulting in the smallest sale of the season to date at the end of the month.

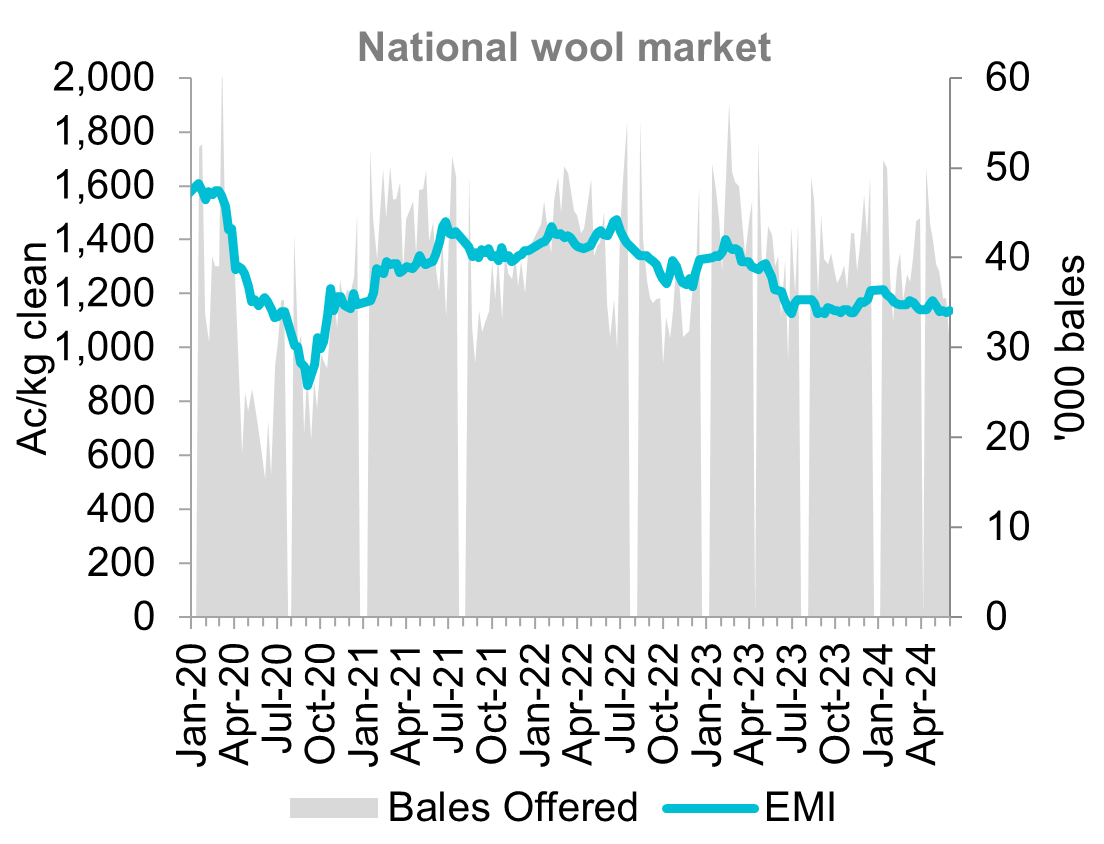

Australian wool prices dropped during May with the Eastern Market Indicator (EMI) ending the month down 35 cents. The EMI ended May at 1,137c/kg losing the hard-won gains of April. This sits 6 per cent lower year-on-year. An improving AUD/USD exchange rate saw limited gains across the month. There had been an initial drop in the US EMI, however it remains 8 cents down from the end of April. The first two weeks of May saw large drops in the EMI of 20 cents followed by 18 cents. There were some improvements later in the month but nothing significant enough to cover these losses.

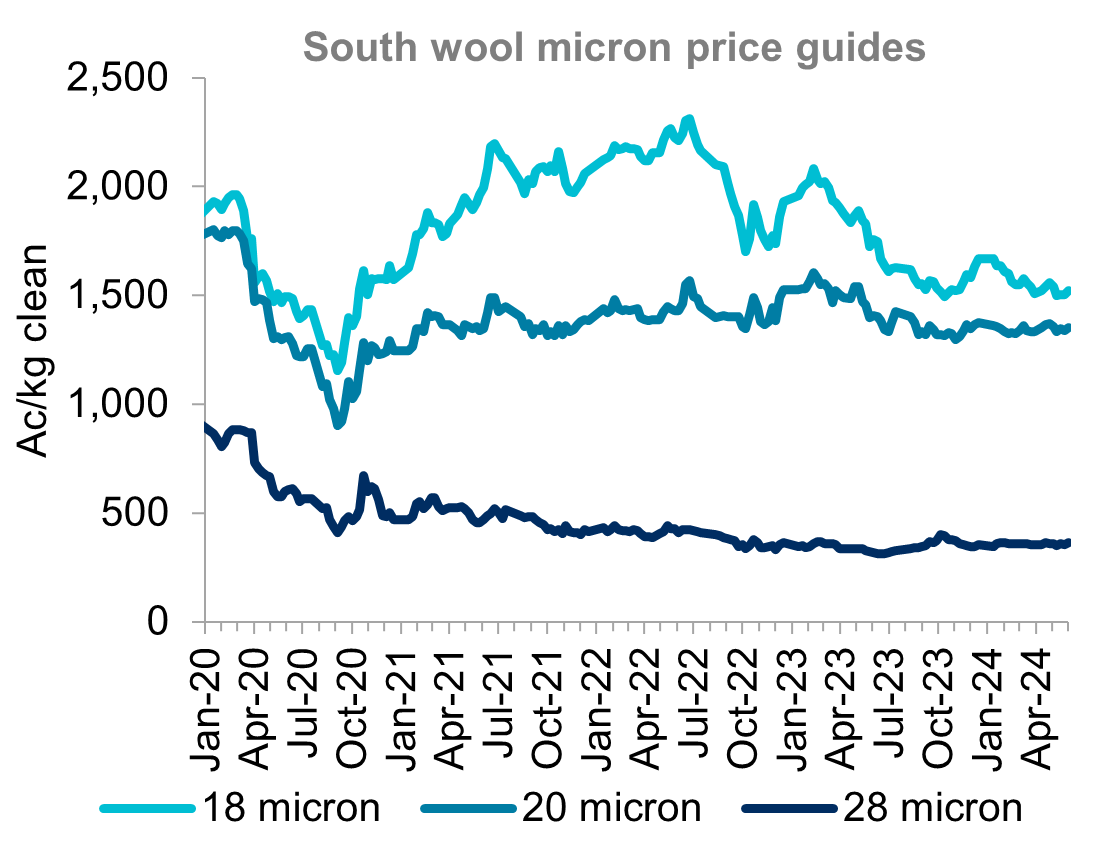

The coarser microns saw limited gains across May, particularly for 26, 28 and 30-micron wool sold through the Southern Centre and 28-micron wool in the North. These microns saw gains of between 1 and 12 cents month-on-month and are also all sitting higher year-on-year. The most significant was the Northern 28-micron wool that is now 20.8 percent higher year-on-year. However, this is still 27.7 per cent down on the five-year average, showing a steady decline over the past five years.

Finer micron wool struggled across May. Though there were some gains towards the end of the month, they were minimal compared to the declines seen earlier. Across the Southern selling centre the finer microns are all sitting 29-63 cents lower month-on-month. Comparisons to a year ago are also unflattering with wool between 16.5 to 18 micron in the south showing declines between 13.4-20.2 per cent. The medium microns are slightly better, only down 1.5- 6.4 per cent.

Australian Wool Innovation (AWI) has noted that demand remains highest for 1 per cent Vegetable Matter (VM) fleece. Buyers from China and India are requiring an average of 1 per cent VM for their completed orders. AWI reported that some finer micron fleeces with higher VM levels (2.5 to 5 plus per cent) were still finding support as the VM type is not difficult to comb at present.

Concerningly, wool prices fell at the same time as the volumes of bales offered tightened significantly. The final week of May saw only 31,282 bales offered. This was down 24.9 per cent from the final week of April and 38.3 per cent lower than the first week of 2024. Due to low volume Fremantle only had one selling day in Week 46 and will have no sales in Week 49 or Week 51. The forecast for the start of June is for less than 30,000 bales on offer nationally. The recent tightening of offering has brought season-to-date volume down 1.8 per cent compared to last season. The forecast for the 2024/25 season is currently indicating a decline in wool production of 5.8 per cent to 306mkg greasy.

Source: Australian Wool Exchange

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.