Insights February 2024

Insights February 2024

Mandatory reporting on greenhouse gas emissions by Australian businesses will rise in prominence in 2024. This will have implications for farming businesses in the near future. To support Australia’s transition to a net zero future the Australian Government has signalled its intent to mandate climate related disclosure. Disclosures will provide Australians and investors with more comparable information about entities. This includes their exposure to climate-related financial risks and opportunities and climate-related plans and strategies. This aims to help regulators to assess and manage systemic risks to the financial system.

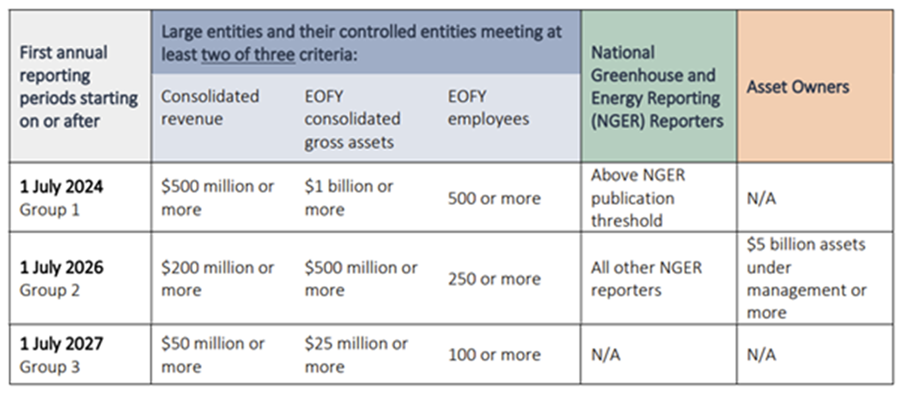

The Federal Treasury released a draft version of the proposed legislation in January. It would mandate climate reporting from the largest down to medium sized businesses. Businesses that will be required to report include:

- Large entities that are required to prepare and lodge annual reports under Chapter 2M of the Corporations Act. This includes listed and unlisted companies, financial institutions, superannuation entities and registered investment schemes.

- Asset owners such as registrable superannuation entities and registered schemes if funds under management are more than $5 billion.

The phasing in of entities occurs over three years. This is due to the complexity of gathering the required data. The more likely date of mandatory reporting for the first level is January 1st, 2025.

Source: Mandatory climate-related financial disclosures, https://treasury.gov.au/sites/default/files/2024-01/c2024-466491-policy-state.pdf

Reporting will be required about an entity’s climate-related risks and opportunities including:

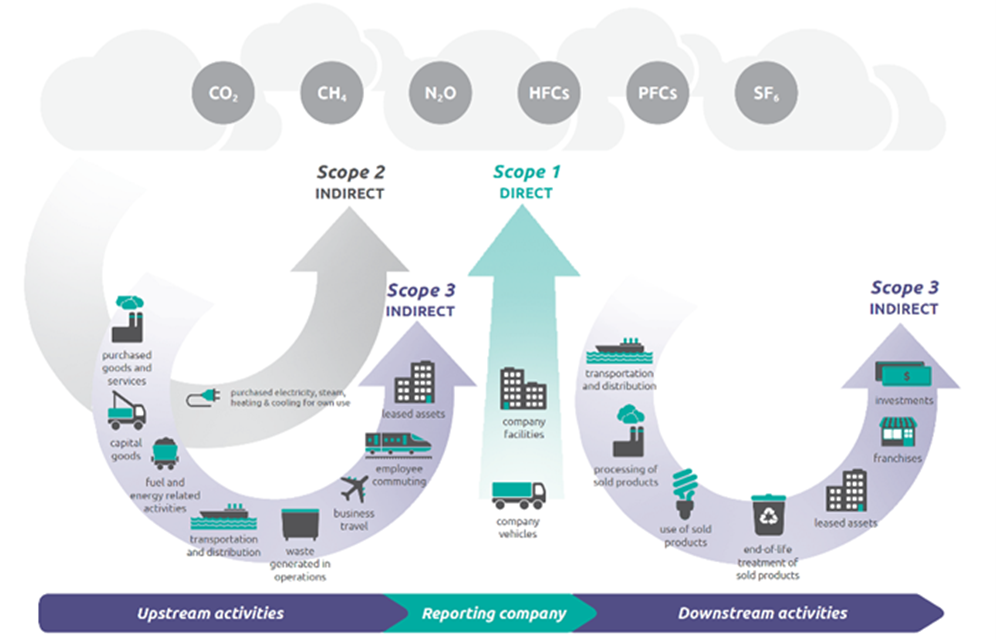

- from the first year, reporting on Scope 1 and Scope 2 greenhouse gas emissions. Scope 1 includes information about greenhouse gas emissions as a result of business operations on site. Scope 2 emissions include those from the energy generated and supplied to the business. Information on governance, strategy, risk management and metrics are also included. As are targets about reductions.

- from the second year, reporting on Scope 3 emissions. These are the emissions that occur up or down their supply chain. Scope 3 disclosures would represent information that is available at the reporting date without undue cost or effort.

Source: Emissions Scopes World Resources Institute WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard (PDF)

Farm businesses are unlikely to need to report directly under this legislation. This is unless they are the among the largest agricultural businesses. However, it is likely that some farming businesses will be contacted by their suppliers and customers to provide information to inform their own disclosures. This results from the obligation on the entities mandated to report to include Scope 3 emissions in the second year. Scope 3 emissions are those generated by businesses in the reporting company’s supply chain, transportation, product usage, or disposal.

This may seem at first a distraction from business. It has become a requirement for many Australian companies in several ways. If the company is not mandated by the upcoming legislation to report on climate impacts, its supply chain will be asking for the reporting. Over time, the process of reporting should become clear cut, familiar and routine.

The Focus for Farming Businesses

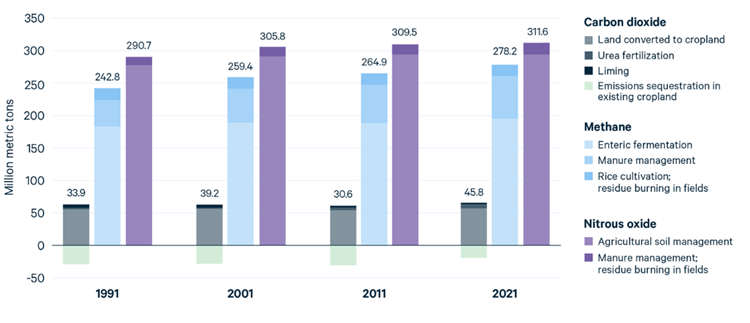

The biggest potential sources of greenhouse gases are methane from ruminants and nitrous oxide arising from soil management. In order to assess the scale of each source, it is necessary to bring the individual gases to a single comparable value. The internationally agreed choice is tonnes of carbon dioxide (CO2) equivalent.

It is also recognised that the different gases have different times of residence in the atmosphere. They also have different reflectivity to thermal infrared wavelengths. These two factors are combined in the Global Warming Potential (GWP) value for the individual gases. Methane has a GWP of 27 to 30 while nitrous oxide has a GWP of 273. One tonne of nitrous oxide has as much impact as 273 tonnes of CO2.

Emissions from US Agriculture. Source: Resources for the Future https://www.rff.org/

Ruminants release methane under certain conditions. Nitrous oxide is released from agricultural lands. The mechanisms by which this comes about, and potential mitigation actions will feature in a future report. The chart above underscores the importance of comparing like with like. In US agriculture, the data shows that GWP emissions from soil management are as significant as methane emissions.

For the moment, farm businesses should monitor the changes around climate obligations and reporting. And take steps to understand how they can measure their own emissions. That role is one that BEN is happy to assist you to understand.

The Clean Energy Regulator recently released another review of its operations. This resulted in numerous recommendations, some suggesting significant changes. We will reflect on the recommendations and provide our insights in the next Monthly Update.