Identify and protect yourself from these common scams

Things to remember

- Never provide your 6-digit Internet Banking security code to anyone - in person, over the phone or online even if they claim to work for your bank and have personal information about you.

- Never provide a caller with remote access to your computer.

- We will never ask you for your Internet Banking PIN, Internet Banking password or 6-digit Internet Banking security code.

- We will never ask you to login to Internet Banking via a link sent in an SMS or sent in an email.

- We may call from time to time and ask to verify your identity by asking for your verbal password. However, we will never ask you for any PIN, password or security code relating to your Internet Banking. If you feel uncomfortable, you can always verify our branch contact details on our website and call us back.

Rural Bank scam alert update

Scams cost Australian consumers, businesses and the economy hundreds of millions of dollars each year and cause serious emotional harm to victims and their families.

In 2021, combined scam losses reported to Scamwatch, banks and other government agencies was $1.8 billion. One third of victims do not report scams, so actual losses were well over $2 billion.

How to spot a scam:

- A threat if you don’t pay immediately.

- An unexpected request that can’t wait.

- A link to update your personal details.

- An immediate payment so you don’t miss out.

- An attachment or link you weren’t expecting.

Remember:

- Stop and check.

- Protect your personal information.

- Be careful with payments.

- Verify before you buy.

- Research any opportunity that is too good to be true.

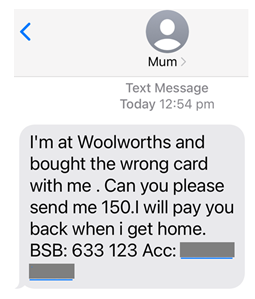

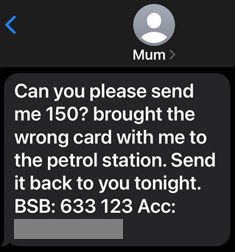

Mum SMS message scam

An indicator of this SMS scam is when you receive an SMS message sent from "Mum" or "Dad" asking for money to be transferred urgently.

The SMS scam messages may vary, however if you unexpectedly receive a message to send money to a family member, always call them on their trusted number (one you have previously spoken to them on) to confirm the message.

Have you received a suspicious SMS?

If you have received a suspicious SMS message claiming to be from us, you can forward it to us for investigation.

Please take care not to click on the link while doing so.

Alternatively, you can take a screenshot of the SMS message and email it to phishing@bendigoadelaide.com.au

Apple device:

- Tap and hold your finger on the SMS message until the pop-up options ‘Copy/More’ appear.

- Select ‘More’.

- Then click the arrow in the bottom right corner to ‘Share/Forward’.

- Type 0429 557 997 as the recipient, and press ‘Send’.

- You can then delete the original and the forwarded version of the SMS message.

Android device:

- Tap and hold your finger on the SMS message until the three-dot menu icon appears in the top right corner.

- Tap the three-dot menu icon.

- Select ‘Forward’.

- Type 0429 557 997 as the recipient, and press ‘Send’.

- You can then delete the original and the forwarded version of the SMS message.

Remote access scams

A remote access scam is when a scammer contacts you via phone, text or email claiming to be from a company you may be familiar with such as your bank, a utility company, telecommunication services (such as NBN) or a government agency.

Scammers will trick people into gaining access to their phone or computer providing them full access to personal information from a remote location. Scammers will try to convince you to install software on your computer or device to gain access to your personal and financial information.

How to protect yourself

- Never provide a caller with remote access to your computer.

- Make sure you complete regular software updates on your devices and ensure that anti-virus software installed on devices is up to date.

- Never provide your 6-digit Internet Banking security code to anyone - in person, over the phone or online even if they claim to work for your bank and have personal information about you.

- We may call from time to time and ask to verify your identity by asking for your verbal password. However, we will never ask you for any PIN, password or security code relating to your Internet Banking. If you feel uncomfortable, you can always verify our branch contact details on our website and call us back.

Business Email Compromise (BEC)

Scammers will take advantage of businesses at busy times such as the end of financial year.

This may be in the form of false billing scams where scammers will issue fake invoices to businesses for unwanted or unauthorised advertisements, products or services.

How to protect yourself

- If you are unsure if an email notification has come from a real sender, make sure you verify a change in BSB and account number verbally with the business prior to making payments.

- Be wary of requests via email to transfer funds outside of your normal business process, even if the request appears to come from your CEO or senior manager.

- If you receive a bill or invoice for a service you do not recall requesting, do your own research to search for the business' details and contact them directly to make an enquiry about the payment prior to transferring any funds.

Investment scams

Investment scams will be masked as an offer to purchase:

- cryptocurrency (like Bitcoin);

- business ventures;

- superannuation schemes;

- managed funds; or

- sale of shares or property.

Scammers will create ‘opportunities’ with professional brochures, websites and advertisement. These mask fraudulent activities and trick individuals into taking up the offer.

How to protect yourself

- Before putting money into an investment, do some of your own research. You can check if the company has an Australian Financial Services Licence by visiting www.moneysmart.gov.au

- Watch out for offers promoting the ability to have easy and early access to your superannuation.

- Don’t be pressured into making an investment or decision about your money, especially if you’re presented with an opportunity via unsolicited email or phone call. Always seek advice from a reputable financial advisor and raise concerns with your local branch.

Romance scams

Dating and romance scammers create fake profiles on real dating websites and social media platforms often using images and photos of identities they have stolen from other people.

Romance scammers will use their fake profile to try and enter online relationships in order to obtain money.

How to protect yourself

- Never send money or provide your personal financial details to someone you have only ever met online.

- Be wary about communicating with a person outside a dating website if you’ve only had a few conversations with them on that platform.

- Be careful about sharing photos of yourself with a person you’ve only recently met online as scammers regularly seek to use photos for criminal purposes.

- If you are unsure about someone you have met online, you can complete an image search via Google.

Online shopping scams

This includes puppy scams and buyer/seller disputes.

Unfortunately, scammers love online shopping too and can easily create very convincing yet fake websites for you to complete your purchases.

A key thing to look for is an unusual method of payment such as a wire transfer, prepaid cards or cheques. Online retailers would not ask you to make payments for goods through an online store via these methods.

How to protect yourself

- Know who you are buying from. Check the About Us and refund policy sections of the website.

- Look for websites with a https and a closed padlock symbol.

- Identify if the online store has a mailing address to send returns.

- Only make payments for products via the website secure payment method - you should not need to pay via wire transfer, prepaid card or cheque.

Cold calling scams

Scammers call customers and appear to have previous knowledge of the customer. This is usually falsified information. They are convincing in detail and generally engineer the call to align with their claim to be from the Bank’s fraud or cyber security team.

They use a method called ‘call line identification overstamping’ (CLI overstamping).

CLI overstamping allows the person calling you to display a different number from the number they are calling from.

For example, an Australian company which operates an overseas call centre may overstamp their calls. These calls, that originate overseas, appear to be from an Australian number so that you recognise this number and return a call. CLI overstamping is legal in Australia and the Bank has no authority or ability to counteract it.

Please check our things to remember whenever you receive a call from anyone saying they are from the Bank.

Sextortion

Sensitive content: This content may be distressing for some due to topics related to sexual exploitation/extortion. It is recommended that you do not read further if you may be impacted by the content.

Sexual extortion, also known as sextortion, is a form of online blackmail. It's where someone tricks or coerces you into sending images of yourself, which may be of a sexual nature. They may use these images as-is or alter the images and threaten to share the images online with friends and family unless you agree to their demands. Victims often feel they have done something wrong. They think they will be punished by parents or carers, or prosecuted by police, if their actions are discovered.

Right now, Australia is experiencing a global trend of offenders mainly targeting teenage boys with requests to send sexual images and then threatening to share them unless they pay. In some instances, child victims are being forced to become money mules when they can no longer meet blackmail demands.

Sextortion can happen on any interactive service. It can include image and video sharing, instant messaging or social media apps.

What to look out for:

- Unsolicited friend or follow requests or random adds from people you don’t know;

- Suddenly sexualised questions or conversations;

- Instantly receiving sexual images from a fake profile who asks for the same from you;

- Getting a direct message on one app, then being asked to continue chatting on a different app;

- Signs that English may be a second language; such as incorrect grammar or spelling.

- The fake profile might say that their webcam or microphone are not working for video calls/chats;

- The fake profile says that they promise to delete your content.

Dos:

- Do stop the chat

- Do take screenshots of the text and profile

- Do block the account and report it to the platform

- Do report to the ACCCE

- Do get support

Don’ts:

- Don’t send any images

- Don’t pay

- Don’t respond to demands

- Don’t enter into further communication

- Don’t think you’re alone

Do you need help?

If you are under the age of 18 and this has happened to you (or another young person you know), you are a victim of online child sexual abuse.

If you or another person is in a life threatening situation, please call 000.

To report or get help: ACCCE (Australian Centre to Counter Child Exploitation).

Think you have been a victim of a scam?

Let us know ASAP if you think you have been a victim of a scam