Insights April 2024

Insights April 2024

Commodity Overview

- Declines in fine wool prices drove an overall easing in the Australian wool market across March and kept prices below average levels.

- Increased supply contributed to the softer market in March while a lack of consumer demand continues to weigh on the outlook.

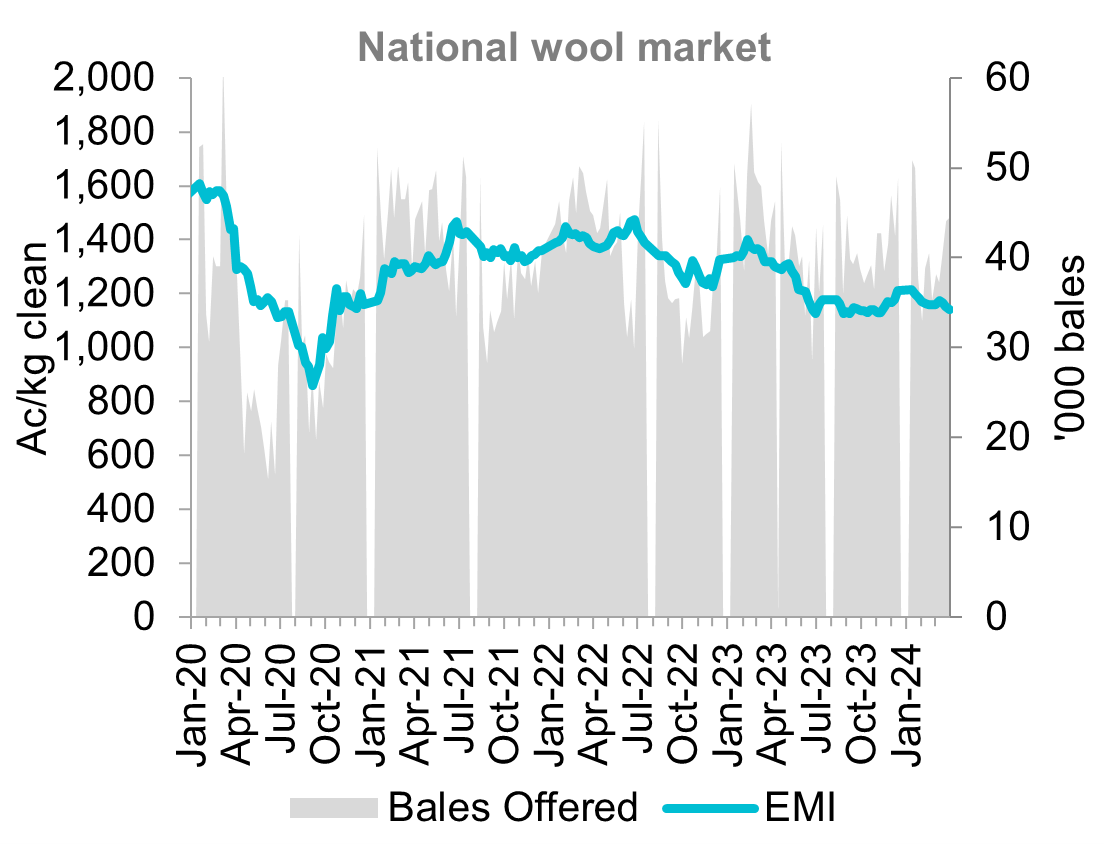

Australian wool prices softened in March despite some short-lived gains at the start of the month. The Eastern Market Indicator (EMI) lost 30 cents across the last three weeks of March to fall to 1,142c/kg. This was the EMI’s lowest point since November and represents a 71 cent fall (-5.9 per cent) from the start of 2024.

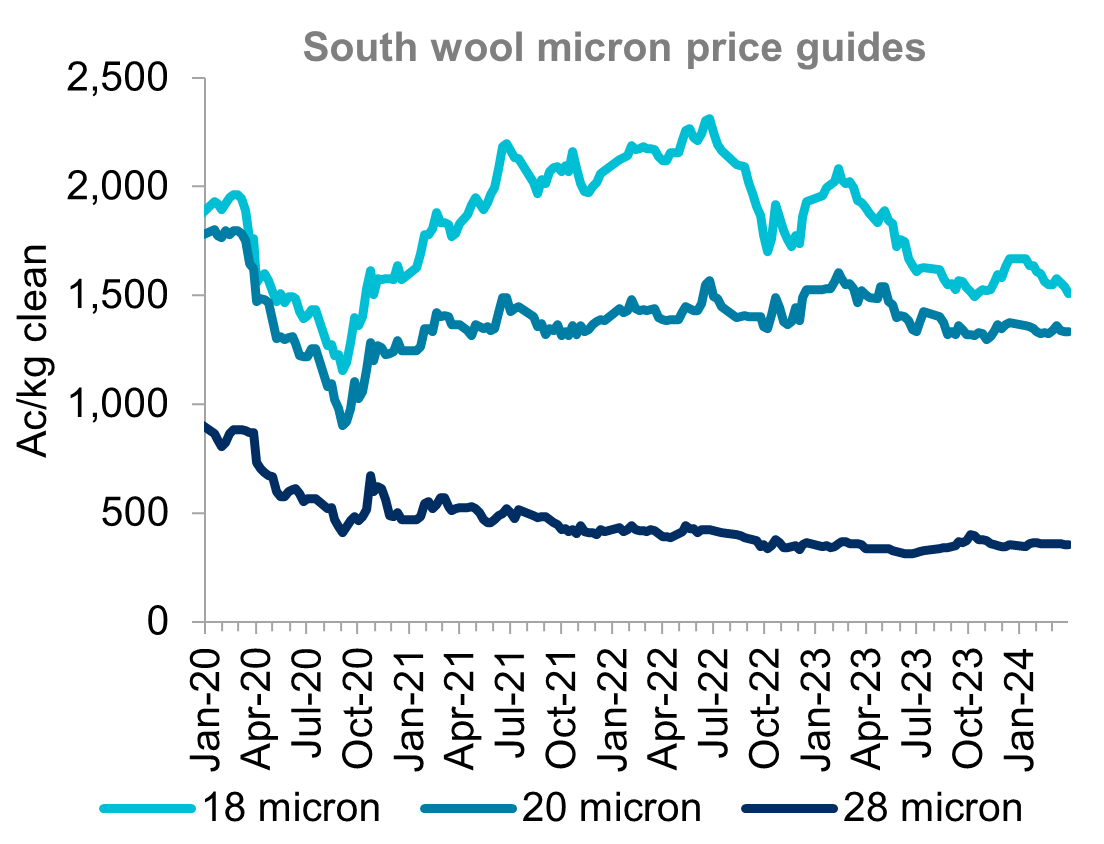

The softening market was driven by finer microns. In the south zone, the price of 18-micron wool fell 39 cents (-2.5 per cent) across March. This added to earlier falls to take 18-micron wool 159 cents (-9.5 per cent) lower than the start of 2024. The decline in 2024 has seen 18-micron wool return to levels seen in October, prior to a late-2023 rally. Meanwhile medium wools remained relatively stable in March with 20-micron wool down only three cents (-0.2 per cent). This took 20-micron wool only 26 cents (-1.9 per cent) lower than the start of 2024. Crossbred wool similarly saw only modest falls in March with 28-micron wool up by 5 cents (+1.4 per cent) from the start of 2024.

Overall, wool prices remain below average. The EMI is trailing its five-year average by 14.4 per cent. Fine wools are behind average by a similar amount with 18-micron wool down 14.7 per cent compared to average. Medium wools are slightly closer to their average with 20-micron wool 8.2 per cent below its five-year average. Crossbred wool remains well-below average with 28-micron wool down on its five-year average by 33.8 per cent.

Increased supply was the primary driver of prices drifting lower in March. March saw three consecutive weeks with more than 40,000 bales offered nationally, the first time this has occurred in 2024. Average weekly bales offered in March was up 10.7 per cent from February and 6.9 per cent above the five-year average. Despite softer prices, sellers still showed a willingness to take the prices on offer with a lower pass-in rate in March. Nationally, weekly pass-in rates averaged 6.7 per cent in March, down from an average of 9.2 per cent in February.

Wool prices are expected to remain relatively stable for the rest of the 2023/24 season with only minor fluctuations to be driven by short-term shifts in supply and currency. Any sustained change in the trajectory of prices will wait until a change in economic conditions reignites consumer confidence. Such an improvement is not on the cards ahead of this year’s northern hemisphere winter which means any improved demand for woollen apparel is likely still a long way off. Without this demand, particularly from European markets, competition for fine wools will remain weak and keep prices subdued.

Sources: Australian Wool Exchange

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.