Insights May 2024

Insights May 2024

Commodity Overview

- Strengthening export demand lifted Australian lamb prices back to five-year averages despite slaughter tracking 32 per cent above average in recent weeks.

- Sheep industry sentiment is weak in Western Australia as dry conditions have led to elevated supply and lower prices.

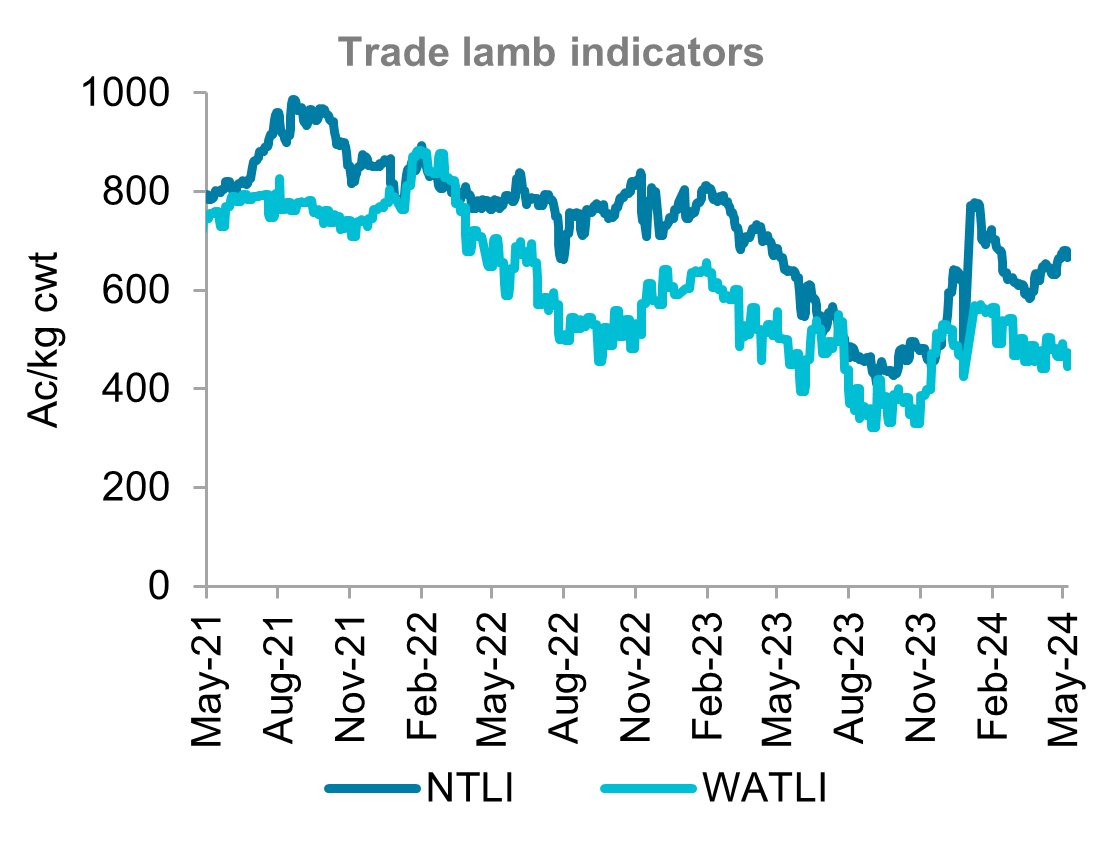

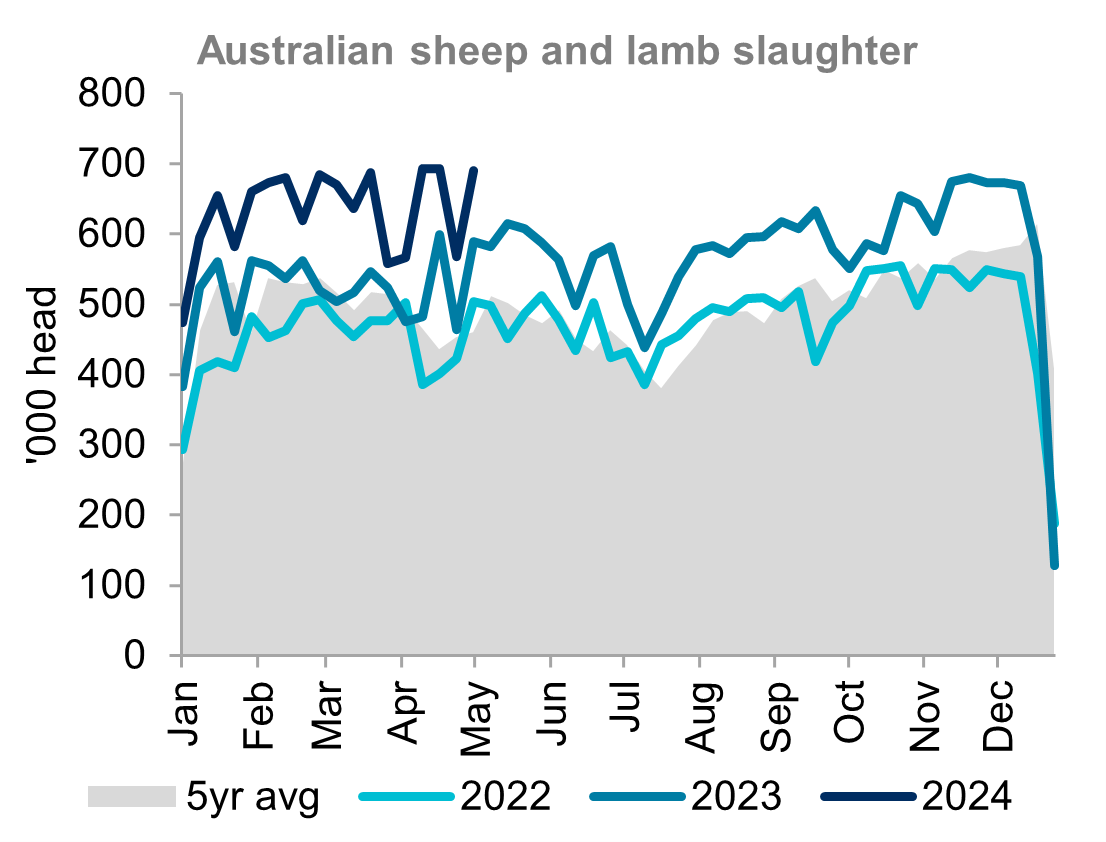

Australian lamb prices have held up well under the weight of high supply in the past month. The National Trade Lamb Indicator (NTLI) had risen by 62c/kg (+10 per cent) from the start of April to 681c/kg in early-May. This recovery has brought current prices on par with both levels from a year ago and the five-year average which should be considered a sign of strength given the high supply of lambs seen in the past month. In the three weeks not shortened by public holidays over the past month, weekly lamb slaughter has averaged 494,000 head. This is 32 per cent above the five-year average.

The resilience of lamb prices to high supply indicates a strengthening in demand. This is evident in the lift in export volumes in 2024. Across the first four months of the year, the volume of lamb exports has been 34 per cent higher year-on-year. This growth is being led by the US, with exports up 51 per cent on last year. China and the UAE are the second and third largest markets for Australian lamb, respectively, and have both seen growth in 2024. Iran has emerged as the fourth largest market for lamb in 2024, taking 6.9 per cent of total export volume. Having imported no Australian lamb between 2020 and 2022, Iran has imported 16,434 tonnes since August 2023. South Korea is also showing signs of improvement. Having been the third largest market in early 2023, export volumes declined 59 per cent from March 2023 to January 2024. The last three months have seen a 74 per cent rise in export volumes to South Korea.

An expected decline in lamb supply through winter bodes well for further increases in lamb prices. The five-year average trend shows an 18 per cent decline in weekly lamb slaughter from early-May to a low in late-July. There could be an extended period of tighter supply this winter. Dry conditions look set to continue in Victoria, South Australia and Western Australia. This will potentially delay new season lambs hitting markets.

While there is optimism for lamb at a national level, sentiment is much weaker in Western Australia. Dry conditions have led to an oversupply of sheep and lambs from the Western Australian sheep industry. Turn-off through both slaughter and live export has seemingly increased to capacity which has prompted the resumption of transfers to eastern states. The first quarter of 2024 saw 358,000 head transferred out of Western Australia. This is up from 40,000 thousand for the same time last year and 44 per cent higher than the full 2023 calendar year. As a result, the Western Australian Trade Lamb Indicator (WATLI) has continued to steadily decline. The WATLI has fallen 22 per cent from a high in early January. This continued decline has widened the WATLI’s discount to the NTLI to 33 per cent, up from 25 per cent a year ago. Further challenges for Western Australian supply are ahead. The moratorium on live exports during the northern hemisphere summer will close off this supply outlet from mid-June to mid-September.

Mutton prices have been less resilient to the pressure of elevated supply. The National Mutton Indicator (NMI) has bounced between 218-297c/kg in the past month. Without a clear upward trend, the NMI is languishing 40 per cent lower year-on-year and 24 per cent below its five-year average. This is understandable as supply has been comparatively higher than lamb in the past month, up 59 per cent compared to the five-year average. At the same time, demand has been softening from mutton’s top two markets: China and Malaysia.

Source: Meat & Livestock Australia

The recent announcement that the export of live sheep by sea will end on 1 May 2028 will have significant impacts on the Western Australian sheep industry. The live sheep export trade was worth $84.9 million in 2022-23. While this equated to only 1.8 per cent of Australian sheep industry export value, it is a significant trade for Western Australia. Western Australia accounted for 98 per cent of Australian live sheep exports in 2022-23. As a result, live sheep exports accounted for 10.7 per cent of Western Australian sheep industry export value. The trade provided an important market for 664,105 sheep in 2022-23, accounting for 11.9 per cent of Western Australian sheep and lamb turn-off. It is worth noting that the size of the trade has shrunk considerably in the last five years. In 2017-18, Western Australia exported 1.6 million sheep live, equivalent to 27.4 per cent of industry turn-off.

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.