Insights November 2023

Insights November 2023

Commodity Overview

- Australian cattle prices are expected to remain relatively stable during the next month with strong supply available at local markets.

- Beef export volume is likely to trend upwards as demand from key markets continues to lift.

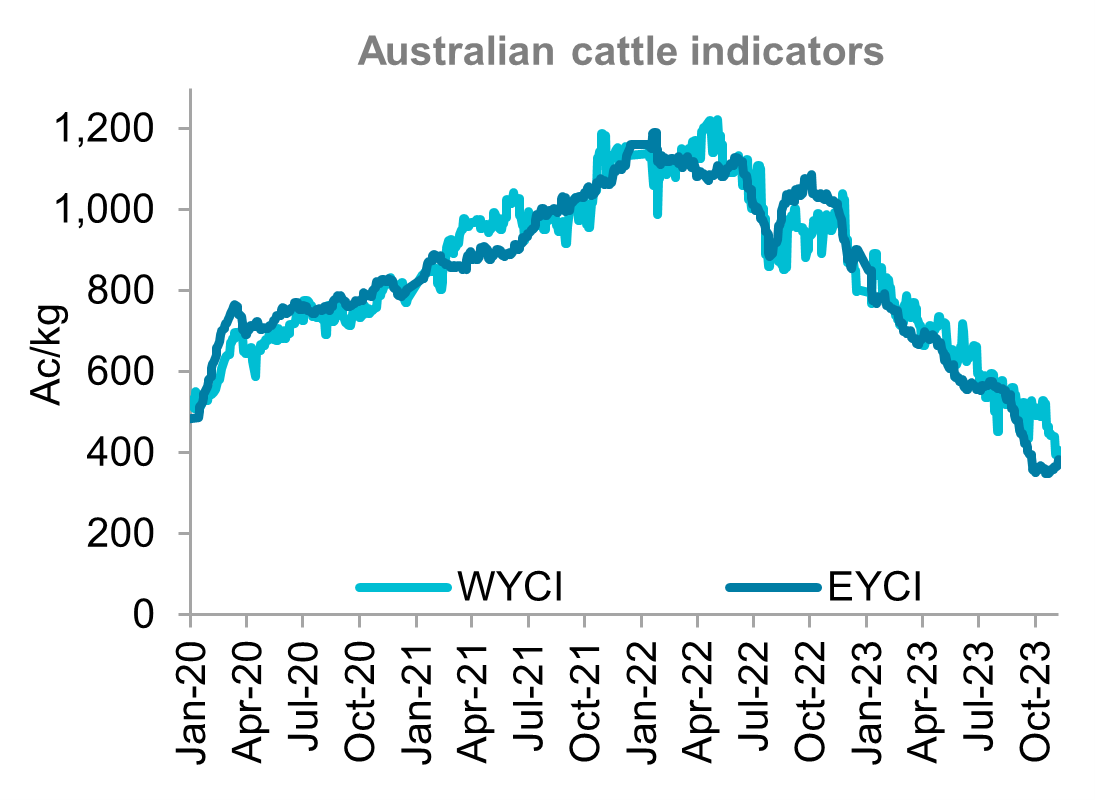

Australian cattle prices are likely to remain relatively stable throughout the next month. The Eastern Young Cattle Indicator (EYCI) lifted 20 cents to 383c/kg in early November. This is the EYCI’s highest point since late September. At this level, the EYCI is 5.5 per cent higher month-on-month but down 62.5 per cent from a year ago. Recent rainfall throughout cattle regions in northern states has boosted domestic cattle prices. Additionally, stability in slaughter rates has provided support for prices. Conversely, the Western Young Cattle Indicator (WYCI) declined 21.2 per cent month-on-month to 387c/kg in the first week of November. This is due to the supply of new season weaners in the west.

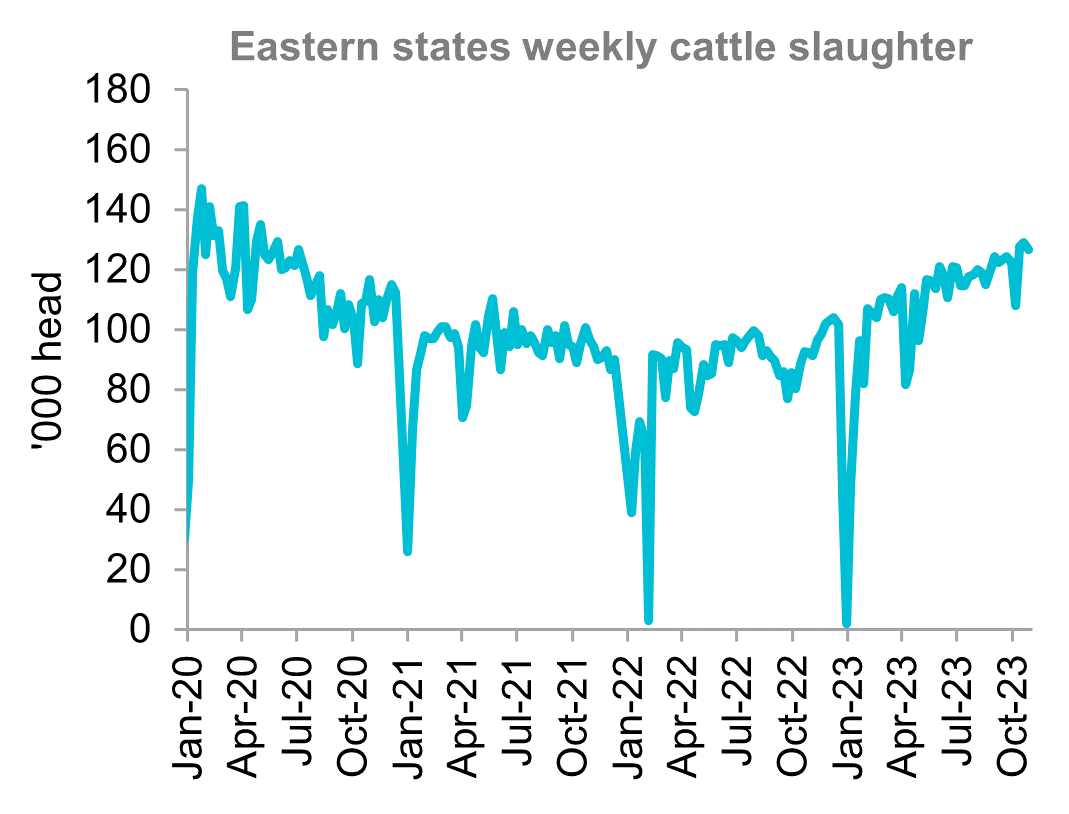

National average weekly slaughter rates increased throughout October. Average weekly slaughter rates were reported at just over 126,000 head over the last month. The last week of October saw slaughter rates four per cent higher month-on-month and 38.1 per cent higher year-on-year. Year to date slaughter rates are 24.1 per cent higher than in 2022. A dry outlook across key cattle production regions throughout October has likely prompted a lift in turnoff of cattle. Most processing centres are reported as fully booked until the beginning of 2024. Some abattoirs in Queensland are adding extra shifts on weekends to manage the significant supply levels. Without much processing capacity available, slaughter rates are only likely to lift marginally in November.

A lift in slaughter rates led to Australian beef exports recording moderate growth during October. Total beef exports increased 6.5 per cent month-on-month to just over 105,000 tonnes. This was 44.1 per cent higher than a year ago and was the largest volume since December 2019. Strong supply levels are expected to be available on local cattle markets throughout the next month. This is likely to contribute to a lift in export volumes to key markets. Beef exports for the year-to-date are 24.4 per cent greater than 2022. The strongest growth continues to come from the United States, which remains Australia’s largest export market so far in 2023. United States beef exports presently sit 76.8 per cent higher year-to-date and lifted 12.8 per cent month-on-month. The decline in the United States supply since the beginning of 2023 is expected to keep export volume strong for the remainder of 2023. Exports to China increased 3.3 per cent month-on-month to reach just under 20,000 tonnes. This rise has pushed year-to date exports up 30.3 per cent, making them 37.4 per cent above this time last year. Market access restrictions for chilled beef on some Australian export processing centres continues to see the majority of Australian beef transported to China frozen, rather than chilled. More than three quarters of total export volume to China is now frozen. This trend is likely to continue for the remainder of 2023 and into Q1 2024. Exports to Japan were 1.8 per cent higher last month with an upwards shift in demand likely to result in an increase during November. Beef exports to South Korea were 6.3 per cent higher month-on-month. Additionally, year to date exports to South Korea are now 18.3 per cent greater than in 2022. These export opportunities will provide some support for Australian cattle prices in November.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.