All time high: Records tumble, export markets diversify, demand to remain strong for Australian agricultural exports through 2022/23

Rural Bank’s Australian Agricultural Trade 2021/22 report has found that resurgent demand and continued favourable seasonal conditions have propelled the value of Australian agricultural exports to a record high of $67.5 billion.

A lower Australian dollar, a rare combination of increased production and higher commodity prices helped lift export value by $18.2 billion, well beyond previous levels and a 37 per cent increase in exports from the sector in 2020/21, reaching an all-time high.

Rural Bank’s Simon Dundon, General Manager Sales, Partnerships and Marketing said “Cropping led the export charge with both volumes and average prices rising to drive an 82 per cent increase in the overall value of Australia’s cropping exports with record winter crop production, restricted global supply and increasing demand for biofuels and cooking oil further supporting Australian canola exports.

“We have seen every commodity sector except for wine and fruit record an increase in export value in 2021/22 with grains, oilseeds and cotton recording the largest growth as increased plantings and high yields led to record production levels.

“Cropping export volumes are set to remain high but forecast to be lower than FY22 in the new financial year thanks to ongoing favourable conditions, with the increased diversification of Australia’s export markets very encouraging to see. Cotton export value rose by an incredible 250 per cent year-on-year in 2021/22 off the back of a 202 per cent increase in volume and 15.8 per cent increase in price.

“We have seen a strong recovery in exports to China following a large decline in 2020/21 and despite ongoing trade restrictions for some commodities, a greater indicator of Australia’s export strength was the breadth of markets which rose in value over 2021/22, building upon the diversification seen the previous year”.

China was the largest growth market in 2021/22 and retained its place as Australia’s most valuable market for the 12th year in a row, followed by Japan recording growth of 38.1 per cent and the United States recording strong growth and a rise of more than 30 per cent in terms of exports by value.

“The American market continues to develop a taste for clean, green, premium produce, with the US toppling China as our number one market for exports of both Australian lamb and wine.

“In fact, diversification of export markets remained quite a theme for Australian agricultural exports in 2021/22 with strong growth seen in a wide range of markets and 28 countries recording growth of more than $100 million - up from 16 markets in 2020/21”.

“The signing of trade agreements with the UK and India will also expand opportunities to grow exports when in effect while progress toward a trade agreement with the EU has resumed and if signed in 2023 will provide further growth opportunities.

“The increased production levels driving these phenomenal export volumes were an important factor in the record growth of export value, but it was higher commodity prices that really accelerated the lift in value. Each of the 12 agricultural commodity sectors monitored by Rural Bank - excluding wine -recorded an increase in average export price with five of those sectors showing price growth of more than 20 per cent”.

“The share of export value to markets outside Australia’s top 10 markets rose to 36.5 per cent in 2021/22, the highest share since 2013/14 and Rural Bank is forecasting demand to remain strong for Australian agricultural exports throughout FY 2023”, Mr Dundon concluded.

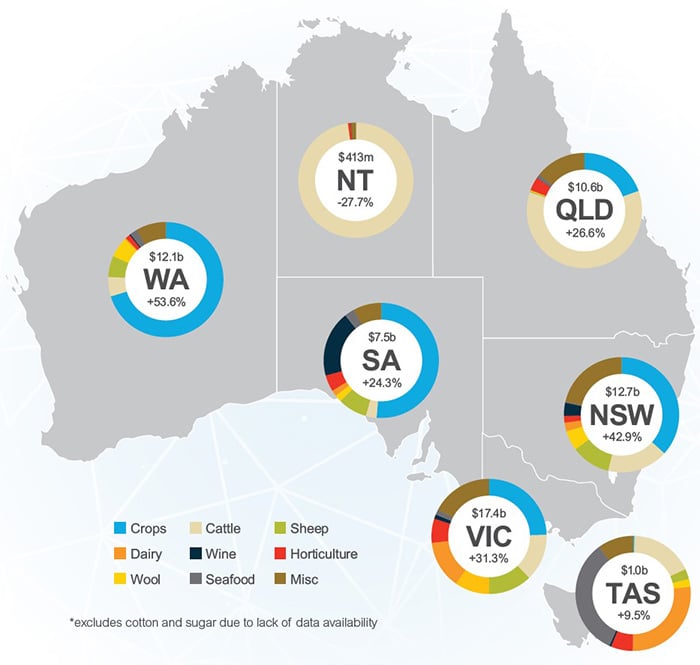

State by State Snapshot

Growth in export value was recorded across every state in 2021/22 with all states reaching a record high value, except Tasmania, however, Tasmanian exports were still just over the $1 billion mark. States where cropping dominates saw the largest growth in value including WA, which overtook QLD to be the third most valuable exporting state. The full breakdown of commodities in value and volumes is in the main report, along with Australia’s biggest and emerging trading partners.

Victoria retained the crown as Australia’s export hero and largest agricultural exporter in 2021/22. The state recorded a lift in value of $4.1 billion (+31.3 per cent) to a record high of $17.4 billion, or 26.5 per cent of national export value.

New South Wales also saw a strong uplift in export value in 2021/22 as a rise in cropping exports of $2.4 billion (+110.3 per cent) drove a rise in overall agricultural export value of $3.8 billion (+42.9 per cent) to reach $12.7 billion.

Western Australia was the largest growth state in 2021/22 as an exceptional year for cropping exports driving a rise in export value of $4.2 billion (+53.6 per cent) to $12.1 billion. WA also remained the largest vegetable exporter, accounting for 42 per cent of national export value, including well over 90 per cent of carrot exports and more than a quarter of potato exports.

Queensland fell further down the rankings of most valuable export states in 2021/22, falling to fourth place with $10.8 billion in exports, however cropping exports more than doubled in value to $2 billion and accounted for 19.5 per cent of the state’s exports. The cattle industry accounted for 60.7 per cent of the state’s export value and rose by $762 million (+13.4 per cent).

South Australia’s agricultural export value reached a new record high of $7.5 billion, driven by a strong year for cropping exports, but partially offset by a significant decline in the value of wine exports, the state’s second most valuable commodity.

Tasmania’s agricultural exports returned more than $1 billion in value in 2021/22 with growth of $90 million (+9.5 per cent). This was led by a $114 million (+69.8 per cent) rise in the state’s dairy exports and a rise in salmon exports of $110 million (+75.6 per cent). Tasmania became Australia’s most valuable seafood export state in 2021/22.

Northern Territory agricultural exports fell to their lowest value since 2013/14 following a decline of 27.7 per cent in 2021/22. Live cattle exports accounted for 97 per cent of the territory’s exports and declined by 26.6 per cent due to tight cattle supply.

Rural Bank’s Australian Agricultural Trade 2021/22 report focuses on the value and volume of Australian agriculture to major global markets on a national, state, and commodity level.

You can view the report with all the details and market movements here in the Knowledge and Insights section of the Rural Bank website: Rural Bank Australian Agriculture Trade 2021/22.

About Rural Bank

Rural Bank is a division of Bendigo and Adelaide Bank Limited and provides exceptional financial services, knowledge and leadership for Australian farmers to grow.