Insights November 2023

Insights November 2023

Commodity Overview

- Australian lamb prices are expected to remain stable over the next few weeks. The spring flush is starting to appear in Victorian saleyards and will ramp up throughout November.

- Retail prices for lamb are reducing, which is seeing an uptick in domestic demand. Both lamb and mutton export volumes are continuing to track well above last year’s levels and the five-year average.

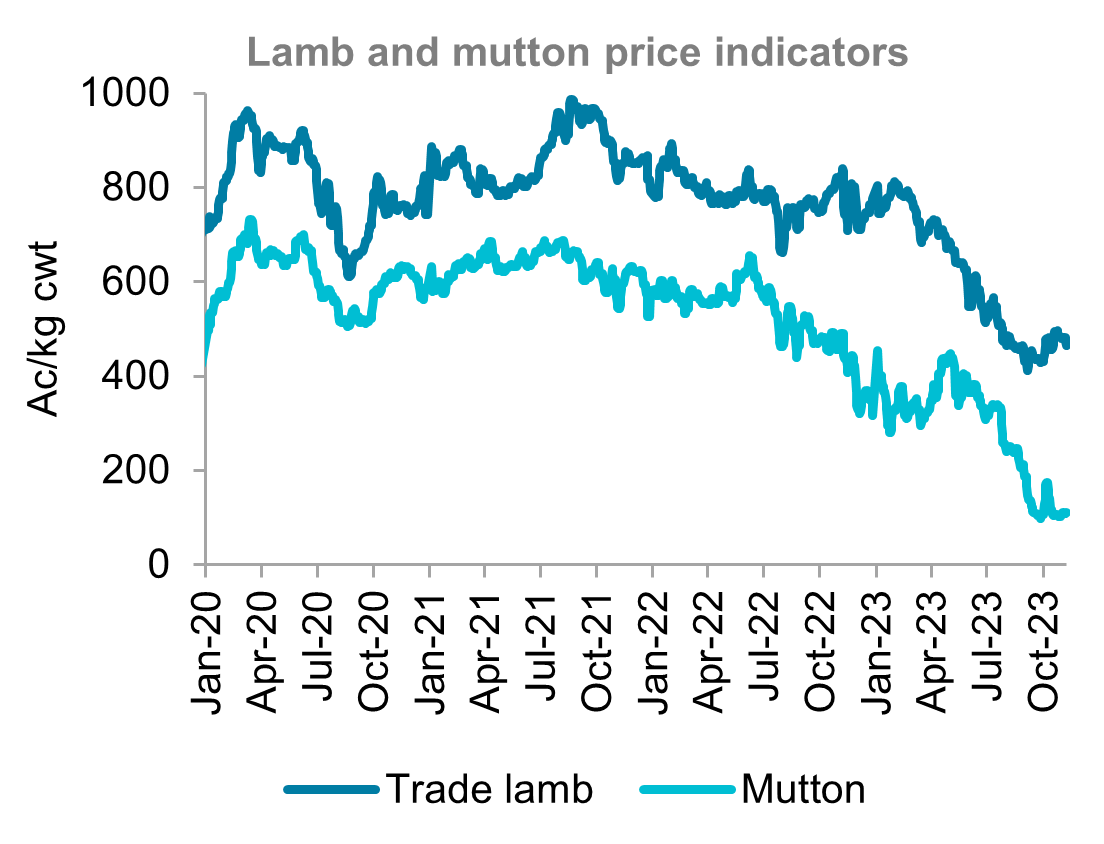

Lamb prices have improved over the past few weeks and are expected to remain relatively stable over the next month. The sharp fall in lamb prices ended in September and have edged higher over the past few weeks. Recent rainfall in the south-east of Australia has given restockers some confidence. However, the dry seasonal outlook continues to be a limiting factor. The National Trade Lamb Indicator softened 15 cents (-3.2 per cent) over the past month. The indicator is lagging 369 cents (-44.2 per cent) behind this time last year.

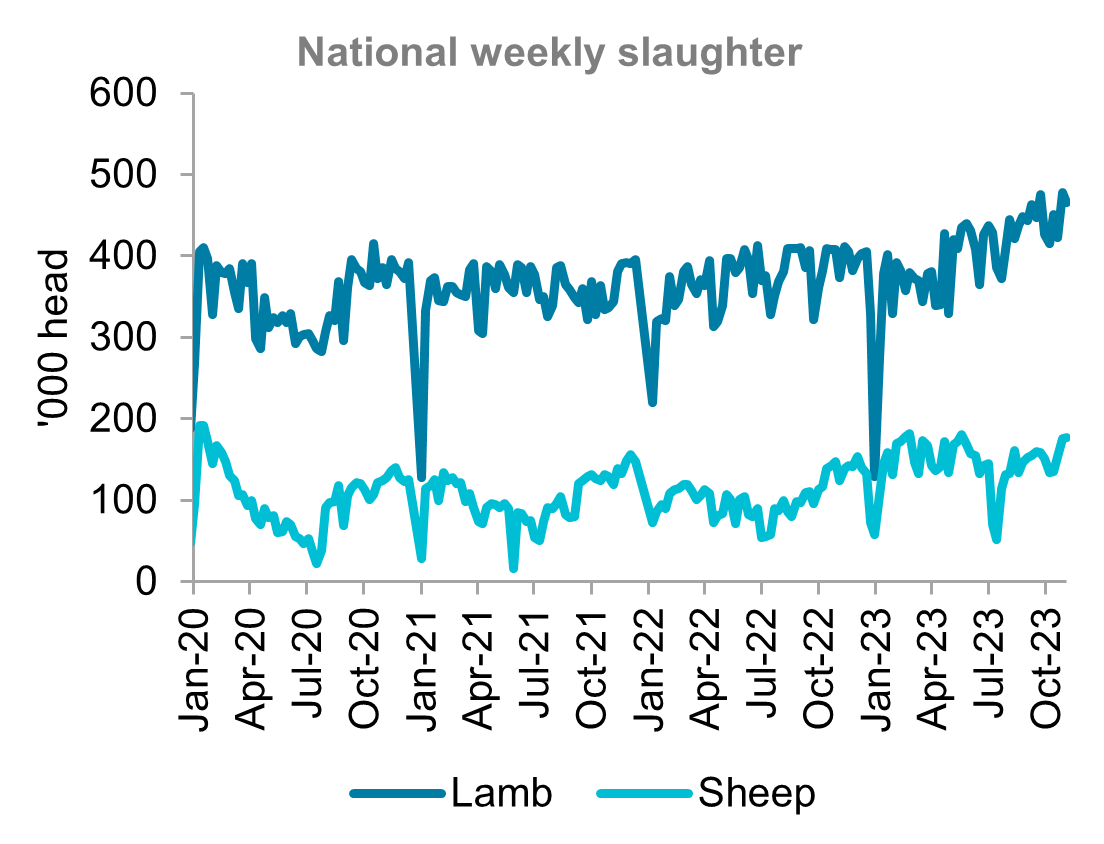

The high supply of lambs continued throughout October. Lamb slaughter averaged almost 442 thousand head per week in October, up 40 thousand head (+10 per cent) from October last year. Year-to-date lamb slaughter continues to trend well above 2022 levels, up over 34 thousand per week (+9.3 per cent). The surge in supply and the dry conditions have both applied significant downward pressure to the market this year.

Lamb supply will increase as the Victorian spring flush flows into the saleyards. The recent rainfall has given some support to the market, but the dry seasonal outlook will continue to limit restocking activity. It seems we may have reached the bottom of the price cycle. Although prices are not expected to increase significantly before the end of the year.

Domestic demand for Australian lamb is returning as retail prices continue to contract. Demand had slowed as high retail prices and cost of living pressures pushed consumers towards cheaper proteins. The recent softening of retail prices has seen consumers starting to opt for lamb. Lamb exports continued their strong run throughout October, with 30,605 tonnes exported for the month. October’s lamb exports have pushed year-to-date exports up 12.2 per cent from last year and 18.1 per cent above the five-year average. China remains our largest trading partner by volume so far this year, with exports 13.4 per cent above the five-year average. Exports to the US slowed in October after growing over the previous six months. Lamb exports to the US are lagging over 10 thousand tonnes (-16.2 per cent) behind last year but remain ahead of the five-year average.

Mutton prices have been relatively steady over the past month. Although there was a brief price spike following rains at the start of October. The National Mutton Indicator is down 345 cents (-75.8 per cent) since the start of the year and plunged to its lowest point since 2013 in late September. Prices have struggled with the surplus of supply, with weekly mutton slaughter up almost 49 thousand head per week (+48.7 per cent) year-to-date. The high slaughter rates have seen export volumes surge in 2023. Year-to-date mutton exports are up over 54 thousand tonnes (+47.6 per cent) and are 45 thousand tonnes (+36.5 per cent) above the five-year average. Sheep yardings usually increase throughout November but given the high yardings earlier in the year this may not be the case. The dry seasonal outlook will limit any significant uplift in prices over the next few weeks.

Source: Meat & Livestock Australia

Most Popular

Subscribe to insights today

Receive reports direct to your email by subscribing to Rural Bank Insights.