Insights April 2024

Insights April 2024

Commodity Overview

- The Australian lamb market has been mostly stable over the past month. Increased processing capacity has been balanced by the higher level of supply.

- Both domestic and retail demand remains strong. Domestic consumption continues to benefit from the softer retail prices. Australian lamb export volumes have continued at record pace.

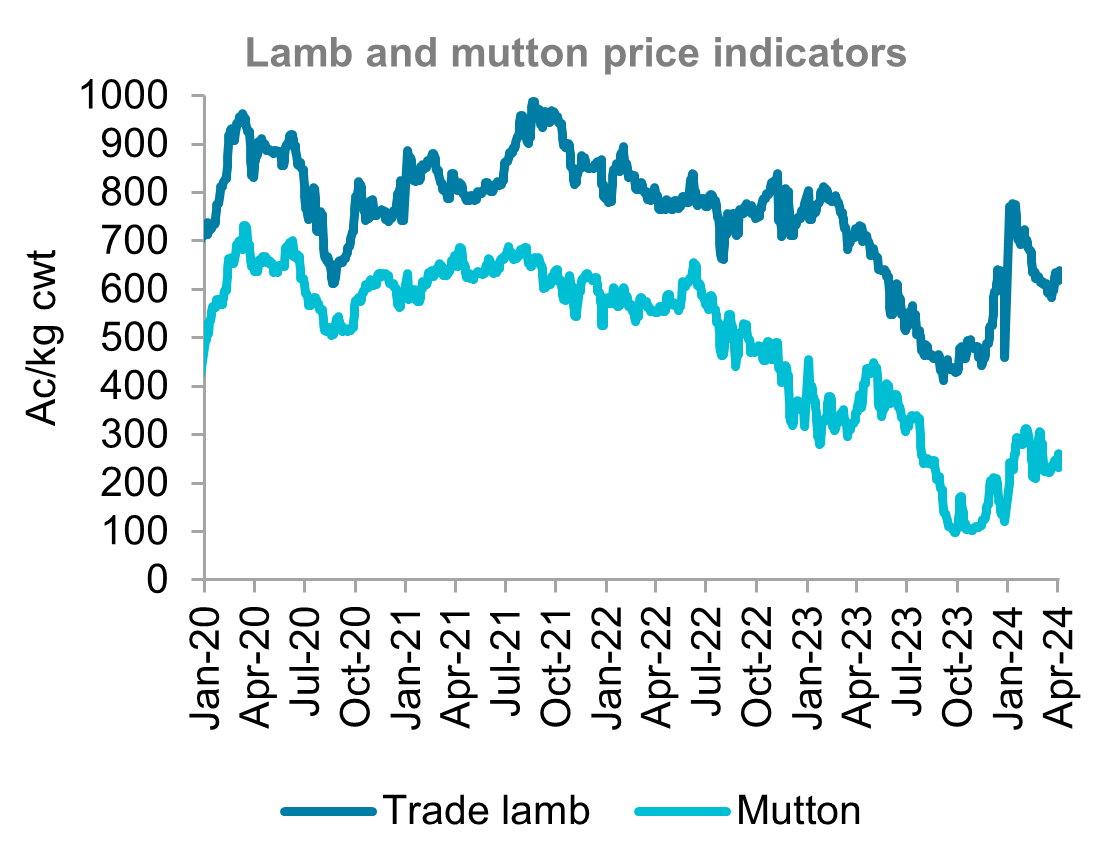

Australian lamb prices have been relatively steady over the past month. Although prices have softened from the peak in mid-January under the weight of continued high supply. The National Trade Lamb Indicator is up 21 cents (+3.4 per cent) from last month. Dry conditions throughout March supported the strong supply, as growers started to turn-off to manage feed availability. Prices are expected to continue sideways to marginally firmer over the next few weeks as processors look to maintain the higher level of throughput they have built up.

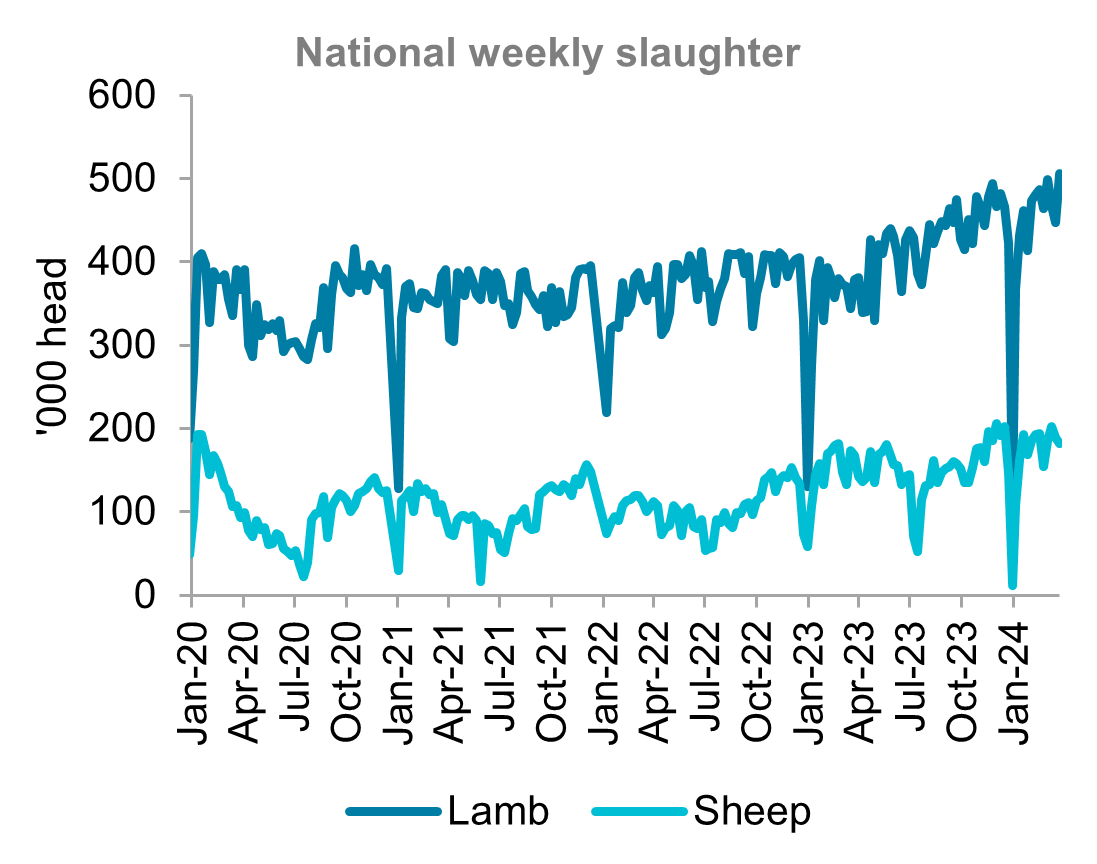

The high rates of lamb slaughter continued throughout March. Australia slaughtered 471,300 lambs per week in March, down 1.1 per cent from February but up 27.6 per cent from March 2023. This trend has been consistent throughout 2024, with average weekly lamb slaughter up 91,720 head (+25.1 per cent) year-to-date. The rebuild of processing capacity over the past 12 months will continue to provide support to the market throughout the rest of the season.

Lamb supply is expected to remain elevated throughout April. Dry seasonal conditions in southern grazing areas are likely to see an increase in turn-off to manage feed availability. This will feed into the already high supply environment. Although the high slaughter rates over the past six months will likely see supply tighten towards the back end of the season. This tightening of supply paired with the increased capacity from processors will provide upwards pressure to the market over the next few months.

Domestic retail prices for lamb have been relatively steady over the past month. At this stage it seems as though retailers are reluctant to pass on the increase in saleyard prices. Retail prices softened throughout 2023 in a delayed response to the sharp decline in saleyard prices. Lamb export volumes have continued their strong start to 2024. Australia exported 30,707 tonnes of lamb in March, up 22.1 per cent from March last year. Lamb exports continue to be underpinned by high volumes going to the US, China, and the Middle East.

Mutton prices fell sharply at the start of March before seeing a slight recovery over the past few weeks. The National Mutton Indicator (NMI) is down 45 cents (-14.7 per cent) from the end of February. The high supply of mutton has continued throughout March. Australian mutton slaughter averaged 184,378 head per week in March, up 1.5 per cent from February and 20.7 per cent higher than March 2023. Export volumes have remained strong as processors look to clear the large volume of mutton slaughtered. Mutton exports totalled 20,263 tonnes in March, with year-to-date exports now tracking 15.5 per cent above this time last year. Mutton prices are expected to continue sideways throughout April. Although dry seasonal conditions may see supply increase and put pressure on the market.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.