Insights March 2024

Insights March 2024

Commodity Overview

- The Australian lamb market has softened over the past few weeks under the weight of continued high supply. Lamb supply is expected to remain relatively high over the next few weeks before tightening later in the season.

- Domestic retail prices have started to creep up over the past few weeks. Cost of living pressures may see domestic consumption have a sharp response to price hikes. February was another strong month for lamb exports due to high processing rates.

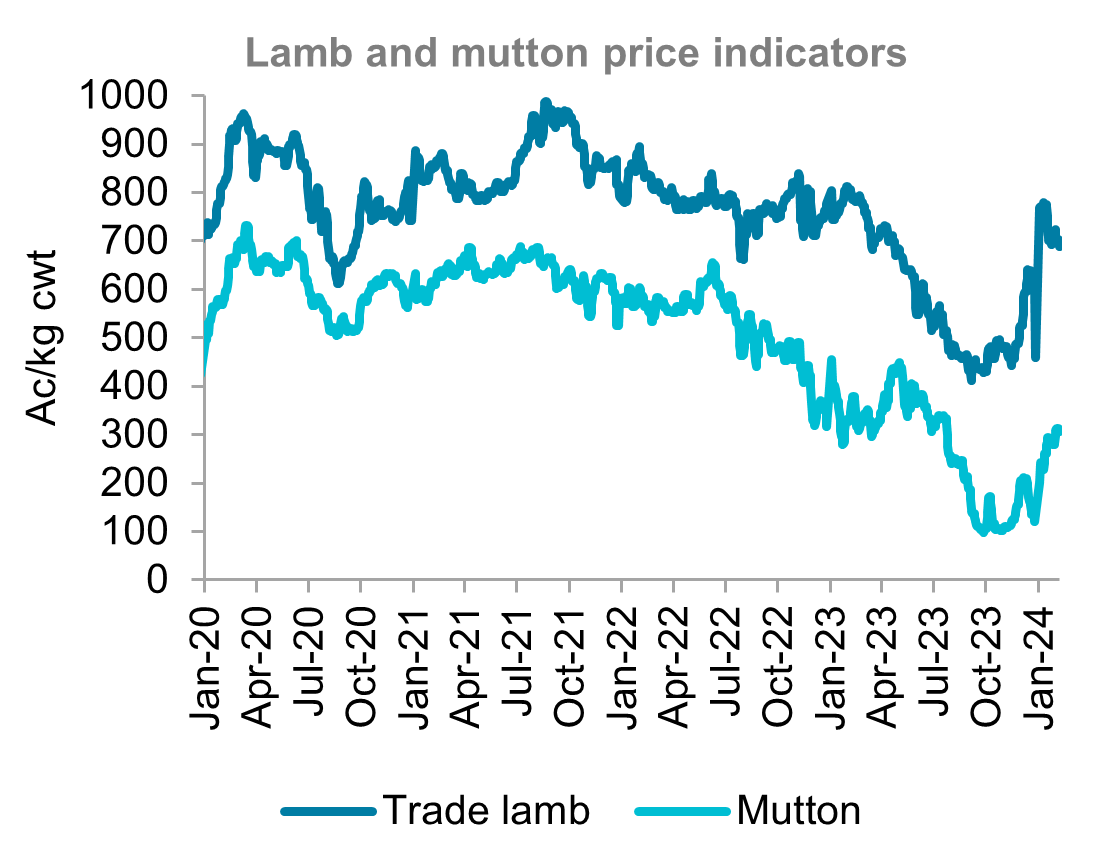

Lamb prices have softened over the past four weeks, as the influx of supply continues to weigh on the market. The National Trade Lamb Indicator (NTLI) has fallen 90 cents (-12.8 per cent) over the past month. The NTLI had a strong start to the year, gaining 251 cents (+47.8 per cent) between the start of December and the middle of January. Prices rebounded on the back of improved seasonal conditions which saw a spike in restocker and trade demand. Prices are expected to continue sideways for the next few weeks as the high supply continues. The market is likely to find support later in the season as supply tightens due to the high turn-off of light lambs in the second half of 2023.

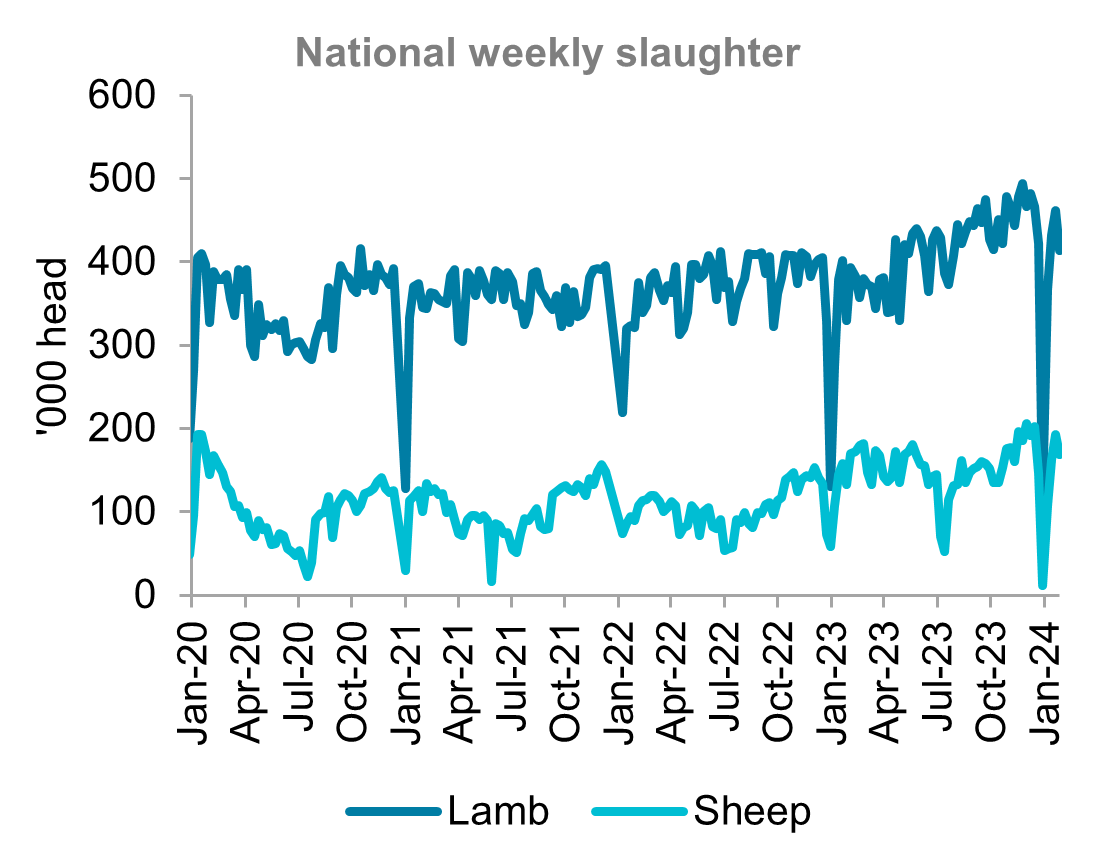

Australia’s lamb processing rates have continued strongly over the past month. Average weekly lamb slaughter was 465 thousand head in February, up 87 thousand head (+23.1 per cent) from February 2023. Year-to-date average lamb slaughter is almost 80 thousand head per week ahead of this time last year. Slaughter rates are likely to remain high over the next few weeks before slowing as supply tightens. Processing capacity has increased over the past six months, which is likely to provide support to prices as supply slows.

The influx of lambs seen over the past two months is expected to slow, as the impact of high turn-off in 2023 starts to influence supply. The ABS quarterly slaughter data showed a significant jump in slaughter rates. Lamb slaughter for the second half of 2023 was up over two million head (+19.6 per cent) compared to the same period in 2022. This was due to the national flock rebuild that had taken place over the past few seasons reaching maturity, as well as dry conditions pushing growers to turn-off stock early. The increased processing rates of light weight lambs is likely to see supply tighten over the next few months.

Domestic retail prices for lamb have started to increase in response to the rebounding saleyard prices. Australian lamb consumption had started to increase throughout 2023 as retail prices eased. Domestic consumption is expected to slow if retail prices continue higher over the next few months. Lamb export volumes continue to strengthen as processors look to find a home for the high volumes of lamb being slaughtered. Australia exported 31,052 tonnes in of lamb in February, up 23.4 per cent from last month and 36.4 per cent from February 2023. Lamb exports have increased this year due to strong growth from the US, China, and the Middle East.

Mutton prices softened throughout February, although there was a brief spike towards the end of the month. The National Mutton Indicator (NMI) has fallen 86 cents (-27.4 per cent) since the start of February and is now 126 cents (-35.7 per cent) lower than this time last year. The ample supply of mutton has continued into February. Year-to-date average slaughter has trended almost 14 thousand head (+8.9 per cent) ahead of this time last year. Strong export volumes of mutton have continued into 2024. Australia exported 21,299 tonnes of mutton in February, up 25.9 per cent from January and 36.6 per cent from February 2023. Mutton supply is expected to be stable over the next few weeks and prices are likely to trend side-ways.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.