Insights June 2024

Insights June 2024

Commodity overview

- Record lamb supply in May was not enough to push prices lower as strong demand has helped lift prices back up above five-year average levels.

- Prices are expected to continue improving as the typical winter slowdown in supply begins.

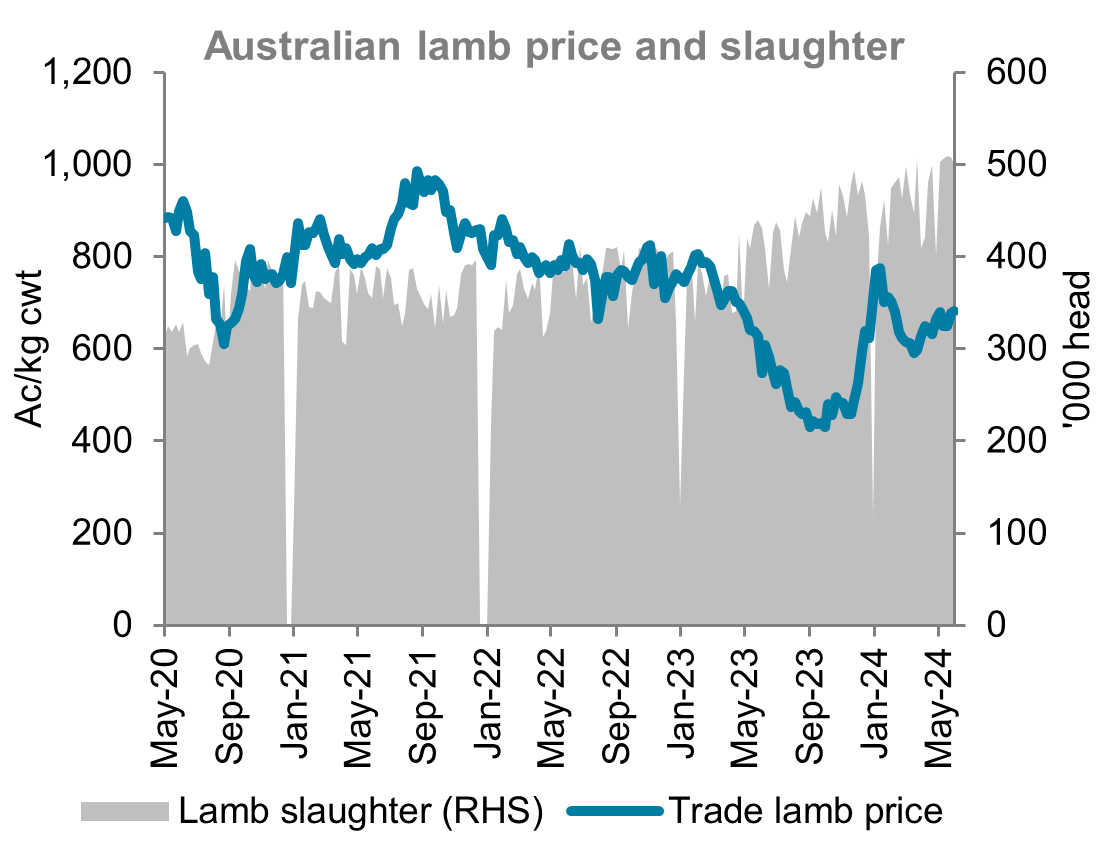

Winter lamb prices will be largely dictated by supply. On average, national weekly slaughter declines by 16 per cent from early June to the end of July before trending higher toward spring. This trend suggests that we are now due to see supply begin to ease from its current record high levels. Having hit the 500,000 head milestone for the first time in March, national weekly lamb slaughter exceeded this mark in all five weeks in May. This included a record high week of 509,499 in mid-May. This extraordinary pace has seen year-to-date slaughter up 23.1 per cent on last year and exceed 10 million head. It wasn’t until the end of June that this level was reached in 2023.

Lamb prices have been resilient under the weight of this unprecedented level of supply. The National Trade Lamb Indicator (NTLI) rose 11 per cent across autumn and has continued to strengthen in the first week of winter. At just below 700c/kg, the NTLI is 27.6 per cent higher than a year ago and 6 per cent above the five-year average. There were some diverging trends across the lamb categories in autumn. Heavy lambs (26-30kg+) followed a similar trend to trade lambs, up 12.6 per cent across autumn. In contrast, light lambs (12-20kg) fell 1.1 per cent across autumn. This is likely reflective of the strength of export demand while demand for light lambs to go back to paddocks or on feed is weaker due to dry conditions. Quality of lambs has also factored into pricing as a greater number of poorly finished lambs are arriving on markets. These are attracting a lack of interest from buyers while well-finished trade and export lambs are highly sought after.

Strong demand is providing plenty of support for lamb prices amidst high supply. Domestic demand is benefitting from lower retail prices for lamb. The average retail price from lamb in the March quarter was 16.2 per cent lower than six months earlier and its lowest level since September 2018. By comparison, beef prices were only 2.7 per cent lower across the same period. This presents lamb as a more appealing product for consumers navigating high costs of living. The decline in lamb retail prices coupled with improved saleyard prices has shrunk the gap between these two indicators back to a level close to the 10-year average.

An anticipated slowdown in lamb supply through winter coupled with firm demand suggests some upside for lamb prices in the next few months. This period of tighter, albeit still relatively high, supply is likely to extend further into winter or early-spring as dry conditions and higher feed costs will delay the onset of the spring flush of lambs. The NTLI could see a winter price peak around 800c/kg, a 14 per cent rise from current prices.

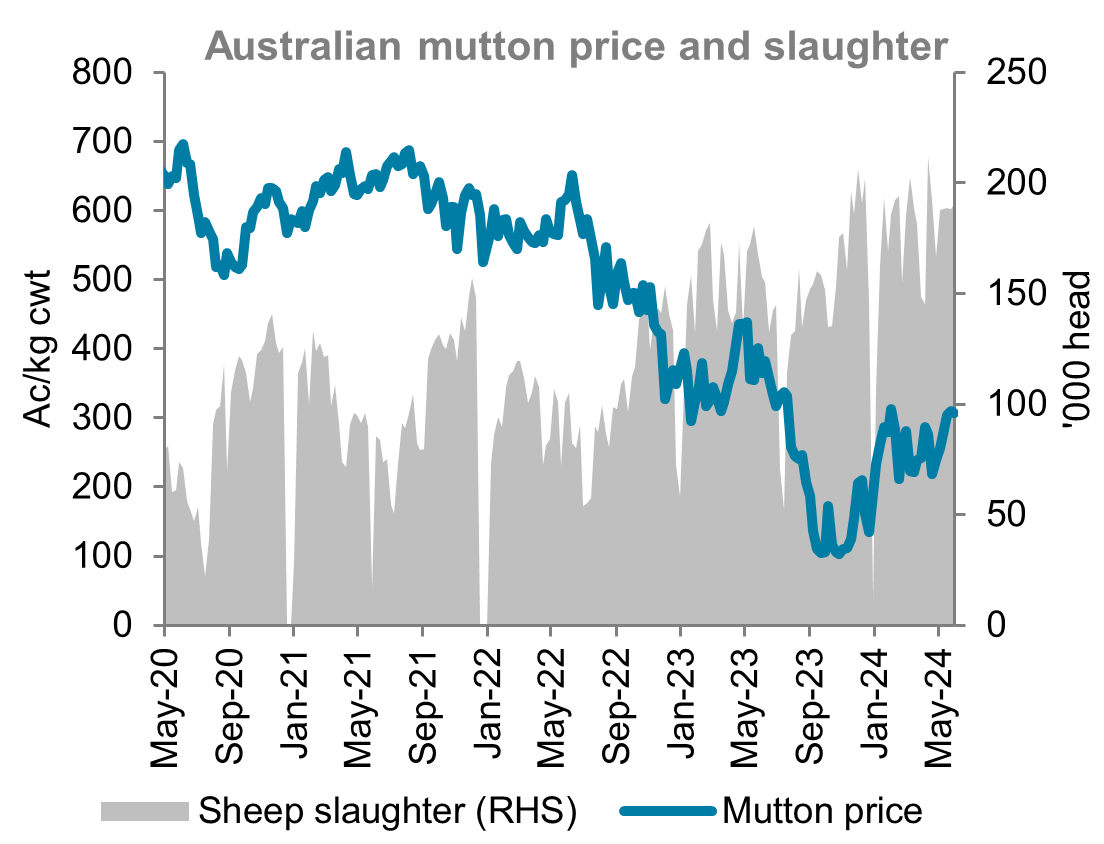

Mutton prices have been on a strong upward trend in recent weeks. Having fallen to 218c/kg in late-April, the National Mutton Indicator has since recovered 114c/kg (+52.6 per cent). Now back above 300c/kg, the NMI is at its highest price since July last year and on par with its five-year average. As with lamb, this recovery has come amidst consistently high supply. Weekly sheep slaughter averaged just under 189,000 in May. This was the highest weekly average for any month since November 2019 and 75 per cent above the five-year average for May. Demand has been sufficient to absorb the high numbers of sheep continuing to be turned off.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.